2025 WRT Price Prediction: Analyzing Potential Growth and Market Trends in the Crypto Sphere

Introduction: WRT's Market Position and Investment Value

WingRiders (WRT), as a decentralized exchange ecosystem based on AMM built on the Cardano network, has been making strides since its inception. As of 2025, WRT's market capitalization has reached $1,563,582, with a circulating supply of approximately 87,891,090 tokens, and a price hovering around $0.01779. This asset, dubbed the "Cardano DeFi Pioneer," is playing an increasingly crucial role in decentralized finance and token exchange within the Cardano ecosystem.

This article will comprehensively analyze WRT's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

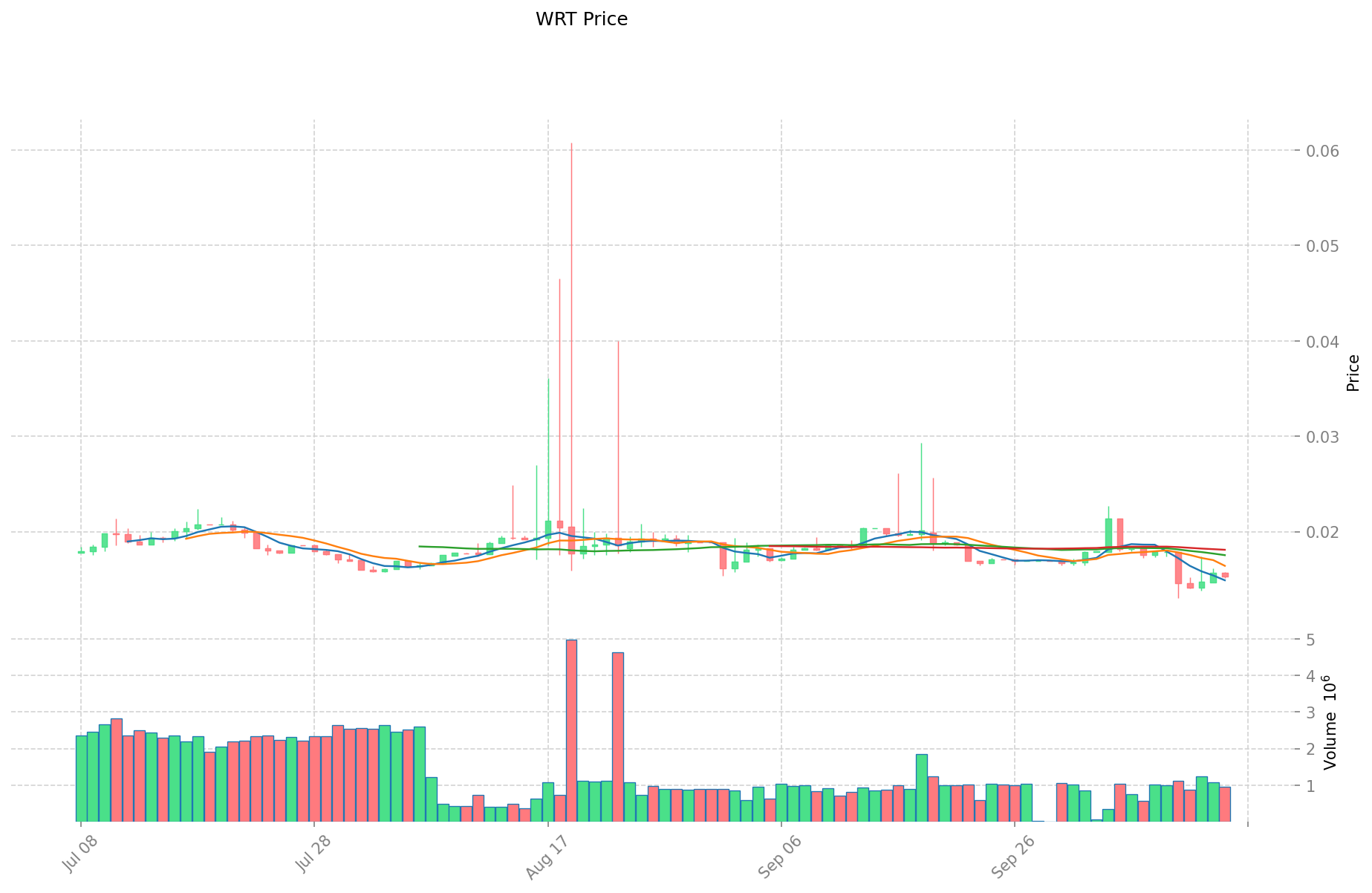

I. WRT Price History Review and Current Market Status

WRT Historical Price Evolution

- 2022: All-time high of $0.949834 reached on July 14, marking a significant milestone for WRT

- 2024: Market downturn, price dropped to an all-time low of $0.00583306 on April 16

- 2025: Gradual recovery, price currently at $0.01779, showing signs of stabilization

WRT Current Market Situation

As of October 15, 2025, WRT is trading at $0.01779, with a market cap of $1,563,582. The token has shown significant volatility in the past 24 hours, with a 13.17% increase. The trading volume stands at $33,230.62, indicating moderate market activity. WRT's current price is 98.13% below its all-time high and 205% above its all-time low, suggesting a potential for recovery but still far from its peak performance. The token's market dominance is relatively low at 0.000043%, reflecting its niche position in the broader cryptocurrency market.

Click to view the current WRT market price

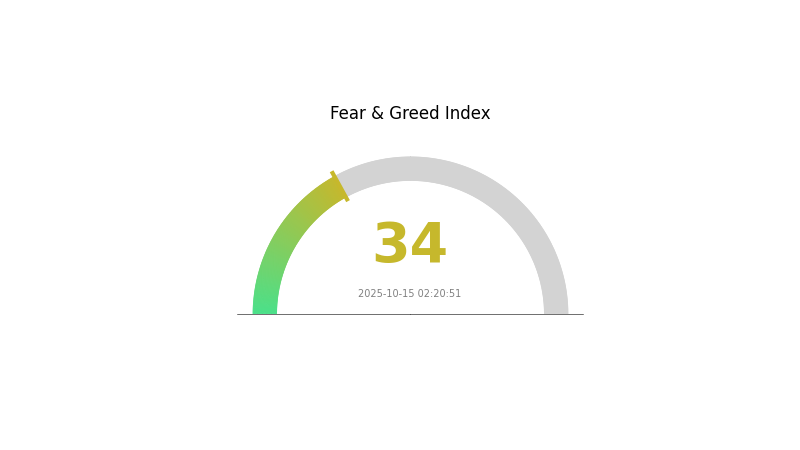

WRT Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, as indicated by the Fear and Greed Index reading of 34. This sentiment suggests that investors are cautious and potentially hesitant to make significant moves in the market. During such times, it's crucial for traders to remain vigilant and conduct thorough research before making any investment decisions. While fear can present buying opportunities for some, it's essential to approach the market with a well-thought-out strategy and risk management plan.

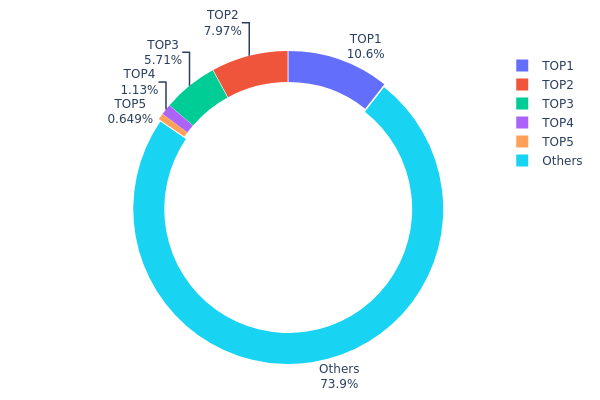

WRT Holdings Distribution

The address holdings distribution data provides insights into the concentration of WRT tokens among different wallet addresses. Analysis of this data reveals a moderate level of concentration in WRT token holdings. The top address holds 10.61% of the total supply, while the top five addresses collectively control 26.04% of WRT tokens. This distribution suggests a notable but not extreme level of concentration.

The remaining 73.96% of WRT tokens are distributed among numerous other addresses, indicating a relatively wide dispersion of ownership. This distribution pattern may contribute to market stability by reducing the potential impact of large individual holders on price movements. However, it's important to note that the top two addresses hold significant portions (10.61% and 7.96% respectively), which could potentially influence market dynamics if these holdings were to be moved or liquidated.

Overall, the current WRT address distribution reflects a moderate level of decentralization. While there is some concentration among top holders, the majority of tokens are spread across a broader base, which may contribute to a more resilient on-chain structure and reduce the risk of market manipulation by individual large holders.

Click to view the current WRT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 134.14K | 10.61% |

| 2 | 0xd43f...d3add8 | 100.67K | 7.96% |

| 3 | 0x51f1...b5320e | 72.22K | 5.71% |

| 4 | 0xa2dc...4c697b | 14.22K | 1.12% |

| 5 | 0x8907...cbb475 | 8.20K | 0.64% |

| - | Others | 934.34K | 73.96% |

II. Key Factors Affecting Future WRT Price

Macroeconomic Environment

- Impact of Monetary Policy: Major central banks' policies are expected to significantly influence the global economic landscape in 2025 and beyond.

- Geopolitical Factors: International trade policies, particularly the 2025 U.S. tariff policy, are bringing notable uncertainties to the global economic structure.

Technological Development and Ecosystem Building

- AI Hardware Advancements: We are likely to see better AI hardware beyond the easily scalable GPU path. Specialized chip sets have been in existence for some time and are expected to play a larger role.

- Ecosystem Applications: The development of new technologies and applications in the WRT ecosystem could potentially drive adoption and value.

III. WRT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.01168 - $0.0160

- Neutral prediction: $0.0160 - $0.0168

- Optimistic prediction: $0.0168 - $0.0176 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.0123 - $0.02316

- 2028: $0.01266 - $0.03034

- Key catalysts: Increasing adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.02243 - $0.03078 (assuming steady market growth)

- Optimistic scenario: $0.03078 - $0.03548 (assuming strong market performance)

- Transformative scenario: $0.03548+ (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: WRT $0.03324 (potential peak before year-end correction)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0176 | 0.016 | 0.01168 | -10 |

| 2026 | 0.02419 | 0.0168 | 0.01226 | -5 |

| 2027 | 0.02316 | 0.0205 | 0.0123 | 15 |

| 2028 | 0.03034 | 0.02183 | 0.01266 | 22 |

| 2029 | 0.03548 | 0.02608 | 0.02243 | 46 |

| 2030 | 0.03324 | 0.03078 | 0.01785 | 73 |

IV. Professional Investment Strategies and Risk Management for WRT

WRT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate WRT during market dips

- Set price targets and rebalance portfolio regularly

- Store WRT in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Identify support and resistance levels

- Use stop-loss orders to manage risk

WRT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: 10-15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Paper wallets for long-term holdings

- Security precautions: Use two-factor authentication, avoid public Wi-Fi for transactions

V. Potential Risks and Challenges for WRT

WRT Market Risks

- High volatility: WRT price can fluctuate dramatically in short periods

- Low liquidity: Limited trading volume may lead to slippage

- Competition: Other DEXs on Cardano may gain market share

WRT Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on DEXs

- AML/KYC requirements: Possible implementation of identity verification measures

- Tax implications: Evolving tax laws may impact WRT holders

WRT Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Scalability issues: Cardano network congestion could affect WingRiders performance

- Interoperability challenges: Limited cross-chain functionality may hinder growth

VI. Conclusion and Recommendations

WRT Investment Value Assessment

WRT shows potential as a key player in the Cardano DeFi ecosystem, but faces significant competition and regulatory uncertainty. Short-term volatility is expected, while long-term value depends on WingRiders' ability to maintain its market position and adapt to challenges.

WRT Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about DeFi and Cardano ecosystem ✅ Experienced investors: Consider allocating a portion of Cardano-focused portfolio to WRT ✅ Institutional investors: Monitor WingRiders' growth and consider strategic investments based on thorough risk assessment

WRT Trading Participation Methods

- Gate.com: Trade WRT on Gate.com's spot market

- DeFi participation: Provide liquidity or stake WRT on WingRiders platform

- OTC trading: For large volume trades, consider Gate.com's OTC services

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is the root network a good investment?

Yes, the Root Network shows promise as an investment. Its innovative technology and growing ecosystem suggest potential for significant value appreciation in the coming years.

What crypto has the highest price prediction?

As of 2025, Ethereum has the highest price prediction among major cryptocurrencies, based on market trends and technological advancements.

What is the price prediction for KP3R in 2025?

Based on market analysis, KP3R is predicted to trade between $6.00 and $6.08 in 2025.

What is the price of WRT?

As of 2025-10-15, the price of WRT is $0.01509, with a 24-hour trading value of $19,531.20.

Share

Content