2025 THL Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: THL's Market Position and Investment Value

Thala (THL), as a DeFi Hyper App and Liquidity Engine on Aptos, has made significant strides since its inception. As of 2025, Thala's market capitalization has reached $3,560,087, with a circulating supply of approximately 61,148,866 tokens, and a price hovering around $0.05822. This asset, often referred to as the "Aptos DeFi Ecosystem Leader," is playing an increasingly crucial role in decentralized finance applications.

This article will comprehensively analyze Thala's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. THL Price History Review and Current Market Status

THL Historical Price Evolution

- 2024: Launch on March 20, price reached all-time high of $3.3333

- 2025: Market downturn, price dropped significantly to current levels

- October 2025: Price hit all-time low of $0.03928 on October 10

THL Current Market Situation

THL is currently trading at $0.05822, representing a 7.38% increase in the last 24 hours. However, the token has experienced significant declines over longer time frames, with a 31.16% decrease in the past week and an 89.52% drop over the past year. The current price is 98.25% below its all-time high of $3.3333 set on March 20, 2024, but has rebounded 48.22% from its recent all-time low of $0.03928 reached just three days ago on October 10, 2025.

The token's market capitalization stands at $3,560,087, ranking it 1984th among all cryptocurrencies. With a circulating supply of 61,148,866.74 THL out of a total supply of 100,000,000, the current circulation ratio is 61.15%. The fully diluted market cap is $5,822,000.

Trading volume in the past 24 hours amounts to $11,524.90, indicating moderate market activity. The token's market dominance is relatively low at 0.00014%, suggesting it is still a small player in the overall cryptocurrency market.

Click to view the current THL market price

THL Market Sentiment Indicator

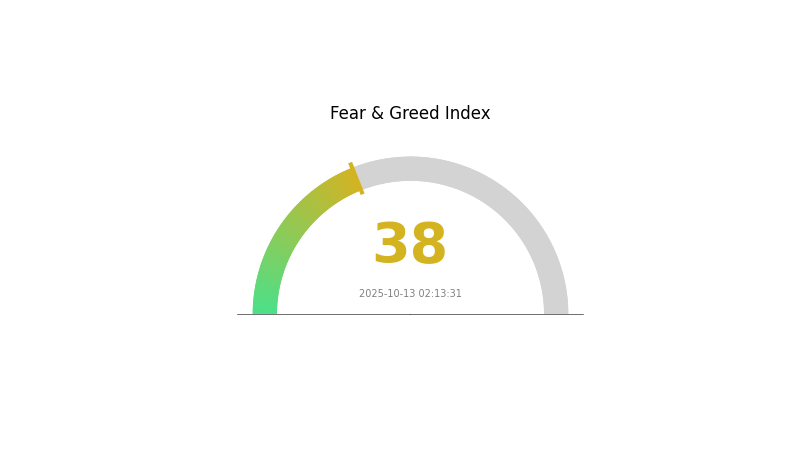

2025-10-13 Fear and Greed Index: 38 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment is currently in the "Fear" zone, with a reading of 38. This indicates a cautious mood among investors, potentially signaling undervalued market conditions. Such periods of fear often present buying opportunities for long-term investors. However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results.

THL Holdings Distribution

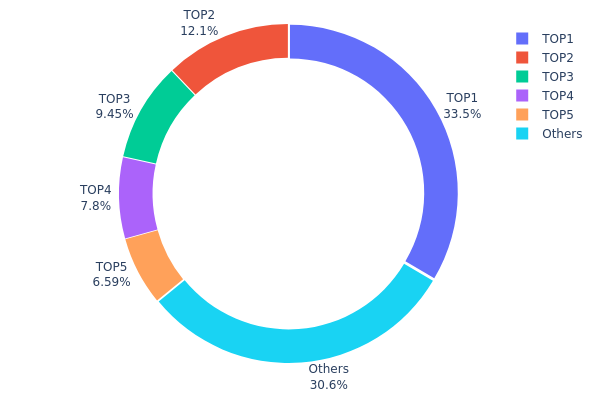

The address holdings distribution data provides crucial insights into the concentration of THL tokens among different addresses. Based on the provided data, we observe a significant concentration of THL tokens in a few top addresses. The top address holds 33.53% of the total supply, with the top 5 addresses collectively controlling 69.45% of THL tokens.

This high concentration raises concerns about potential market manipulation and price volatility. With a single address holding over one-third of the supply, there's a risk of large-scale sell-offs or accumulation that could significantly impact THL's market dynamics. The top 5 addresses' combined holdings of nearly 70% further exacerbate this centralization issue, potentially compromising the token's decentralization ethos.

Such a concentrated distribution structure may lead to increased price volatility and susceptibility to whale movements. It also suggests a relatively low level of widespread adoption among smaller holders. While this concentration might provide some stability in the short term, it poses long-term risks to the token's ecosystem health and market resilience.

Click to view the current THL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4dca...ff5ee9 | 20742.86K | 33.53% |

| 2 | 0xcf86...99012a | 7471.64K | 12.08% |

| 3 | 0xe8ca...49b9ea | 5845.27K | 9.45% |

| 4 | 0x127e...bc9755 | 4823.37K | 7.80% |

| 5 | 0x9c6d...1d83e1 | 4075.83K | 6.59% |

| - | Others | 18912.04K | 30.55% |

II. Key Factors Influencing Future THL Price

Supply Mechanism

- Capacity Oversupply: The industry is facing a situation of excess production capacity, which may lead to price declines.

- Historical Pattern: In the past, oversupply has typically resulted in significant price drops in the industry.

- Current Impact: The current oversupply is expected to continue exerting downward pressure on THL prices.

Macroeconomic Environment

- Inflation Hedging Properties: THL's performance in an inflationary environment may impact its price. If it demonstrates strong inflation hedging capabilities, it could attract more investors during periods of high inflation.

- Geopolitical Factors: International situations and conflicts can affect the global economic landscape, potentially influencing THL's price.

Technological Development and Ecosystem Building

- Energy Efficiency Improvements: Technological innovations aimed at improving energy efficiency could enhance THL's competitiveness and potentially drive up its price.

- Low-Carbon Economy Initiatives: National efforts to develop a low-carbon economy may provide strong support for THL's growth and price appreciation.

- Ecosystem Applications: The development of downstream industries and their changing demands will directly determine the future development of the THL industry.

III. THL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.04014 - $0.05817

- Neutral prediction: $0.05817 - $0.06108

- Optimistic prediction: $0.06108 - $0.07000 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.04176 - $0.08231

- 2028: $0.04570 - $0.09712

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.08427 - $0.10238 (assuming steady market growth)

- Optimistic scenario: $0.10648 - $0.12050 (assuming strong market performance)

- Transformative scenario: $0.12050 - $0.15000 (assuming breakthrough developments)

- 2030-12-31: THL $0.10238 (potential year-end price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06108 | 0.05817 | 0.04014 | 0 |

| 2026 | 0.06141 | 0.05962 | 0.04472 | 2 |

| 2027 | 0.08231 | 0.06052 | 0.04176 | 3 |

| 2028 | 0.09712 | 0.07141 | 0.0457 | 22 |

| 2029 | 0.1205 | 0.08427 | 0.06826 | 44 |

| 2030 | 0.10648 | 0.10238 | 0.0686 | 75 |

IV. Professional Investment Strategies and Risk Management for THL

THL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate THL during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to limit potential losses

- Take profits at predetermined levels to secure gains

THL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for THL

THL Market Risks

- High volatility: Price fluctuations may be extreme

- Liquidity risk: Limited trading volume could impact price stability

- Competition: Other DeFi projects on Aptos may gain market share

THL Regulatory Risks

- Regulatory uncertainty: Potential for increased scrutiny of DeFi projects

- Compliance challenges: Evolving regulations may impact Thala's operations

- Cross-border restrictions: International regulatory differences could limit adoption

THL Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: Aptos blockchain performance issues could affect Thala

- Oracle failures: Inaccurate price feeds could disrupt Thala's products

VI. Conclusion and Action Recommendations

THL Investment Value Assessment

THL presents a high-risk, high-potential investment in the Aptos DeFi ecosystem. Long-term value lies in Thala's integrated product suite, but short-term volatility and regulatory uncertainties pose significant risks.

THL Investment Recommendations

✅ Newcomers: Start with small positions, focus on education and understanding the project ✅ Experienced investors: Consider allocating a portion of DeFi portfolio to THL, actively manage positions ✅ Institutional investors: Conduct thorough due diligence, potentially include THL in diversified DeFi portfolios

THL Participation Methods

- Spot trading: Buy and hold THL tokens on Gate.com

- Staking: Participate in Thala's governance by locking THL into veTHL

- Liquidity provision: Contribute to Thala's AMM pools for potential yield

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is thl a good buy?

Yes, THL appears to be a good buy. It's rated 'Buy' with a 12-month target price of $2.51, suggesting a 14.09% potential upside from the current price.

What is Tenaya Therapeutics stock price forecast for 2025?

Tenaya Therapeutics stock is forecasted to reach an average price of $3.77 in 2025, with potential highs of $6.99 and lows of $0.56.

Can telcoin reach $1?

Based on current forecasts, it's unlikely Telcoin will reach $1. Predictions suggest a maximum price of $0.051 by 2030. However, market conditions and project developments could impact future prices.

What is the outlook for Tullow oil?

Tullow Oil's outlook is mixed. Revenue may decline, but earnings and EPS are projected to grow significantly, with EPS expected to increase by 64.9% annually.

Share

Content