2025 WCT Price Prediction: Market Analysis and Future Outlook for World Computer Token

Introduction: WCT's Market Position and Investment Value

WalletConnect (WCT), as the connectivity network redefining onchain user experience, has become a trusted standard in the crypto world since its inception. As of 2025, WalletConnect's market capitalization has reached $45,786,580, with a circulating supply of approximately 186,200,000 tokens, and a price hovering around $0.2459. This asset, often referred to as the "Visa of Web3," is playing an increasingly crucial role in facilitating seamless interactions between wallets, applications, and blockchains across the DeFi and NFT ecosystems.

This article will provide a comprehensive analysis of WalletConnect's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. WCT Price History Review and Current Market Status

WCT Historical Price Evolution

- 2025: WCT token launch, price reached an all-time high of $1.3968 on May 30

- 2025: Market correction, price declined to $0.2445 on September 30

WCT Current Market Situation

As of September 30, 2025, WCT is trading at $0.2459, experiencing a 4.5% decrease in the last 24 hours. The token has seen significant downward pressure, with a 11.74% decline over the past week and an 18.33% drop in the last 30 days. The current price represents a 82.4% decrease from its all-time high of $1.3968 set on May 30, 2025.

WCT's market capitalization stands at $45,786,580, ranking it 724th among all cryptocurrencies. The fully diluted market cap is $245,900,000, with a circulating supply of 186,200,000 WCT out of a total supply of 1,000,000,000 tokens.

Trading volume in the past 24 hours reached $700,448, indicating moderate market activity. The token's market dominance is currently at 0.0059%, reflecting its relatively small share in the overall cryptocurrency market.

Click to view the current WCT market price

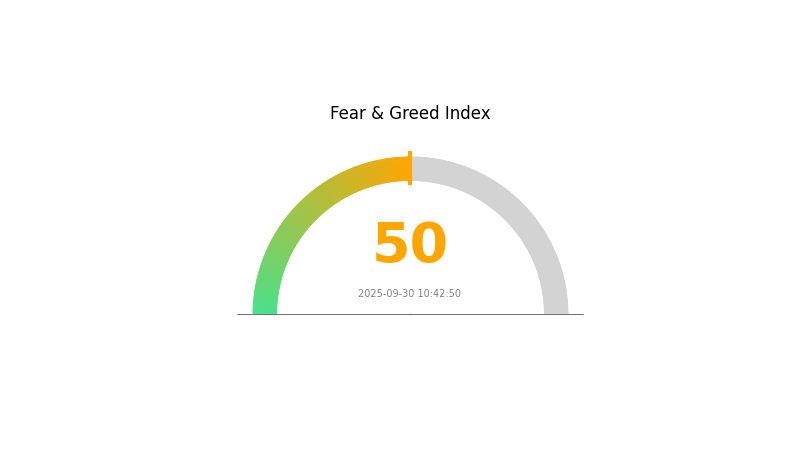

WCT Market Sentiment Indicator

2025-09-30 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains neutral, with the Fear and Greed Index standing at 50. This balanced state suggests investors are neither overly fearful nor excessively greedy. Market participants appear to be cautiously optimistic, weighing potential risks against opportunities. As the crypto landscape continues to evolve, traders should stay vigilant and make informed decisions based on thorough research and analysis. Remember, market conditions can change rapidly, so it's crucial to keep an eye on emerging trends and adjust strategies accordingly.

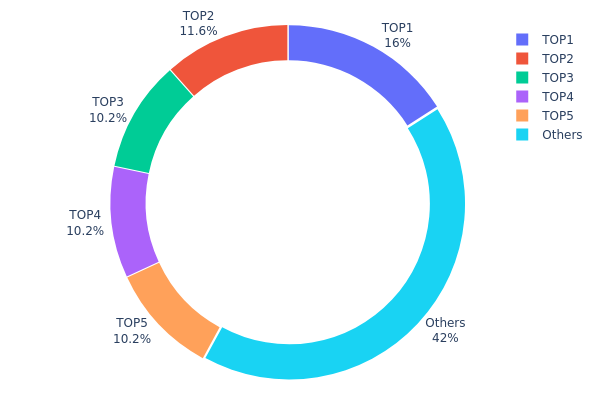

WCT Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of WCT tokens. The top five addresses collectively hold 58.02% of the total supply, with the largest holder possessing 15.96%. This indicates a relatively high concentration of tokens among a few key addresses.

Such concentration raises concerns about potential market manipulation and price volatility. The presence of three addresses each holding 10.17% of the supply suggests possible strategic allocations or institutional involvement. However, with 41.98% distributed among other addresses, there is still a significant level of decentralization in the token's ownership structure.

This distribution pattern reflects a market structure that balances between centralized control and wider participation. While the concentration among top holders could impact price stability, the substantial portion held by smaller addresses contributes to overall market resilience and liquidity.

Click to view the current WCT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2ff1...1e2ec2 | 156925.06K | 15.96% |

| 2 | 0xa86c...6ba6e7 | 113513.87K | 11.55% |

| 3 | 0x3635...0c7246 | 100000.00K | 10.17% |

| 4 | 0x9ce1...0fd60d | 100000.00K | 10.17% |

| 5 | 0xf853...b61c61 | 100000.00K | 10.17% |

| - | Others | 412265.33K | 41.98% |

II. Key Factors Influencing WCT's Future Price

Market Sentiment

- Short-term fluctuations: Market conditions play a major role in price movements, especially for newly listed tokens.

- Current impact: The initial price volatility after listing, ranging from $0.4 to $0.3, was influenced by market sentiment, new token weakness, and selling pressure from airdrops and new offerings.

Macroeconomic Environment

- Global economic factors: Past economic uncertainties, such as the pandemic and supply chain disruptions, have affected overall investment sentiment and crypto markets.

- Market cycles: WCT's value is expected to be fully realized in the later stages of a bull market when investors focus on projects with real users, revenue, and demand.

Technical Development and Ecosystem Building

- Network usage growth: A key indicator of WCT's value is the increase in network usage.

- Ecosystem expansion: The development and growth of the WCT ecosystem are crucial for long-term value.

- Governance mechanisms: Improvements in governance mechanisms contribute to WCT's fundamental strength.

Institutional and Large Holder Dynamics

- Investor focus: As the market matures, there's an increasing emphasis on projects with real users, genuine revenue streams, and actual demand, which could lead to a revaluation of infrastructure leaders like WCT.

Regulatory Environment

- Policy and regulations: Regulatory decisions can significantly impact the price of cryptocurrencies, including WCT.

III. WCT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.13054 - $0.20000

- Neutral prediction: $0.20000 - $0.28000

- Optimistic prediction: $0.28000 - $0.32758 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.28048 - $0.48507

- 2028: $0.22821 - $0.59906

- Key catalysts: Technological advancements, wider market acceptance

2029-2030 Long-term Outlook

- Base scenario: $0.50329 - $0.61402 (assuming steady market growth)

- Optimistic scenario: $0.61402 - $0.87191 (assuming strong adoption and favorable market conditions)

- Transformative scenario: $0.87191 - $1.00000 (assuming breakthrough use cases and mainstream integration)

- 2030-12-31: WCT $0.61402 (potential for significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.32758 | 0.2463 | 0.13054 | 0 |

| 2026 | 0.37302 | 0.28694 | 0.20086 | 16 |

| 2027 | 0.48507 | 0.32998 | 0.28048 | 34 |

| 2028 | 0.59906 | 0.40753 | 0.22821 | 65 |

| 2029 | 0.72474 | 0.50329 | 0.28184 | 104 |

| 2030 | 0.87191 | 0.61402 | 0.54648 | 149 |

IV. Professional WCT Investment Strategies and Risk Management

WCT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and belief in WalletConnect's long-term potential

- Operation suggestions:

- Accumulate WCT during market dips

- Set predetermined profit-taking levels

- Store tokens securely in a hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Watch for significant news or updates from the WalletConnect team

- Monitor trading volume for potential breakouts

WCT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for WCT

WCT Market Risks

- Price volatility: WCT may experience significant price swings

- Competition: Other connectivity solutions may emerge and gain market share

- Market sentiment: Overall crypto market conditions can impact WCT's price

WCT Regulatory Risks

- Unclear regulations: Evolving crypto regulations may affect WCT's adoption

- Compliance challenges: WalletConnect may face regulatory scrutiny as it grows

- Cross-border restrictions: International regulations may limit WCT's global use

WCT Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the token contract

- Network congestion: High usage could lead to slower transaction times

- Interoperability issues: Challenges in maintaining compatibility across various blockchains

VI. Conclusion and Action Recommendations

WCT Investment Value Assessment

WCT presents a unique opportunity in the Web3 infrastructure space, with strong potential for long-term growth. However, investors should be aware of short-term volatility and the evolving nature of the crypto market.

WCT Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about WalletConnect's technology ✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading ✅ Institutional investors: Evaluate WCT as part of a diversified crypto portfolio, focusing on its role in Web3 infrastructure

WCT Trading Participation Methods

- Spot trading: Buy and sell WCT on Gate.com's spot market

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore DeFi platforms that support WCT for additional utility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for WCT token in 2030?

Based on current market trends, the WCT token is predicted to reach a maximum price of $2.26 and a minimum of $2.12 in 2030.

Is a WCT token a good investment?

Yes, WCT token appears to be a good investment in 2025. Technical analysis suggests positive trends and potential for growth in the coming years.

Is WCT a good investment?

WCT shows potential for growth, with projections indicating a peak price of $2.54. Despite short-term fluctuations, long-term trends appear bullish, making it a promising investment option in the current market.

Who is the owner of WCT coin?

WCT coin is owned by Chwee Lai Wong, Sewe Wing Wong, Soon Huat Chan, and Kim Hwa Taing, who founded the company on January 14, 1981.

Share

Content