2025 USD1 Price Prediction: Crypto's Next Bull Run or Bearish Slump?

Introduction: USD1's Market Position and Investment Value

USD1 (USD1), as a fiat-backed digital asset designed to maintain a 1:1 equivalence with the U.S. dollar, has made significant strides since its inception in 2025. As of 2025, USD1's market capitalization has reached $2,149,870,657, with a circulating supply of approximately 2,151,591,931 tokens, and a price hovering around $0.9992. This asset, often referred to as a "regulatory-compliant stablecoin," is playing an increasingly crucial role in streamlining digital transactions and providing seamless fungibility between fiat currency and digital assets.

This article will comprehensively analyze USD1's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. USD1 Price History Review and Current Market Status

USD1 Historical Price Evolution

- April 2025: USD1 launched by World Liberty Financial, price stable at $1

- June 2025: Reached all-time high of $1.971 on June 2nd

- June 2025: Dropped to all-time low of $0.9663 on June 27th

USD1 Current Market Situation

As of November 14, 2025, USD1 is trading at $0.9992, showing a slight deviation from its intended $1 peg. The 24-hour trading volume stands at $15,022,387.22, indicating moderate market activity. The total market capitalization is $2,149,870,657.46, ranking USD1 at 51st position in the overall cryptocurrency market.

The circulating supply of USD1 is 2,151,591,931 tokens, which is equal to its total supply, suggesting no further issuance is planned. USD1 has experienced minor price fluctuations recently, with a 1-hour change of -0.071%, a 24-hour change of -0.02%, and a 7-day change of -0.04%.

USD1 is currently available on 30 exchanges and has 47,017 holders. The stablecoin operates on multiple blockchains, including BEP-20 and ERC-20 standards, enhancing its accessibility and utility across different platforms.

Click to view the current USD1 market price

USD1 Market Sentiment Index

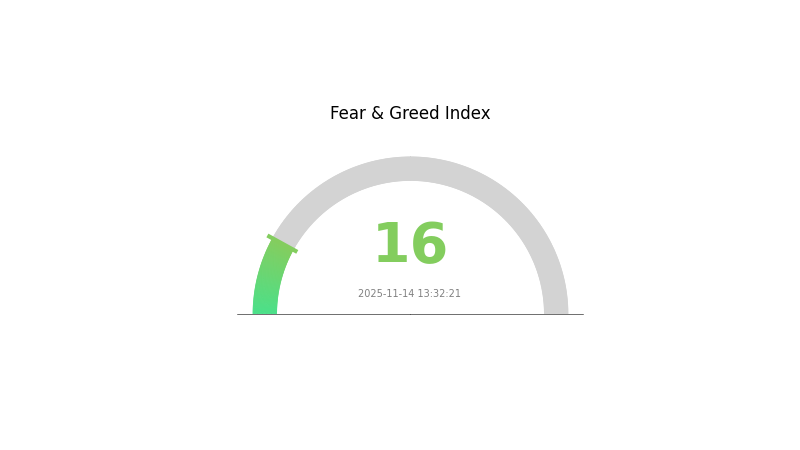

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of extreme fear, with the sentiment index plummeting to 16. This indicates a high level of uncertainty and pessimism among investors. During such times, it's crucial to remain calm and avoid making impulsive decisions. While some may see this as a potential buying opportunity, it's important to conduct thorough research and consider your risk tolerance before making any investment choices. Remember, market sentiment can shift quickly, and it's always wise to diversify your portfolio.

USD1 Holdings Distribution

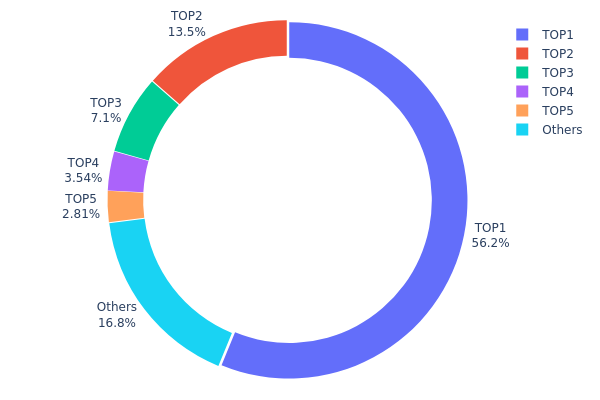

The address holdings distribution data for USD1 reveals a highly concentrated ownership structure. The top address holds 56.20% of the total supply, equivalent to 399,600,000 USD1 tokens. This significant concentration is followed by the second-largest holder with 13.52% and the third with 7.09%. Collectively, the top five addresses control 83.16% of the total supply, leaving only 16.84% distributed among other holders.

This level of concentration raises concerns about the decentralization and market stability of USD1. With over half of the supply controlled by a single address, there's a potential for significant market impact should this holder decide to liquidate or transfer large amounts. The high concentration also increases the risk of market manipulation and could lead to heightened price volatility. Furthermore, this distribution pattern may undermine confidence in the token's ecosystem and its ability to maintain a stable value proposition.

Overall, the current address distribution of USD1 reflects a centralized structure that contrasts with the principles of decentralization often associated with cryptocurrencies. This concentration of holdings may impact the token's resilience to market shocks and its long-term sustainability, potentially affecting its adoption and utility in the broader crypto ecosystem.

Click to view the current USD1 Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xff95...f7fd8d | 399600.00K | 56.20% |

| 2 | 0x5be9...957dbb | 96194.70K | 13.52% |

| 3 | 0xf977...41acec | 50479.83K | 7.09% |

| 4 | 0x28c6...f21d60 | 25189.97K | 3.54% |

| 5 | 0x36a7...d9c141 | 20002.50K | 2.81% |

| - | Others | 119522.23K | 16.84% |

II. Key Factors Affecting USD1's Future Price

Supply Mechanism

- Fixed Supply: USD1 has a fixed total supply, which creates scarcity and potentially supports long-term value.

Institutional and Whale Dynamics

- Corporate Adoption: Several companies have begun using USD1 for international transactions, increasing its utility and demand.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' policies regarding interest rates and quantitative easing may influence USD1's attractiveness as an alternative store of value.

- Inflation Hedging Properties: In inflationary environments, USD1 may be seen as a potential hedge, affecting its demand and price.

- Geopolitical Factors: International tensions and economic uncertainties could drive investors towards USD1 as a safe-haven asset.

Technical Development and Ecosystem Building

- Ecosystem Applications: Various DApps and projects are being built on platforms that support USD1, expanding its use cases and potential value.

III. USD1 Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.89919 - $1.00

- Neutral forecast: $1.00 - $1.20

- Optimistic forecast: $1.20 - $1.33879 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range predictions:

- 2027: $1.16521 - $1.64962

- 2028: $1.07998 - $1.83448

- Key catalysts: Increased adoption and positive market sentiment

2029-2030 Long-term Outlook

- Base scenario: $1.65695 - $1.88892 (assuming steady market growth)

- Optimistic scenario: $2.12090 - $2.58782 (assuming strong bullish trends)

- Transformative scenario: Above $2.58782 (extremely favorable market conditions)

- 2030-12-31: USD1 $1.88892 (potential average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.33879 | 0.9991 | 0.89919 | 0 |

| 2026 | 1.44949 | 1.16895 | 0.59616 | 16 |

| 2027 | 1.64962 | 1.30922 | 1.16521 | 31 |

| 2028 | 1.83448 | 1.47942 | 1.07998 | 48 |

| 2029 | 2.1209 | 1.65695 | 1.40841 | 65 |

| 2030 | 2.58782 | 1.88892 | 1.66225 | 89 |

IV. USD1 Professional Investment Strategies and Risk Management

USD1 Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stability

- Operation suggestions:

- Allocate a portion of portfolio to USD1 as a hedge against volatility

- Set up automatic purchases at regular intervals

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term price deviations

- Volume Indicators: Assess market liquidity and potential price movements

- Key points for swing trading:

- Monitor peg stability closely

- Set tight stop-loss orders to manage risk

USD1 Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10%

- Moderate investors: 10-20%

- Aggressive investors: 20-30%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple stablecoins

- Collateral backing: Monitor USD1's reserve assets regularly

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for USD1

USD1 Market Risks

- Peg instability: Potential for temporary deviations from $1 value

- Liquidity risk: Possibility of reduced market depth during high volatility

- Counterparty risk: Reliance on World Liberty Financial's financial stability

USD1 Regulatory Risks

- Regulatory scrutiny: Potential for increased oversight of stablecoins

- Compliance changes: Possible shifts in legal requirements for stablecoin issuers

- Cross-border restrictions: Risk of limitations on international transfers

USD1 Technical Risks

- Smart contract vulnerabilities: Potential for coding errors or exploits

- Blockchain congestion: Risk of delayed transactions during network stress

- Integration issues: Possible compatibility problems with new platforms or protocols

VI. Conclusion and Action Recommendations

USD1 Investment Value Assessment

USD1 offers a stable store of value with potential for use in digital transactions and as a hedge against crypto volatility. However, investors should be aware of regulatory uncertainties and the importance of issuer credibility.

USD1 Investment Recommendations

✅ Beginners: Allocate a small portion (1-5%) of crypto portfolio to USD1 for stability ✅ Experienced investors: Use USD1 for short-term trading or as a temporary haven during market volatility ✅ Institutional investors: Consider USD1 for treasury management and efficient cross-border transactions

USD1 Trading Participation Methods

- Spot trading: Buy and sell USD1 on Gate.com's spot market

- Savings: Explore staking or lending options for passive income

- Payment use: Utilize USD1 for fast and low-cost digital transactions where accepted

Cryptocurrency investments are extremely risky, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will Shiba hit $1 in 2040?

It's highly unlikely for Shiba Inu to reach $1 by 2040. While the crypto market is unpredictable, such a massive price increase would require an unrealistic market cap. A more modest growth is possible, but $1 is an extreme target.

Can I buy USD1 stablecoin?

Yes, you can buy USD1 stablecoin. It's designed to maintain a stable value of $1, making it a popular choice for traders and investors in the crypto market.

How much will the Shiba coin be in 2025?

Based on market trends and expert predictions, Shiba coin could potentially reach $0.0001 by 2025, representing significant growth from its current price.

How much is a USD1 coin worth today?

As of November 14, 2025, a USD1 coin is worth exactly $1. It maintains a stable value pegged to the US dollar.

Share

Content