2025 SUSD Fiyat Tahmini: Piyasa Trendleri ile Potansiyel Büyüme Faktörlerinin Analizi

Giriş: SUSD'nin Piyasadaki Konumu ve Yatırım Potansiyeli

sUSD (SUSD), Havven Vakfı tarafından geliştirilen bir stablecoin olarak, piyasaya sürüldüğü günden beri likiditenin artırılmasında giderek daha kritik bir rol üstleniyor. 2025 yılı itibarıyla sUSD'nin piyasa değeri 44.742.724 $ düzeyine ulaşırken, yaklaşık 43.549.469 adet dolaşımdaki token ile fiyatı 1,0274 $ civarında seyrediyor. “Dijital stabil dolar” olarak bilinen bu varlık, kripto para piyasasında fiyat istikrarının korunmasında önemli bir görev üstleniyor.

Bu makalede, sUSD'nin 2025-2030 arasında fiyat hareketleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında detaylı şekilde incelenecek, yatırımcılara uzman fiyat tahminleri ve uygulamaya dönük stratejiler sunulacaktır.

I. SUSD Fiyat Geçmişi ve Güncel Piyasa Durumu

SUSD Fiyatının Tarihsel Seyri

- 2020: 18 Şubat'ta 2,45 $ ile tüm zamanların en yüksek seviyesine ulaşarak önemli bir kilometre taşı kaydedildi

- 2020: Piyasa gerilemesiyle, 18 Mart'ta fiyat 0,429697 $ ile en düşük seviyeye indi

- 2025: Mevcut fiyat 1,0274 $ civarında, stablecoin olarak direnç gösteriyor

SUSD Güncel Piyasa Görünümü

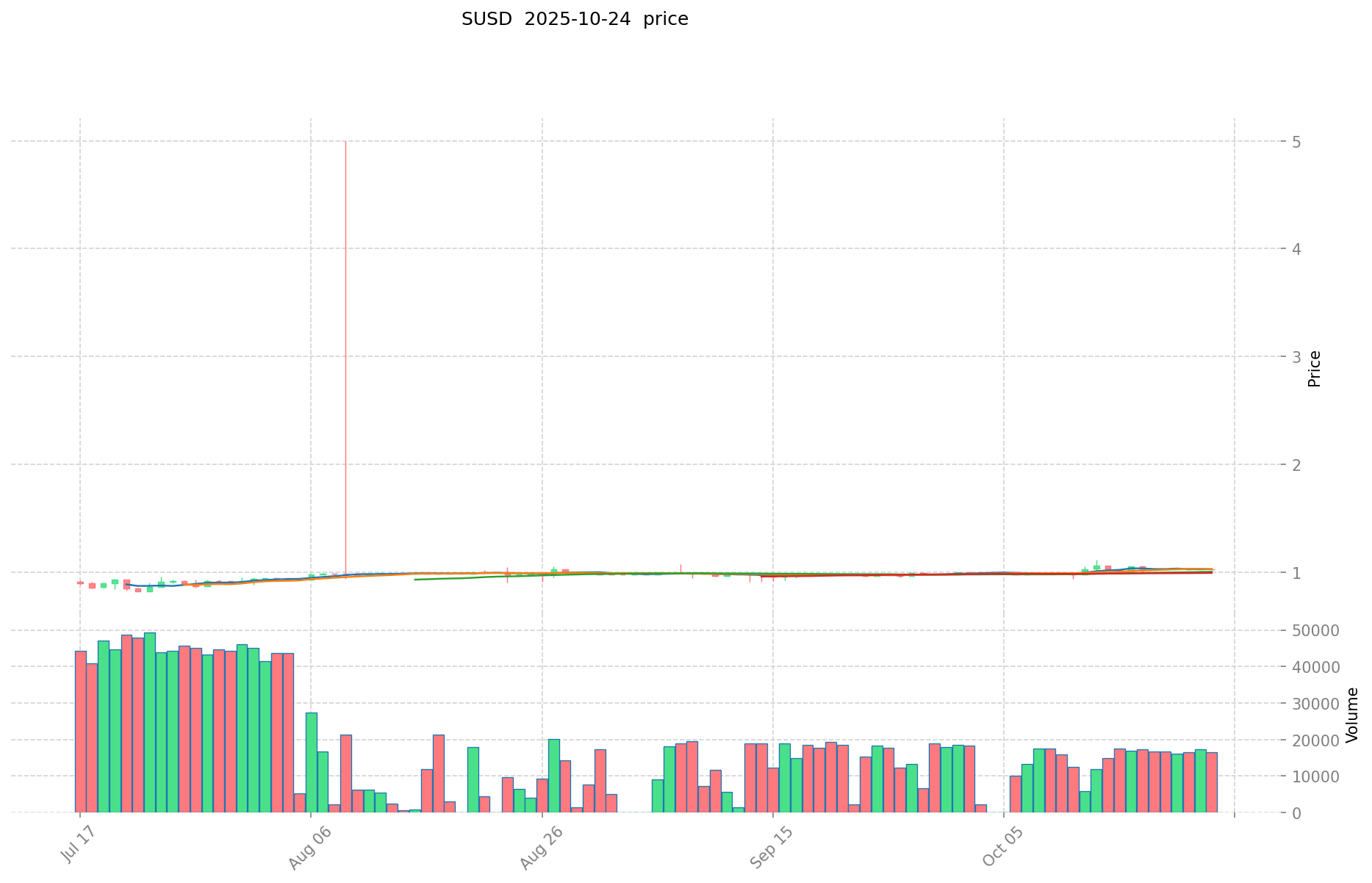

24 Ekim 2025 itibarıyla SUSD, 1,0274 $ seviyesinden işlem görüyor ve 1 $ sabit seviyesine yakın bir istikrar sergiliyor. 24 saatlik işlem hacmi 17.272,59 $ olarak orta düzeyde piyasa aktivitesine işaret ediyor. SUSD’nin piyasa değeri 44.742.724,93 $ ile kripto para piyasasında 669. sırada yer alıyor. Dolaşımdaki miktar, toplam arz ile aynı olup 43.549.469,47 SUSD ile tokenlerin tamamı dolaşımda. Son 24 saatte SUSD fiyatında %0,01’lik düşük oynaklık görülerek stabil karakterini koruduğu gözleniyor. Ancak daha uzun vadede, son bir haftada % -2,54’lük değer kaybı ve son 30 günde %6,67’lik artış ile sabitlenme mekanizmasında dalgalanmalar yaşandığı anlaşılıyor.

Güncel SUSD piyasa fiyatını görmek için tıklayın

SUSD Piyasa Duyarlılığı Endeksi

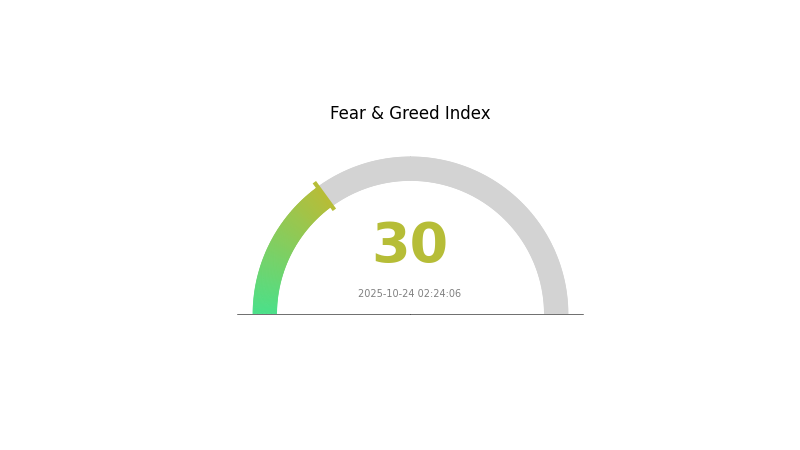

2025-10-24 Korku ve Açgözlülük Endeksi: 30 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto para piyasasında hâlihazırda korku hâkim; Korku ve Açgözlülük Endeksi 30 seviyesinde. Yatırımcılar temkinli davranıyor ve alım fırsatlarına odaklanıyor. Bu dönemlerde dikkatli hareket etmek ve yatırım kararı öncesi detaylı araştırma yapmak hayati önem taşır. Unutmayın, piyasa duyarlılığı ani değişimler gösterebilir; bugün korku olan ortam yarın fırsata dönüşebilir. Bilgi sahibi olun, Gate.com'da akıllıca işlem yapın.

SUSD Varlık Dağılımı

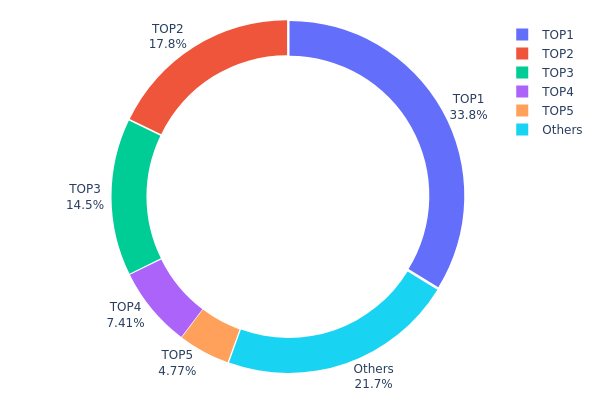

Adres bazlı varlık dağılımı incelendiğinde, SUSD tokenlerinin büyük bölümünün birkaç büyük adreste toplandığı görülüyor. En büyük sahip toplam arzın %33,78’ini elinde tutarken, ilk beş adres tüm tokenlerin %78,23’ünü oluşturuyor. Bu yoğunlaşma, SUSD ekosisteminde merkezileşme riskini gündeme getiriyor.

Böylesi bir dağılım, piyasa dinamiklerinde ve fiyat istikrarında önemli etkiler yaratabilir. Büyük sahiplerin piyasada toplu hareketleri volatilitenin artmasına neden olabilir. Ayrıca, bu yapı piyasa manipülasyonu riskini de artırır; zira büyük sahipler token arz ve talebinde önemli etkiye sahip.

Piyasa yapısı açısından mevcut dağılım, SUSD için düşük merkeziyetsizlik düzeyini gösterir. Büyük sahiplerin uzun vadeli yatırımları bir miktar istikrar sağlasa da, ekosistemin zayıf noktalarını da ortaya koyar. Token dağılımının daha geniş bir adres yelpazesinde yayılması, ekosistemin dayanıklılığını ve piyasa dengesini güçlendirebilir.

Güncel SUSD Varlık Dağılımı için tıklayın

| Sıra | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | 0xfa1d...203e99 | 14.713,89K | 33,78% |

| 2 | 0xebac...d0e73d | 7.767,50K | 17,83% |

| 3 | 0x4b5e...ceebae | 6.293,05K | 14,45% |

| 4 | 0x5572...019dcb | 3.228,00K | 7,41% |

| 5 | 0x4209...50f4e0 | 2.075,83K | 4,76% |

| - | Diğerleri | 9.471,20K | 21,77% |

II. SUSD’nin Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Makroekonomik Faktörler

- Para Politikası Etkisi: Federal Reserve politikaları, SUSD fiyatına doğrudan etki eder. Faiz artışı ABD doları ve SUSD’yi güçlendirirken, indirimler zayıflatır.

- Enflasyon Korumalı Özellikler: USD’ye endeksli bir stablecoin olarak SUSD, enflasyonist ortamlarda ABD dolarıyla paralel hareket eder.

- Jeopolitik Unsurlar: Küresel finansal riskler ve uluslararası gerilimler, yatırımcıları USD ve SUSD gibi güvenli limanlara yönlendirerek değer artışını tetikleyebilir.

Teknik Gelişim ve Ekosistem Genişlemesi

- Ekosistem Kullanım Alanları: SUSD’nin istikrarı ve benimsenmesinde, arkasındaki Synthetix protokolü belirleyicidir. Synthetix ekosisteminin sağlığı, doğrudan SUSD performansına yansır.

III. 2025-2030 Arası SUSD Fiyat Tahmini

2025 Öngörüleri

- Temkinli tahmin: 0,75998 $ - 1,027 $

- Tarafsız tahmin: 1,027 $ - 1,15 $

- İyimser tahmin: 1,15 $ - 1,28375 $ (olumlu piyasa koşullarıyla)

2027-2028 Öngörüleri

- Piyasa beklentisi: Kademeli büyüme ve artan benimsenme

- Fiyat aralığı tahmini:

- 2027: 0,77711 $ - 1,50153 $

- 2028: 1,31067 $ - 1,94487 $

- Başlıca katalizörler: Kullanım alanlarının çoğalması ve iyileşen piyasa duyarlılığı

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 1,6771 $ - 2,07122 $ (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 2,07122 $ - 2,46533 $ (kurumsal benimsenmenin artmasıyla)

- Dönüştürücü senaryo: 2,46533 $ - 2,85828 $ (yaygın ana akım kabulüyle)

- 2030-12-31: SUSD 2,07122 $ (2025’e göre %101 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 1,28375 | 1,027 | 0,75998 | 0 |

| 2026 | 1,47888 | 1,15538 | 0,61235 | 12 |

| 2027 | 1,50153 | 1,31713 | 0,77711 | 28 |

| 2028 | 1,94487 | 1,40933 | 1,31067 | 37 |

| 2029 | 2,46533 | 1,6771 | 1,45908 | 63 |

| 2030 | 2,85828 | 2,07122 | 1,367 | 101 |

IV. SUSD için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

SUSD Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun: İstikrarlı getiri arayan temkinli yatırımcılar

- İşlem önerileri:

- Piyasa geri çekilmelerinde SUSD biriktirin

- Düzenli alım planları oluşturun

- Özel anahtar kontrolüyle güvenli cüzdanlarda saklama yapın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalama: Kısa ve uzun vadeli trendleri izleyin

- RSI: Aşırı alım ve aşırı satım durumlarını tespit edin

- Swing trading için temel noktalar:

- SUSD'nin genel kripto piyasası ile korelasyonunu izleyin

- Zarar durdur emirleri ile risk yönetimini sağlayın

SUSD Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: %1-3

- Orta seviye yatırımcılar: %3-5

- Agresif yatırımcılar: %5-10

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımlarınızı farklı stablecoin’lere dağıtın

- Opsiyon stratejileri: Düşüş riskine karşı put opsiyonu kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 cüzdan

- Soğuk saklama: Yüksek tutarlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama, güçlü şifre kullanımı

V. SUSD için Potansiyel Riskler ve Zorluklar

SUSD Piyasa Riskleri

- Volatilite: Stablecoin olmasına rağmen SUSD kısa vadede fiyat dalgalanması yaşayabilir

- Likidite: Büyük stablecoin’lere göre daha düşük işlem hacmi likiditeyi olumsuz etkileyebilir

- Piyasa duyarlılığı: Synthetix ile ilgili olumsuz gelişmeler SUSD’nin istikrarını bozabilir

SUSD Regülasyon Riskleri

- Stablecoin düzenlemeleri: Yeni regülasyonlar SUSD’nin işleyişini etkileyebilir

- Sınır ötesi kısıtlamalar: Uluslararası regülasyon farkları SUSD’nin küresel kabulünü sınırlayabilir

- Uyum gereklilikleri: Artan KYC/AML uygulamaları kullanıcı erişimini etkileyebilir

SUSD Teknik Riskleri

- Akıllı kontrat açıkları: Temel kod hataları

- Oracle hataları: Yanlış fiyat verileri SUSD’nin istikrar mekanizmasını bozabilir

- Ağ yoğunluğu: Yüksek Ethereum gas maliyetleri SUSD işlemlerini olumsuz etkileyebilir

VI. Sonuç ve Eylem Önerileri

SUSD Yatırım Değeri Analizi

SUSD, Synthetix ekosisteminde merkeziyetsiz bir stablecoin olarak öne çıkıyor. DeFi kullanıcıları için avantajlar sunarken, yatırımcıların majör stablecoin’lere göre daha düşük piyasa değeri ve likidite risklerini dikkate alması gerekir.

SUSD Yatırım Tavsiyeleri

✅ Yeni başlayanlar: SUSD’nin DeFi’deki rolünü anlamak için küçük tutarlarla başlayın

✅ Deneyimli yatırımcılar: Synthetix’te likidite sağlama ve yield farming için SUSD’yi değerlendirin

✅ Kurumsal yatırımcılar: SUSD’yi çeşitlendirilmiş stablecoin portföyünüzde analiz edin

SUSD İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden SUSD alıp satabilirsiniz

- DeFi entegrasyonu: Synthetix protokollerinde SUSD ile stake ve alım-satım yapın

- Yield farming: SUSD havuzlarında likidite fırsatlarını değerlendirin

Kripto para yatırımları son derece yüksek risk barındırır; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kararlarını kendi risk toleranslarına göre vermeli, profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Hamster Kombat Coin 1 $’a ulaşır mı?

Hamster Kombat, 2030 yılına kadar 1 $ seviyesine ulaşma potansiyeline sahip. 2025-10-24 itibarıyla fiyatı 0,0004134 $; tahminler güçlü bir büyüme öngörüyor.

Sandbox 10 $’a ulaşır mı?

Evet, bazı iyimser tahminlere göre The Sandbox (SAND), 2030’a kadar 10 $ seviyesine çıkabilir. Ancak bu öngörü kesin değildir ve spekülatiftir.

SUSD fiyatı nedir?

2025-10-24 tarihi itibarıyla SUSD fiyatı 0,99549392 $ ve son 24 saatte %0,05 artış göstermiştir.

Sui kripto 2025’te ne yapacak?

2025’te Sui kripto, DeFi ve oyun alanındaki artan benimsenme ile güçlü piyasa trendleri ve teknik avantajlarla büyüme bekliyor. Ölçeklenebilirlik ve kullanım alanları temel itici güçlerdir.

2025'te Gate'de GUSD: Gemini Dolarının Avantajları ve Fırsatları

2025 USUAL Fiyat Tahmini: Pazar Dinamikleri ve Pandemi Sonrası Ekonomide Yatırım Fırsatları

GUSD Nasıl Alınır: Gemini Doları için Kapsamlı Bir Rehber

2025 USDP Fiyat Tahmini: Stablecoin’in Olası Büyüme Potansiyeli ve Piyasa Faktörlerinin Analizi

TrueUSD (TUSD) iyi bir yatırım mı?: Kripto piyasasında bu stablecoin’in potansiyeli ve risklerinin analizi

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması