2025 ZKJ Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Zero-Knowledge Journey Ecosystem

Introduction: ZKJ's Market Position and Investment Value

Polyhedra Network (ZKJ) has established itself as a pioneering force in the Zero-Knowledge (ZK) Proof sector for Web3 since its inception. As of 2025, ZKJ has achieved a market capitalization of $45,767,865, with a circulating supply of approximately 370,500,000 tokens, and a price hovering around $0.12353. This asset, often referred to as the "ZK Bridge Innovator," is playing an increasingly crucial role in enhancing blockchain interoperability and scalability.

This article will provide a comprehensive analysis of ZKJ's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ZKJ Price History Review and Current Market Status

ZKJ Historical Price Evolution

- 2024: Initial listing, price reached all-time high of $100 on March 19, 2024

- 2025: Market downturn, price dropped significantly to current all-time low

ZKJ Current Market Situation

As of September 30, 2025, ZKJ is trading at $0.12353, representing a significant decline from its all-time high. The token has experienced a 6.27% decrease in the past 24 hours and a substantial 89.25% drop over the past year. With a current market cap of $45,767,865 and a circulating supply of 370,500,000 ZKJ, the token ranks 725th in the overall cryptocurrency market. The 24-hour trading volume stands at $1,032,133.53, indicating moderate market activity. Despite the recent downtrend, ZKJ has shown a slight recovery in the past hour with a 0.49% increase.

Click to view the current ZKJ market price

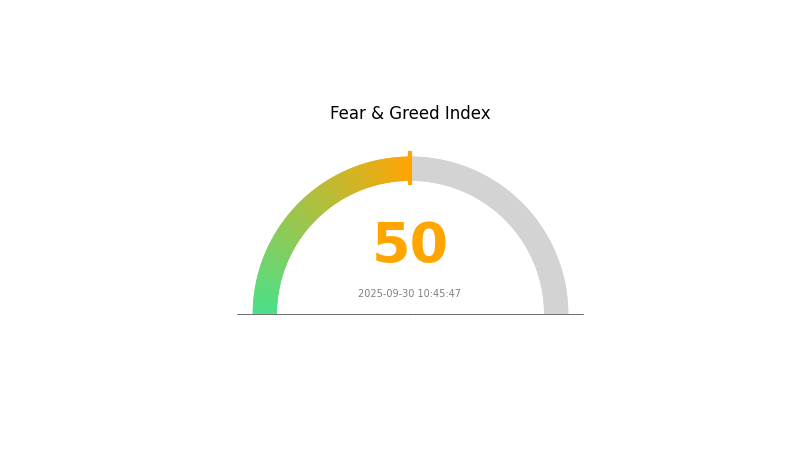

ZKJ Market Sentiment Indicator

2025-09-30 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced as we enter the final quarter of 2025. With a neutral reading of 50, investors are exhibiting a cautious yet optimistic approach. This equilibrium suggests a potential turning point in market dynamics, where neither extreme fear nor excessive greed is dominating trader behavior. Savvy investors may see this as an opportunity to reassess their strategies and position themselves for potential market movements in either direction. As always, it's crucial to stay informed and manage risks appropriately in the ever-evolving crypto landscape.

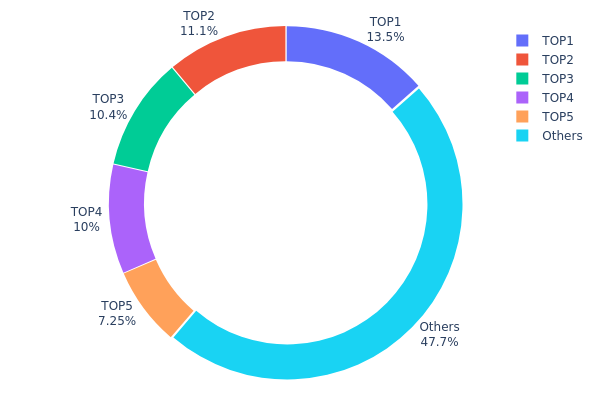

ZKJ Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of ZKJ tokens among different wallet addresses. Analysis of this data reveals a significant concentration of ZKJ tokens among the top holders. The top five addresses collectively control 52.27% of the total ZKJ supply, with the largest holder possessing 13.53% of the tokens.

This level of concentration raises concerns about potential market manipulation and price volatility. The top holders have substantial influence over the token's supply, which could lead to significant price swings if large amounts are sold or transferred. Additionally, the concentration of tokens in a few hands may impact the overall decentralization and governance of the ZKJ ecosystem.

However, it's worth noting that 47.73% of the tokens are distributed among other addresses, indicating some level of wider distribution. This balance between concentrated holdings and broader distribution suggests a mixed market structure for ZKJ, with potential for both stability and volatility depending on the actions of major holders.

Click to view the current ZKJ Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x74df...34274a | 121805.56K | 13.53% |

| 2 | 0xe434...f1b6d8 | 100000.00K | 11.11% |

| 3 | 0xdb1a...4cee12 | 93194.44K | 10.35% |

| 4 | 0x6e41...113eb9 | 90277.78K | 10.03% |

| 5 | 0xb833...194d58 | 65277.78K | 7.25% |

| - | Others | 429444.44K | 47.73% |

II. Core Factors Affecting ZKJ's Future Price

Supply Mechanism

- Liquidity Provision: ZKJ's price stability is heavily influenced by its liquidity providers, who typically set narrow price ranges.

- Historical Pattern: Sudden large sell-offs breaking through these narrow ranges have led to significant price drops in the past.

- Current Impact: The tight liquidity ranges make ZKJ susceptible to rapid price fluctuations if large-scale trading occurs.

Institutional and Whale Dynamics

- Enterprise Adoption: The adoption of ZKJ by notable enterprises could significantly impact its future value.

Macroeconomic Environment

- Monetary Policy Impact: Changes in policy environments can affect investor confidence, potentially leading to capital inflows or outflows in the cryptocurrency market.

- Geopolitical Factors: Economic recession risks and uncertainties in tariff policies may influence ZKJ's price.

Technical Development and Ecosystem Building

- zkBridge Technology: Polyhedra Network's zkBridge technology represents a potential growth factor for ZKJ.

- Ecosystem Applications: The development of DApps and ecosystem projects on the Polyhedra Network could drive demand for ZKJ.

III. ZKJ Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.11751 - $0.12369

- Neutral prediction: $0.12369 - $0.13791

- Optimistic prediction: $0.13791 - $0.15214 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.12512 - $0.18618

- 2028: $0.14411 - $0.21784

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.16953 - $0.19945 (assuming steady market growth)

- Optimistic scenario: $0.19945 - $0.23535 (assuming strong market performance)

- Transformative scenario: $0.23535+ (with exceptional market conditions and widespread adoption)

- 2030-12-31: ZKJ $0.23535 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.15214 | 0.12369 | 0.11751 | 0 |

| 2026 | 0.15998 | 0.13791 | 0.1324 | 11 |

| 2027 | 0.18618 | 0.14895 | 0.12512 | 20 |

| 2028 | 0.21784 | 0.16757 | 0.14411 | 35 |

| 2029 | 0.20619 | 0.1927 | 0.13489 | 55 |

| 2030 | 0.23535 | 0.19945 | 0.16953 | 61 |

IV. ZKJ Professional Investment Strategies and Risk Management

ZKJ Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors focused on Web3 infrastructure

- Operation suggestions:

- Accumulate ZKJ during market dips

- Set price targets for partial profit-taking

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use for trend identification

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor zkBridge adoption metrics

- Track partnerships with major blockchain projects

ZKJ Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Balance ZKJ with other crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, regular security audits

V. ZKJ Potential Risks and Challenges

ZKJ Market Risks

- High volatility: Significant price fluctuations common in crypto markets

- Competition: Other ZK-proof projects may gain market share

- Liquidity risk: Limited trading volume may impact price stability

ZKJ Regulatory Risks

- Uncertain regulations: Potential for unfavorable crypto regulations

- Cross-border compliance: Challenges in adhering to multiple jurisdictions

- Tax implications: Evolving tax treatment of crypto assets

ZKJ Technical Risks

- Smart contract vulnerabilities: Potential for exploits in zkBridge

- Scalability challenges: Ability to handle increasing transaction volumes

- Interoperability issues: Compatibility problems with new blockchain networks

VI. Conclusion and Action Recommendations

ZKJ Investment Value Assessment

ZKJ presents a compelling long-term value proposition as a crucial infrastructure for Web3 interoperability. However, short-term volatility and regulatory uncertainties pose significant risks.

ZKJ Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a core holding with active management around market cycles ✅ Institutional investors: Explore strategic partnerships and potential integration opportunities

ZKJ Trading Participation Methods

- Spot trading: Purchase ZKJ tokens on Gate.com

- Staking: Participate in Staking programs if available

- DeFi integration: Utilize ZKJ in decentralized finance protocols

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is ZKJ a good investment?

ZKJ offers high potential returns but with significant risk. Its innovative technology could drive future growth, making it an attractive option for risk-tolerant investors.

What crypto will 1000x prediction?

Analysts predict Dogecoin (DOGE) could reach $14.60 by 2025, potentially gaining over 1000x from current prices. This forecast is based on current trends and market analysis.

What happened to the ZKJ coin?

ZKJ crashed on June 15, 2025, losing over 63% value in 2 hours. $99 million in liquidations occurred. The crash was linked to liquidity issues in the Koge pool, sparking manipulation claims.

Can Chainlink reach $100?

Yes, Chainlink could potentially reach $100 by 2031. Its strong position in oracle services and growth in real-world asset integration may drive significant value appreciation.

Share

Content