2025 SUSD Price Prediction: Will the Stablecoin Maintain Its Dollar Peg Amid Evolving Crypto Regulations?

Introduction: SUSD's Market Position and Investment Value

sUSD (SUSD), as a stablecoin in the cryptocurrency market, has played an increasingly important role since its inception. As of 2025, sUSD's market capitalization has reached $47,209,765, with a circulating supply of approximately 48,276,680 tokens, and its price maintaining around $0.9779. This asset, known as a "synthetic USD stablecoin," is playing an increasingly crucial role in decentralized finance (DeFi) applications and synthetic asset trading.

This article will comprehensively analyze sUSD's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. SUSD Price History Review and Current Market Status

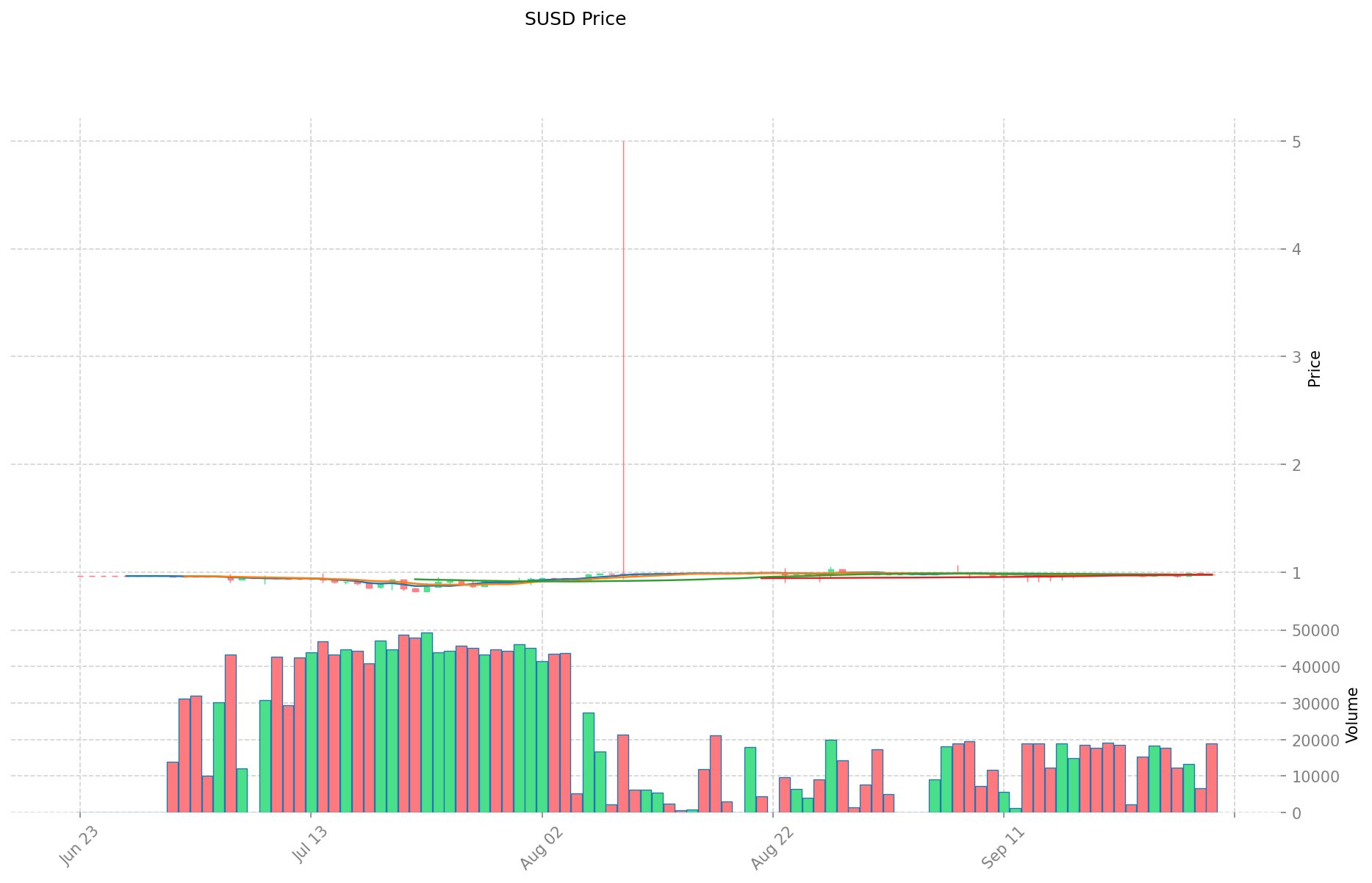

SUSD Historical Price Evolution

- 2020: All-time high of $2.45 reached on February 18, marking a significant milestone

- 2020: Market crash on March 18, price plummeted to all-time low of $0.429697

- 2025: Steady recovery and stabilization, price fluctuating around $0.98

SUSD Current Market Situation

As of September 30, 2025, SUSD is trading at $0.9779, with a 24-hour trading volume of $18,070.16. The token has shown minimal volatility in the past 24 hours, with a slight decrease of 0.04%. SUSD's market capitalization stands at $47,209,765, ranking it 709th in the overall cryptocurrency market.

The token has demonstrated resilience over the past year, with a 4.22% price increase. However, short-term performance shows mixed results, with a 1.60% gain over the past week but a 0.12% decline over the last 30 days. The current price is significantly lower than its all-time high of $2.45, but well above its all-time low of $0.429697.

SUSD's circulating supply of 48,276,680.23772181 tokens matches its total and maximum supply, indicating full circulation. With a market dominance of 0.0011%, SUSD remains a niche player in the stablecoin market.

Click to view the current SUSD market price

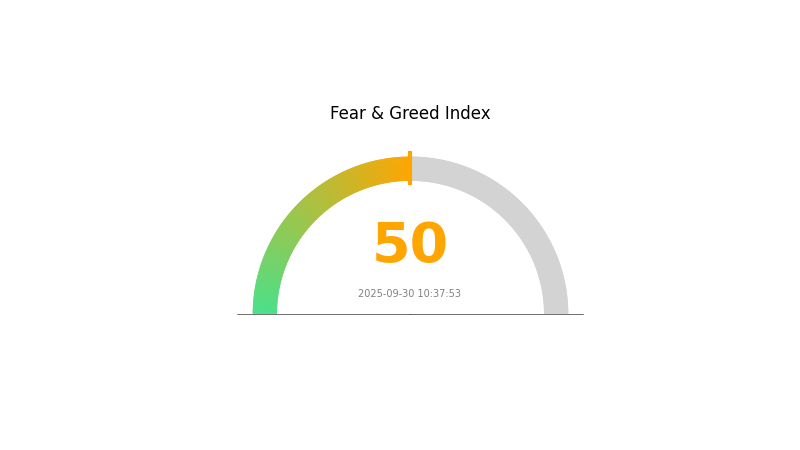

SUSD Market Sentiment Indicator

2025-09-30 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index standing at 50, indicating a neutral position. This suggests that investors are neither overly fearful nor excessively greedy. Such equilibrium often presents opportunities for thoughtful trading decisions. Traders should stay vigilant, as neutral markets can shift quickly. It's advisable to conduct thorough research and consider diverse market factors before making any investment choices in this stable yet potentially volatile environment.

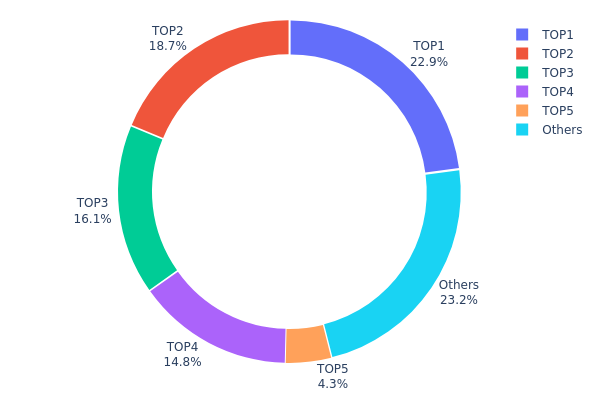

SUSD Holdings Distribution

The address holdings distribution data for SUSD reveals a significant concentration of tokens among a few top addresses. The top 5 addresses collectively hold 76.81% of the total SUSD supply, with the largest holder controlling 22.91%. This high concentration suggests a relatively centralized ownership structure, which could have implications for market dynamics and price stability.

Such a concentrated distribution raises concerns about potential market manipulation and volatility. The top holders have substantial influence over the token's supply, potentially impacting liquidity and price movements. This concentration also indicates a lower degree of decentralization in SUSD's ecosystem, which may affect its resilience and governance structure.

However, it's worth noting that 23.19% of the supply is distributed among other addresses, indicating some level of wider distribution. This balance between major holders and smaller participants will be crucial to monitor for assessing SUSD's long-term market stability and adoption potential.

Click to view the current SUSD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xfa1d...203e99 | 11063.51K | 22.91% |

| 2 | 0xd252...964126 | 9044.54K | 18.73% |

| 3 | 0xebac...d0e73d | 7767.50K | 16.08% |

| 4 | 0x4b5e...ceebae | 7147.58K | 14.80% |

| 5 | 0x4209...50f4e0 | 2075.83K | 4.29% |

| - | Others | 11177.71K | 23.19% |

II. Key Factors Influencing SUSD's Future Price

Supply Mechanism

- SIP-420 Proposal: Implementation of a centralized debt pool ("420 Pool") to optimize SNX staking mechanism and capital efficiency.

- Historical Pattern: The transition between old and new mechanisms temporarily disabled SUSD's pegging restoration capability.

- Current Impact: Supply-demand imbalance due to lack of incentives for users to buy SUSD to repay debts.

Institutional and Whale Dynamics

- Institutional Holdings: Synthetix protocol sold 90% of its ETH position and increased SNX holdings to address the depegging issue.

- Corporate Adoption: Synthetix ecosystem developments directly impact SUSD's market performance.

Macroeconomic Environment

- Monetary Policy Impact: Federal interest rate policies indirectly affect SUSD prices through their influence on the broader cryptocurrency market.

- Geopolitical Factors: International situations and conflicts may influence global markets, potentially affecting SUSD's value.

Technological Development and Ecosystem Building

- SIP-420 Implementation: Aimed at improving SNX staking mechanism and capital efficiency, with potential long-term benefits for the Synthetix ecosystem.

- Debt Jubilee Plan: Proposed debt relief program aimed at clearing historical debts and potentially boosting system efficiency.

- Ecosystem Applications: Synthetix's position in the DeFi sector and its competitive edge in synthetic assets directly impact SUSD's utility and demand.

III. SUSD Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.86 - $0.98

- Neutral prediction: $0.98 - $1.00

- Optimistic prediction: $1.00 - $1.03 (requires stable market conditions)

2027 Mid-term Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $0.71 - $1.24

- 2027: $0.61 - $1.33

- Key catalysts: Increased adoption of stablecoins, regulatory clarity

2030 Long-term Outlook

- Base scenario: $1.42 - $1.56 (assuming steady market growth)

- Optimistic scenario: $1.56 - $2.03 (assuming widespread stablecoin adoption)

- Transformative scenario: $2.03+ (extreme favorable conditions in crypto markets)

- 2030-12-31: SUSD $2.03 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.02743 | 0.9785 | 0.86108 | 0 |

| 2026 | 1.24367 | 1.00296 | 0.7121 | 2 |

| 2027 | 1.32552 | 1.12332 | 0.60659 | 14 |

| 2028 | 1.50603 | 1.22442 | 0.82036 | 25 |

| 2029 | 1.76114 | 1.36522 | 1.28331 | 39 |

| 2030 | 2.03214 | 1.56318 | 1.4225 | 59 |

IV. SUSD Professional Investment Strategies and Risk Management

SUSD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable returns

- Operation suggestions:

- Accumulate SUSD during market dips

- Set up regular purchase plans

- Store in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

SUSD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Allocate investments across various stablecoins

- Collateral: Use SUSD as collateral in DeFi protocols

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. SUSD Potential Risks and Challenges

SUSD Market Risks

- Price volatility: Despite being a stablecoin, minor fluctuations may occur

- Liquidity risk: Limited trading pairs may affect ease of conversion

- Market sentiment: Negative news can impact investor confidence

SUSD Regulatory Risks

- Regulatory scrutiny: Increased oversight of stablecoins by financial authorities

- Compliance requirements: Potential new regulations may affect operations

- Cross-border restrictions: Varying regulations in different jurisdictions

SUSD Technical Risks

- Smart contract vulnerabilities: Potential bugs in the underlying code

- Network congestion: High Ethereum gas fees during peak times

- Centralization concerns: Reliance on the Synthetix foundation for stability

VI. Conclusion and Action Recommendations

SUSD Investment Value Assessment

SUSD offers a relatively stable investment option within the volatile crypto market. Its long-term value proposition lies in its potential use as a trading pair and DeFi collateral. However, short-term risks include regulatory uncertainties and market sentiment shifts.

SUSD Investment Recommendations

✅ Beginners: Start with small allocations, focus on understanding the stablecoin ecosystem

✅ Experienced investors: Consider using SUSD for yield farming or liquidity provision

✅ Institutional investors: Explore SUSD as part of a diversified stablecoin portfolio

SUSD Trading Participation Methods

- Spot trading: Buy and sell SUSD on Gate.com

- DeFi integration: Use SUSD in various decentralized finance protocols

- Yield farming: Provide liquidity to SUSD pools for potential returns

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is sUSD a stablecoin?

Yes, sUSD is a stablecoin. It's designed to maintain a stable value and is backed by a reserve asset, ensuring its price remains consistent.

Will hamster token prices increase?

Yes, hamster token prices are expected to increase. Projections suggest a potential rise to $0.094916 by 2030, representing a significant gain from current levels.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction for 2025, with Ethereum following closely. These predictions are based on current market trends and expert analysis.

How much is the sUSD token?

As of 2025-09-30, the sUSD token is priced at $0.987. This stablecoin aims to maintain a value close to $1.

Share

Content