AARK vs HBAR: Comparing Two Emerging Cryptocurrencies in the Digital Asset Landscape

Introduction: Investment Comparison of AARK vs HBAR

In the cryptocurrency market, the comparison between AARK vs HBAR has always been a topic that investors cannot ignore. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different crypto asset positioning.

AARK (AARK): Since its launch, it has gained market recognition for its position as the first-of-its-kind Leverage-Everything Perpetual DEX.

HBAR (HBAR): Since its inception in 2019, it has been hailed as a fast, secure, and fair public ledger network, and is one of the cryptocurrencies with high global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between AARK vs HBAR, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, and attempt to answer the question that investors are most concerned about:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

AARK (Coin A) and HBAR (Coin B) Historical Price Trends

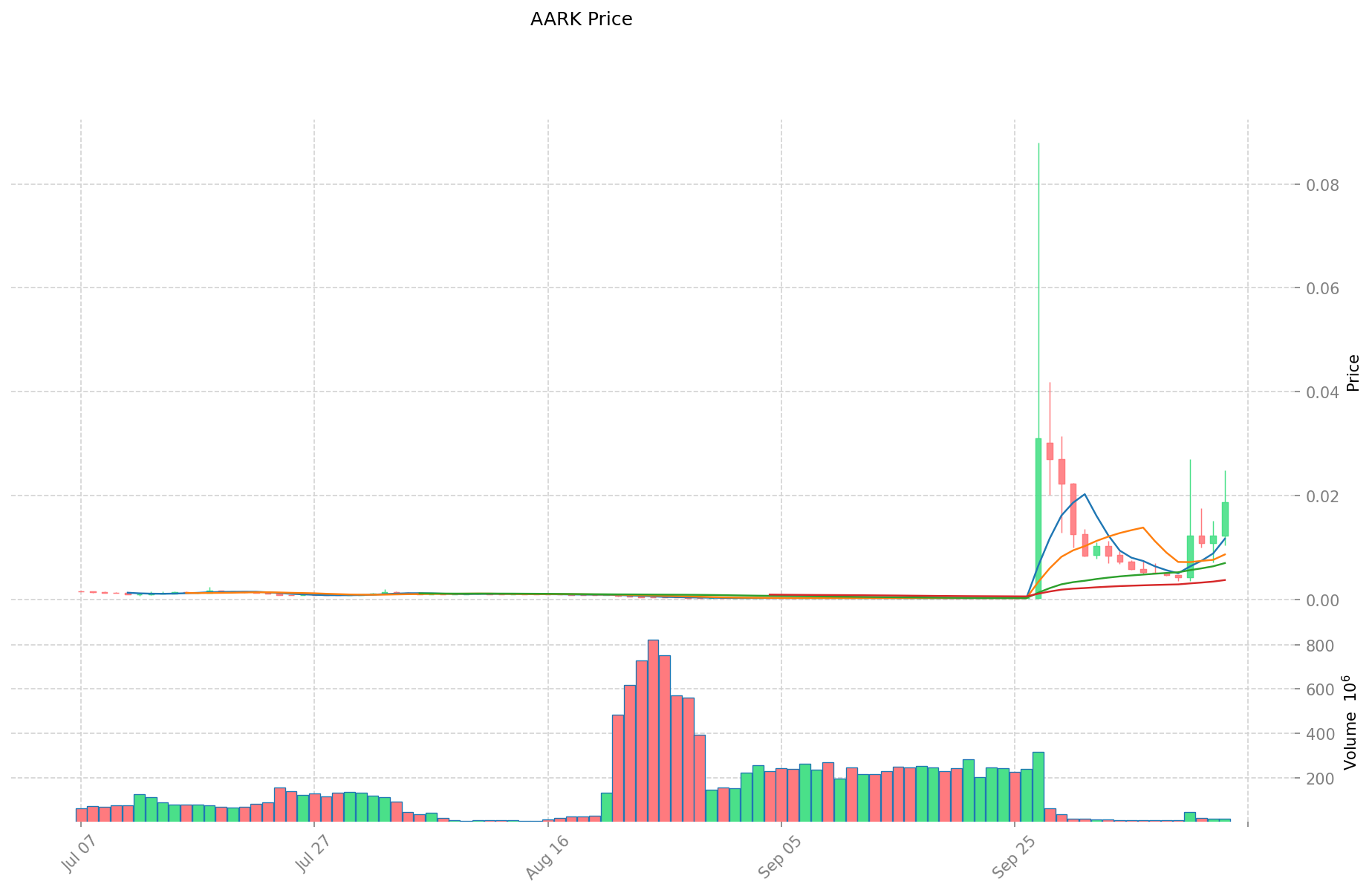

- 2024: AARK reached its all-time high of $0.0992 on June 10, 2024.

- 2021: HBAR hit its all-time high of $0.569229 on September 15, 2021.

- Comparative analysis: AARK's price has fluctuated significantly, dropping from its ATH to a low of $0.0002154 on August 29, 2025. In contrast, HBAR has shown more stability, maintaining a higher price level since its ATH.

Current Market Situation (2025-10-14)

- AARK current price: $0.018646

- HBAR current price: $0.1939

- 24-hour trading volume: AARK $284,180.24 vs HBAR $14,508,936.14

- Market Sentiment Index (Fear & Greed Index): 38 (Fear)

Click to view real-time prices:

- Check AARK current price Market Price

- Check HBAR current price Market Price

II. Core Factors Affecting the Investment Value of AARK vs HBAR

Supply Mechanisms Comparison (Tokenomics)

- AARK: Fixed maximum supply of 10 billion AARK tokens with all tokens minted at launch

- HBAR: Gradually released supply with a cap of 50 billion HBAR; time-based release schedule that extends until 2025

- 📌 Historical pattern: Fixed supply models like AARK's tend to create scarcity effects during high demand periods, while HBAR's gradual release may mitigate volatility but create continued selling pressure.

Institutional Adoption and Market Applications

- Institutional holdings: HBAR has stronger institutional backing through the Hedera Governing Council which includes major corporations like Google, IBM, Boeing, and LG

- Enterprise adoption: HBAR has established enterprise use cases in supply chain, carbon credit tracking, and document verification while AARK's applications remain more speculative

- Regulatory attitudes: HBAR benefits from regulatory clarity through its governing council structure, while AARK faces the typical regulatory uncertainty of newer altcoins

Technology Development and Ecosystem Building

- AARK technology: Built on Solana with focus on financial applications and cross-chain interoperability

- HBAR technology: Utilizes hashgraph consensus with high throughput (10,000+ TPS) and confirmed finality, creating advantages for enterprise applications requiring consistency

- Ecosystem comparison: HBAR has more developed enterprise applications and use cases, particularly in fields requiring trusted transaction networks, while AARK is positioning itself within DeFi and financial applications

Macroeconomic Factors and Market Cycles

- Performance during inflation: HBAR's enterprise utility and governance structure may provide more stability during inflation periods

- Macroeconomic monetary policy: Both tokens face similar impacts from interest rate changes and dollar strength, though HBAR's enterprise adoption may provide some insulation

- Geopolitical factors: HBAR's multinational governing council may provide advantages for cross-border transaction applications in varying geopolitical scenarios

III. 2025-2030 Price Prediction: AARK vs HBAR

Short-term Prediction (2025)

- AARK: Conservative $0.016722 - $0.018789 | Optimistic $0.018789 - $0.027432

- HBAR: Conservative $0.182680 - $0.194340 | Optimistic $0.194340 - $0.223491

Mid-term Prediction (2027)

- AARK may enter a growth phase, with projected prices of $0.016335 - $0.036358

- HBAR may enter a steady growth phase, with projected prices of $0.209584 - $0.331048

- Key drivers: Institutional capital inflow, ETFs, ecosystem development

Long-term Prediction (2030)

- AARK: Base scenario $0.025876 - $0.040431 | Optimistic scenario $0.040431 - $0.049326

- HBAR: Base scenario $0.319291 - $0.347055 | Optimistic scenario $0.347055 - $0.454642

Disclaimer: The above predictions are based on historical data and market analysis. Cryptocurrency markets are highly volatile and subject to rapid changes. These projections should not be considered as financial advice. Always conduct your own research before making investment decisions.

AARK:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.027432086 | 0.0187891 | 0.016722299 | 0 |

| 2026 | 0.02958155904 | 0.023110593 | 0.02241727521 | 22 |

| 2027 | 0.0363575849076 | 0.02634607602 | 0.0163345671324 | 40 |

| 2028 | 0.046400709086424 | 0.0313518304638 | 0.02037868980147 | 66 |

| 2029 | 0.04198637135712 | 0.038876269775112 | 0.0349886427976 | 106 |

| 2030 | 0.049326211090662 | 0.040431320566116 | 0.025876045162314 | 115 |

HBAR:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.223491 | 0.19434 | 0.1826796 | 0 |

| 2026 | 0.26741184 | 0.2089155 | 0.148330005 | 7 |

| 2027 | 0.3310475013 | 0.23816367 | 0.2095840296 | 22 |

| 2028 | 0.3671412054885 | 0.28460558565 | 0.216300245094 | 46 |

| 2029 | 0.368236936993252 | 0.32587339556925 | 0.254181248544015 | 67 |

| 2030 | 0.454642267828439 | 0.347055166281251 | 0.319290752978751 | 78 |

IV. Investment Strategy Comparison: AARK vs HBAR

Long-term vs Short-term Investment Strategies

- AARK: Suitable for investors focused on DeFi and financial applications potential

- HBAR: Suitable for investors seeking enterprise adoption and stability

Risk Management and Asset Allocation

- Conservative investors: AARK: 20% vs HBAR: 80%

- Aggressive investors: AARK: 40% vs HBAR: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- AARK: Higher volatility and susceptibility to market sentiment

- HBAR: Potential selling pressure from gradual token release

Technical Risks

- AARK: Scalability, network stability on Solana

- HBAR: Centralization concerns, potential security vulnerabilities

Regulatory Risks

- Global regulatory policies may have different impacts on both, with HBAR potentially having an advantage due to its governing council structure

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- AARK advantages: Potential for high growth in DeFi sector, fixed supply model

- HBAR advantages: Strong institutional backing, established enterprise use cases, regulatory clarity

✅ Investment Advice:

- New investors: Consider a higher allocation to HBAR for its stability and established use cases

- Experienced investors: Balanced portfolio with both AARK and HBAR, adjusting based on risk tolerance

- Institutional investors: Focus on HBAR for its enterprise adoption and regulatory advantages

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between AARK and HBAR? A: AARK is a Leverage-Everything Perpetual DEX built on Solana, focusing on DeFi applications. HBAR is a public ledger network using hashgraph consensus, with strong institutional backing and enterprise use cases. AARK has a fixed supply of 10 billion tokens, while HBAR has a gradual release schedule with a 50 billion cap.

Q2: Which cryptocurrency has shown more price stability? A: Based on historical data, HBAR has shown more price stability compared to AARK. HBAR has maintained a higher price level since its all-time high, while AARK's price has experienced significant fluctuations.

Q3: How do the institutional adoptions of AARK and HBAR compare? A: HBAR has stronger institutional backing through its Hedera Governing Council, which includes major corporations like Google, IBM, Boeing, and LG. AARK's institutional adoption is less established in comparison.

Q4: What are the key technological differences between AARK and HBAR? A: AARK is built on Solana and focuses on financial applications and cross-chain interoperability. HBAR uses hashgraph consensus, offering high throughput (10,000+ TPS) and confirmed finality, which is advantageous for enterprise applications requiring consistency.

Q5: How do the long-term price predictions for AARK and HBAR compare? A: By 2030, AARK's base scenario prediction ranges from $0.025876 to $0.040431, with an optimistic scenario of $0.040431 to $0.049326. HBAR's base scenario prediction for 2030 is $0.319291 to $0.347055, with an optimistic scenario of $0.347055 to $0.454642.

Q6: What are the main risks associated with investing in AARK and HBAR? A: AARK faces higher volatility, market sentiment risks, and potential scalability issues. HBAR risks include potential selling pressure from gradual token release, centralization concerns, and potential security vulnerabilities. Both face regulatory risks, though HBAR may have an advantage due to its governing council structure.

Q7: Which cryptocurrency might be more suitable for new investors? A: New investors might consider a higher allocation to HBAR due to its stability, established use cases, and strong institutional backing. However, individual investment decisions should be based on personal risk tolerance and thorough research.

Share

Content