2025 TUSD Fiyat Tahmini: TrueUSD’nin Potansiyel Büyümesi ve Piyasa Trendlerinin Analizi

Giriş: TUSD'nin Piyasa Konumu ve Yatırım Değeri

TrueUSD (TUSD), kripto para piyasasında önde gelen stablecoin'lerden biri olarak 2018'deki lansmanından bu yana kayda değer bir gelişim gösterdi. 2025 yılı itibarıyla TUSD'nin piyasa değeri 493.518.313 $ seviyesine ulaşırken, yaklaşık 494.515.083 adet dolaşımdaki token ile fiyatı 0,9966 $ civarında seyrediyor. “Şeffaf ve denetlenmiş stablecoin” olarak öne çıkan bu varlık, dijital varlık ekosisteminde güvenilir bir değişim ve değer saklama aracı olarak giderek daha merkezi bir rol üstleniyor.

Bu makalede, TUSD'nin 2025-2030 dönemindeki fiyat trendleri; tarihi hareketler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı biçimde incelenecek; yatırımcılara profesyonel fiyat tahminleriyle pratik yatırım stratejileri sunulacaktır.

I. TUSD Fiyat Geçmişi ve Güncel Piyasa Durumu

TUSD'nin Tarihsel Fiyat Seyri

- 2018: TrueUSD piyasaya sürüldü, fiyatı 1 $ civarında dalgalandı

- 2020: COVID-19 kaynaklı piyasa çöküşü, fiyat kısa süreyle 0,88355 $'a geriledi

- 2022: Stablecoin piyasasında dalgalanma, TUSD 1 $ seviyesinde istikrarını korudu

TUSD Güncel Piyasa Durumu

17 Ekim 2025 itibarıyla TUSD, 0,9966 $ seviyesinden işlem görüyor ve 1 $ sabit değerinden hafif bir sapma gösteriyor. 24 saatlik işlem hacmi 959.090,83 $ ile piyasanın orta düzeyde aktif olduğunu gösteriyor. TUSD'nin piyasa değeri 492.833.731,72 $ olup, genel kripto para piyasasında 157. sırada yer alıyor. Dolaşımdaki arz 494.515.083 TUSD olup, toplam arz olan 495.202.000 TUSD'ye oldukça yakın. Mevcut piyasa değeri ile tam seyreltilmiş değer oranı %99,86 olup neredeyse tüm tokenler dolaşımdadır. Son 24 saatte TUSD'nin fiyatı %0,07 oranında hafif bir düşüş gösterirken, son 1 saatte %0,10'luk küçük bir artış yaşandı.

Güncel TUSD piyasa fiyatını görüntülemek için tıklayın

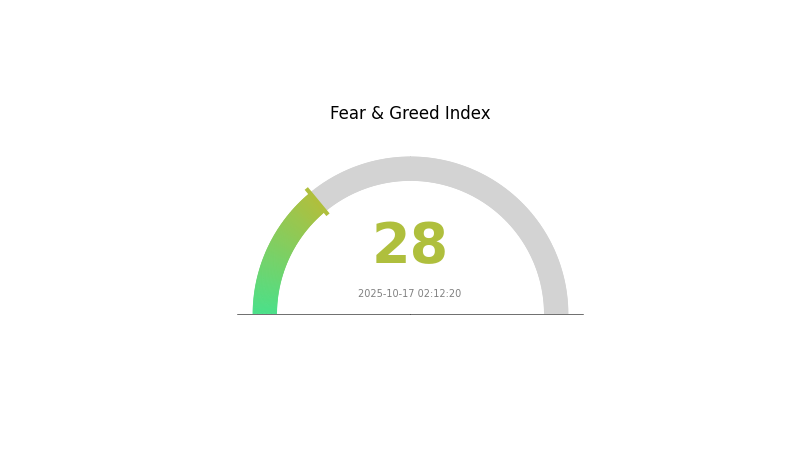

TUSD Piyasa Duyarlılığı Göstergesi

2025-10-17 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasası şu anda belirsizlik döneminden geçiyor; Korku ve Açgözlülük Endeksi'nin 28 seviyesinde olması, yatırımcılar arasında korkunun hakim olduğunu gösteriyor. Böyle zamanlarda, işlem kararlarında temkinli olmak ve detaylı araştırma yapmak önemlidir. Bazı yatırımcılar bu ortamı fırsat olarak görebilirken, diğerleri daha istikrarlı piyasa koşullarını beklemeyi tercih edebilir. Piyasa duyarlılığı hızla değişebileceğinden, gelişmeleri yakından takip edin ve stratejinizi buna göre güncelleyin.

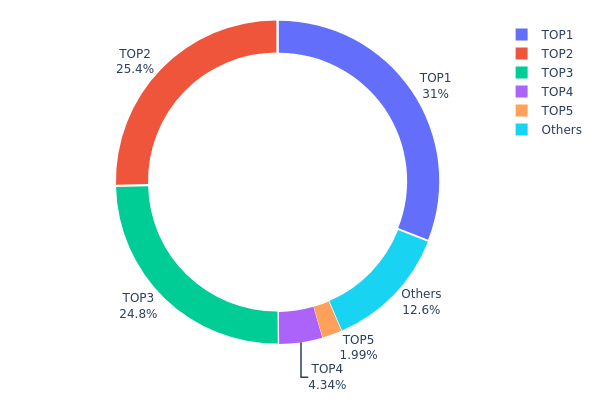

TUSD Varlık Dağılımı

TUSD'nin adres bazlı varlık dağılımı, sahipliğin oldukça yoğunlaşmış olduğunu gösteriyor. İlk üç adres, toplam TUSD arzının %81,09'unu elinde bulunduruyor ve en büyük sahip %30,96 paya sahip. Bu yoğunlaşma, TUSD'nin merkeziyetsizliği ve olası piyasa manipülasyonları açısından kaygı oluşturuyor.

Böylesi bir dağılım, bu büyük sahiplerin pozisyonlarını likide etmesi durumunda fiyat dalgalanmasını ve volatiliteyi artırabilir. Ayrıca, bu az sayıdaki adres TUSD ekosistemi ve piyasa dinamikleri üzerinde önemli etkiye sahip olur. “Diğerleri” kategorisinin sadece %12,59 paya sahip olması ise küçük yatırımcılar arasındaki dağılımın kısıtlı olduğunu gösteriyor.

Bu yoğunluk seviyesi, TUSD'nin zincir üstü yapısının bir stablecoin için idealden daha az istikrarlı olabileceğini ve güvenilirlik ile piyasa şoklarına karşı direncinin zayıflayabileceğini gösteriyor. Merkeziyetsizliğin düşük olması ise daha yaygın ve sağlam bir stablecoin arayan yatırımcılar için dezavantaj olabilir.

Güncel TUSD Varlık Dağılımı için tıklayın

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xd423...a4c261 | 97.585,50K | 30,96% |

| 2 | 0x7000...60ad34 | 80.000,00K | 25,38% |

| 3 | 0x2bb1...95ca7d | 78.000,00K | 24,75% |

| 4 | 0x9390...e6a1d1 | 13.688,69K | 4,34% |

| 5 | 0x4359...def7cb | 6.256,60K | 1,98% |

| - | Diğerleri | 39.594,75K | 12,59% |

II. TUSD'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Rezerv Varlıklar: TUSD'nin fiyat istikrarı, her bir tokenin yüksek likiditeli yasal finans varlıklarıyla, başta ABD doları olmak üzere desteklenmesiyle sağlanır.

- Tarihsel Eğilimler: TUSD'nin arzındaki değişimler, geçmişte piyasa talebi ve düzenleyici uyum ile yakından bağlantılı olmuştur.

- Güncel Etki: Son dönemde TUSD rezerv yönetimiyle ilgili tartışmalar, yatırımcı güveni ve arz dinamiklerini etkileyebilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Büyük kurumların TUSD varlıkları, piyasadaki istikrar ve likidite üzerinde belirleyici rol oynar.

- Kurumsal Benimseme: Önde gelen şirketlerin TUSD'yi küresel maaş ve sınır ötesi ödemelerde tercih etmesi, talebi artırabilir.

- Hükümet Politikaları: Düzenleyici değişiklikler ve devletlerin stablecoin'lere yaklaşımı, TUSD'nin benimsenmesi ve yasal statüsünde kritik öneme sahiptir.

Makroekonomik Ortam

- Para Politikası Etkisi: Özellikle ABD Merkez Bankası'nın politikaları, TUSD gibi USD'ye endeksli stablecoin'lerin talebini şekillendirebilir.

- Enflasyon Korumalı Özellikler: Yüksek enflasyon dönemlerinde, TUSD geleneksel dolar varlıklarına dijital bir alternatif olarak daha çok ilgi görebilir.

- Jeopolitik Faktörler: Uluslararası gerginlikler ve yaptırımlar, stablecoin'lere alternatif ödeme çözümü olarak talebi artırabilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Çapraz Zincir Uyumluluğu: TUSD'nin farklı blokzincir ağlarında çalışabilirliğinin artması, kullanım alanını ve talebini genişletebilir.

- DeFi Protokollerine Entegrasyon: TUSD'nin merkeziyetsiz finans uygulamalarında daha fazla yer alması, kullanım senaryolarını ve piyasa varlığını güçlendirebilir.

- Ekosistem Uygulamaları: Kripto ekosisteminde TUSD tabanlı finansal ürün ve hizmetlerin gelişmesi, benimsenme ve fiyat istikrarını destekler.

III. 2025-2030 TUSD Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,98-1,00 $

- Tarafsız tahmin: 0,99-1,01 $

- İyimser tahmin: 1,00-1,02 $ (DeFi protokollerinde artan kullanım varsayımıyla)

2026-2028 Görünümü

- Piyasa dönemi beklentisi: Küçük dalgalanmalarla istikrarlı büyüme

- Fiyat aralığı tahmini:

- 2026: 0,99-1,01 $

- 2027: 0,99-1,01 $

- 2028: 0,99-1,01 $

- Temel katalizörler: Düzenleyici netlik, geleneksel finans ile entegrasyon

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,99-1,01 $ (kripto piyasasında istikrarın devamı halinde)

- İyimser senaryo: 1,00-1,02 $ (sınır ötesi işlemlerde yaygın kullanılırsa)

- Dönüştürücü senaryo: 1,00-1,03 $ (TUSD küresel stablecoin lideri olursa)

- 31 Aralık 2030: TUSD 1,01 $ (yüksek talep nedeniyle hafif primli)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişim Oranı |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. TUSD için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

TUSD Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Değer koruması arayan muhafazakâr yatırımcılar

- İşlem önerileri:

- Portföyünüzün bir bölümünü düşük riskli varlık olarak TUSD'ye ayırın

- TUSD rezerv ve denetim raporlarını düzenli olarak inceleyin

- TUSD'yi güvenli donanım cüzdanlarında veya güvenilir borsalarda saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli ortalamalar: Kısa vadeli fiyat hareketlerini izleyin

- RSI: Aşırı alım/satım koşullarını belirleyin

- Dalgalı işlem için önemli noktalar:

- 1 $ civarındaki küçük fiyat dalgalanmalarına odaklanın

- Risk yönetimi için sıkı zarar durdur emirleri kullanın

TUSD Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Muhafazakâr yatırımcılar: %5-10

- Orta riskli yatırımcılar: %10-20

- Agresif yatırımcılar: %20-30

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı birden fazla stablecoin'e dağıtın

- Düzenli denetim: TUSD rezerv ve teminatlarını izleyin

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdan

- Soğuk depolama: Büyük varlıklar için donanım cüzdanları

- Güvenlik önlemleri: 2FA etkinleştirin, benzersiz şifreler kullanın, oltalama saldırılarına karşı dikkatli olun

V. TUSD İçin Potansiyel Riskler ve Zorluklar

TUSD Piyasa Riskleri

- Rekabet: Stablecoin seçeneklerinin çoğalması

- Benimseme: DeFi ve geleneksel finans entegrasyonunun yavaş seyretmesi

- Likidite: Aşırı piyasa koşullarında potansiyel likidite sorunları

TUSD Düzenleyici Riskler

- Stablecoin düzenlemeleri: Faaliyetleri etkileyebilecek yeni yasal düzenlemeler

- Banka iş ortaklıkları: Bankacılık ilişkilerindeki olası değişiklikler

- Sınır ötesi kısıtlamalar: Uluslararası kullanımda potansiyel sınırlamalar

TUSD Teknik Riskler

- Akıllı sözleşme açıkları: Potansiyel kod hataları

- Blokzincir tıkanıklığı: Ağ yoğunluğunda işlem gecikmeleri

- Oracle hataları: Sabit değer korumasını etkileyebilecek yanlış fiyat akışları

VI. Sonuç ve Eylem Önerileri

TUSD Yatırım Değeri Değerlendirmesi

TUSD, düzenli denetimlerle desteklenen, görece istikrarlı ve şeffaf bir stablecoin seçeneği sunar. Güvenilir bir değer saklama aracı olsa da, yatırımcılar değişen stablecoin ortamında düzenleyici ve piyasa risklerini göz önünde bulundurmalıdır.

TUSD Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Kriptoya düşük riskle giriş için TUSD'yi değerlendirin

✅ Deneyimli yatırımcılar: Portföy istikrarı ve işlem çifti olarak TUSD kullanın

✅ Kurumsal yatırımcılar: Hazine yönetimi ve sınır ötesi işlemler için TUSD'yi değerlendirin

TUSD Katılım Yöntemleri

- Doğrudan satın alma: Gate.com üzerinde TUSD alımı

- DeFi entegrasyonu: TUSD'yi merkeziyetsiz finans protokollerinde kullanma

- Forex alternatifi: Uluslararası işlemler için TUSD kullanımı

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi niteliği taşımaz. Yatırımcılar kararlarını kendi risk profilleri doğrultusunda dikkatlice vermeli ve profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

TUSD'nin güncel değeri nedir?

17 Ekim 2025 tarihi itibarıyla TUSD'nin değeri 0,9701 $ olup, son 24 saatte %0,10 azalmıştır.

2030 için TRX fiyat tahmini nedir?

2030 yılında TRX'in, artan benimseme ve ağ büyümesiyle 0,50-1,00 $ aralığına ulaşması beklenmektedir. Bu öngörü mevcut eğilim ve piyasa analizlerine dayanmaktadır.

2025 için TRX fiyat tahmini nedir?

TRX fiyatının 2025 sonunda önemli ölçüde artması ve artan talep ile işlem hacmi sayesinde 0,30-0,40 $ aralığına ulaşması beklenmektedir.

TUSD nasıl bir kripto para birimidir?

TUSD, ABD dolarına 1:1 oranında endeksli, itibari para teminatlı bir stablecoin'dir. Üçüncü taraf saklayıcılar tarafından tutulan gerçek ABD doları rezervleriyle tamamen desteklenir; bu da istikrar ve şeffaflık sağlar.

Dai Fiyat Analizi 2025: Stabilcoin Pazarının Eğilimleri ve Görünümü

USDe Fiyat Tahmini: 2025 Ethena Stabilcoin Pazar Analizi ve Yatırım Stratejisi

Gate'de USD1 stablecoin: WLFI Token için Analiz ve Yatırım Fırsatları

2025'te Gate'de GUSD: Gemini Dolarının Avantajları ve Fırsatları

PKR'den Sterlin'e: Bir Başarısız Para Biriminin Gerçekleri

2025'te Gate.com üzerinden USD1 stablecoin kullanarak ödüller nasıl kazanılır

MetaMask ile ERC20 Token Yönetimi: Bir Rehber

Dijital Varlıkların Güvenli Saklanması: Kripto Saklama Çözümlerinde En İyi Uygulamalar

Blockchain’de Çifte Harcama Nedir? Kapsamlı Bir İnceleme

Dijital varlık alım satımında üçlü tepe formasyonlarının anlaşılması

Layer 2 Ölçeklenme Çözümü: Arbitrum Optimistic Rollup’a Kapsamlı Bir Bakış