AZUR vs RUNE: The Battle of Magical Artifacts in a Fantasy Realm

Introduction: Investment Comparison of AZUR vs RUNE

In the cryptocurrency market, the comparison between Azuro (AZUR) vs RUNE has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance but also represent different positioning in the crypto asset space.

Azuro (AZUR): Since its launch, it has gained market recognition for its tooling, oracle & liquidity solutions supporting prediction app ecosystems.

RUNE: Since its inception in 2019, it has been hailed as a highly optimized multi-chain solution, being one of the cryptocurrencies with significant trading volume and market capitalization globally.

This article will comprehensively analyze the investment value comparison between AZUR vs RUNE, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question most concerning to investors:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

AZUR (Coin A) and RUNE (Coin B) Historical Price Trends

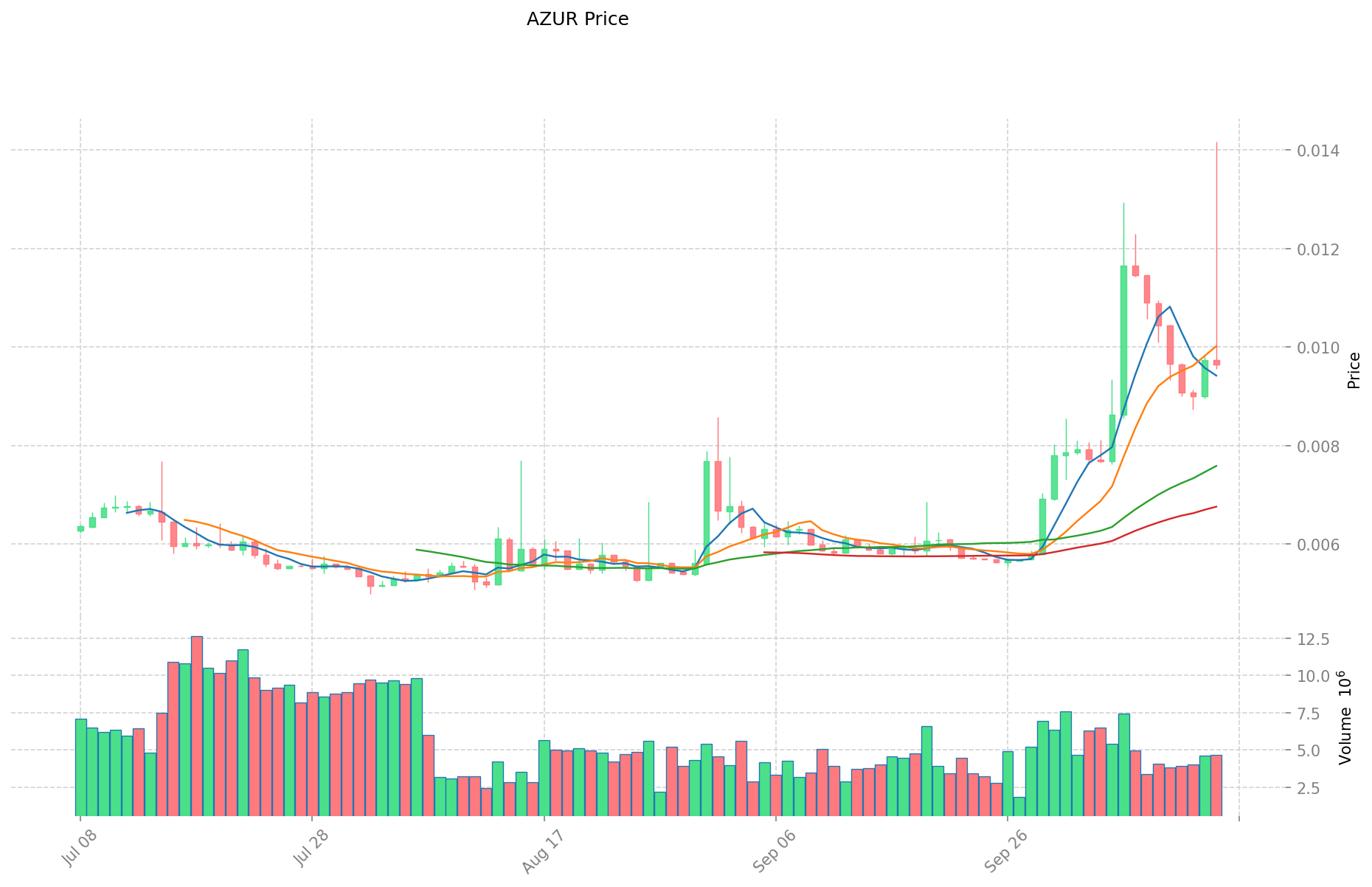

- 2024: AZUR reached its all-time high of $0.24052 on July 20, 2024.

- 2025: RUNE experienced a significant decline, dropping to $0.9161 from its previous all-time high of $20.87.

- Comparative analysis: In the current market cycle, AZUR has fallen from its peak of $0.24052 to $0.009652, while RUNE has dropped from $20.87 to $0.9161, showing a more severe decline for RUNE in percentage terms.

Current Market Situation (2025-10-15)

- AZUR current price: $0.009652

- RUNE current price: $0.9161

- 24-hour trading volume: AZUR $46,684.34 vs RUNE $1,189,694.11

- Market Sentiment Index (Fear & Greed Index): 34 (Fear)

Click to view real-time prices:

- View AZUR current price Market Price

- View RUNE current price Market Price

AZUR vs RUNE Investment Value Core Factors

Comparative Supply Mechanisms (Tokenomics)

- AZUR: Native token focused on prediction markets with emphasis on sports betting events, providing recurring revenue streams for liquidity providers (current APY around 12%)

- RUNE: Tied to blockchain infrastructure with scalability features, following a peer-to-pool model similar to GMX

- 📌 Historical Pattern: AZUR shows seasonal trading volume variations linked to sports seasons, while RUNE's value fluctuations correlate with blockchain infrastructure developments

Institutional Adoption and Market Applications

- Institutional Holdings: AZUR attracts traditional betting users and liquidity providers seeking consistent yields, while RUNE appeals to blockchain infrastructure investors

- Enterprise Applications: AZUR excels in sports prediction markets with potential expansion into political events, while RUNE focuses on blockchain scalability solutions

- Regulatory Landscape: Prediction markets like AZUR face varying regulatory scrutiny across jurisdictions, particularly related to betting regulations

Technical Development and Ecosystem Building

- AZUR Technical Upgrades: Expanding beyond sports betting into political and news markets; integration with AI agents through Olas to enhance liquidity provision and dispute resolution

- RUNE Technical Development: Focus on blockchain infrastructure improvements and peer-to-pool liquidity model enabling even distribution across multiple markets

- Ecosystem Comparison: AZUR creates strong recurring user engagement through multiple smaller markets (only 0.74% of volume from top events), providing deeper liquidity pools across diverse markets

Macroeconomic and Market Cycles

- Inflation Resistance: Both tokens derive value from user activity rather than traditional inflation hedging

- Market Trends: AZUR experiences seasonal fluctuations with summer slowdowns during sports off-seasons

- Cross-border Demand: Both platforms represent "economically-backed sources of truth" in an increasingly misinformation-filled world, with potential to expand into decentralized surveys and sentiment analysis tools

III. 2025-2030 Price Prediction: AZUR vs RUNE

Short-term Prediction (2025)

- AZUR: Conservative $0.00917795 - $0.009661 | Optimistic $0.009661 - $0.01111015

- RUNE: Conservative $0.73296 - $0.9162 | Optimistic $0.9162 - $0.971172

Mid-term Prediction (2027)

- AZUR may enter a growth phase, with an estimated price range of $0.009282626935 - $0.01313152103

- RUNE may enter a bullish market, with an estimated price range of $0.7514099775 - $1.595301183

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- AZUR: Base scenario $0.016085615169573 - $0.017372464383138 | Optimistic scenario $0.017372464383138

- RUNE: Base scenario $1.73291671831005 - $1.975525058873457 | Optimistic scenario $1.975525058873457

Disclaimer: The above predictions are based on historical data and market analysis. Cryptocurrency markets are highly volatile and subject to change. This information should not be considered as financial advice. Always conduct your own research before making investment decisions.

AZUR:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01111015 | 0.009661 | 0.00917795 | 0 |

| 2026 | 0.0122549785 | 0.010385575 | 0.00758146975 | 7 |

| 2027 | 0.01313152103 | 0.01132027675 | 0.009282626935 | 17 |

| 2028 | 0.0150378556347 | 0.01222589889 | 0.008558129223 | 26 |

| 2029 | 0.018539353076796 | 0.01363187726235 | 0.009269676538398 | 41 |

| 2030 | 0.017372464383138 | 0.016085615169573 | 0.013994485197528 | 66 |

RUNE:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.971172 | 0.9162 | 0.73296 | 0 |

| 2026 | 1.3683447 | 0.943686 | 0.68889078 | 3 |

| 2027 | 1.595301183 | 1.15601535 | 0.7514099775 | 26 |

| 2028 | 1.664546502465 | 1.3756582665 | 0.85290812523 | 50 |

| 2029 | 1.9457310521376 | 1.5201023844825 | 0.927262454534325 | 65 |

| 2030 | 1.975525058873457 | 1.73291671831005 | 1.005091696619829 | 89 |

IV. Investment Strategy Comparison: AZUR vs RUNE

Long-term vs Short-term Investment Strategies

- AZUR: Suitable for investors focused on prediction markets and consistent yield opportunities

- RUNE: Suitable for investors interested in blockchain infrastructure and scalability solutions

Risk Management and Asset Allocation

- Conservative investors: AZUR: 30% vs RUNE: 70%

- Aggressive investors: AZUR: 60% vs RUNE: 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- AZUR: Seasonal fluctuations in trading volume, dependency on sports betting events

- RUNE: Higher volatility due to broader market trends in blockchain infrastructure

Technical Risks

- AZUR: Scalability, network stability during high-volume betting events

- RUNE: Centralization of mining power, potential security vulnerabilities

Regulatory Risks

- Global regulatory policies may impact AZUR more due to its focus on prediction markets and betting

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- AZUR advantages: Strong recurring revenue streams, expansion into diverse prediction markets

- RUNE advantages: Focus on blockchain scalability, potential for broader adoption in DeFi

✅ Investment Advice:

- New investors: Consider a balanced approach with a slight preference for RUNE due to its broader market application

- Experienced investors: Explore AZUR for its unique market position in prediction markets

- Institutional investors: Evaluate both based on specific portfolio needs and risk tolerance

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between AZUR and RUNE? A: AZUR focuses on prediction markets, particularly sports betting, while RUNE is centered on blockchain infrastructure and scalability solutions. AZUR provides recurring revenue streams for liquidity providers, while RUNE follows a peer-to-pool model similar to GMX.

Q2: How do the price trends of AZUR and RUNE compare? A: As of 2025-10-15, AZUR has fallen from its peak of $0.24052 to $0.009652, while RUNE has dropped from $20.87 to $0.9161. RUNE has shown a more severe decline in percentage terms compared to AZUR.

Q3: What are the key factors influencing the investment value of AZUR and RUNE? A: Key factors include supply mechanisms, institutional adoption, technical development, ecosystem building, and macroeconomic trends. AZUR's value is influenced by sports seasons and betting events, while RUNE's value correlates with blockchain infrastructure developments.

Q4: How do the long-term price predictions for AZUR and RUNE compare? A: By 2030, AZUR is predicted to reach a base scenario of $0.016085615169573 - $0.017372464383138, while RUNE is expected to reach $1.73291671831005 - $1.975525058873457 in the base scenario.

Q5: What are the main risks associated with investing in AZUR and RUNE? A: AZUR faces risks related to seasonal fluctuations and regulatory scrutiny in the betting industry. RUNE's risks include higher volatility due to broader market trends and potential centralization of mining power. Both face technical risks related to scalability and network stability.

Q6: How should investors approach allocating their portfolio between AZUR and RUNE? A: Conservative investors might consider allocating 30% to AZUR and 70% to RUNE, while aggressive investors might opt for 60% AZUR and 40% RUNE. The exact allocation should be based on individual risk tolerance and investment goals.

Q7: Which token might be better suited for different types of investors? A: New investors might prefer a balanced approach with a slight preference for RUNE due to its broader market application. Experienced investors could explore AZUR for its unique position in prediction markets. Institutional investors should evaluate both based on specific portfolio needs and risk tolerance.

Share

Content