2025 TRX Fiyat Tahmini: TRON'un DeFi Ekosistemi Genişledikçe Pozitif Görünüm

Giriş: TRX'in Piyasa Konumu ve Yatırım Değeri

TRON (TRX), merkeziyetsiz blockchain platformları arasında liderler arasında sayılır ve 2017'deki kuruluşundan bu yana önemli başarılara imza atmıştır. 2025 yılı itibarıyla TRON'un piyasa değeri 30,09 milyar dolara ulaşmış, yaklaşık 94,67 milyar token dolaşımdadır ve fiyatı 0,32 dolar civarında seyretmektedir. "Web 3.0 altyapısı" olarak bilinen bu varlık, merkeziyetsiz finans ve blockchain tabanlı uygulamalar için giderek daha belirleyici bir konuma yükselmiştir.

Bu makalede, 2025-2030 arasında TRON fiyat eğilimleri; geçmiş hareketler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler ışığında kapsamlı şekilde analiz edilerek, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. TRX Fiyat Geçmişi ve Güncel Piyasa Durumu

TRX Tarihsel Fiyat Gelişimi

- 2017: İlk çıkış, fiyat 0,00180434 dolardan başladı

- 2022: USDD stablecoin lansmanı, ekosistemde büyük genişleme

- 2024: 4 Aralık'ta tüm zamanların en yüksek seviyesi olan 0,431288 dolara ulaşıldı

TRX Güncel Piyasa Durumu

15 Ekim 2025 itibarıyla TRX, 0,31783 dolardan işlem görmekte olup, 24 saatlik işlem hacmi 8.583.359 dolardır. Son 24 saatte %1,13'lük hafif bir düşüş yaşanmıştır. TRX, kripto para piyasasında 11. sıradadır ve piyasa değeri 30.087.856.492 dolara ulaşmıştır. Dolaşımdaki arz 94.666.508.803 TRX olup, bu miktar toplam arzın %99,99'una karşılık gelir. TRX geçtiğimiz yıl %97,97 oranında yükselerek güçlü bir performans sergilemiş; ancak kısa vadede, son bir haftada %5,74 ve son bir ayda %9,03 düşüş yaşamıştır. Mevcut fiyat, tüm zamanların en yüksek seviyesinin yaklaşık %26,3 altında olup, büyüme alanını korumaktadır.

Güncel TRX piyasa fiyatını görmek için tıklayın

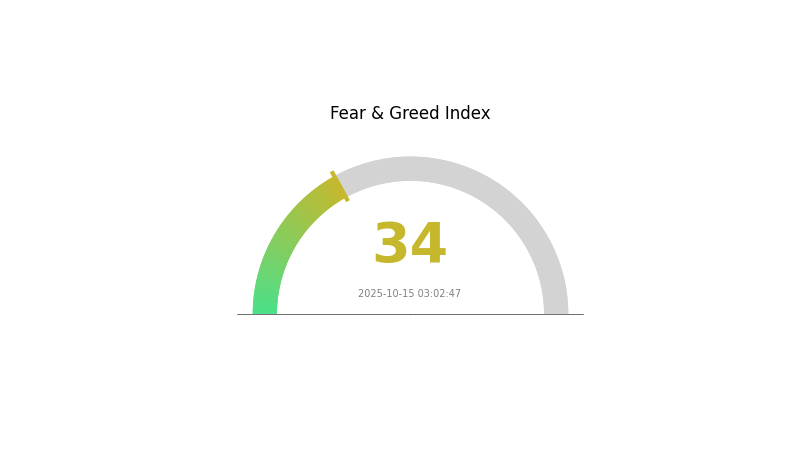

TRX Piyasa Duyarlılık Göstergesi

2025-10-15 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda korku hakim ve Korku ve Açgözlülük Endeksi 34 seviyesinde. Bu, yatırımcıların temkinli davrandığını ve çoğunluğun aksine hareket edenler için potansiyel alım fırsatları oluşabileceğini gösteriyor. Ancak piyasa duyarlılığının çok hızlı değişebileceği unutulmamalıdır. Yatırım kararı vermeden önce mutlaka detaylı araştırma yapmalı ve kendi risk profilinizi dikkate almalısınız. Gate.com bu belirsiz dönemde güncel piyasa verileriyle sizi bilgilendirir.

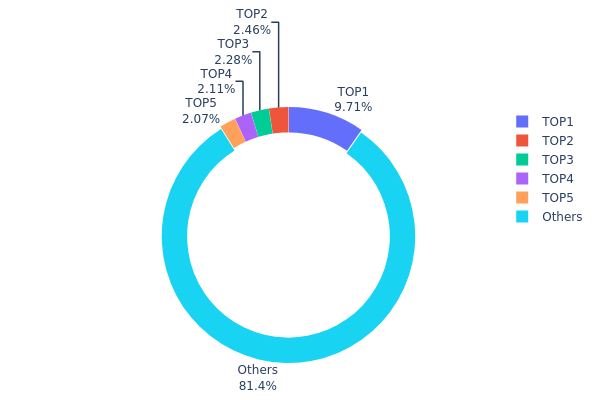

TRX Varlık Dağılımı

TRX'in adres bazlı varlık dağılımı, görece yoğunlaşmış bir sahiplik yapısına işaret eder. En büyük adres toplam arzın %9,71'ini elinde tutarken, sonraki dört büyük adresin her biri %2,07 ile %2,45 arasında paya sahiptir. İlk beş adres, toplam TRX'in %18,62'sini kontrol ederken, kalan %81,38 diğer adresler arasında paylaştırılmıştır.

Bu dağılım yapısı, makul seviyede merkezileşme olduğunu gösterir ve tokenların önemli bir kısmı az sayıda elde toplanır. Bu yapı piyasa dinamiklerini etkileyebilir; üst sıralardaki adreslerin büyük miktarda satış yapması fiyatlarda oynaklık yaratabilir. Ancak tokenların %80'den fazlasının daha küçük adreslerde bulunması, belirli bir merkeziyetsizlik ve geniş piyasa katılımına işaret eder.

Mevcut dağılım, merkezi etki ile geniş dağıtılmış sahiplik arasında bir denge sunar. Bu durum, piyasada istikrara katkı sağlayabilir; ancak büyük sahiplerin önemli işlemler yapması halinde volatiliteyi artırabilir. Yatırımcılar, olası piyasa değişimlerini öngörmek için üst sıralardaki adreslerdeki büyük token hareketlerini izlemelidir.

Güncel TRX Varlık Dağılımını görmek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | TU3kjF...yuSLQ5 | 9.192.641,67K | 9,71% |

| 2 | TT2T17...EWkU9N | 2.326.426,63K | 2,45% |

| 3 | TE2Rzo...oxvRwP | 2.161.825,76K | 2,28% |

| 4 | TNPdqt...jLeHAF | 1.999.998,98K | 2,11% |

| 5 | TPcnRb...ZPpdGb | 1.964.182,49K | 2,07% |

| - | Diğerleri | 77.021.519,60K | 81,38% |

II. TRX'in Gelecek Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Enflasyonist Model: TRX'in maksimum arzı 100,8 milyar tokendir, mevcut dolaşımdaki arzı 71,6 milyardır. Kalan tokenlar TRON Vakfı'nın elindedir ve blok ödülleri ile oylama teşvikleriyle kademeli olarak dolaşıma girer.

- Güncel Etki: Yıllık enflasyon oranı yaklaşık %0,5'tir; bu oran zamanla token değerinde hafif bir seyrelmeye neden olabilir.

Kurumsal ve Balina Dinamikleri

- Kurumsal Benimseme: BitTorrent'in TRON ekosistemine entegrasyonu, milyonlarca kullanıcıyı sisteme kazandırarak TRX'in kullanım alanını ve talebini artırmıştır.

- Ulusal Politikalar: Justin Sun'ın Aralık 2023'te Grenada'nın WTO temsilcisi olarak atanması, TRX fiyatını kısa süreli etkileyerek politik gelişmelerin token değerine etkisini göstermiştir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: Merkeziyetsiz dijital bir varlık olarak TRX, özellikle ekonomik belirsizlik dönemlerinde enflasyona karşı potansiyel bir koruma aracı olarak değerlendirilebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Yüksek Performanslı Blockchain: TRON'un Delegated Proof-of-Stake (DPoS) konsensüs mekanizması, saniyede 2.000'den fazla işlemle yüksek verimlilik ve düşük işlem ücretleri sağlar.

- Akıllı Sözleşme Desteği: TRON, Turing-tam akıllı sözleşmeleri destekler ve geliştiricilere çeşitli merkeziyetsiz uygulamalar (DApp) inşa etme imkanı sunar.

- Çapraz Zincir Uyumluluğu: TRON, farklı blok zincirleri arasında varlık transferini ve veri paylaşımını mümkün kılan çapraz zincir çözümlerini aktif biçimde destekler.

- Ekosistem Uygulamaları: TRON ekosisteminde DeFi projeleri, APENFT gibi NFT pazarları ve GameFi platformları yer alır; bu da platformun genel kullanımını ve değerini artırır.

III. 2025-2030 Dönemi TRX Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,21924 - 0,31774 dolar

- Nötr tahmin: 0,31774 - 0,33522 dolar

- İyimser tahmin: 0,33522 - 0,35269 dolar (pozitif piyasa duyarlılığı ve artan benimseme varsayımıyla)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Artan benimsenmeyle potansiyel büyüme dönemi

- Fiyat tahmini aralığı:

- 2027: 0,35072 - 0,4978 dolar

- 2028: 0,41121 - 0,51182 dolar

- Temel katalizörler: Teknolojik gelişmeler, blockchain entegrasyonunun yaygınlaşması ve olası stratejik ortaklıklar

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,47464 - 0,496 dolar (istikrarlı piyasa büyümesi ve sürekli proje ilerlemesi varsayımıyla)

- İyimser senaryo: 0,496 - 0,51736 dolar (kurumsal benimsemenin artması ve olumlu düzenleyici ortamla)

- Dönüştürücü senaryo: 0,51736+ dolar (çığır açıcı kullanım alanları ve ana akım entegrasyon olması durumunda)

- 2030-12-31: TRX 0,51584 dolar (mevcut projeksiyonlara göre olası zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,35269 | 0,31774 | 0,21924 | 0 |

| 2026 | 0,41902 | 0,33522 | 0,24806 | 5 |

| 2027 | 0,4978 | 0,37712 | 0,35072 | 18 |

| 2028 | 0,51182 | 0,43746 | 0,41121 | 37 |

| 2029 | 0,51736 | 0,47464 | 0,3275 | 49 |

| 2030 | 0,51584 | 0,496 | 0,28272 | 56 |

IV. Profesyonel TRX Yatırım Stratejileri ve Risk Yönetimi

TRX Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profiller: Uzun vadeli bakış açısına ve yüksek risk toleransına sahip yatırımcılar

- Operasyonel öneriler:

- Piyasa düşüşlerinde TRX biriktirin

- Maliyetleri dengelemek için düzenli alım planları oluşturun

- Varlıklarınızı güvenli, saklama hizmeti olmayan cüzdanlarda koruyun

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüşleri tespit etmek için kullanılır

- Göreceli Güç Endeksi (RSI): Aşırı alım/aşırı satım seviyelerini izler

- Dalgalı alım-satımda temel noktalar:

- Açık giriş ve çıkış noktaları belirleyin

- Risk yönetimi için zarar durdur (stop-loss) emirleri kullanın

TRX Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-20

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları birden fazla kripto varlık arasında dağıtın

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdan

- Soğuk depolama: Büyük varlıklar için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama kullanın, özel anahtarlarınızı güvenli şekilde yedekleyin

V. TRX İçin Potansiyel Riskler ve Zorluklar

TRX Piyasa Riskleri

- Volatilite: Kripto piyasalarındaki yoğun fiyat dalgalanmaları

- Likidite: Büyük hacimli işlemlerde yeterli alıcı veya satıcı bulunamaması

- Rekabet: Yeni blockchain platformlarının piyasaya çıkışı

TRX Düzenleyici Riskler

- Küresel düzenleyici belirsizlik: Değişen politikalar TRX'in benimsenmesini etkileyebilir

- Uyum zorlukları: Sınır ötesi transferlerde potansiyel sorunlar

- Hukuki statü: Kripto varlıkların farklı ülkelerde değişen yasal durumu

TRX Teknik Riskler

- Ağ tıkanıklığı: Yoğun kullanımda ölçeklenebilirlik sorunları

- Akıllı sözleşme açıkları: DApp ekosistemindeki güvenlik riskleri

- Teknolojik eskime: Blockchain teknolojisindeki hızlı değişimler

VI. Sonuç ve Eylem Önerileri

TRX Yatırım Değeri Değerlendirmesi

TRX, artan benimsenmesiyle bir akıllı sözleşme platformu olarak uzun vadede potansiyel sunar; ancak kısa vadede yüksek volatilite ve düzenleyici belirsizliklerle karşı karşıyadır.

TRX Yatırım Önerileri

✅ Yeni başlayanlar: Piyasayı anlamak için küçük ve düzenli yatırımlar yapın ✅ Deneyimli yatırımcılar: Tutma ve al-sat stratejilerini dengeleyin ✅ Kurumsal yatırımcılar: Stratejik ortaklıkları ve büyük ölçekli staking fırsatlarını değerlendirin

TRX İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden TRX alım-satımı

- staking: TRX staking’e katılarak pasif gelir elde edebilirsiniz

- DeFi entegrasyonu: TRX tabanlı merkeziyetsiz finans protokollerini keşfedin

Kripto para yatırımları oldukça yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finans danışmanları ile çalışmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını yatırmamanız önerilir.

SSS

TRX 10 dolara ulaşabilir mi?

TRX'in 10 dolara ulaşması, blockchain ekosisteminde büyük değişiklikler olmadan pek mümkün görünmemektedir. Mevcut piyasa trendleri böyle bir fiyat artışını desteklememektedir. Olasılık düşüktür.

2025'te TRX'in değeri ne olacak?

Güncel tahminler, Ekim 2025'te TRX'in 0,33 ila 0,35 dolar aralığında olmasını öngörmekte ve bu aralığın üzerine çıkma olasılığı da bulunmaktadır.

2030 için TRON fiyat tahmini nedir?

2030 yılında TRON (TRX) için beklenti, token başına 0,50 ila 1,00 dolar aralığına ulaşılması yönündedir. Bu öngörü, artan benimseme, ağ büyümesi ve genel kripto piyasa genişlemesine dayanmaktadır.

TRX 5 dolara ulaşabilir mi?

Evet, TRX'in 2025'e kadar ağ popülerliğinin ve stablecoin benimsenmesinin artması sayesinde 5 dolara ulaşma potansiyeli vardır. Mevcut piyasa eğilimleri bu ihtimali desteklemektedir.

TRON Fiyat Analizi: 2025 TRX Pazar Eğilimleri ve Yatırım Beklentileri

2025 COTI Fiyat Tahmini: Gelişen kripto para ekosisteminde piyasa trendleri ve geleceğe yönelik potansiyelin değerlendirilmesi

WinkLink Kripto: Nedir ve Nasıl Çalışır

2025 ROSE Fiyat Tahmini: Oasis Network’in yerel token’ı için piyasa trendleri ve olası büyümenin analizi

2025 CELO Fiyat Tahmini: Boğa Koşusu mu, Ayı Piyasası mı? CELO'nun Gelecekteki Değerini Belirleyen Temel Faktörlerin Analizi

2025 NEWT Fiyat Tahmini: Gelişen DeFi Ekosisteminde Newt Finance İçin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Xenea Günlük Quiz Yanıtı 14 Aralık 2025

Kripto Terminolojisini Anlama: Yeni Başlayanlar İçin Rehber

NFT’lerde Yeni Bir Dönem: Soulbound Token’ların Temelini Kavramak

Blockchain Teknolojisinde Tendermint’in Konsensüs Mekanizmasını Anlamak

Ethereum Name Service Alan Adlarını Satın Alma ve Yönetme Yöntemleri