2025 WIZZ Fiyat Tahmini: Bütçe havayolu şirketinin hisse performansına yönelik artan beklentiler

Giriş: WIZZ’in Piyasa Konumu ve Yatırım Potansiyeli

Wizzwoods (WIZZ), çapraz zincir özellikli bir piksel çiftçiliği oyunu olarak, piyasaya sürülüşünden bu yana blokzincir tabanlı oyun sektöründe büyük ilgi topluyor. 2025 yılı itibarıyla WIZZ’in piyasa değeri 711.486 dolar; dolaşımdaki arzı yaklaşık 423.000.000 token ve fiyatı 0,001682 dolar civarında. Sektörde sıkça bir "Web3 oyun yenilikçisi" olarak anılan WIZZ, sosyal finans ile blokzincir oyunları arasındaki bağı güçlendirmede gitgide daha kritik bir rol üstleniyor.

Bu makale, 2025’ten 2030’a kadar WIZZ’in fiyat hareketlerini; geçmiş trendleri, piyasa arz-talebini, ekosistem gelişimini ve makroekonomik etkenleri analiz ederek profesyonel fiyat öngörüleri ve yatırımcılar için uygulanabilir stratejiler sunacaktır.

I. WIZZ Fiyat Geçmişi ve Güncel Durumu

WIZZ Tarihsel Fiyat Gelişimi

- 2025: WIZZ, 31 Mart’ta 0,0401 dolar ile tüm zamanların en yüksek seviyesine ulaştı ve proje için önemli bir kilometre taşı oldu

- 2025: Token fiyatı sert bir düşüş yaşayarak 28 Ekim’de 0,001433 dolar ile en düşük seviyesine indi

- 2025: WIZZ, aynı yıl içinde ATH ile ATL arasında yüksek oynaklık gösterdi

WIZZ Güncel Piyasa Durumu

30 Ekim 2025’te WIZZ, 0,001682 dolardan işlem görüyor ve son 24 saatte %4,53 artış kaydetti. Token’ın piyasa değeri 711.486 dolar olup, kripto piyasasında 3.140. sırada yer alıyor. Farklı zaman aralıklarında karma bir performans sergileyen WIZZ, son bir saatte %2,13 yükselirken son 30 günde %46,66 oranında değer kaybetti. Son 24 saatlik işlem hacmi 26.632,42 dolar ile orta düzeyde piyasa hareketliliği gösteriyor. 423.000.000 dolaşımdaki WIZZ token, toplam 1.800.000.000 arzın %23,5’ini oluşturuyor. Tam seyreltilmiş piyasa değeri ise 3.027.600 dolar; bu, tüm tokenlar dolaşıma girdiğinde büyüme potansiyelini gösteriyor.

Güncel WIZZ piyasa fiyatını görüntülemek için tıklayın

WIZZ Piyasa Duyarlılık Göstergesi

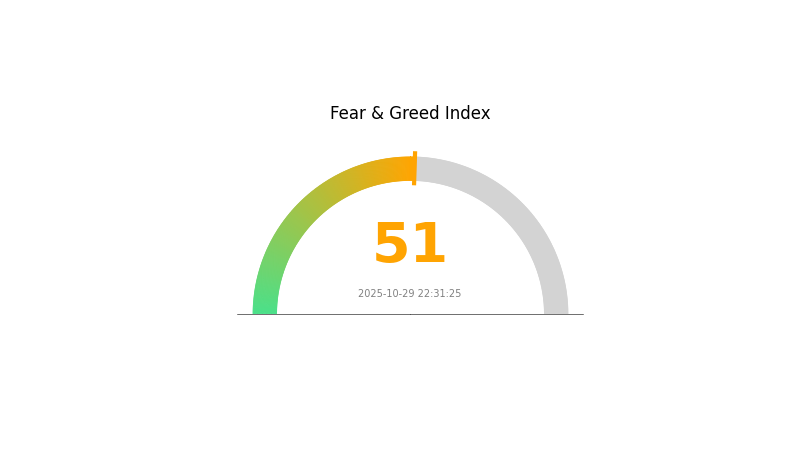

2025-10-29 Korku ve Açgözlülük Endeksi: 51 (Nötr)

Güncel Korku ve Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında duyarlılık dengeli; Korku ve Açgözlülük Endeksi’nin 51 seviyesinde sabit kalması, yatırımcıların ne aşırı kötümser ne de aşırı iyimser olduğunu gösteriyor. Bu denge, temkinli yaklaşımı sürdürürken bir miktar iyimserlik de barındırıyor. Yatırımcılar, bu nötr tablonun gelecek piyasa gelişmeleri veya regülasyon haberleriyle hızla değişebileceğini göz önünde bulundurmalı. Her koşulda, kripto piyasasında başarılı bir şekilde ilerlemek için çeşitlendirme ve detaylı araştırma kritik önem taşır.

WIZZ Varlık Dağılımı

WIZZ token için adres varlık dağılımı verisi mevcut değil; bu da konsantrasyon özelliklerinin detaylı analizini sınırlandırıyor. Veri eksikliğinin nedeni, token’ın yeni olması, zincir üstü aktivitenin sınırlı olması ya da veri toplama ve raporlama sorunları olabilir.

Adres dağılımına ilişkin kesin bilgi olmadan merkeziyetsizlik, olası piyasa manipülasyonu riskleri ve WIZZ’in zincir üstü yapısının istikrarı net şekilde değerlendirilemiyor. Bu veri açığı, büyük sahiplerin fiyat oynaklığını tetikleyip tetiklemediğini veya piyasayı etkileyebilecek baskın adreslerin varlığını tespit etmeyi de güçleştiriyor.

WIZZ’in piyasa yapısı ve potansiyel risklerinin daha isabetli analizi için güncel adres varlık verilerinin edinilmesi ve analiz edilmesi şart. Yatırımcılar ve analistler, WIZZ’e yatırım yapmadan önce dikkatli olmalı ve ek bilgi arayışında bulunmalıdır.

Güncel WIZZ varlık dağılımını görüntülemek için tıklayın

| En Büyük | Adres | Varlık Adedi | Varlık (%) |

|---|

II. WIZZ’in Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Kurumsal ve Büyük Sahip Dinamikleri

- Kurumsal Benimseme: Düşük maliyetli havayolu şirketi Wizz Air, WIZZ fiyatını etkileyebilecek stratejik değişiklikler açıkladı.

- Ulusal Politikalar: Ekonomik zorluk dönemlerinde havayolu şirketlerine yönelik devlet politikaları ve destekler, WIZZ’in performansı üzerinde etkili olabilir.

Makroekonomik Ortam

- Parasal Politika Etkisi: Merkez bankası politikaları ve genel ekonomik koşullar, havacılık sektörünün ve dolayısıyla WIZZ’in performansında belirleyici rol oynar.

- Jeopolitik Faktörler: Uluslararası gelişmeler ve seyahat kısıtlamaları, havacılık sektörü ve WIZZ’in değeri üzerinde önemli etkiye sahip olabilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Stratejik Düzenlemeler: Wizz Air, önümüzdeki üç yıl için yıllık büyüme hedefini %15-20’den %10-12’ye düşürdü; bu değişiklik yatırımcı duyarlılığını ve WIZZ fiyatını etkileyebilir.

- Operasyonel İyileştirmeler: Şirket kapasitesini kayda değer şekilde azaltmayı planlıyor; bu, finansal performansı ve WIZZ fiyatını olumlu yönde etkileyebilir.

III. WIZZ 2025-2030 Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,0014 - 0,00169 dolar

- Nötr tahmin: 0,00169 - 0,002 dolar

- İyimser tahmin: 0,002 - 0,00231 dolar (olumlu piyasa koşulları gerektirir)

2026-2028 Görünümü

- Piyasa fazı beklentisi: Kademeli büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: 0,00108 - 0,00266 dolar

- 2027: 0,00223 - 0,00342 dolar

- 2028: 0,00178 - 0,00391 dolar

- Ana tetikleyiciler: Artan benimseme, teknolojik ilerleme, piyasa duyarlılığı

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00339 - 0,00402 dolar (istikrarlı piyasa büyümesi varsayılırsa)

- İyimser senaryo: 0,00402 - 0,00464 dolar (güçlü piyasa performansı varsayılırsa)

- Dönüştürücü senaryo: 0,00464 - 0,00498 dolar (olağanüstü piyasa koşulları ve yaygın benimseme varsayılırsa)

- 2030-12-31: WIZZ 0,00498 dolar (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,00231 | 0,00169 | 0,0014 | 0 |

| 2026 | 0,00266 | 0,002 | 0,00108 | 18 |

| 2027 | 0,00342 | 0,00233 | 0,00223 | 38 |

| 2028 | 0,00391 | 0,00287 | 0,00178 | 70 |

| 2029 | 0,00464 | 0,00339 | 0,0019 | 101 |

| 2030 | 0,00498 | 0,00402 | 0,00366 | 138 |

IV. WIZZ Profesyonel Yatırım Stratejileri ve Risk Yönetimi

WIZZ Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Web3 sosyal finans ve blokzincir oyunlarına ilgi duyan risk toleransı yüksek yatırımcılar

- İşlem önerileri:

- Piyasa geri çekilmelerinde WIZZ token biriktirin

- Wizzwoods oyun geliştirme ve kullanıcı tabanını takip edin

- Token’ları yedekli ve güvenli bir cüzdanda saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve destek/direnç noktalarını belirlemede kullanılabilir

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım durumlarını izleyin

- Kısa vadeli al-sat için önemli noktalar:

- Zarar durdur emirleriyle olası kayıpları sınırlandırın

- Önceden belirlenen fiyat hedeflerinde kâr alın

WIZZ Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Birden fazla oyun ve Web3 projesine yatırım yapın

- Zarar durdur emirleri: Olası kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama kullanın, güçlü şifreler belirleyin ve özel anahtarları çevrimdışı tutun

V. WIZZ Potansiyel Riskler ve Zorluklar

WIZZ Piyasa Riskleri

- Yüksek oynaklık: WIZZ fiyatı ciddi dalgalanmalara uğrayabilir

- Rekabet: Diğer blokzincir oyun projeleri Wizzwoods’un pazar payını etkileyebilir

- Piyasa duyarlılığı: Genel kripto piyasa koşulları WIZZ fiyatı üzerinde etkili olabilir

WIZZ Düzenleyici Riskleri

- Belirsiz regülasyonlar: Kripto para regülasyonlarında olası değişiklikler WIZZ üzerinde etkili olabilir

- Çapraz zincir uyumluluğu: Farklı blokzincir ekosistemlerinde regülasyon zorlukları

- Oyun mevzuatı: Bazı ülkelerde blokzincir tabanlı oyunlara getirilebilecek kısıtlamalar

WIZZ Teknik Riskler

- Akıllı kontrat zafiyetleri: Token kontratında potansiyel güvenlik açıkları

- Çapraz zincir riskleri: Birden fazla blokzincirle sorunsuz entegrasyonun sürdürülebilmesinde zorluklar

- Ölçeklenebilirlik endişeleri: Artan kullanıcı aktivitesini yönetmede olası kısıtlar

VI. Sonuç ve Eylem Önerileri

WIZZ Yatırım Değeri Değerlendirmesi

WIZZ, blokzincir oyunları ve sosyal finans alanında uzun vadeli büyüme için benzersiz fırsatlar sunar. Ancak, projenin erken aşamada olması ve piyasa dalgalanmaları nedeniyle kısa vadede yüksek risk taşır.

WIZZ Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Wizzwoods ekosistemini keşfetmek için küçük ve deneme yatırımları yapın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle düzenli alım stratejisi uygulayın ✅ Kurumsal yatırımcılar: Detaylı inceleme yaparak WIZZ’i çeşitlendirilmiş bir Web3 portföyüne dahil etmeyi değerlendirin

WIZZ İşlem Katılım Yöntemleri

- Spot işlem: Gate.com üzerinden WIZZ token satın alın

- Staking: Wizzwoods platformunda varsa staking programlarına katılım sağlayın

- Oyun içi alımlar: Wizzwoods oyun ekosisteminde kullanım için WIZZ token edinin

Kripto para yatırımları son derece yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profillerine göre dikkatli karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

2025’te WIZZ Ekosistem Coin fiyat tahmini nedir?

Piyasa analizlerine göre WIZZ’in 2025’te 0,000002838 ile 0,00001565 dolar arasında işlem görmesi bekleniyor.

Wizz alınmalı mı, satılmalı mı?

Wizz potansiyel bir alım fırsatı olarak görülüyor. Analistlerin görüşleri karışık olsa da bazıları alım tavsiye ediyor. Karar vermeden önce piyasa trendlerini ve yatırım stratejinizi mutlaka değerlendirin.

2030’da Wizz Air hisse fiyatı tahmini nedir?

Wizz Air’ın hisse fiyatının 2030’da yaklaşık 2.800 GBX’e yükselmesi öngörülüyor; bu da 2025’teki tahmini 1.730 GBX seviyesinden istikrarlı bir artış anlamına geliyor.

2025 için NVDA fiyat hedefi nedir?

Analist tahminlerine göre NVDA’nın 2025 yılı ortalama fiyat hedefi 227,26 dolar olup, en yüksek tahmin 320,00 dolardır.

Moonveil (MORE) iyi bir yatırım mı?: Bu yeni kripto paranın potansiyelini ve risklerini inceliyoruz

FPS vs FIL: Oyun Performansında Liderlik Yarışı

2025 MELD Fiyat Tahmini: Potansiyel Büyüme Faktörleri ile Piyasa Trendlerinin Analizi

2025 ESPORTS Fiyat Tahmini: Rekabetçi Oyun Sektöründe Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 TICO Fiyat Tahmini: Dijital Varlık için Piyasa Trendleri ve Gelecek Perspektiflerinin Analizi

2025 Yılında Atılım Yapacak 5 Kripto Para Tahmini

2025 yılında borsalara giren varlıklar ve DOT tutarları, Polkadot'un likiditesi ile fon hareketleri üzerinde nasıl bir etki yaratır?

Token Ekonomisi Modeli Nedir: LUNC'nin %1,2 Yakım Vergisi ve Deflasyon Mekanizması Nasıl İşler