ALLO vs ICP: The Battle of Layer-1 Blockchain Protocols for Web3 Dominance

Introduction: Investment Comparison of ALLO vs ICP

In the cryptocurrency market, the comparison between Allora (ALLO) vs Internet Computer (ICP) remains a topic of interest for investors. The two differ significantly in market cap ranking, use cases, and price performance, representing distinct positions in the crypto asset landscape.

Allora (ALLO): Launched as an open intelligence platform designed to enhance the adaptability, collaboration, and efficiency of artificial intelligence systems.

Internet Computer (ICP): Introduced as a decentralized cloud blockchain, capable of hosting secure and resilient applications, websites, and enterprise systems while supporting trustless multi-chain interactions.

This article will provide a comprehensive analysis of the investment value comparison between ALLO and ICP, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future projections, aiming to address the key question on investors' minds:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

ALLO (Allora) and ICP (Internet Computer) Historical Price Trends

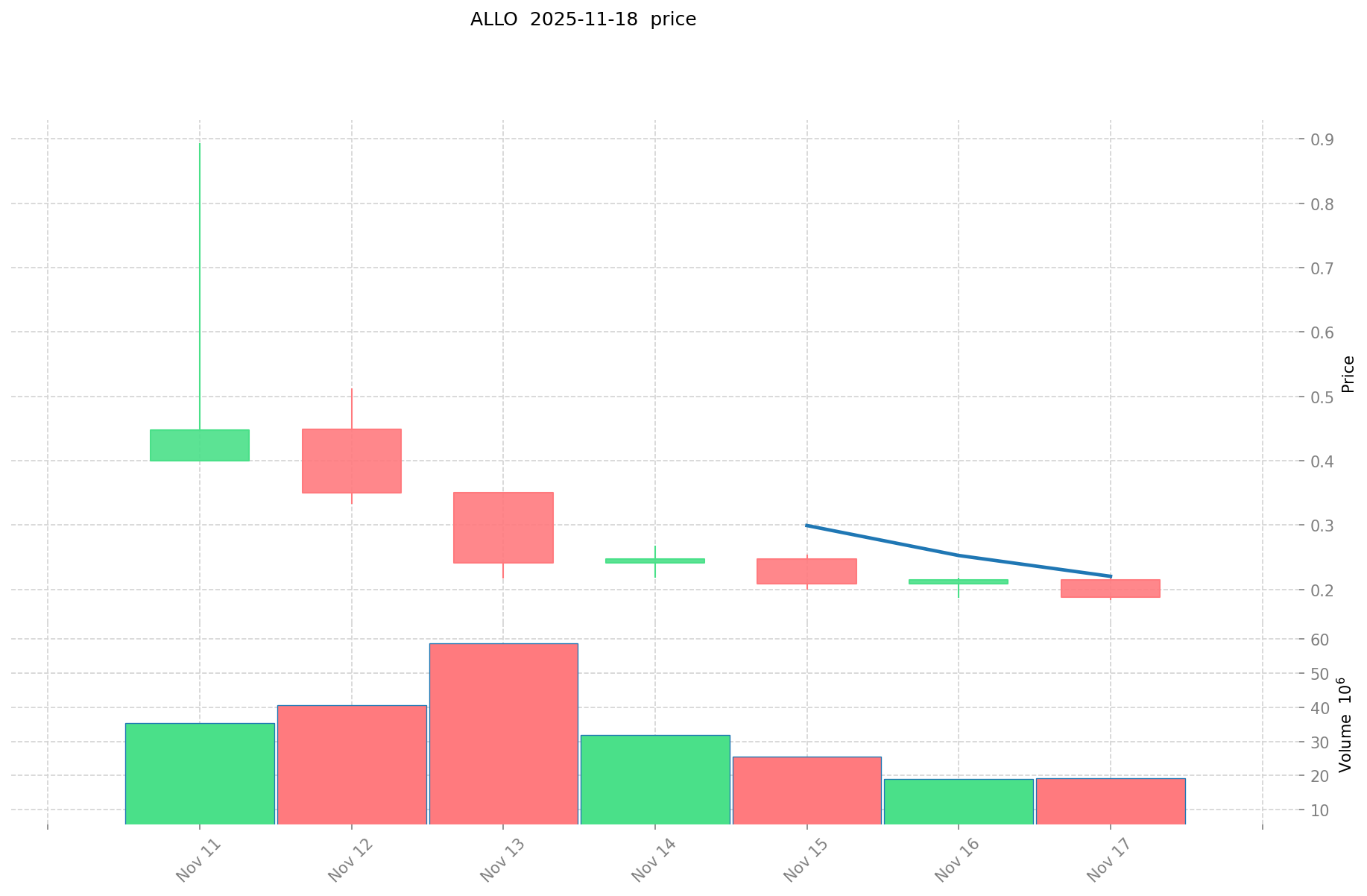

- 2025: ALLO experienced a significant price drop, falling from its all-time high of $0.8937 to its current price of $0.1753.

- 2021: ICP reached its all-time high of $700.65, but has since declined substantially to its current price level.

- Comparative Analysis: In the recent market cycle, ALLO has dropped from its peak of $0.8937 to a low of $0.1721, while ICP has fallen from its all-time high of $700.65 to its current price of $5.331, representing a more severe decline in percentage terms.

Current Market Situation (2025-11-18)

- ALLO current price: $0.1753

- ICP current price: $5.331

- 24-hour trading volume: ALLO $4,621,382 vs ICP $24,984,182

- Market Sentiment Index (Fear & Greed Index): 11 (Extreme Fear)

Click to view real-time prices:

- Check ALLO current price Market Price

- Check ICP current price Market Price

ALLO vs ICP Investment Value: Core Factors

Impact Factors on ALLO and ICP Investment Value

Network Usage and Ecosystem Growth

- ALLO: Value highly dependent on actual network usage and ecosystem scale after mainnet launch; currently remains a "potential asset"

- ICP: Value linked to strategic partnerships and global Web3 support initiatives

- 📌 Key Pattern: Projects with robust ecosystem adoption typically show stronger long-term value retention regardless of market cycles

Strategic Partnerships and Development Support

- Institutional Backing: ALLO is backed by Polychain Capital, while ICP has established partnership with Web3Labs

- Enterprise Adoption: ICP x Web3Labs global acceleration program demonstrates institutional commitment to fostering Web3 startups

- Development Framework: ICP offers more comprehensive support for global Web3 startup teams through structured acceleration programs

Technology Infrastructure and Innovation

- ALLO's Technology: Focused on decentralized AI network capabilities

- ICP's Technology: Internet Computer Protocol provides blockchain-based infrastructure for Web3 applications

- Ecosystem Comparison: ICP appears to have more established Web3 integration points and developer tools

Market Positioning and Growth Trajectory

- Growth Stage: ALLO is in earlier development stages with higher risk-reward potential

- Market Establishment: ICP has demonstrated more concrete ecosystem development milestones

- Global Expansion: ICP shows stronger signs of international market penetration through strategic partnerships

III. Price Prediction for 2025-2030: ALLO vs ICP

Short-term Prediction (2025)

- ALLO: Conservative $0.088 - $0.174 | Optimistic $0.174 - $0.259

- ICP: Conservative $4.728 - $5.313 | Optimistic $5.313 - $6.534

Mid-term Prediction (2027)

- ALLO may enter a growth phase, with an estimated price range of $0.184 - $0.277

- ICP may enter a bullish market, with an estimated price range of $5.950 - $9.085

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- ALLO: Base scenario $0.226 - $0.294 | Optimistic scenario $0.294 - $0.311

- ICP: Base scenario $8.264 - $10.733 | Optimistic scenario $10.733 - $12.450

Disclaimer: This information is for educational purposes only and should not be considered as financial advice. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making any investment decisions.

ALLO:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.259707 | 0.1743 | 0.088893 | 0 |

| 2026 | 0.23870385 | 0.2170035 | 0.136712205 | 23 |

| 2027 | 0.2779814835 | 0.227853675 | 0.18456147675 | 29 |

| 2028 | 0.2655634582125 | 0.25291757925 | 0.1492213717575 | 44 |

| 2029 | 0.329235458788687 | 0.25924051873125 | 0.202207604610375 | 47 |

| 2030 | 0.311892268085566 | 0.294237988759968 | 0.226563251345175 | 67 |

ICP:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 6.53499 | 5.313 | 4.72857 | 0 |

| 2026 | 6.8718342 | 5.923995 | 5.0946357 | 11 |

| 2027 | 9.085038732 | 6.3979146 | 5.950060578 | 20 |

| 2028 | 10.37357873244 | 7.741476666 | 7.43181759936 | 45 |

| 2029 | 12.4088129479314 | 9.05752769922 | 7.5177479903526 | 69 |

| 2030 | 12.450477575347812 | 10.7331703235757 | 8.264541149153289 | 101 |

IV. Investment Strategy Comparison: ALLO vs ICP

Long-term vs Short-term Investment Strategy

- ALLO: Suitable for investors focused on AI technology potential and early-stage growth

- ICP: Suitable for investors seeking established Web3 infrastructure and ecosystem development

Risk Management and Asset Allocation

- Conservative investors: ALLO 20% vs ICP 80%

- Aggressive investors: ALLO 40% vs ICP 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risk

- ALLO: Higher volatility due to early-stage development and market uncertainty

- ICP: Susceptible to broader crypto market trends and Web3 adoption rates

Technical Risk

- ALLO: Scalability, network stability, and AI integration challenges

- ICP: Network congestion, smart contract vulnerabilities

Regulatory Risk

- Global regulatory policies may impact both, with potentially greater scrutiny on ICP due to its more established presence

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- ALLO advantages: Early-stage growth potential, AI-focused blockchain technology

- ICP advantages: Established ecosystem, strategic partnerships, Web3 infrastructure support

✅ Investment Advice:

- Novice investors: Consider a smaller allocation to ALLO within a diversified portfolio, with a larger position in ICP

- Experienced investors: Balance between ALLO and ICP based on risk tolerance and belief in AI vs Web3 potential

- Institutional investors: Evaluate ALLO for long-term AI blockchain potential, while leveraging ICP for current Web3 infrastructure exposure

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

FAQ

Q1: What are the key differences between ALLO and ICP in terms of investment potential? A: ALLO is an early-stage AI-focused blockchain project with higher growth potential but more risk, while ICP is a more established Web3 infrastructure project with a developed ecosystem and strategic partnerships.

Q2: How do the current prices of ALLO and ICP compare to their all-time highs? A: ALLO has dropped from its all-time high of $0.8937 to $0.1753, while ICP has fallen from $700.65 to $5.331, representing a more severe decline for ICP in percentage terms.

Q3: What are the price predictions for ALLO and ICP by 2030? A: For ALLO, the base scenario predicts $0.226 - $0.294, with an optimistic scenario of $0.294 - $0.311. For ICP, the base scenario predicts $8.264 - $10.733, with an optimistic scenario of $10.733 - $12.450.

Q4: How should investors allocate their portfolio between ALLO and ICP? A: Conservative investors might consider 20% ALLO and 80% ICP, while aggressive investors could opt for 40% ALLO and 60% ICP, depending on individual risk tolerance and market outlook.

Q5: What are the main risks associated with investing in ALLO and ICP? A: ALLO faces higher volatility due to early-stage development and market uncertainty, while ICP is more susceptible to broader crypto market trends and Web3 adoption rates. Both face potential regulatory risks, with ICP possibly facing greater scrutiny due to its more established presence.

Q6: Which project has shown stronger signs of institutional adoption? A: ICP has demonstrated stronger institutional adoption through its partnership with Web3Labs and its global acceleration program for Web3 startups, indicating more concrete ecosystem development milestones.

Share

Content