2025 TET Fiyat Tahmini: Piyasa Analizi ve Token Ekonomisi Trendlerine Yönelik Gelecek Projeksiyonları

Giriş: TET'in Piyasadaki Konumu ve Yatırım Potansiyeli

Tectum (TET), Bitcoin ve diğer kripto paralar için Katman 2 çözümü olarak piyasaya girişinden bu yana kayda değer ilerlemeler kaydetti. 2025 yılı itibarıyla Tectum'un piyasa değeri $10.892.990 seviyesine ulaşırken, dolaşımdaki yaklaşık 9.894.622 token ile fiyatı $1,1009 civarında seyrediyor. "Nihai Bitcoin/Kripto Katman 2 çözümü" olarak görülen bu varlık, blokzincir işlem hızlarını ve ölçeklenebilirliği iyileştirmede giderek daha önemli bir rol üstleniyor.

Bu makalede, 2025-2030 dönemi için Tectum'un fiyat hareketleri; geçmiş eğilimler, arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı şekilde incelenecek, yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. TET Fiyat Geçmişi ve Güncel Piyasa Durumu

TET Tarihsel Fiyat Gelişim Grafiği

- 2023: TET piyasaya sunuldu, ilk fiyat yaklaşık $7,178

- 2024: 14 Mart'ta tarihi zirve olan $39,79'a ulaştı

- 2025: Büyük düşüşle, 4 Temmuz'da tarihi dip olan $0,3434'e geriledi

TET Güncel Piyasa Görünümü

8 Ekim 2025 tarihi itibarıyla, TET $1,1009 seviyesinden işlem görüyor ve 24 saatlik işlem hacmi $90.093,34. Son 24 saatte token %2,31 oranında değer kaybetti. Piyasa değeri şu anda $10.892.990,10 olup, kripto para piyasasında 1.370. sırada yer alıyor. Dolaşımdaki miktar 9.894.622,67 TET – bu rakam toplam arzın %98,95'ine (10.000.000 TET) karşılık geliyor. Son 24 saate göre düşüş yaşansa da, TET son bir hafta ve ayda sırasıyla %50,44 ve %42,78 yükselerek güçlü bir performans sergiledi. Fakat token bir yıl öncesine kıyasla %90,25 değer kaybetmiş durumda.

Güncel TET piyasa fiyatını görüntülemek için tıklayın

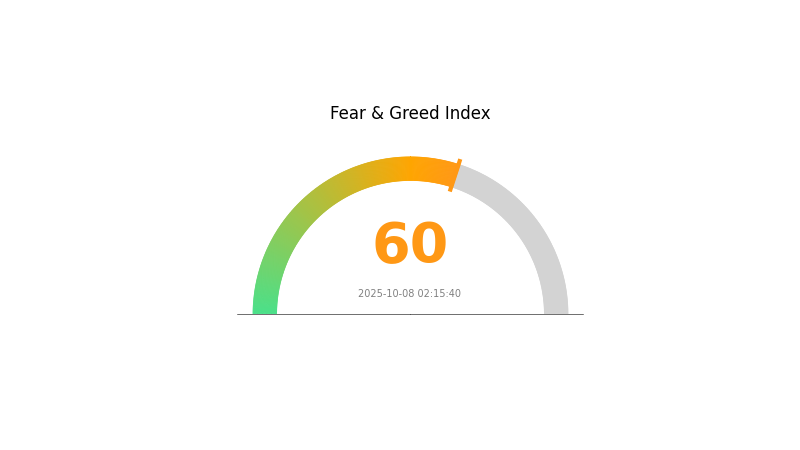

TET Piyasa Duyarlılık Göstergesi

08 Ekim 2025 Korku ve Açgözlülük Endeksi: 60 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında açgözlülük hakim; Korku ve Açgözlülük Endeksi 60'a ulaştı. Bu, yatırımcıların olumlu piyasa trendleri veya iyi haberlerle artan iyimserliğine işaret ediyor. Ancak aşırı açgözlülük fiyatların fazla şişmesine ve oynaklığın artmasına yol açabilir. Yatırımcılar portföylerini çeşitlendirmeli ve uygun zarar-durdur seviyeleri belirlemeli. Her zaman olduğu gibi, detaylı araştırma ve sağlam risk yönetimi kripto piyasasında başarı için gereklidir.

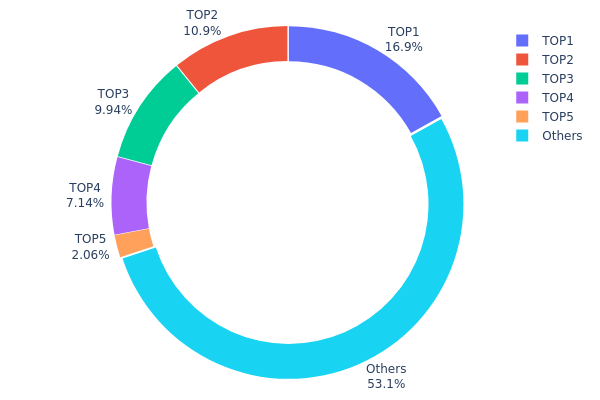

TET Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, TET tokenlarının önemli bir kısmının birkaç üst adreste toplandığını gösteriyor. En büyük sahip toplam arzın %16,90'ına sahipken, ilk 5 adres tüm TET tokenlarının %46,91'ini kontrol ediyor. Bu oran, merkeziyete yakın bir sahiplik yapısına işaret ediyor.

Böyle bir yoğunlaşma, piyasa dinamiklerinde belirleyici olabilir. "Balina" olarak bilinen büyük sahipler, ticaretleriyle fiyat hareketlerini ciddi anlamda etkileyebilir. Yoğunlaşmış dağılım, üst sahiplerin koordineli işlemleriyle token fiyatı ve likiditesinin manipüle edilebileceği riskini artırır.

Yine de, TET tokenlarının %53,09'u diğer adresler arasında dağılmış durumda. Bu dağılım, bir ölçüde merkeziyetsizlik sağlayarak aşırı yoğunlaşmanın risklerini azaltabilir. Ancak genel yapı, dalgalanma potansiyeli ve büyük paydaşların TET piyasa davranışı üzerindeki etkisine karşı dikkatli piyasa değerlendirmesini gerekli kılıyor.

Güncel TET Varlık Dağılımını görüntülemek için tıklayın

| Üst | Adres | Sahip Adedi | Sahiplik (%) |

|---|---|---|---|

| 1 | 0x8f6b...2a672d | 1.690,82K | 16,90% |

| 2 | 0x9642...2f5d4e | 1.087,48K | 10,87% |

| 3 | 0x3cc9...aecf18 | 994,15K | 9,94% |

| 4 | 0xefdf...b18b24 | 714,49K | 7,14% |

| 5 | 0x0d07...b492fe | 206,50K | 2,06% |

| - | Diğerleri | 5.306,56K | 53,09% |

II. Gelecekteki TET Fiyatlarını Etkileyecek Temel Unsurlar

Arz Mekanizması

- Piyasa Dengesi: Arz ve talep dengesi, TET fiyatında temel belirleyicidir.

- Geçmiş Desen: Önceki arz değişimleri, fiyat dalgalanmalarını tetiklemiştir.

- Mevcut Etki: Yaklaşan arz değişikliklerinin fiyat artışını desteklemesi beklenmektedir.

Kurumsal ve Balina Hareketleri

- Kurumsal Varlıklar: Büyük kurumsal sahipler fiyat hareketlerinde doğrudan rol oynar.

- Kurumsal Benimseme: Bilinen şirketlerin TET'i benimsemesi, değer üzerinde etkili olabilir.

Makroekonomik Koşullar

- Para Politikası Etkisi: Merkez bankası kararları TET fiyatlarını etkileyebilir.

- Enflasyona Karşı Koruma: Enflasyonist ortamlarda TET'in performansı önemli bir faktördür.

- Jeopolitik Unsurlar: Uluslararası gelişmeler TET fiyatlarında oynaklığa yol açabilir.

Teknoloji ve Ekosistem Gelişimi

- Otomotiv Talebi: Otomotiv sektöründeki değişim TET fiyatını etkiler.

- Mücevher Talebi: Mücevher piyasasındaki dalgalanmalar TET'e yansır.

- Ekosistem Uygulamaları: Ana DApp ve projelerin gelişimi, benimsenme ve fiyat üzerinde doğrudan etkilidir.

III. 2025-2030 TET Fiyat Tahminleri

2025 Öngörüleri

- Temkinli tahmin: $0,68522 - $1,00

- Tarafsız tahmin: $1,00 - $1,1052

- İyimser tahmin: $1,1052 - $1,18256 (güçlü piyasa duyarlılığı ve yaygın benimseme gerektirir)

2027-2028 Öngörüleri

- Piyasa fazı: Dalgalanmaların arttığı potansiyel büyüme dönemi

- Fiyat tahmini:

- 2027: $0,81662 - $1,82701

- 2028: $1,10783 - $2,34411

- Kilit etkenler: Teknolojik yenilik, yaygın benimseme ve olası düzenleyici açıklık

2029-2030 Uzun Vadeli Öngörüler

- Temel senaryo: $1,97483 - $2,08345 (istikrarlı büyüme ve yaygın benimsemeyle)

- İyimser senaryo: $2,19206 - $2,66681 (hızlı benimseme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: $2,66681+ (çığır açan kullanım durumları ve ana akım entegrasyon ile)

- 2030-31 Aralık: TET $2,08345 (büyümeden sonra olası istikrar noktası)

| Yıl | Öngörülen En Yüksek Fiyat | Öngörülen Ortalama Fiyat | Öngörülen En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 1,18256 | 1,1052 | 0,68522 | 0 |

| 2026 | 1,62431 | 1,14388 | 0,89223 | 3 |

| 2027 | 1,82701 | 1,3841 | 0,81662 | 25 |

| 2028 | 2,34411 | 1,60555 | 1,10783 | 45 |

| 2029 | 2,19206 | 1,97483 | 1,52062 | 79 |

| 2030 | 2,66681 | 2,08345 | 1,52092 | 89 |

IV. Profesyonel TET Yatırım Stratejileri ve Risk Yönetimi

TET Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Kime uygun: Uzun vadeli perspektife ve yüksek risk toleransına sahip yatırımcılar

- Uygulama önerileri:

- Piyasa geri çekilmelerinde TET biriktirin

- Kısmi kar almak için fiyat hedefleri oluşturun

- Tokenleri donanım cüzdanında güvenle saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüş noktalarını belirlemek için kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım veya aşırı satım durumlarını izleyin

- Dalgalı alım-satımda dikkat edilmesi gereken noktalar:

- Fiyat hareketlerinin teyidi için işlem hacmini takip edin

- Aşağı yönlü riski sınırlamak için zarar-durdur emirlerini kullanın

TET Risk Yönetimi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü oranında

- Agresif yatırımcılar: Kripto portföyünün %5-10'u arası

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Farklı kripto paralar arasında yatırım dağılımı

- Zarar-durdur emirleri: Olası kayıpları sınırlandırmak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdanı

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanı kullanımı

- Güvenlik önlemleri: İki aşamalı doğrulama ve güçlü şifreler tercih edin

V. TET İçin Riskler ve Zorluklar

TET Piyasa Riskleri

- Yüksek oynaklık: TET fiyatı keskin dalgalanmalara açık

- Düşük likidite: Büyük işlemlerin gerçekleştirilmesinde zorluklar yaşanabilir

- Piyasa hissiyatı: Genel kripto piyasasındaki eğilimlere duyarlı

TET Düzenleme Riskleri

- Belirsiz yasal ortam: TET'i etkileyebilecek yeni düzenleme olasılığı

- Sınır ötesi işlemler: Farklı ülkelerde değişen hukuki statüler

- Vergisel etkiler: Kripto işlemlerine dair değişen vergi mevzuatı

TET Teknik Riskleri

- Akıllı kontrat açıkları: Güvenlik açıkları veya hatalara karşı risk

- Ağ ölçeklenebilirliği: Artan işlem hacmini yönetmede zorluklar

- Teknolojik geri kalma: Yeni blokzincir çözümlerinin gerisinde kalma riski

VI. Sonuç ve Eylem Önerileri

TET Yatırım Değeri Analizi

TET, Bitcoin için Katman 2 ölçeklenme çözümü olarak potansiyel sunmaktadır; ancak güçlü rekabet ve piyasa riskleriyle karşı karşıyadır. Uzun vadeli değer önerisi benimseme ve teknolojik ilerleme ile bağlantılıyken, kısa vadede yüksek oynaklık ve düzenleyici belirsizlikler risk oluşturmaktadır.

TET Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük, deneme amaçlı pozisyonlarla piyasaya giriş yapın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle maliyet ortalaması stratejisini uygulayın ✅ Kurumsal yatırımcılar: Kapsamlı inceleme ile çeşitlendirilmiş portföylerde TET'i değerlendirin

TET Katılım Yöntemleri

- Spot işlem: Gate.com üzerinden TET alım-satımı ve tutma

- Staking: Uygun programlar varsa staking ile getiri elde etme

- DeFi entegrasyonu: TET içeren merkeziyetsiz finans fırsatlarını değerlendirme

Kripto para yatırımlarında risk son derece yüksektir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerini gözeterek karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayınız.

SSS

En yüksek fiyat tahmini hangi kripto parada?

Bitcoin (BTC), 2025 yılında en yüksek fiyat tahminiyle öne çıkıyor. Yatırımcılar için hâlâ ilk tercih. Sürekli yükseliş trendi bu öngörüyü destekliyor.

TET token nedir?

TET, Bitcoin ölçeklenmesine odaklı Tectum blokzincir projesinin yerel tokenıdır. Tectum ağında işlemler ve yönetişim için kullanılır.

2030'da Qtum için öngörü nedir?

İstatistiksel modellere göre Qtum, 2030 yılının ortasında yaklaşık $1,75'e ve yıl sonunda $1,87'ye ulaşabilir.

2030 için ETH'nin gerçekçi fiyat tahmini nedir?

ETH için 2030 yılında gerçekçi fiyat tahmini, akıllı kontratlarda %70 pazar payı öngörüsüyle yaklaşık $11.800 olarak belirlenmektedir.

Bitcoin'in 1 Milyon Doları Bulma Olasılığı

Kanada Bitcoin Fiyatı: Temmuz 2025 CAD Döviz Kuru ve Trendler

Kripto Çöküşü mü Yoksa Sadece Düzeltme mi?

İrlanda Bankalarının ve Avrupa Kripto Varlıklar Regülasyonunun Geleceği

Siyah Kuğu Etkinliği nedir?

BTC'yi PKR'ye: 2025 Yılı İçin Pakistanlı Yatırımcılar İçin Gerçek Zamanlı Dönüşüm Oranları

Cysic: AI ve Dağıtık Hesaplama için Sıfır Bilgi Altyapı Platformu

ABD Bankacılık Düzenleyicisi OCC, ulusal bankaların kripto para ticareti yapmasını kolaylaştırıyor

ASTER Spot İşlem Rehberi: Anlık Fiyat Analizi ve İşlem Hacmi Bilgileri

Cantor Equity ile birleşmenin ardından Twenty One Capital Bitcoin hissesi yüzde 25 değer kaybetti

Dropee Günlük Kombinasyonu 10 Aralık 2025