2025 VETPrice Prediction: Expected Market Trends, Key Catalysts and Realistic Targets for VeChain's Native Token

Introduction: VET's Market Position and Investment Value

VeChain (VET), as a leading blockchain platform for enterprise solutions, has made significant strides since its inception in 2015. As of 2025, VeChain's market capitalization has reached $2.08 billion, with a circulating supply of approximately 85.99 billion tokens, and a price hovering around $0.02423. This asset, often hailed as the "Supply Chain Blockchain," is playing an increasingly crucial role in supply chain management, logistics, and product authentication.

This article will provide a comprehensive analysis of VeChain's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. VET Price History Review and Current Market Status

VET Historical Price Evolution

- 2020: Market low point, price reached $0.00191713 on March 13

- 2021: Bull market peak, price hit all-time high of $0.280991 on April 19

- 2025: Current price at $0.02423, down 91.37% from ATH

VET Current Market Situation

As of September 10, 2025, VET is trading at $0.02423. The 24-hour trading volume stands at $386,115.0460317. VET has experienced a 2.33% decrease in the last 24 hours, but shows a 1.72% increase over the past week. The current market capitalization is $2,083,417,547.7187102, ranking VET at 66th position in the crypto market. With a circulating supply of 85,985,041,177 VET and a maximum supply of 86,712,634,466 VET, the market cap to fully diluted valuation ratio is 99.16%, indicating a high level of token distribution.

Click to view the current VET market price

VET Market Sentiment Indicator

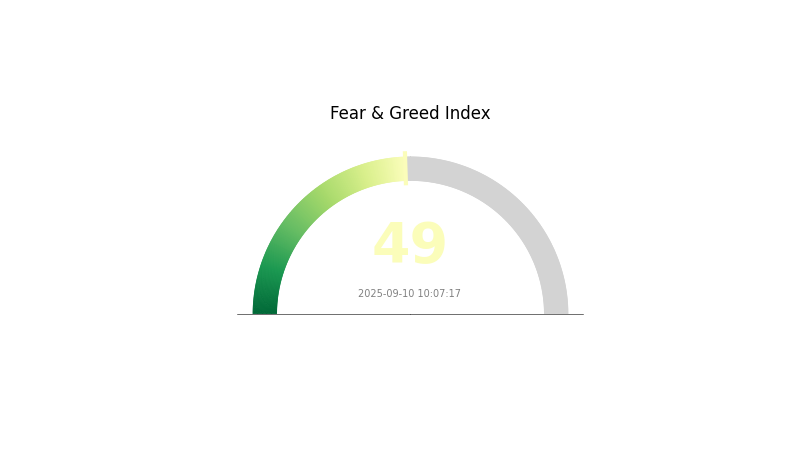

2025-09-10 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment for VET remains balanced, with the Fear and Greed Index at 49, indicating a neutral stance. This equilibrium suggests investors are neither overly fearful nor excessively optimistic. Traders should remain vigilant, as neutral sentiment often precedes significant market movements. It's advisable to monitor key technical indicators and news closely, while maintaining a diversified portfolio. Remember, market conditions can change rapidly, so stay informed and trade responsibly on Gate.com.

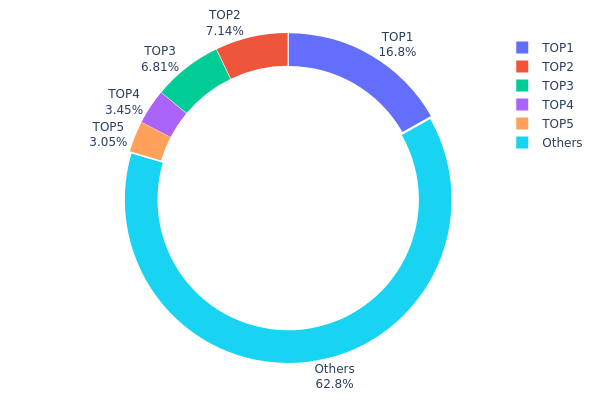

VET Holdings Distribution

The address holdings distribution data reveals significant concentration in VET token ownership. The top address holds a substantial 16.77% of the total supply, with the top 5 addresses collectively controlling 37.2% of all VET tokens. This level of concentration suggests a relatively centralized ownership structure, which could potentially impact market dynamics.

Such concentration of holdings may lead to increased price volatility and susceptibility to market manipulation. Large holders, often referred to as "whales," have the capacity to influence market movements through significant buy or sell orders. However, it's noteworthy that 62.8% of VET tokens are distributed among other addresses, indicating a degree of broader market participation.

This distribution pattern reflects a moderate level of decentralization for VET, albeit with notable concentration at the top. The presence of major stakeholders could be interpreted as a sign of confidence in the project, but it also underscores the importance of monitoring large address movements for potential market impacts.

Click to view the current VET Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1263...e111eB | 14425314.20K | 16.77% |

| 2 | 0x1856...21DeE7 | 6142540.00K | 7.14% |

| 3 | 0xfdE6...3B6c6a | 5851312.25K | 6.80% |

| 4 | 0x7581...1a1d65 | 2964056.87K | 3.44% |

| 5 | 0xCECc...6fAaE0 | 2624948.58K | 3.05% |

| - | Others | 53976869.28K | 62.8% |

II. Key Factors Influencing VET's Future Price

Supply Mechanism

- Circulating Supply: The current circulating supply of VET is 85,985,041,177 tokens.

- Historical Pattern: Past supply changes have influenced VET's price movements.

- Current Impact: With a maximum supply of 86,712,634,466 tokens, VET's limited supply may positively impact its price in the future.

Institutional and Whale Dynamics

- Enterprise Adoption: Major companies like BMW and Walmart China have partnered with VeChain, potentially boosting VET's value.

- Government Policies: Regulatory changes in various countries could significantly impact VeChain's growth and adoption.

Macroeconomic Environment

- Inflation Hedging Properties: VET's performance in inflationary environments may affect its appeal as a potential hedge.

- Geopolitical Factors: International situations and conflicts can influence the broader cryptocurrency market, including VET.

Technical Development and Ecosystem Building

- VeChainThor Mainnet Upgrades: Continuous technological improvements aim to enhance network scalability, security, and operational efficiency.

- Ecosystem Applications: VeChain's focus on supply chain management and business process optimization contributes to its growing ecosystem.

- Strategic Partnerships: Collaborations across various industries leverage blockchain potential to address complex supply chain challenges.

III. VET Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.02132 - $0.02423

- Neutral forecast: $0.02423 - $0.02992

- Optimistic forecast: $0.02992 - $0.03562 (requires sustained market recovery and increased VeChain adoption)

2027-2028 Outlook

- Market phase expectation: Potential bull market phase with increased volatility

- Price range prediction:

- 2027: $0.02524 - $0.05265

- 2028: $0.03371 - $0.05189

- Key catalysts: Expanded enterprise partnerships, technological advancements in supply chain management

2030 Long-term Outlook

- Base scenario: $0.04504 - $0.05005 (assuming steady growth in blockchain adoption)

- Optimistic scenario: $0.05005 - $0.05555 (with widespread integration of VeChain in global supply chains)

- Transformative scenario: Above $0.05555 (if VeChain becomes a leading platform for enterprise blockchain solutions)

- 2030-12-31: VET $0.05555 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03562 | 0.02423 | 0.02132 | 0 |

| 2026 | 0.04219 | 0.02992 | 0.02184 | 23 |

| 2027 | 0.05265 | 0.03606 | 0.02524 | 48 |

| 2028 | 0.05189 | 0.04435 | 0.03371 | 83 |

| 2029 | 0.05197 | 0.04812 | 0.04187 | 98 |

| 2030 | 0.05555 | 0.05005 | 0.04504 | 106 |

IV. Professional VET Investment Strategies and Risk Management

VET Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable growth

- Operation suggestions:

- Accumulate VET during market dips

- Set price targets and review holdings periodically

- Store VET in a secure wallet with private key backup

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and potential reversal points

- RSI (Relative Strength Index): Gauge overbought or oversold conditions

- Key points for swing trading:

- Monitor VeChain ecosystem developments and partnerships

- Set stop-loss orders to limit potential losses

VET Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Moderate investors: 3-7% of portfolio

- Aggressive investors: 7-15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Dollar-Cost Averaging: Regularly invest fixed amounts to reduce timing risk

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official VeChainThor Wallet

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for VET

VET Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Competition: Other blockchain platforms may capture market share

- Adoption: Slow enterprise adoption could impact VET's value

VET Regulatory Risks

- Government regulations: Changing policies may affect VET's usage

- Global restrictions: Varying international regulations could limit growth

- Compliance issues: Potential legal challenges in different jurisdictions

VET Technical Risks

- Smart contract vulnerabilities: Potential exploits in the VeChain ecosystem

- Network congestion: Scalability issues during high transaction periods

- Technological obsolescence: Emerging technologies may outpace VeChain

VI. Conclusion and Action Recommendations

VET Investment Value Assessment

VeChain (VET) offers long-term potential in supply chain management and enterprise blockchain solutions. However, short-term volatility and regulatory uncertainties pose risks.

VET Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a mix of long-term holding and strategic trading ✅ Institutional investors: Evaluate VeChain's enterprise partnerships and technology roadmap

VET Trading Participation Methods

- Spot trading: Buy and sell VET on Gate.com

- Staking: Participate in VET staking programs for passive income

- DeFi: Explore decentralized finance options within the VeChain ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will VeChain reach $1?

VeChain has potential to reach $1 by 2025, according to some analyst predictions. This would represent a significant increase from its current price, driven by its strong focus on supply chain management and partnerships.

How high will VeChain go in 2025?

Based on market analysis, VeChain is projected to reach an average price of $0.0250525 per token in 2025, with a minimum potential value of $0.024158.

Can VeChain reach 10$?

While reaching $10 is ambitious, VeChain's long-term potential remains strong. Experts are cautiously optimistic about its bullish trend, though $10 may not be achieved in the near future.

How much will vet be worth in 2030?

Based on current projections, VET could reach $0.33 by 2030, driven by the VeChain Renaissance upgrade and favorable market conditions.

Share

Content