2025 ZYRA Fiyat Tahmini: Yeni Kripto Para Biriminin Potansiyel Büyümesi ve Piyasa Eğilimlerinin Analizi

Giriş: ZYRA'nın Piyasadaki Konumu ve Yatırım Potansiyeli

Bitcoin ZK (ZYRA), sıfır bilgi kanıtı teknolojisiyle inşa edilen Bitcoin için Layer 2 ölçeklenme ağı olarak, piyasaya çıktığı günden bu yana Bitcoin ana ağının kapasitesini genişletmede önemli bir rol oynuyor. 2025 yılı itibarıyla ZYRA’nın piyasa değeri 99.880.000 $’a ulaşırken, yaklaşık 1.000.000.000 adet dolaşımdaki token ile 0,09988 $ civarında işlem görüyor. “Bitcoin Layer 2 Yönetim Token’ı” olarak bilinen bu varlık, Bitcoin’in güvenliğini ve merkeziyetsiz yapısını korurken, düşük maliyetli ve yüksek işlem hacimli akıllı sözleşmeler ile işlemleri mümkün kılarak ekosistemde giderek daha kritik bir konum ediniyor.

Bu makalede; ZYRA’nın 2025’ten 2030’a kadar olan fiyat hareketleri, geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler dikkate alınarak kapsamlı biçimde analiz edilecek, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. ZYRA Fiyat Geçmişi ve Güncel Piyasa Durumu

ZYRA Tarihsel Fiyat Gelişimi

- 2025: ZYRA piyasaya çıktı, fiyatı 0,06 $ ile 0,17 $ arasında dalgalandı

- 11 Eylül 2025: ZYRA tüm zamanların en yüksek seviyesi olan 0,17 $’ı gördü

- 11 Eylül 2025: ZYRA tüm zamanların en düşük seviyesi olan 0,06 $’ı gördü

ZYRA Güncel Piyasa Durumu

20 Ekim 2025 itibarıyla ZYRA, 0,09988 $ seviyesinden işlem görüyor ve son 24 saatte %16,06 oranında değer kaybetti. Token’ın piyasa değeri 99.880.000 $ olup, kripto para piyasasında 407. sıradadır. ZYRA, son bir saatte %2,55, son bir haftada %36,43 ve son 30 günde %21,66 oranında düşüş yaşadı. 24 saatlik işlem hacmi 90.125,76 $ olup, fiyat düşüşüne rağmen piyasada aktif işlem gören bir varlık olduğunu gösteriyor. Mevcut fiyat, tüm zamanların en yüksek seviyesinin %41,25 altında ve en düşük seviyesinin %66,47 üstünde; her iki seviye de 11 Eylül 2025’te kaydedildi. Dolaşımdaki arz, toplam ve maksimum arz ile eşit şekilde 1.000.000.000 ZYRA token olup, ek token basımıyla enflasyonun olmayacağını gösteriyor.

Mevcut ZYRA piyasa fiyatını görmek için tıklayın

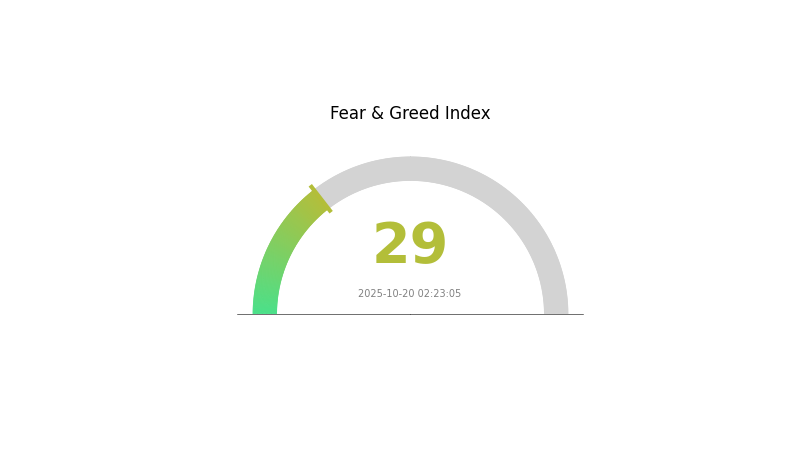

ZYRA Piyasa Duyarlılık Endeksi

20 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Mevcut Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında şu an korku hakim; Korku ve Açgözlülük Endeksi 29 seviyesinde. Bu tablo, yatırımcıların piyasa koşulları hakkında temkinli ve belirsiz olduklarını gösteriyor. Böyle dönemlerde güncel kalmak ve bilinçli, temkinli kararlar almak önemlidir. Unutmayın, korku ortamı uzun vadeli yatırımcılar için alım fırsatları sunabilir; ancak mutlaka detaylı araştırma yapmalı ve riskinizi doğru şekilde yönetmelisiniz. Önümüzdeki günlerde kripto fiyatlarını etkileyebilecek piyasa trendlerini ve temel unsurları yakından izleyin.

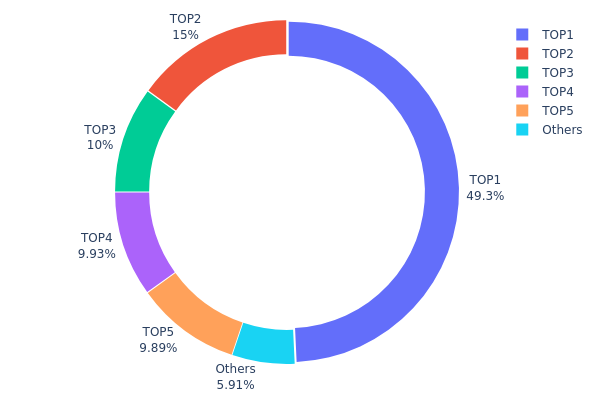

ZYRA Varlık Dağılımı

ZYRA adres bazındaki varlık dağılımı; sahiplik yapısının son derece yoğunlaşmış olduğunu gösteriyor. En üstteki adres, toplam arzın %49,25’ini elinde tutarken, ilk 5 adres tüm ZYRA token’larının %94,07’sini kontrol ediyor. Bu düzeydeki yoğunlaşma, merkezileşme ve olası piyasa manipülasyonu açısından risk oluşturuyor.

Bu dağılım, büyük fiyat dalgalanmalarına ve oynaklığa yol açabilir; birkaç büyük yatırımcının kararı piyasayı ciddi biçimde etkileyebilir. Yüksek yoğunlaşma, düşük merkeziyetsizlik anlamına gelir ve bu da blokzincir projelerinin temel ilkeleriyle çelişebilir.

Bu tablo, ZYRA için henüz olgunlaşmamış bir piyasa yapısı ve küçük yatırımcılar arasında sınırlı benimsenme olduğunu gösteriyor. Ayrıca, fiyat istikrarı ve likidite konusunda risklere işaret etmekte; zira büyük yatırımcılar, piyasadaki fiyat dinamiklerini ciddi şekilde etkileyebilir.

Mevcut ZYRA Varlık Dağılımını görüntülemek için tıklayın

| Üst | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0x7fcc...a3433c | 492.580,84K | 49,25% |

| 2 | 0x15e1...44b427 | 150.000,00K | 15,00% |

| 3 | 0x6e73...1ad5d9 | 100.000,00K | 10,00% |

| 4 | 0x21d0...6e52cb | 99.338,60K | 9,93% |

| 5 | 0xa8dd...673a5e | 98.937,29K | 9,89% |

| - | Diğerleri | 59.143,26K | 5,93% |

II. ZYRA’nın Gelecekteki Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Sabit Arz: ZYRA’nın toplam arzı sabittir; bu, zamanla kıtlık yaratabilir ve fiyatı yukarı çekebilir.

- Tarihsel Eğilim: Sınırlı arz, sabit arzlı kripto paralarda tarihsel olarak fiyat artışına zemin hazırlamıştır.

- Mevcut Etki: Sabit arzın, talep artarsa, ZYRA fiyatını desteklemeye devam etmesi bekleniyor.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Bazı kurumsal yatırımcılar ZYRA’ya ilgi gösteriyor; bu durum fiyat istikrarı sağlayabilir.

- Kurumsal Kullanım: Bazı teknoloji şirketleri iç işlemler için ZYRA’yı araştırıyor; bu da fayda ve değeri artırabilir.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankalarının sıkılaştırıcı politikaları, kısa vadede ZYRA gibi riskli varlıkları etkileyebilir.

- Enflasyona Karşı Koruma: ZYRA, yüksek enflasyon dönemlerinde yatırımcılar için bir miktar enflasyon koruması rolü üstlenmiştir.

- Jeopolitik Unsurlar: Küresel ekonomik belirsizlikler, ZYRA gibi alternatif varlıklara olan ilgiyi artırabilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Ölçeklenebilirlik Güncellemesi: ZYRA, işlem hızını artırmak ve işlem ücretlerini düşürmek için ağ güncellemesi planlıyor.

- Akıllı Sözleşme Özelliği: Akıllı sözleşme desteğinin eklenmesiyle ZYRA’nın kullanım alanlarının genişlemesi bekleniyor.

- Ekosistem Uygulamaları: ZYRA ağı üzerinde geliştirilen çeşitli DeFi projeleri, faydayı ve talebi artırabilir.

III. 2025-2030 ZYRA Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,06145 $ - 0,08000 $

- Tarafsız tahmin: 0,08000 $ - 0,10074 $

- İyimser tahmin: 0,10074 $ - 0,13096 $ (olumlu piyasa koşulları ve artan benimseme ile)

2026-2028 Görünümü

- Piyasa aşaması beklentisi: Kademeli büyüme ve olası oynaklık

- Fiyat aralığı tahmini:

- 2026: 0,06719 $ - 0,15987 $

- 2027: 0,07445 $ - 0,18887 $

- 2028: 0,11109 $ - 0,16827 $

- Temel katalizörler: Teknolojik ilerlemeler, genişleyen kullanım alanları ve genel kripto piyasa trendleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,16582 $ - 0,18323 $ (istikrarlı piyasa büyümesi ve benimseme ile)

- İyimser senaryo: 0,20064 $ - 0,24553 $ (hızlı benimseme ve olumlu düzenleyici ortam ile)

- Dönüştürücü senaryo: 0,24553 $ - 0,30000 $ (çığır açan uygulamalar ve ana akım entegrasyon ile)

- 31 Aralık 2030: ZYRA 0,18323 $ (2025 ortalamasına göre %83 büyüme)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,13096 | 0,10074 | 0,06145 | 0 |

| 2026 | 0,15987 | 0,11585 | 0,06719 | 15 |

| 2027 | 0,18887 | 0,13786 | 0,07445 | 38 |

| 2028 | 0,16827 | 0,16337 | 0,11109 | 63 |

| 2029 | 0,20064 | 0,16582 | 0,13265 | 66 |

| 2030 | 0,24553 | 0,18323 | 0,14658 | 83 |

IV. ZYRA Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ZYRA Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Uzun vadeli yatırımcılar ve Bitcoin’e inananlar

- İşlem önerileri:

- Piyasa düşüşlerinde ZYRA token biriktirin

- Düzenli yatırım planı oluşturun

- Token’ları güvenli donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüş noktalarını belirlemek için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım/satım durumlarını tespit etmek için kullanılır

- Swing trading için önemli noktalar:

- Net giriş ve çıkış noktaları belirleyin

- Risk yönetimi için zarar-durdur emirlerinden faydalanın

ZYRA Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımlarınızı farklı kripto varlıklara dağıtın

- Zarar-durdur emirleri: Potansiyel kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 cüzdanı

- Soğuk saklama: Uzun vadeli varlıklar için çevrimdışı depolama kullanın

- Güvenlik önlemleri: İki faktörlü doğrulama ve güçlü şifreler kullanın

V. ZYRA İçin Potansiyel Riskler ve Zorluklar

ZYRA Piyasa Riskleri

- Oynaklık: Kripto piyasalarında yüksek fiyat dalgalanmaları sık görülür

- Likidite: Sınırlı işlem hacmi fiyat istikrarını etkileyebilir

- Rekabet: Diğer Layer 2 çözümleri ZYRA’nın pazar payını azaltabilir

ZYRA Düzenleyici Riskler

- Düzenleyici belirsizlik: Değişen regülasyonlar ZYRA’nın faaliyetlerini etkileyebilir

- Uyum sorunları: Sürekli değişen regülasyonlara uyum sağlama zorluğu

- Sınır ötesi kısıtlamalar: Uluslararası kullanımda olası engeller

ZYRA Teknik Riskler

- Akıllı sözleşme açıkları: Kod istismarına karşı potansiyel riskler

- Ölçeklenebilirlik sorunları: Artan ağ yüküyle baş etme zorlukları

- Entegrasyon karmaşıklığı: Bitcoin ana ağıyla sorunsuz entegrasyon güçlüğü

VI. Sonuç ve Eylem Önerileri

ZYRA Yatırım Potansiyeli Değerlendirmesi

ZYRA, Bitcoin Layer 2 çözümü olarak uzun vadede güçlü bir değer sunarken, piyasa oynaklığı ve teknik zorluklar nedeniyle kısa vadede risklerle karşı karşıya kalabilir.

ZYRA Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasayı anlamak için küçük ve düzenli yatırımlarla başlayın

✅ Deneyimli yatırımcılar: Uzun vadeli tutma ve aktif alım-satım arasında dengeli bir yaklaşım izleyin

✅ Kurumsal yatırımcılar: Stratejik ortaklıklar ve büyük ölçekli benimseme fırsatlarını değerlendirin

ZYRA İşlem Katılım Yöntemleri

- Spot işlemler: Gate.com üzerinden ZYRA token alıp satabilirsiniz

- Staking: Uygun ise staking programlarına katılın

- DeFi entegrasyonu: BitcoinZK ekosistemindeki merkeziyetsiz finans fırsatlarını keşfedin

Kripto para yatırımları çok yüksek risk içerir. Bu makale yatırım tavsiyesi niteliği taşımaz. Yatırımcılar, kararlarını kendi risk toleranslarına göre vermeli ve profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Bitcoin ZK (ZYRA) iyi bir yatırım mı?: Bu yeni kripto paranın potansiyelini ve risklerini değerlendiriyoruz

2025 ZYRA Fiyat Tahmini: Yükselen Kripto Para Birimi İçin Büyüme Potansiyeli ve Piyasa Trendlerinin Analizi

SatoshiVM (SAVM) iyi bir yatırım mı?: Gelişmekte olan bu Blockchain platformunun potansiyeli ve riskleri üzerine detaylı analiz

2025 ZKPrice Tahmini: Sıfır Bilgi Protokolleri İçin Piyasa Trendlerinin ve Büyüme Potansiyelinin Analizi

2025 ZKC Fiyat Tahmini: Sıfır Bilgi Kriptografi Ekosisteminde ZKC'nin Piyasa Analizi ve Büyüme Potansiyeli

2025 B2Price Fiyat Tahmini: Dijital Para Birimi İçin Piyasa Trendleri ve Yatırım Fırsatları

BTC Blockchain'ında Stake Etme: 2025 Yılı İçin En Son Rehber

Kripto piyasasına yeni adım atanlar için Gate ETF Kaldıraçlı Tokenlar Ticaret Rehberi: Düşük başlangıç seviyeli, yüksek getirili araçların detaylı açıklaması

SEC, Ondo Finance hakkındaki soruşturmayı sonlandırdı: Bu durum DeFi token geliştirme süreçleri ve kripto uyumluluğu açısından ne ifade ediyor?

20 Hafta Önce Ne Kadar Süre Geçti?

USDT’nin Düzenleyici Olarak Tanınması: Stablecoin’ler ADGM’de Uyumluluğu Nasıl Sağlar