2025 XYO Price Prediction: Bullish Trends and Key Factors Driving XYO's Potential Growth

Introduction: XYO's Market Position and Investment Value

XYO Network (XYO), as the original and largest Decentralized Physical Infrastructure Network (DePIN), has achieved significant growth since its inception in 2018. As of 2025, XYO's market capitalization has reached $104,707,026, with a circulating supply of approximately 13,931,216,938 tokens, and a price hovering around $0.007516. This asset, dubbed the "Real-World Data Oracle," is playing an increasingly crucial role in bridging Web3 and Web2 in AI, geolocation, and beyond.

This article will comprehensively analyze XYO's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. XYO Price History Review and Current Market Status

XYO Historical Price Evolution

- 2020: XYO reached its all-time low of $0.00009672 on March 13, during the global market crash.

- 2021: XYO hit its all-time high of $0.081391 on November 6, amid the broader crypto bull market.

- 2025: XYO is currently trading at $0.007516, showing a 23.73% increase over the past year.

XYO Current Market Situation

As of October 20, 2025, XYO is trading at $0.007516, with a market capitalization of $104,707,026. The token has experienced a 1.23% decrease in the last 24 hours and a more significant 8.19% drop over the past week. Despite these short-term declines, XYO has shown resilience over the past year with a 23.73% price increase. The current price represents a 90.76% decrease from its all-time high and a 7,670% increase from its all-time low, indicating substantial volatility in its price history. With a circulating supply equal to its total supply of 13,931,216,938 XYO, the token has a fully diluted market cap matching its current market cap.

Click to view the current XYO market price

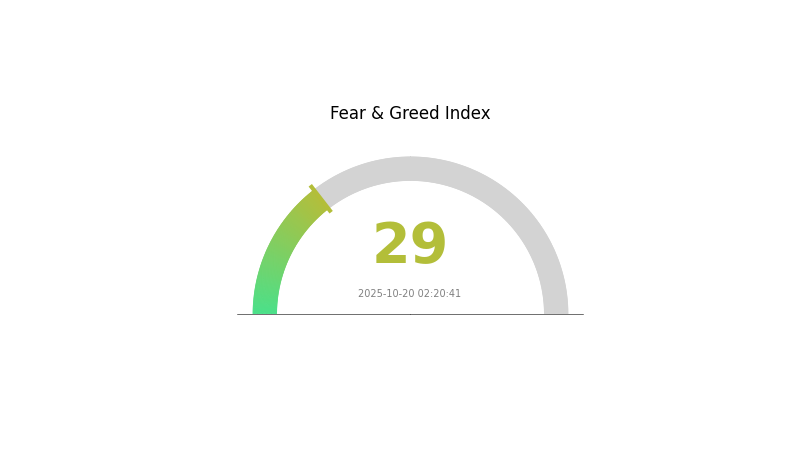

Crypto Market Sentiment Index

2025-10-20 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious, with the Fear and Greed Index at 29, indicating a state of fear. This suggests investors are hesitant and risk-averse. During such periods, some see opportunities for accumulation, while others prefer to wait for clearer market direction. It's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Remember, market sentiment can shift rapidly in the volatile crypto space.

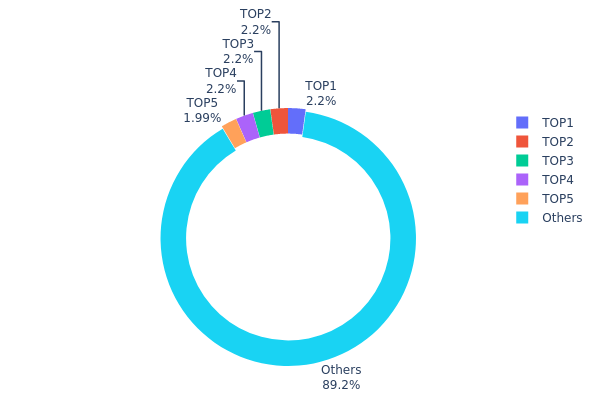

XYO Holdings Distribution

The address holdings distribution for XYO reveals a relatively decentralized structure. The top five addresses each hold approximately 2.19% of the total supply, with the fifth largest holding 1.99%. Collectively, these top addresses account for only 10.75% of the total XYO supply, while the remaining 89.25% is distributed among other addresses.

This distribution pattern suggests a healthy level of decentralization for XYO. The absence of any single address holding a significant portion of the supply reduces the risk of market manipulation or sudden price volatility due to large sell-offs. Furthermore, the balanced distribution among the top holders and the substantial allocation to other addresses indicates a diverse user base and potentially strong community involvement.

The current address distribution reflects positively on XYO's market structure, suggesting a reduced likelihood of centralized control. This distribution pattern may contribute to more stable price movements and a lower risk of market manipulation, enhancing the overall stability and reliability of the XYO network.

Click to view the current XYO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xdda3...c56291 | 306119.99K | 2.19% |

| 2 | 0xc3ed...fc20b0 | 306119.99K | 2.19% |

| 3 | 0xbe70...c0e90b | 306119.99K | 2.19% |

| 4 | 0x28e7...f3d172 | 306094.42K | 2.19% |

| 5 | 0x319e...357f26 | 277389.33K | 1.99% |

| - | Others | 12429373.23K | 89.25% |

II. Key Factors Affecting XYO's Future Price

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, XYO may potentially serve as a hedge against inflation in traditional fiat currencies. However, its effectiveness as an inflation hedge would depend on its market adoption and stability over time.

Technical Development and Ecosystem Building

- Ecosystem Applications: XYO Network aims to build a decentralized location data network. The development of location-based DApps and services within the XYO ecosystem could potentially drive adoption and value for the XYO token.

III. XYO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00497 - $0.00753

- Neutral prediction: $0.00753 - $0.00877

- Optimistic prediction: $0.00877 - $0.01001 (requires favorable market conditions and increased adoption)

2026-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2026: $0.00780 - $0.01166

- 2027: $0.00981 - $0.01277

- 2028: $0.00609 - $0.01379

- Key catalysts: Technological advancements, partnerships, and wider integration of XYO Network

2029-2030 Long-term Outlook

- Base scenario: $0.01264 - $0.01536 (assuming steady market growth and adoption)

- Optimistic scenario: $0.01536 - $0.01808 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.01808 - $0.02000 (with breakthrough use cases and mainstream integration)

- 2030-12-31: XYO $0.01689 (potential peak before year-end consolidation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01001 | 0.00753 | 0.00497 | 0 |

| 2026 | 0.01166 | 0.00877 | 0.0078 | 16 |

| 2027 | 0.01277 | 0.01021 | 0.00981 | 35 |

| 2028 | 0.01379 | 0.01149 | 0.00609 | 52 |

| 2029 | 0.01808 | 0.01264 | 0.00809 | 68 |

| 2030 | 0.01689 | 0.01536 | 0.00968 | 104 |

IV. Professional Investment Strategies and Risk Management for XYO

XYO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and belief in XYO's long-term potential

- Operational suggestions:

- Accumulate XYO tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor XYO's correlation with major cryptocurrencies

- Pay attention to project announcements and partnerships

XYO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different DePIN projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for XYO

XYO Market Risks

- Volatility: XYO's price may experience significant fluctuations

- Competition: Other DePIN projects may gain market share

- Adoption: Slow uptake of XYO's technology could impact token value

XYO Regulatory Risks

- Uncertain regulations: Changing cryptocurrency laws may affect XYO's operations

- Data privacy concerns: Stricter data protection laws could impact XYO's data collection methods

- Token classification: Potential for XYO to be classified as a security

XYO Technical Risks

- Smart contract vulnerabilities: Potential for exploits in XYO's blockchain infrastructure

- Scalability issues: Challenges in handling increased network activity

- Oracle reliability: Ensuring accuracy of real-world data inputs

VI. Conclusion and Action Recommendations

XYO Investment Value Assessment

XYO presents a unique value proposition in the DePIN sector with its established network and real-world data validation capabilities. However, investors should be aware of short-term volatility and potential regulatory challenges.

XYO Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the project's dynamics

✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading

✅ Institutional investors: Explore partnerships and integration opportunities with XYO's technology

XYO Trading Participation Methods

- Spot trading: Buy and sell XYO tokens on Gate.com

- Staking: Participate in XYO staking programs if available

- DeFi integration: Explore XYO-related DeFi opportunities as they emerge

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does XYO COIN have a future?

Yes, XYO COIN has a promising future. With its innovative geospatial blockchain technology and growing adoption, XYO is poised for significant growth in the coming years. By 2025, it's expected to play a crucial role in location-based services and IoT applications.

Is XYO a good long-term investment?

Yes, XYO shows potential as a long-term investment. Its innovative geospatial blockchain technology and growing adoption in various industries suggest promising future growth and value appreciation.

Why is XYO pumping?

XYO's price surge is likely due to increased adoption, positive market sentiment, and potential partnerships or technological advancements in the XYO Network ecosystem.

What crypto has the highest price prediction?

Bitcoin (BTC) is often predicted to have the highest future price among cryptocurrencies, with some analysts forecasting six-figure values by 2030.

Share

Content