2025 WALLET Fiyat Tahmini: Dijital Varlık Saklama Çözümlerinin Piyasa Eğilimleri ve Gelecek Potansiyelinin Değerlendirilmesi

Giriş: WALLET’in Piyasa Konumu ve Yatırım Potansiyeli

Açık kaynaklı, yönetimsiz ve tam donanımlı bir DeFi cüzdanı olan Ambire Wallet (WALLET), kuruluşundan bu yana önemli kilometre taşlarına imza attı. 2025 yılı itibarıyla WALLET’in piyasa değeri 18.067.638 $’a ulaşırken, yaklaşık 721.608.692 adet token dolaşımda bulunuyor ve fiyatı 0,025038 $ civarında seyrediyor. “Kullanıcı dostu DeFi çözümü” olarak bilinen bu varlık, merkeziyetsiz finans ve kripto para yönetimi alanında giderek daha stratejik bir rol üstleniyor.

Bu makale, 2025-2030 yılları arasında WALLET’in fiyat dinamiklerini; tarihsel eğilimler, piyasa arz-talep dengeleri, ekosistem gelişimi ve makroekonomik etkenler ışığında kapsamlı şekilde analiz ederek, yatırımcılara uzman fiyat tahminleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. WALLET Fiyat Geçmişi ve Güncel Piyasa Durumu

WALLET Tarihsel Fiyat Seyri

- 2022: Tüm zamanların zirvesi; 4 Şubat’ta fiyat 0,199652 $’a ulaştı

- 2023: Piyasa düşüşü; 6 Eylül’de fiyat tüm zamanların en düşük seviyesi olan 0,00329061 $’a geriledi

- 2025: Piyasa toparlanması; güncel fiyat 0,025038 $

WALLET Güncel Piyasa Görünümü

6 Ekim 2025 itibarıyla WALLET’in fiyatı 0,025038 $. Token, son bir yılda %54,92 oranında değer kazanarak ciddi dalgalanma gösterdi. Kısa vadede, geçtiğimiz hafta %9,77 yükseliş, son 30 gün ise %5,17 düşüş gerçekleşti. 24 saatlik işlem hacmi 17.435,43 $ olup, bu durum orta düzey piyasa hareketliliğine işaret ediyor. Dolaşımdaki WALLET miktarı 721.608.692 ve toplam arz 728.927.654,77; piyasa değeri ise 18.067.638,43 $. Mevcut fiyat, zirve seviyesinden %87,45 daha düşük ve piyasa koşulları iyileşirse büyüme için potansiyel barındırıyor.

Güncel WALLET piyasa fiyatını görüntülemek için tıklayın

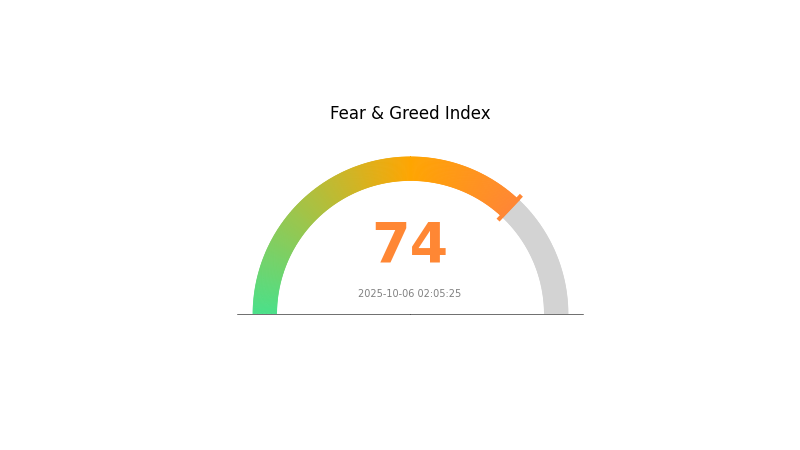

WALLET Piyasa Duyarlılığı Göstergesi

2025-10-06 Korku ve Açgözlülük Endeksi: 74 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda iyimserlik hakim; Korku ve Açgözlülük Endeksi’nin 74 puanla “Açgözlülük” seviyesinde olması, yatırımcıların piyasa beklentileri konusunda olumlu düşündüğünü gösteriyor. Bu tür bir duyarlılık genellikle fiyatlarda yükselişle sonuçlansa da, yüksek açgözlülük düzeyi bazen düzeltmelerin öncüsü olabilir. Risk yönetimi için portföyünüzü çeşitlendirin ve piyasa araştırmasını ihmal etmeyin.

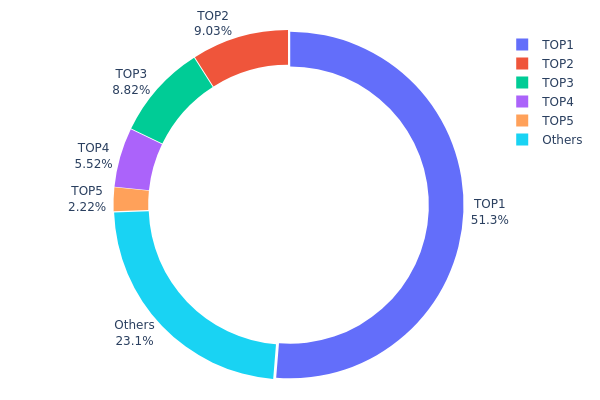

WALLET Token Dağılımı

Adres bazlı varlık dağılımı, WALLET’te son derece yoğunlaşmış bir sahiplik yapısına işaret ediyor. En büyük adres, toplam arzın %51,29’unu elinde tutarken, sonraki dört adres birlikte %25,56’lık paya sahip. Böylece, ilk 5 adres WALLET tokenlarının %76,85’ini kontrol ediyor; kalan %23,15 ise diğer yatırımcılar arasında dağılmış durumda.

Bu yoğunlaşma, piyasa manipülasyonu ve fiyat oynaklığı riskini artırıyor. En büyük adresin sahip olduğu devasa miktar, büyük işlemlerle piyasa dinamiklerini ciddi şekilde etkileyebilir. Merkeziyetsizliğin düşük olması, WALLET’in piyasa şoklarına karşı kırılganlığını ve istikrarını azaltabilir. Mevcut dağılım, WALLET’in piyasa yapısının az sayıda büyük yatırımcıya bağımlı olduğunu ve bu nedenle küçük katılımcılar için likiditenin düşük, fiyat dalgalanmasının ise yüksek olabileceğini gösteriyor.

Güncel WALLET Varlık Dağılımı için tıklayın

| İlk | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x47cd...c12935 | 373.882,98K | 51,29% |

| 2 | 0xfde6...2664d1 | 65.813,41K | 9,02% |

| 3 | 0x1870...dda12e | 64.273,21K | 8,81% |

| 4 | 0x53bb...875a66 | 40.234,34K | 5,51% |

| 5 | 0x0d07...b492fe | 16.194,66K | 2,22% |

| - | Diğerleri | 168.518,51K | 23,15% |

II. WALLET’in Gelecek Fiyatını Belirleyen Temel Unsurlar

Arz Mekanizması

- Halving: Blok ödüllerindeki periyodik azalma, dolaşıma giren yeni WALLET miktarını doğrudan etkiler.

- Tarihsel Model: Geçmişteki halving’ler, arzın azalmasıyla genellikle fiyat artışına neden oldu.

- Güncel Etki: Yaklaşan halving’in WALLET fiyatında yukarı yönlü baskı oluşturması bekleniyor.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Önde gelen kurumlar WALLET’i portföylerine aktif şekilde eklemeye başladı.

- Kurumsal Benimseme: MicroStrategy gibi şirketler önemli WALLET alımları gerçekleştirdi.

- Devlet Politikaları: Bazı ülkelerde düzenleyici netliğin artması, kurumsal katılımı teşvik ediyor.

Makroekonomik Koşullar

- Para Politikası Etkisi: Merkez bankalarının faiz kararları, WALLET’in yatırım cazibesini doğrudan etkiler.

- Enflasyona Karşı Koruma: WALLET, altın gibi enflasyona karşı koruma aracı olarak görülebiliyor.

- Jeopolitik Unsurlar: Küresel ekonomik belirsizlikler, yatırımcıları WALLET’e güvenli liman olarak yönlendirebilir.

Teknik Gelişim ve Ekosistem Büyümesi

- Layer 2 Çözümleri: Ölçeklenebilirlik ve işlem hızındaki iyileşmeler WALLET’in kullanımını artırıyor.

- DeFi Entegrasyonu: Merkeziyetsiz finans platformlarıyla artan entegrasyon WALLET’in işlevselliğini genişletiyor.

- Ekosistem Uygulamaları: WALLET blockchain üzerinde geliştirilen DApp ve projelerin artışı, benimsemeyi hızlandırıyor.

III. 2025-2030 WALLET Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,02179 $ – 0,02505 $

- Tarafsız tahmin: 0,02505 $ – 0,03000 $

- İyimser tahmin: 0,03000 $ – 0,03407 $ (pozitif piyasa algısı ve artan benimseme ile)

2027-2028 Görünümü

- Piyasa fazı: Yükselen dalgalanma ile potansiyel büyüme dönemi

- Fiyat aralık öngörüsü:

- 2027: 0,01836 $ – 0,04161 $

- 2028: 0,02924 $ – 0,05090 $

- Temel tetikleyiciler: Teknolojik inovasyonlar, kripto paranın yaygın kabulu ve olası düzenleyici netlik

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,04350 $ – 0,05351 $ (istikrarlı büyüme ve benimseme ile)

- İyimser senaryo: 0,05351 $ – 0,06351 $ (hızlı benimseme ve olumlu piyasa koşulları ile)

- Dönüştürücü senaryo: 0,06351 $ – 0,06689 $ (çığır açan inovasyon ve yaygın entegrasyon ile)

- 2030-12-31: WALLET 0,06689 $ (iyimser projeksiyona göre olası zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,03407 | 0,02505 | 0,02179 | 0 |

| 2026 | 0,03163 | 0,02956 | 0,02483 | 18 |

| 2027 | 0,04161 | 0,03059 | 0,01836 | 22 |

| 2028 | 0,0509 | 0,0361 | 0,02924 | 44 |

| 2029 | 0,06351 | 0,0435 | 0,03915 | 73 |

| 2030 | 0,06689 | 0,05351 | 0,04067 | 113 |

IV. WALLET Profesyonel Yatırım Stratejileri ve Risk Yönetimi

WALLET Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı: Uzun vadeli bakış açısına sahip, risk toleransı yüksek yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde WALLET biriktirin

- Kısmi kâr için fiyat hedefleri belirleyin

- Tokenları gelişmiş güvenlik için Gate Web3 cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Eğilim ve olası giriş/çıkış noktalarını belirleyin

- RSI: Aşırı alım/aşırı satım sinyallerini takip edin

- Swing trade için ana noktalar:

- Zararı durdur emirleriyle potansiyel kayıpları sınırlayın

- Belirlenmiş direnç seviyelerinde kâr alın

WALLET Risk Yönetimi Yapısı

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Orta riskli yatırımcı: Kripto portföyünün %3-5’i

- Aggresif yatırımcı: Kripto portföyünün %5-10’u

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Farklı kripto varlıklara yatırım yapın

- Zararı durdur emirleri: Potansiyel kayıpları sınırlandırın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdan

- Soğuk saklama: Donanım cüzdanı ile uzun vadeli muhafaza

- Güvenlik önlemleri: İki adımlı doğrulama ve güçlü şifreler kullanın

V. WALLET ile İlgili Potansiyel Riskler ve Zorluklar

WALLET Piyasa Riskleri

- Volatilite: Kripto piyasasında aşırı fiyat dalgalanmaları sık görülür

- Likidite: Düşük işlem hacmi alım-satım kolaylığını azaltabilir

- Rekabet: Diğer DeFi cüzdan projeleri pazar payı kazanabilir

WALLET Düzenleyici Riskler

- Belirsiz düzenlemeler: Olumsuz yasal değişiklikler yaşanabilir

- Uyumluluk gereklilikleri: Artan KYC/AML zorunluluğu benimsemeyi etkileyebilir

- Vergisel etkiler: Değişen vergi politikaları yatırım getirisini etkileyebilir

WALLET Teknik Riskler

- Akıllı kontrat açıkları: Güvenlik zaafları ve hatalar

- Ağ tıkanıklığı: Ethereum’da yüksek gas ücretleri kullanım zorluğu yaratabilir

- Entegrasyon sorunları: Farklı DeFi protokollerine uyumluluk problemleri

VI. Sonuç ve Öneriler

WALLET Yatırım Potansiyeli Değerlendirmesi

WALLET, DeFi cüzdan kategorisinde uzun vadeli büyüme potansiyeli ile öne çıkıyor. Ancak yatırımcılar, kısa vadeli dalgalanma ve düzenleyici belirsizliklere karşı temkinli olmalıdır.

WALLET Yatırım Önerileri

✅ Yeni başlayanlar: Pozisyon oluşturmak için küçük ve düzenli yatırımlarla başlayın ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ve aktif alım-satımı dengeleyin ✅ Kurumsal yatırımcılar: Yatırım öncesi detaylı analiz yaparak WALLET’i çeşitlendirilmiş portföye dahil edin

WALLET Alım-Satım Yöntemleri

- Spot alım-satım: Gate.com’da WALLET token alıp satın

- DeFi likidite sağlama: Likidite havuzlarına katılıp ek ödül elde edin

- Stake etme: Ambire ekosisteminde stake seçenekleriyle pasif gelir sağlayın

Kripto para yatırımları son derece yüksek risk içerir, bu makale yatırım tavsiyesi niteliğinde değildir. Her yatırımcı, kendi risk toleransını dikkate almalı ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

En iyi wallet token ne kadar yükselebilir?

Başarılı ön satış ve lansman gerçekleşirse, en iyi wallet token 2025 sonunda 0,0841 $ seviyesine ulaşabilir.

2030 için en iyi wallet fiyat tahmini nedir?

2030’da en iyi wallet fiyat tahmini 0,82 $’dır. Bu öngörü, kripto benimsemesindeki büyüme ve olumlu piyasa koşulları varsayımıyla yapılmıştır.

Trust Wallet tahmini nedir?

Trust Wallet Token’ın 2030’da ortalama 2,88 $ fiyatına ulaşması bekleniyor; bu tahmin, Ekim 2025 itibarıyla yükseliş eğilimli teknik analizlere dayanmaktadır.

2025’te kripto fiyat tahmini nedir?

Bitcoin’in 100.000 $’a, Ethereum’un 5.000 $’a ve Solana’nın 2025’te 100 $’a ulaşması bekleniyor.

En büyük kripto güvenlik riskleri nelerdir ve varlıklarınızı nasıl koruyabilirsiniz?

En Büyük Kripto Güvenlik Riskleri Nelerdir ve Bunlara Karşı Nasıl Önlem Alabilirsiniz?

En Büyük Kripto Güvenlik Riskleri Nelerdir ve Nasıl Önlenir?

En büyük kripto güvenlik riskleri nelerdir ve yatırımcılar kendilerini nasıl koruyabilir?

En büyük kripto güvenlik riskleri nelerdir ve yatırımcılar kendilerini nasıl koruyabilir?

Custodial Cüzdanları Anlamak: Kapsamlı Bir Rehber

Kripto para ticareti yapmak için en iyi merkeziyetsiz borsa platformları

Kripto para birimlerinde Blockchain Node'larının işleyişini kavramak: Temel kavramlara dair bilgiler

Otomatik Piyasa Yapıcıların işleyişini anlamak

Zebec Protocol'un İncelenmesi: Solana'dan Nautilus Chain'e Akışkan Ödemelerin Evrimi

Blokzincir teknolojisiyle ilgilenen yeni kullanıcılar için en uygun kripto para havuz madenciliği seçenekleri