2025 TURBO Price Prediction: Analyzing Market Trends and Future Valuation Prospects in the Evolving Cryptocurrency Ecosystem

Introduction: TURBO's Market Position and Investment Value

Turbo (TURBO), as a revolutionary meme coin with a futuristic toad mascot, has made significant strides since its inception in 2023. As of 2025, TURBO's market capitalization has reached $245,295,000, with a circulating supply of approximately 69,000,000,000 tokens, and a price hovering around $0.003555. This asset, dubbed the "Turbo Toad Token," is playing an increasingly crucial role in the meme coin ecosystem.

This article will comprehensively analyze TURBO's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. TURBO Price History Review and Current Market Status

TURBO Historical Price Evolution

- 2023: Launch of TURBO, price reached an all-time low of $0.00006496 on September 11

- 2024: Significant growth, price hit an all-time high of $0.014477 on December 11

- 2025: Market correction, price declined to $0.003555 as of September 23

TURBO Current Market Situation

As of September 23, 2025, TURBO is trading at $0.003555, ranking 264th in the cryptocurrency market. The token has experienced a slight increase of 0.14% in the last 24 hours, with a trading volume of $973,335.80. TURBO's market capitalization stands at $245,295,000, representing a 0.0059% share of the total crypto market.

Despite the recent 24-hour gain, TURBO has shown negative performance over longer time frames. The token has decreased by 11.45% in the past week and 17.59% over the last 30 days. The year-on-year performance shows a significant decline of 35.94%.

The current price is 75.45% below its all-time high of $0.014477, reached on December 11, 2024. However, it remains 5,371.83% above its all-time low of $0.00006496, recorded on September 11, 2023.

TURBO has a circulating supply of 69,000,000,000 tokens, which is equal to its maximum supply, indicating that all tokens are in circulation. The fully diluted market capitalization matches the current market cap at $245,295,000.

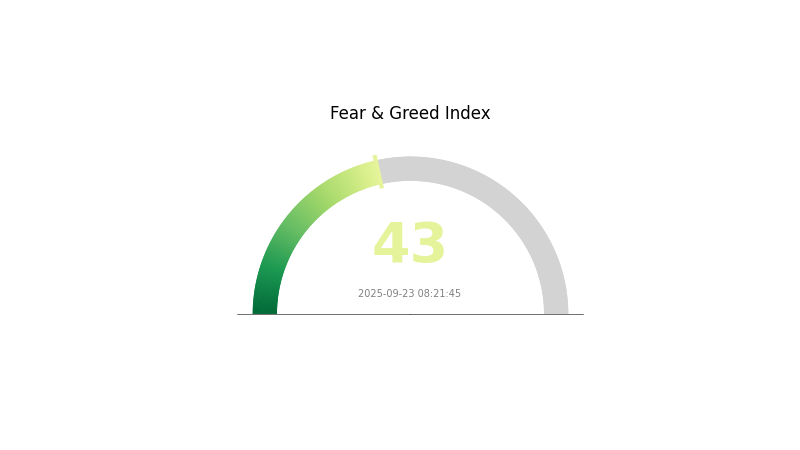

The market sentiment for cryptocurrencies is currently in the "Fear" zone, with a VIX index of 43, which may be influencing TURBO's price performance.

Click to view the current TURBO market price

TURBO Market Sentiment Indicator

2025-09-23 Fear and Greed Index: 43 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 43, indicating a state of fear. This suggests investors are hesitant and potentially looking for buying opportunities. While fear can signal a good time to invest, it's crucial to conduct thorough research and manage risks. Remember, market sentiment can shift quickly, so stay informed and consider diversifying your portfolio. Gate.com offers various tools to help you navigate these market conditions and make informed decisions.

TURBO Holdings Distribution

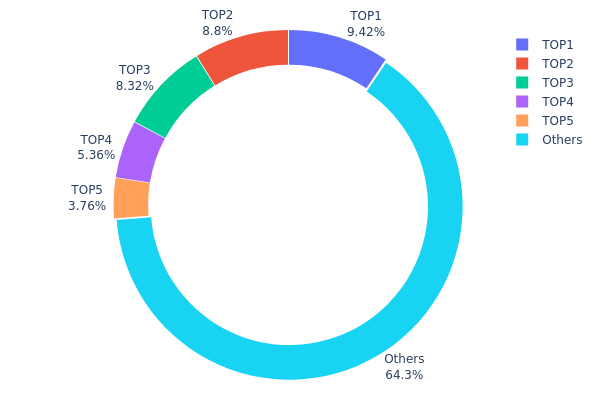

The address holdings distribution data provides crucial insights into the concentration of TURBO tokens among different wallet addresses. Analysis of this data reveals a relatively high concentration among the top holders. The top 5 addresses collectively control 35.65% of the total TURBO supply, with the largest holder possessing 9.42% of all tokens.

This level of concentration suggests a moderate centralization risk for TURBO. While not excessively concentrated in a single address, the significant holdings of the top addresses could potentially impact market dynamics. Large holders have the capacity to influence price movements through substantial buy or sell orders, potentially leading to increased volatility.

Despite this, the fact that 64.35% of TURBO tokens are distributed among other addresses indicates a degree of decentralization. This broader distribution may help mitigate some of the risks associated with high concentration, potentially contributing to a more stable on-chain structure and reducing the likelihood of market manipulation by a single entity.

Click to view the current TURBO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 6500000.00K | 9.42% |

| 2 | 0x377b...190873 | 6075020.49K | 8.80% |

| 3 | 0x0529...c553b7 | 5739018.10K | 8.31% |

| 4 | 0x211d...699da4 | 3700000.00K | 5.36% |

| 5 | 0x611f...dfb09d | 2595213.28K | 3.76% |

| - | Others | 44390748.13K | 64.35% |

II. Key Factors Affecting TURBO's Future Price

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, TURBO may potentially serve as a hedge against inflation, similar to other digital assets. However, its effectiveness as an inflation hedge would depend on various factors including market adoption and overall cryptocurrency market trends.

Technological Development and Ecosystem Building

- Ecosystem Applications: While specific information is not provided, TURBO, like many cryptocurrencies, may be developing its ecosystem with various DApps and projects. The success and adoption of these applications could significantly impact TURBO's future price and utility.

III. TURBO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00307 - $0.00335

- Neutral prediction: $0.00335 - $0.00365

- Optimistic prediction: $0.00365 - $0.00372 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.00353 - $0.00435

- 2028: $0.00294 - $0.00604

- Key catalysts: Technological advancements and wider adoption of TURBO

2029-2030 Long-term Outlook

- Base scenario: $0.00509 - $0.00628 (assuming steady market growth)

- Optimistic scenario: $0.00628 - $0.00923 (assuming strong bullish trends)

- Transformative scenario: $0.00923+ (exceptional market conditions and TURBO ecosystem expansion)

- 2030-12-31: TURBO $0.00923 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00372 | 0.00357 | 0.00307 | 0 |

| 2026 | 0.00419 | 0.00365 | 0.00219 | 2 |

| 2027 | 0.00435 | 0.00392 | 0.00353 | 10 |

| 2028 | 0.00604 | 0.00413 | 0.00294 | 16 |

| 2029 | 0.00748 | 0.00509 | 0.00305 | 43 |

| 2030 | 0.00923 | 0.00628 | 0.00421 | 76 |

IV. Professional Investment Strategies and Risk Management for TURBO

TURBO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a high appetite for speculation

- Operation suggestions:

- Allocate only a small portion of portfolio to TURBO

- Monitor project developments and community growth

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to manage downside risk

- Take profits at predetermined levels

TURBO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 0-1%

- Aggressive investors: 1-3%

- Professional investors: 3-5%

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use hardware wallets for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for TURBO

TURBO Market Risks

- High volatility: Meme coins are subject to extreme price swings

- Lack of fundamental value: Price driven primarily by speculation and hype

- Market saturation: Increasing competition in the meme coin space

TURBO Regulatory Risks

- Potential crackdowns: Regulators may target meme coins for increased scrutiny

- Advertising restrictions: Limitations on promoting meme coins may affect growth

- Exchange delistings: Risk of removal from trading platforms due to regulatory pressure

TURBO Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Network congestion: High transaction fees and slow confirmations during peak times

- Wallet compatibility issues: Limited support from some wallet providers

VI. Conclusion and Action Recommendations

TURBO Investment Value Assessment

TURBO presents a high-risk, high-reward opportunity in the meme coin market. While it has potential for significant short-term gains, its long-term value proposition remains speculative and uncertain.

TURBO Investment Recommendations

✅ Beginners: Avoid or limit exposure to a very small portion of portfolio ✅ Experienced investors: Consider short-term trading with strict risk management ✅ Institutional investors: Approach with caution, only for high-risk allocations

TURBO Trading Participation Methods

- Spot trading: Buy and sell TURBO on Gate.com

- Futures trading: Engage in leveraged trading with caution

- Staking: Participate in yield-generating opportunities if available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will Turbo crypto reach $1?

Based on current market trends and Turbo's growth potential, it's possible for Turbo to reach $1 by 2026. However, this depends on various factors including market conditions and project developments.

Can turbo reach 10 cents?

Yes, TURBO has the potential to reach 10 cents by 2025, given its strong fundamentals and growing adoption in the Web3 space.

Is Turbo a buy or sell?

Based on current market trends and potential growth, Turbo appears to be a buy. Its innovative technology and increasing adoption suggest promising future value.

What is happening with Turbo coin?

Turbo coin is experiencing significant growth, with its price surging by 150% in the past month. The project's recent partnerships and technological upgrades have fueled investor interest and increased adoption.

Share

Content