2025 THINK Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: THINK’in Piyasa Konumu ve Yatırım Değeri

Think Protocol (THINK), yeni nesil ajan tabanlı internetin temeli olarak kurulduğu günden bu yana dikkat çekici ilerlemeler kaydetmektedir. 2025 yılı itibarıyla THINK’in piyasa değeri 4.229.400 $’a ulaşırken, dolaşımdaki arz yaklaşık 700.000.000 token olup fiyatı 0,006042 $ seviyesinde dalgalanmaktadır. “AI ajan bağlayıcısı” olarak da bilinen bu varlık, yapay zeka ve açık kaynaklı araçlar alanında giderek daha stratejik bir rol üstlenmektedir.

Bu makalede, 2025’ten 2030’a kadar THINK’in fiyat hareketleri; tarihsel desenler, piyasa arz ve talebi, ekosistem gelişimi ile makroekonomik faktörler ışığında profesyonel fiyat tahminleri ve yatırımcılar için uygulanabilir stratejilerle detaylı olarak ele alınacaktır.

I. THINK Fiyat Geçmişi ve Güncel Piyasa Durumu

THINK Tarihsel Fiyat Seyri

- 2025: THINK, 29 Temmuz’da 0,03576 $ ile tüm zamanların en yüksek seviyesini gördü ve fiyat tarihinde önemli bir eşik aşıldı.

- 2025: Piyasa sert bir düşüş yaşadı; THINK’in fiyatı 11 Ekim’de 0,005751 $ ile tarihinin en düşük noktasına indi.

THINK Güncel Piyasa Görünümü

12 Ekim 2025 itibarıyla THINK, 0,006042 $ seviyesinde işlem görmekte ve son 24 saat içinde %0,69’luk hafif bir toparlanma sergilemektedir. Ancak, uzun vadede token ciddi kayıplar yaşamıştır; son yedi günde %18,09, son 30 günde ise %56,54 düşüş göstermiştir. Mevcut fiyat, bir yıl önceki zirvesinin %89,38 altında seyretmektedir.

THINK’in mevcut piyasa değeri 4.229.400 $’dır ve tam seyreltilmiş değeri 6.042.000 $’dır. Dolaşımdaki token miktarı 700.000.000 THINK olup bu, toplam arzın %70’ini (1.000.000.000 THINK) oluşturmaktadır. 24 saatlik işlem hacmi ise 75.656,87 $ ile piyasadaki hareketliliğin kısıtlı olduğunu göstermektedir.

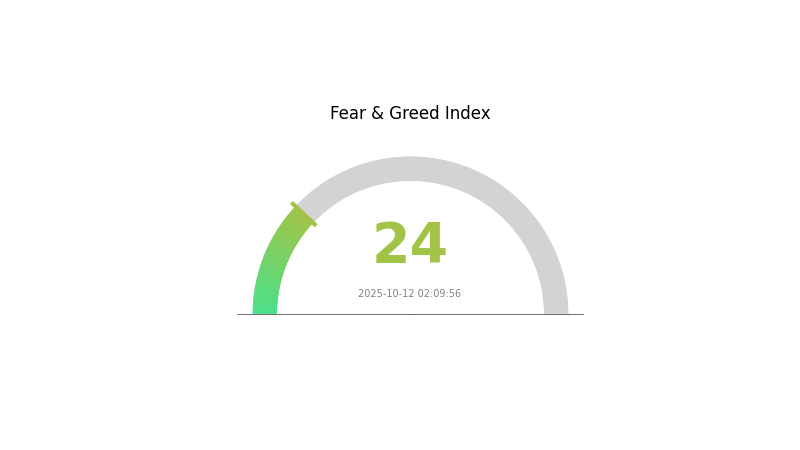

Genel kripto para piyasası hissiyatı şu an “Aşırı Korku” seviyesinde; VIX endeksi 24’te ve bu durum THINK ile diğer kripto varlıklarında düşüş eğilimini destekleyebilir.

Güncel THINK piyasa fiyatını görmek için tıklayın

THINK Piyasa Duyarlılık Göstergesi

12 Ekim 2025 Korku ve Açgözlülük Endeksi: 24 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksini incelemek için tıklayın

Bugün kripto piyasasında aşırı korku hakim; Korku ve Açgözlülük Endeksi 24 ile oldukça düşük seviyede. Bu kadar karamsar bir ortam, karşıt görüşlü yatırımcılar için potansiyel alım fırsatı anlamına gelebilir. Ancak temkinli olmak ve kapsamlı araştırma yapmak gereklidir. Piyasa duyarlılığının hızla değişebileceğini unutmayın. Bilgili hareket edin, portföyünüzü çeşitlendirin ve Gate.com’un gelişmiş işlem araçlarını kullanarak bu belirsiz ortamda yol alın.

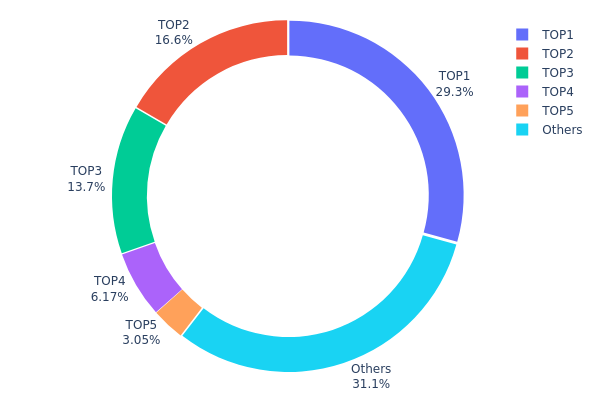

THINK Varlık Dağılımı

THINK’in adres bazlı varlık dağılımı, tokenlerin büyük bölümünün az sayıda adreste yoğunlaştığını ortaya koyuyor. En büyük adres toplam arzın %29,33’üne sahipken, ilk beş adres THINK’in %68,88’ini kontrol ediyor. Bu yoğunlaşma, piyasa manipülasyonu ve volatilite risklerini artırıyor.

Böylesine merkezi bir dağılım yapısı, THINK’in piyasa dinamiklerinde ciddi etkiler yaratabilir. Büyük adreslerin önemli miktarda tokeni satması veya aktarması durumunda fiyat oynaklığı artabilir. Aynı zamanda, yoğunlaşma projenin yönetişim süreçlerini de etkileyebilir.

Tokenlerin %31,12’si diğer adresler arasında dağılmış olsa da, mevcut dağılım THINK’te merkeziyetsizliğin görece düşük olduğunu gösteriyor. Bu durum, tokenin piyasa şoklarına karşı direncini ve zincir üzerindeki istikrarını olumsuz etkileyebilir. Yatırımcılar ve paydaşlar, büyük adreslerdeki önemli değişimleri yakından izlemeli; çünkü bu değişiklikler, tokenin piyasa davranışında ve uzun vadeli görünümünde önemli rol oynayabilir.

Güncel THINK Varlık Dağılımı için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x43c3...290343 | 293.351,25K | 29,33% |

| 2 | 0xd4a9...d2b8a2 | 166.161,11K | 16,61% |

| 3 | 0x0807...87d101 | 137.376,93K | 13,73% |

| 4 | 0xc202...799986 | 61.705,71K | 6,17% |

| 5 | 0x1ab4...8f8f23 | 30.454,42K | 3,04% |

| - | Diğerleri | 310.950,58K | 31,12% |

II. THINK’in Gelecekteki Fiyatını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Tarihsel desenler: Geçmiş arz değişimleri fiyat trendlerine yön verdi

- Güncel etkiler: Mevcut arz değişikliklerinin öngörülen etkileri

Kurumsal ve Whale Dinamikleri

- Ulusal politikalar: Ulusal düzeydeki ilgili düzenlemeler

Makroekonomik Ortam

- Parasal politika etkisi: Ana merkez bankalarının politikalarına dair beklentiler

- Jeopolitik faktörler: Küresel gelişmelerin piyasaya etkisi

Teknolojik Gelişim ve Ekosistem Oluşumu

- Ekosistem uygulamaları: Öne çıkan DApp’ler ve ekosistem projeleri

III. 2025-2030 Dönemi için THINK Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,00381 $ - 0,00605 $

- Tarafsız tahmin: 0,00605 $

- İyimser tahmin: 0,00641 $ (olumlu piyasa hissiyatı gerektirir)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,00451 $ - 0,00761 $

- 2028: 0,00459 $ - 0,00767 $

- Kilit katalizörler: Benimsenme artışı, teknolojik ilerlemeler

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00916 $ (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 0,00971 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,01091 $ (istisnai piyasa koşullarıyla)

- 31 Aralık 2030: THINK 0,00916 $ (2025’e göre %51 yükseliş)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00641 | 0,00605 | 0,00381 | 0 |

| 2026 | 0,00723 | 0,00623 | 0,00567 | 3 |

| 2027 | 0,00761 | 0,00673 | 0,00451 | 11 |

| 2028 | 0,00767 | 0,00717 | 0,00459 | 18 |

| 2029 | 0,01091 | 0,00742 | 0,00438 | 22 |

| 2030 | 0,00971 | 0,00916 | 0,00541 | 51 |

IV. THINK için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

THINK Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profiller: Uzun vadeli yatırımcılar ve yapay zeka teknolojisi meraklıları

- Operasyonel öneriler:

- Fiyat düşüşlerinde THINK token biriktirin

- Proje gelişmelerini ve yapay zeka sektörü trendlerini takip edin

- Token’ları özel anahtar kontrolüne sahip güvenli bir cüzdanda saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri izleyin

- RSI (Göreceli Güç Endeksi): Aşırı alım/satım koşullarını belirleyin

- Dalgalı işlemde kritik noktalar:

- Teknik göstergelere göre açık giriş ve çıkış noktaları oluşturun

- Yapay zeka sektörü haberlerini fiyat katalizörleri açısından izleyin

THINK Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Saldırgan yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı farklı yapay zeka ve blok zinciri projelerine dağıtın

- Zarar-durdur emirleri: Potansiyel kayıpları sınırlayın

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı önerisi: Gate Web3 Wallet

- Yazılım cüzdanı seçeneği: Çoklu imza ile cüzdan kurulumu

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü şifreler ve düzenli yazılım güncellemeleri

V. THINK için Olası Riskler ve Zorluklar

THINK Piyasa Riskleri

- Yüksek volatilite: Yapay zeka token piyasasında ani fiyat dalgalanmaları

- Rekabet: Yeni yapay zeka projeleri THINK’in pazar payını azaltabilir

- Benimsenme belirsizliği: AI ajanlarının yaygın uygulamasında zorluklar

THINK Düzenleyici Riskler

- AI düzenlemeleri: Değişen yasal çerçeveler THINK’in faaliyetlerini etkileyebilir

- Token sınıflandırması: THINK’in menkul kıymet olarak değerlendirilme riski

- Uluslararası uyum: Farklı ülkelerde AI ve kripto regülasyonları

THINK Teknik Riskler

- Akıllı sözleşme açıkları: Kodda olası istismar ve hatalar

- Ölçeklenebilirlik sorunları: Kullanıcı artışıyla ağda tıkanıklık

- Uyumluluk sorunları: Farklı AI araçları ve protokollerle entegrasyon zorlukları

VI. Sonuç ve Eylem Önerileri

THINK Yatırım Değeri Analizi

THINK, yükselen yapay zeka-blok zinciri kesişiminde yüksek riskli ancak yüksek potansiyelli bir fırsat sunmaktadır. Uzun vadeli değer, birlikte çalışabilir AI ajan vizyonunda; kısa vadeli riskler ise piyasa oynaklığı ve düzenleyici belirsizliklerde yatmaktadır.

THINK Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Kapsamlı araştırmadan sonra küçük ve uzun vadeli pozisyonlar almayı değerlendirin

✅ Tecrübeli yatırımcılar: Sıkı risk yönetimiyle birlikte ortalama maliyetle alım stratejisi uygulayın

✅ Kurumsal yatırımcılar: Stratejik ortaklıkları keşfedin ve derinlemesine inceleme yapın

THINK İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden doğrudan token alımı

- Staking: Sunuluyorsa getiri fırsatlarını değerlendirin

- AI ajan geliştirme: THINK protokolü üzerinde ekosisteme katkı sağlayın

Kripto para yatırımları çok yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar kararlarını kendi risk profillerine göre dikkatli şekilde vermeli ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alamayacağınız bir tutardan fazla yatırım yapmayın.

Sıkça Sorulan Sorular

2030’da NVDA için fiyat tahmini nedir?

2030 yılında, NVDA’nın fiyatı yükseliş senaryosunda 491 $, temel senaryoda 241 $ ve düşüş senaryosunda 38 $ olarak öngörülmektedir; bu durum AI başarısına bağlıdır.

Yapay zeka kripto fiyatlarını tahmin edebilir mi?

Yapay zeka, gelişmiş algoritmalar ve veri analiziyle kripto fiyatlarını tahmin edebilir; ancak bu tahminlerin doğruluğu garanti değildir. Genellikle insan uzmanlığıyla birlikte daha iyi sonuçlar için kullanılır.

En yüksek fiyat tahminine sahip kripto para hangisidir?

Bitcoin, 139.249 $’a ulaşan tahminlerle en yüksek fiyat öngörüsüne sahiptir. Chainlink ise 59,67 $ ile onu izlemektedir.

2025’te Cann hisseleri için fiyat tahmini nedir?

Piyasa analizine göre, Cann hisselerinin 2025 yılında ortalama 0,0749 $’a ulaşması; en yüksek 0,1313 $ ve en düşük 0,0185 $ seviyelerinde olması beklenmektedir.

2025 AI16Z Fiyat Tahmini: Devrim Yaratan Yapay Zekâ Teknolojisinin Piyasa Trendlerinin ve Gelecek Değerinin Analizi

2025 AITECH Fiyat Tahmini: Makine öğrenimi modelleri, teknoloji sektöründe piyasa eğilimlerini ve yatırım fırsatlarını öngörüyor

2025 OGPU Fiyat Tahmini: Grafik İşlemcilerin Geleceğini Belirleyen Piyasa Trendleri ve Teknolojik Gelişmeler

2025 PALM Fiyat Tahmini: Palm Yağı Sektöründe Piyasa Eğilimleri, Sürdürülebilirlik Etkileri ve Büyüme Potansiyelinin Değerlendirilmesi

2025 AWE Fiyat Tahmini: Piyasa Eğilimleri ve Gelecek Değeri Etkileyen Unsurların Analizi

2025 GPUAI Fiyat Tahmini: Pazar Trendleri ve Teknolojik Gelişmeler, Yapay Zekâ Donanım Maliyetlerinin Geleceğini Belirliyor

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak