2025 TMAI Fiyat Tahmini: Dijital Varlık İçin Piyasa Eğilimleri ve Olası Büyüme Faktörlerinin Değerlendirilmesi

Giriş: TMAI'nin Piyasa Konumu ve Yatırım Potansiyeli

Token Metrics AI (TMAI), kripto topluluğuna yapay zeka tabanlı araçlar ve analizler sunan, yenilikçi bir token olarak piyasaya adım attığından beri sektörde dikkat çekmektedir. 2025 yılı itibarıyla TMAI’nin piyasa değeri 3.200.666,88 Amerikan dolarıdır; dolaşımdaki toplam token sayısı yaklaşık 7.989.682.672 olup, fiyatı ise 0,0004006 Amerikan doları civarında seyretmektedir. “Yapay zeka ile güçlendirilmiş işlem arkadaşı” olarak anılan bu varlık, otomatik alım-satım stratejileri ve piyasa analizlerinde giderek daha önemli bir rol üstlenmektedir.

Bu makalede, TMAI’nin 2025 ile 2030 yılları arasındaki fiyat hareketleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler doğrultusunda profesyonel tahminler ve uygulanabilir yatırım stratejileriyle kapsamlı şekilde incelenecektir.

I. TMAI Fiyat Geçmişi ve Güncel Piyasa Durumu

TMAI Tarihsel Fiyat Eğrisi

- 2024: İlk çıkış, 17 Aralık’ta fiyat 0,017747 Amerikan dolarında zirveye ulaştı

- 2025: Piyasa gerilemesi, 11 Ekim’de fiyat tüm zamanların en düşük seviyesi olan 0,0003403 Amerikan dolarına indi

TMAI Güncel Piyasa Durumu

13 Ekim 2025 itibarıyla TMAI, 0,0004006 Amerikan dolarından işlem görmektedir; son 24 saatteki işlem hacmi 15.050,04 Amerikan dolarıdır. Token, son 24 saatte %8,74 oranında kayda değer bir artış göstererek kısa vadeli toparlanma sinyali vermiştir. Ancak, son bir haftada %17,56 ve son bir ayda %14,39 değer kaybederek orta vadede süregelen volatilite ve düşüş baskısını ortaya koymaktadır.

Mevcut fiyat, zirve değerine göre %97,74 gerilemiştir; bu durum TMAI’nin hâlâ uzun süreli bir ayı trendinde olduğunu göstermektedir. Token’in piyasa değeri 3.200.666,88 Amerikan doları olup, genel kripto piyasasında 2.043’üncü sıradadır.

Son yükselişe rağmen TMAI fiyatı dip seviyeye oldukça yakın kalarak zorlu piyasa koşullarına işaret etmektedir. Token’in son bir yılki performansı %91,041 oranında sert bir gerilemeye işaret ederek, uzun vadede ciddi bir baskı altında olduğunu göstermektedir.

Güncel TMAI piyasa fiyatını görüntülemek için tıklayın

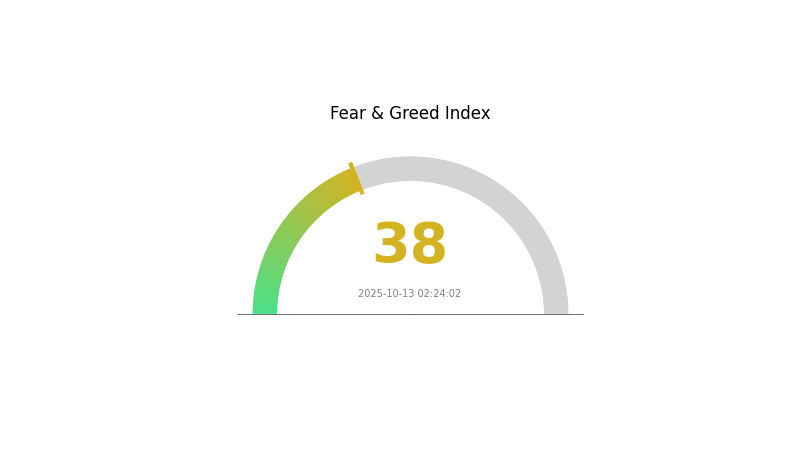

TMAI Piyasa Duyarlılığı Göstergesi

13 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksi’ni görüntülemek için tıklayın

Kripto para piyasası şu anda korku aşamasında ve Korku & Açgözlülük Endeksi 38 seviyesinde. Bu, yatırımcıların tedbirli davrandığına işaret ediyor. Böyle dönemlerde, ani kararlar almaktan kaçınmak ve piyasayı dikkatle izlemek gerekir. Korku ortamı bazıları için alım fırsatı anlamına gelse de, detaylı araştırma yapmak ve risk toleransını gözetmek şarttır. Piyasa döngüleri doğaldır; bu duyarlılık ileride değişebilir. Güncel kalın ve Gate.com gibi platformlarla trendleri takip ederek bilinçli adımlar atın.

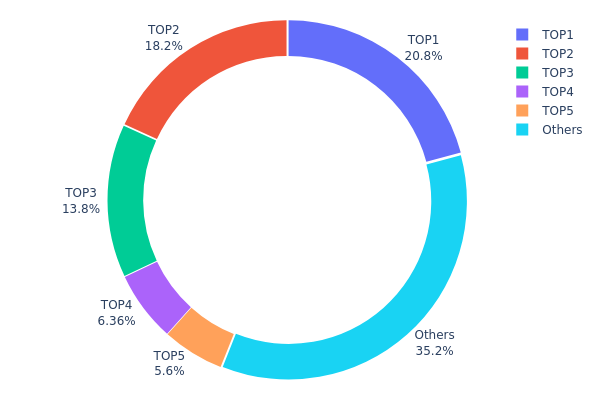

TMAI Varlık Dağılımı

TMAI’nin adres bazlı varlık dağılımı, sahipliğin oldukça yoğunlaştığını gösteriyor. En büyük 5 adres, toplam arzın %64,78’ini elinde bulunduruyor; en büyük sahip ise %20,84 paya sahip. Bu yoğunlaşma, fiyat manipülasyonu ve volatilite açısından kırılganlık yaratabilir.

İkinci ve üçüncü en büyük sahipler sırasıyla %18,15 ve %13,84 paya sahip olup, TMAI’nin merkeziyetçi yapısını daha da pekiştiriyor. Bu da büyük yatırımcıların işlem hareketleriyle fiyatı ciddi biçimde etkileyebileceği anlamına gelir.

TMAI’nin %35,22’si diğer adresler arasında dağılmış durumda olsa da, mevcut yapı düşük merkeziyetsizlik düzeyine işaret ediyor. Bu yoğunlaşma zincir üstü istikrarı etkileyebilir ve daha eşit dağıtım isteyen yatırımcılar açısından risk teşkil edebilir.

Güncel TMAI Varlık Dağılımı’nı görüntülemek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x1494...c4e5d7 | 2.084.367,07K | 20,84% |

| 2 | 0xbbee...300464 | 1.815.823,08K | 18,15% |

| 3 | 0x0529...c553b7 | 1.384.610,55K | 13,84% |

| 4 | 0xb859...53734e | 636.400,47K | 6,36% |

| 5 | 0x5383...d012f8 | 559.638,72K | 5,59% |

| - | Diğerleri | 3.519.160,12K | 35,22% |

II. TMAI'nin Gelecek Fiyatını Etkileyecek Başlıca Faktörler

Arz Mekanizması

- Dolaşımdaki Arz: TMAI’nin mevcut dolaşımdaki token sayısı 7.989.682.672’dir.

- Mevcut Etki: Piyasa değeri bu dolaşımdaki arz üzerinden hesaplanır; bu da fiyatı doğrudan etkiler.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Kurumsal ilgideki artış fiyat üzerinde önemli etki yaratabilir; bu konuda özel veri bulunmamaktadır.

- Kurumsal Benimseme: Bilinen şirketlerin TMAI’yi benimsemesi, token’in değerini ve piyasa bilinirliğini artırır.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankası kararları ve ekonomik veri açıklamaları TMAI fiyatını etkileyebilir.

- Jeopolitik Faktörler: Uluslararası gelişmeler ve jeopolitik riskler, genel kripto piyasasını ve TMAI’yi etkileyebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- AI Gelişmeleri: TMAI, kripto topluluğuna yapay zeka tabanlı araçlar sunduğu için AI teknolojisindeki ilerlemeler değerini artırabilir.

- Ekosistem Uygulamaları: TMAI, token sahiplerine AI tabanlı alım-satım botları sunar; bu da kullanıcı çekerek talebi artırabilir.

III. 2025-2030 TMAI Fiyat Tahmini

2025 Projeksiyonu

- Temkinli tahmin: 0,00036 - 0,00038 Amerikan doları

- Tarafsız tahmin: 0,00039 - 0,00041 Amerikan doları

- İyimser tahmin: 0,00045 - 0,00047 Amerikan doları (olumlu piyasa koşulları gerektirir)

2027-2028 Projeksiyonu

- Piyasa fazı beklentisi: Potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,00032 - 0,00054 Amerikan doları

- 2028: 0,00043 - 0,00057 Amerikan doları

- Temel katalizörler: Artan benimseme, teknolojik gelişmeler

2029-2030 Uzun Vadeli Projeksiyon

- Temel senaryo: 0,00054 - 0,00056 Amerikan doları (istikrarlı piyasa büyümesi)

- İyimser senaryo: 0,00057 - 0,00060 Amerikan doları (güçlü piyasa performansı)

- Dönüştürücü senaryo: 0,00060 - 0,00062 Amerikan doları (çığır açan gelişmelerle)

- 2030-12-31: TMAI 0,00062 Amerikan doları (olası dönem zirvesi)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 0,00047 | 0,0004 | 0,00036 | 0 |

| 2026 | 0,00055 | 0,00043 | 0,00023 | 8 |

| 2027 | 0,00054 | 0,00049 | 0,00032 | 23 |

| 2028 | 0,00057 | 0,00052 | 0,00043 | 29 |

| 2029 | 0,00057 | 0,00054 | 0,00044 | 35 |

| 2030 | 0,00062 | 0,00056 | 0,0005 | 39 |

IV. TMAI Yatırım Stratejileri ve Risk Yönetimi

TMAI Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Hedef grup: Uzun vadeli yatırımcılar ve yapay zeka teknolojisi meraklıları

- Operasyonel öneriler:

- Piyasa geri çekilmelerinde TMAI biriktirin

- Token Metrics AI projesinin gelişmelerini izleyin

- Tokenleri özel anahtara sahip güvenli cüzdanlarda tutun

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri izleyin

- RSI (Göreli Güç Endeksi): Aşırı alım ve satım bölgelerini belirleyin

- Dalgalı işlem için ipuçları:

- Teknik göstergelere göre net giriş ve çıkış noktaları belirleyin

- Fiyat hareketlerini doğrulamak için işlem hacmini izleyin

TMAI Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %10-15’i

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Birden fazla AI odaklı tokena yatırım yapın

- Zarar-durdur emirleri: Olası kayıpları sınırlayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli saklamada donanım cüzdanı tercih edin

- Güvenlik önlemleri: İki faktörlü doğrulama ve güçlü şifre kullanımı

V. TMAI için Olası Riskler ve Zorluklar

TMAI Piyasa Riskleri

- Yüksek volatilite: TMAI fiyatı ciddi dalgalanmalara açık

- Rekabet: Diğer AI odaklı tokenlerin piyasaya girişi TMAI’nin payını azaltabilir

- Piyasa duyarlılığı: Genel kripto piyasası şartları TMAI performansını etkiler

TMAI Düzenleyici Riskler

- Düzenleyici belirsizlik: Gelişen mevzuat AI odaklı tokenleri etkileyebilir

- Uyum gereklilikleri: Yeni düzenlemeler ilave uyum yükümlülüğü doğurabilir

- Sınır ötesi kısıtlamalar: Ülkelere göre değişen mevzuat benimsemeyi sınırlayabilir

TMAI Teknik Riskler

- Akıllı sözleşme açıkları: Token kodunda olası açıklar veya hatalar

- AI teknolojisi sınırları: AI tabanlı alım-satım araçlarının beklenen performansı göstermemesi

- Ölçeklenebilirlik sorunları: Artan kullanıcı ve işlem talebiyle başa çıkma zorlukları

VI. Sonuç ve Eylem Önerileri

TMAI Yatırım Potansiyeli Değerlendirmesi

TMAI, yapay zeka destekli kripto işlem alanında benzersiz potansiyel sunar. Uzun vadede AI tabanlı araçlara artan talep avantaj yaratırken, kısa vadede volatilite ve teknolojiye bağlı riskler öne çıkar.

TMAI Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Tokenin davranışını anlamak için küçük ve düzenli yatırımlar yapın ✅ Tecrübeli yatırımcılar: Uzun vadeli tutma ile aktif alım-satımı dengeleyin ✅ Kurumsal yatırımcılar: TMAI’yi çeşitlendirilmiş bir AI ve blokzincir portföyüne dahil edin

TMAI İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden TMAI token alın

- DCA stratejisi: Fiyat dalgalanmasını ortalamak için düzenli alım emirleri ayarlayın

- Staking: Proje sunuyorsa staking fırsatlarını değerlendirin

Kripto para yatırımları yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarına göre temkinli karar almalı ve profesyonel finansal danışmana başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

TMAI token nedir?

TMAI, alım-satım analizlerinde yapay zekadan faydalanan bir kripto para projesidir. 2025’te piyasaya çıkmış, AI tabanlı analizlerle işlem stratejilerini geliştirmeyi amaçlamaktadır.

2025’te hangi meme coin yükselişe geçer? Fiyat tahmini

Shiba Inu’nun, güçlü topluluk desteği ve viral trendlerle 2025’te yükselmesi öngörülmektedir.

TMAI kripto nereden alınır?

TMAI, merkeziyetsiz borsalar (DEX) ile kripto para platformlarında satın alınabilir. Güncel listelemeleri kontrol edin ve işlem öncesinde erişimi doğrulayın.

2030’da XRP için fiyat tahmini nedir?

2030’a kadar XRP’nin 90-120 Amerikan doları aralığına ulaşması beklenmektedir. Bu tahmin, mevcut piyasa trendlerine dayalı önemli bir büyüme hedefidir.

Kripto Varlıklar performansında 73.33'ün sıralaması nedir?

2025 yılında kripto rakip analizi nasıl evriliyor?

2025 AIBOT Fiyat Tahmini: Yapay Zeka ile Güçlendirilmiş Alım Satım Çözümlerinin Geleceğini Şekillendirmek

2025 AIBOT Fiyat Tahmini: Piyasa Eğilimleri ve Potansiyel Büyüme Faktörlerinin Analizi

Yapay Zekâ Tabanlı Kripto Para Alım-Satım Botu Çözümleri

Otomatik botlar ile zahmetsiz kripto alım satımı

Ödeme Verimliliğini En Üst Düzeye Çıkarmak: Visa ve Blockchain İşlem Hızı Karşılaştırması

Ethereum ERC20 Rehberi: Token Standardını Anlamak

Kripto para işlemlerinde gas ücretlerini azaltmak için etkili stratejiler

Blockchain Oracle'larını Anlamak: Detaylı Bir Kılavuz

Kriptopara dünyasında DAO'nun ne olduğunu anlamak