2025 VINEPrice Prediction: Comprehensive Market Analysis and Future Outlook for Digital Asset Investors

Introduction: VINE's Market Position and Investment Value

Vine (VINE), as a token commemorating togetherness and creation, has made significant strides since its inception in 2025. As of 2025, VINE's market capitalization has reached $55,448,831, with a circulating supply of approximately 999,978,920 tokens, and a price hovering around $0.05545. This asset, hailed as a "beacon for free speech and self-expression," is playing an increasingly crucial role in digital content creation and social media.

This article will comprehensively analyze VINE's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. VINE Price History Review and Current Market Status

VINE Historical Price Evolution Trajectory

- 2025 (January): VINE reached its all-time high of $0.48185, marking a significant milestone for the project.

- 2025 (March): The token experienced a sharp decline, hitting its all-time low of $0.02331, possibly due to market volatility.

- 2025 (September): VINE has shown recovery, with the price stabilizing around $0.05545.

VINE Current Market Situation

As of September 29, 2025, VINE is trading at $0.05545, with a 24-hour trading volume of $1,554,818. The token has seen a 6.71% increase in the last 24 hours, indicating positive short-term momentum. However, looking at longer timeframes, VINE has experienced a 11.63% decrease over the past week and a 19.16% decline over the last 30 days. Despite these recent downtrends, VINE has shown remarkable growth over the past year, with a staggering 65,604.13% increase.

The current market capitalization of VINE stands at $55,448,831, ranking it 645th in the overall cryptocurrency market. With a circulating supply of 999,978,920 VINE tokens, which is very close to its maximum supply of 1,000,000,000, the project has almost reached its full distribution.

Click to view the current VINE market price

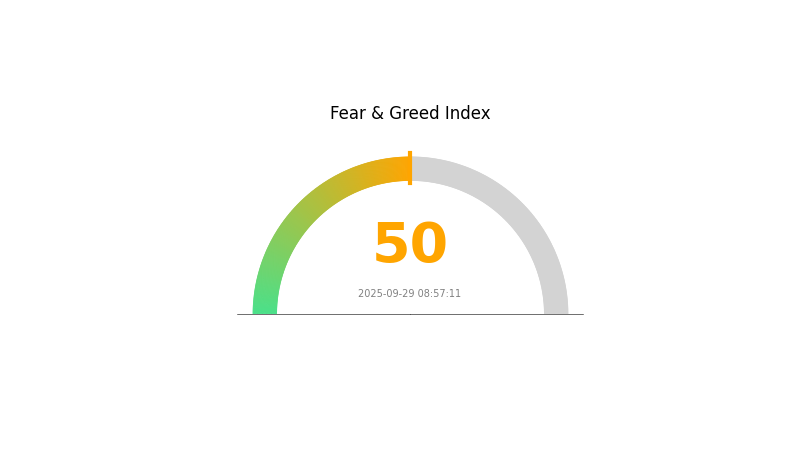

VINE Market Sentiment Indicator

2025-09-29 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index at 50, indicating a neutral outlook. This suggests that investors are neither overly fearful nor excessively greedy. Such equilibrium often presents opportunities for traders to make informed decisions based on thorough analysis rather than emotional impulses. As always, it's crucial to conduct proper research and consider your risk tolerance before making any investment choices in the volatile crypto market.

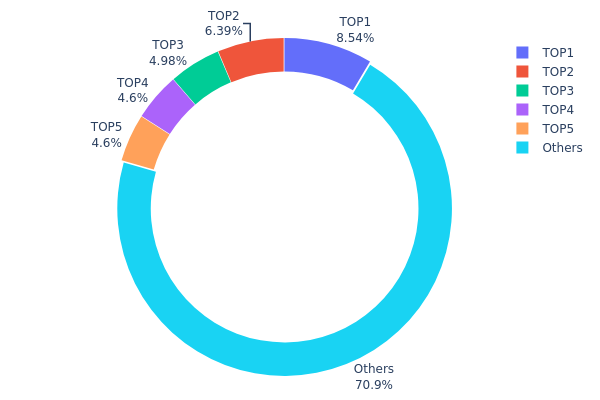

VINE Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of VINE tokens across different addresses. Analysis of this data reveals a moderate level of centralization, with the top 5 addresses collectively holding 29.1% of the total VINE supply. The largest holder possesses 8.54% of tokens, followed by four addresses holding between 4.59% and 6.39% each.

This distribution pattern suggests a relatively balanced ownership structure, with no single entity controlling an overwhelming majority of tokens. However, the concentration among the top holders is significant enough to potentially influence market dynamics. The remaining 70.9% distributed among other addresses indicates a substantial level of decentralization, which could contribute to market stability and resilience against manipulation attempts.

The current address distribution reflects a market structure where major stakeholders have significant influence, but not absolute control. This balance may help maintain price stability while still allowing for organic market movements. It also suggests a maturing ecosystem where early adopters and larger investors coexist with a broader base of smaller token holders, potentially fostering a more robust and diverse VINE community.

Click to view the current VINE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | CBEADk...sebkVG | 85411.93K | 8.54% |

| 2 | u6PJ8D...ynXq2w | 63912.89K | 6.39% |

| 3 | 3mrj3A...Kexq35 | 49810.54K | 4.98% |

| 4 | 5Q544f...pge4j1 | 46032.69K | 4.60% |

| 5 | C68a6R...XFdqyo | 45962.89K | 4.59% |

| - | Others | 708847.99K | 70.9% |

II. Key Factors Affecting VINE's Future Price

Supply Mechanism

- Whale Activity: Early sniper actions by smart money and wallet clusters led to VINE reaching a market cap of over $200 million within the first few hours of trading.

- Historical Pattern: Previous supply changes have shown significant impact on price, with VINE experiencing over 161,000% growth from its low in the first 7 hours of trading.

- Current Impact: The main pool absorbed $3.5 million in liquidity, allowing early whales to partially cash out. The token's market cap fell from a peak of $220 million to $159 million on the first day of trading.

Institutional and Whale Dynamics

- Institutional Holdings: While specific institutional holdings are not mentioned, the article notes that whales and exchanges took VINE seriously, accelerating trading.

- Corporate Adoption: The potential relaunch of Vine as a video service with integrated token payments could drive corporate adoption.

- National Policies: No specific national policies are mentioned, but regulatory changes could potentially impact VINE's future price.

Macroeconomic Environment

- Geopolitical Factors: The launch of VINE as an "American-made" crypto trend could be influenced by international dynamics and the slowing trend of AI agent launches.

Technical Development and Ecosystem Building

- Video Service Integration: The potential relaunch of a Vine-like video service that integrates the token for tipping or payments could significantly impact VINE's value.

- Ecosystem Applications: The combination of the official meme token with a relaunched short-form video service could expand the "American-made" crypto trend, potentially boosting VINE's ecosystem.

III. VINE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.03716 - $0.05

- Neutral prediction: $0.05 - $0.06

- Optimistic prediction: $0.06 - $0.071 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.05697 - $0.10802

- 2028: $0.08736 - $0.11739

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.10003 - $0.12712 (assuming steady market growth)

- Optimistic scenario: $0.12712 - $0.15005 (assuming strong market performance)

- Transformative scenario: $0.15005 - $0.16017 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: VINE $0.16017 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.071 | 0.05547 | 0.03716 | 0 |

| 2026 | 0.08474 | 0.06324 | 0.0449 | 14 |

| 2027 | 0.10802 | 0.07399 | 0.05697 | 33 |

| 2028 | 0.11739 | 0.091 | 0.08736 | 64 |

| 2029 | 0.15005 | 0.1042 | 0.10003 | 87 |

| 2030 | 0.16017 | 0.12712 | 0.09153 | 129 |

IV. Professional Investment Strategies and Risk Management for VINE

VINE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high risk tolerance

- Operational suggestions:

- Accumulate VINE tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key points for swing trading:

- Monitor social media sentiment and project announcements

- Set strict stop-loss orders to manage risk

VINE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Options strategies: Consider using options to hedge downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use a hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for VINE

VINE Market Risks

- High volatility: VINE's price may experience significant fluctuations

- Limited liquidity: Trading volume may be insufficient for large transactions

- Market sentiment: VINE's value may be influenced by overall crypto market trends

VINE Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting meme coins

- Platform dependence: VINE's success is tied to the Solana ecosystem's regulatory status

- Cross-border restrictions: Some countries may limit or ban trading of VINE

VINE Technical Risks

- Smart contract vulnerabilities: Potential for coding errors or exploits

- Scalability issues: Solana network congestion could affect VINE transactions

- Technological obsolescence: Emerging blockchain technologies may challenge VINE's relevance

VI. Conclusion and Action Recommendations

VINE Investment Value Assessment

VINE presents a high-risk, high-potential investment opportunity within the meme coin sector. While its cultural significance and community support offer long-term value potential, investors should be aware of the extreme volatility and regulatory uncertainties associated with such tokens.

VINE Investment Recommendations

✅ Beginners: Allocate only a small portion of your portfolio, if any ✅ Experienced investors: Consider small positions as part of a diversified crypto strategy ✅ Institutional investors: Approach with caution, conduct thorough due diligence

VINE Trading Participation Methods

- Spot trading: Buy and sell VINE tokens on Gate.com

- Staking: Participate in VINE staking programs if available

- Social trading: Follow and copy successful VINE traders on social trading platforms

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is vine coin a good investment?

Yes, Vine coin shows potential. Its innovative features and growing adoption suggest it could be a profitable investment in the Web3 ecosystem.

What is the vine coin prediction for 2030?

Based on current trends, Vine Coin is predicted to reach a maximum price of $0.497503 and a minimum of $0.465443 by 2030.

Will vine coins increase?

Yes, Vine coins are projected to increase. Forecasts suggest VINE could reach $0.215563 by 2030, indicating a positive long-term outlook for the cryptocurrency.

Will Vine coin be listed on Coinbase?

As of 2025, Vine coin is not listed on Coinbase. However, rumors suggest a potential listing in the near future. Stay tuned for official announcements.

Share

Content