2025 VR Price Prediction: Market Trends and Investment Opportunities in the Virtual Reality Ecosystem

Introduction: VR's Market Position and Investment Value

Victoria VR (VR), as a leading project in the virtual reality and blockchain space, has made significant strides since its inception. As of 2025, Victoria VR's market capitalization has reached $48,597,781, with a circulating supply of approximately 8,141,695,688 tokens, and a price hovering around $0.005969. This asset, dubbed the "Virtual Reality Pioneer," is playing an increasingly crucial role in the realms of immersive digital experiences and decentralized virtual worlds.

This article will comprehensively analyze Victoria VR's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. VR Price History Review and Current Market Status

VR Historical Price Evolution

- 2021: All-time high reached, price peaked at $0.615957 on December 11

- 2022-2024: Prolonged bear market, price gradually declined

- 2025: Market recovery phase, price rebounded from the all-time low of $0.00222735 on September 6

VR Current Market Situation

As of September 30, 2025, VR is trading at $0.005969, experiencing a 6.24% decrease in the past 24 hours. Despite the recent dip, VR has shown strong performance over the past month with a 114.07% increase. The current price represents a significant recovery from its all-time low but remains 99.03% below its all-time high.

The market capitalization of VR stands at $48,597,781, ranking it 684th among all cryptocurrencies. With a circulating supply of 8,141,695,688 VR tokens and a total supply of 16,800,000,000, the current circulating ratio is 48.46%.

VR has demonstrated volatile price movements, with a 31.019% increase over the past week contrasting with a 21.42% decrease over the past year. This volatility reflects the dynamic nature of the cryptocurrency market and the ongoing developments in the Victoria VR project.

Click to view the current VR market price

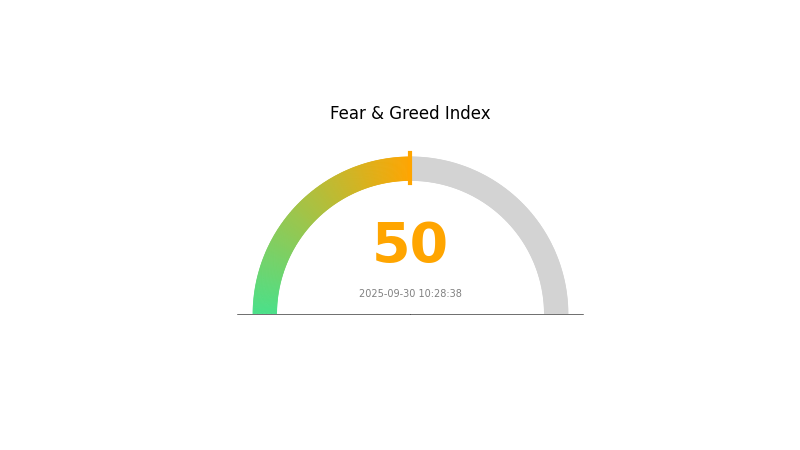

VR Market Sentiment Indicator

2025-09-30 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The VR market sentiment remains balanced today, with the Fear and Greed Index standing at 50. This neutral reading suggests investors are neither overly fearful nor excessively greedy. It's a prime opportunity for traders to reassess their strategies and consider diversifying their portfolios. While the market shows stability, it's crucial to stay informed and monitor potential catalysts that could shift sentiment in either direction. As always, conducting thorough research and managing risk are key to navigating the dynamic VR landscape.

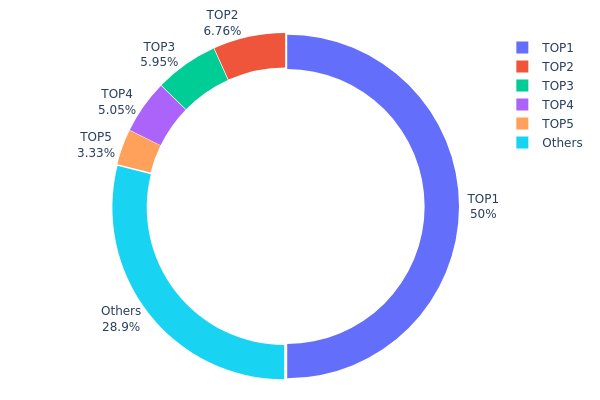

VR Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of VR token ownership. Analysis reveals a highly centralized structure, with the top address holding 50% of the total supply. The top 5 addresses collectively control 71.07% of VR tokens, indicating significant concentration.

This level of centralization raises concerns about market stability and potential price manipulation. The dominant holder, with 50% ownership, has substantial influence over the token's supply and could impact market dynamics significantly. The concentration in few hands may lead to increased volatility and susceptibility to large-scale sell-offs or accumulation events.

While some level of concentration is common in emerging cryptocurrencies, the current distribution of VR suggests a relatively low level of decentralization. This structure may pose challenges for the token's long-term stability and equitable market participation. Investors should monitor any changes in this distribution, as shifts could signal important market movements or evolving token economics.

Click to view the current VR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x27e6...c5f721 | 8400000.00K | 50.00% |

| 2 | 0xd621...d19a2c | 1136407.28K | 6.76% |

| 3 | 0xc3f9...f87152 | 999999.90K | 5.95% |

| 4 | 0x9b87...6048bc | 848000.10K | 5.04% |

| 5 | 0x362a...ae81ce | 559225.01K | 3.32% |

| - | Others | 4856367.70K | 28.93% |

II. Key Factors Affecting Future VR Prices

Supply Mechanism

- Cost and Material Quality: High-performance requirements for core optical film materials, especially 1/4 phase delay films and reflective polarizing films. Only a few companies globally, such as 3M and Nitto Denko, can meet these standards.

- Current Impact: As technology advances and production scales up, costs are expected to decrease, potentially leading to lower VR device prices in the future.

Macroeconomic Environment

- COVID-19 Impact: The pandemic has affected VR technology companies, with VR gaming centers forced to close during lockdowns. Supply chain disruptions and business closures have influenced the market.

Technological Development and Ecosystem Building

- Hardware Iteration: Ongoing improvements in VR hardware are driving growth in the industry.

- Content Maturity: The development of more sophisticated VR content is a key factor in the industry's expansion.

- Ecosystem Applications: The VR market is shifting from hardware subsidies to content creation, fostering a thriving ecosystem that stimulates increased shipments, creating a flywheel effect.

III. VR Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00309 - $0.00595

- Neutral prediction: $0.00595 - $0.00642

- Optimistic prediction: $0.00642 - $0.0069 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing volatility

- Price range forecast:

- 2027: $0.00604 - $0.00778

- 2028: $0.00457 - $0.00949

- Key catalysts: Technological advancements in VR industry, wider cryptocurrency adoption

2030 Long-term Outlook

- Base scenario: $0.00763 - $0.00887 (assuming steady market growth)

- Optimistic scenario: $0.00887 - $0.01233 (assuming strong VR market expansion)

- Transformative scenario: Above $0.01233 (assuming breakthrough VR applications and mass adoption)

- 2030-12-31: VR $0.01233 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0069 | 0.00595 | 0.00309 | 0 |

| 2026 | 0.007 | 0.00642 | 0.00488 | 7 |

| 2027 | 0.00778 | 0.00671 | 0.00604 | 12 |

| 2028 | 0.00949 | 0.00725 | 0.00457 | 21 |

| 2029 | 0.00938 | 0.00837 | 0.00594 | 40 |

| 2030 | 0.01233 | 0.00887 | 0.00763 | 48 |

IV. VR Professional Investment Strategies and Risk Management

VR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate VR tokens during market dips

- Stake VR tokens to earn rewards

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought and oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

VR Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-20%

(2) Risk Hedging Solutions

- Diversification: Spread investments across different crypto assets

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet solution: Use reputable mobile or desktop wallets with strong security features

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for VR

VR Market Risks

- High volatility: VR token price can experience significant fluctuations

- Market sentiment: Influenced by broader cryptocurrency market trends

- Competition: Other virtual reality projects may impact VR's market share

VR Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations on cryptocurrencies

- Cross-border compliance: Varying regulations across different jurisdictions

- Tax implications: Evolving tax policies for cryptocurrency transactions

VR Technical Risks

- Smart contract vulnerabilities: Potential for bugs or exploits in the underlying code

- Scalability challenges: Ability to handle increased user adoption and transactions

- Technological obsolescence: Rapid advancements in VR technology may outpace the project

VI. Conclusion and Action Recommendations

VR Investment Value Assessment

Victoria VR presents a unique opportunity in the virtual reality and blockchain space. While it offers long-term potential in the growing VR market, investors should be aware of short-term volatility and regulatory uncertainties.

VR Investment Recommendations

✅ Beginners: Start with small investments and focus on learning about the technology ✅ Experienced investors: Consider a balanced approach with a mix of holding and trading strategies ✅ Institutional investors: Conduct thorough due diligence and consider VR as part of a diversified crypto portfolio

VR Trading Participation Methods

- Spot trading: Buy and sell VR tokens on Gate.com

- Staking: Participate in VR token staking programs for additional rewards

- DeFi integration: Explore decentralized finance options involving VR tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What meme coin will explode in 2025 price prediction?

Dogecoin (DOGE) is predicted to explode in 2025, potentially reaching $1. Shiba Inu (SHIB) and PEPE are also expected to see significant gains.

What is the price prediction for virtual crypto in 2030?

Based on statistical models, the predicted price for virtual crypto in 2030 is around $1.48 by mid-year and $1.39 by year-end.

What are vet's price predictions for 2025?

Based on machine-Gradient calculations, VET is predicted to reach a minimum price of $0.024 and an average price of $0.025 per token in 2025.

What is VR crypto?

VR crypto refers to digital currencies associated with virtual reality technology. These tokens enable transactions and power operations within VR platforms and ecosystems.

Share

Content