2025 STX Price Prediction: Bullish Outlook as Stacks Ecosystem Expands

Introduction: STX's Market Position and Investment Value

Stacks (STX), as a platform for decentralized applications, has achieved significant milestones since its inception in 2019. As of 2025, Stacks has reached a market capitalization of $826,079,064, with a circulating supply of approximately 1,804,848,294 tokens, and a price hovering around $0.4577. This asset, often referred to as the "Google of blockchain," is playing an increasingly crucial role in the development of a new decentralized internet.

This article will comprehensively analyze Stacks' price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. STX Price History Review and Current Market Status

STX Historical Price Evolution

- 2020: Launch of Stacks 2.0, price fluctuated around $0.20

- 2021: Bull market cycle, price surged to all-time high of $3.86

- 2022-2023: Crypto winter, price declined to around $0.50

STX Current Market Situation

As of October 16, 2025, STX is trading at $0.4577, marking a 3.02% decrease in the last 24 hours. The token's market capitalization stands at $826,079,064, ranking it 106th among all cryptocurrencies. STX has experienced significant volatility, with a 24.56% decrease over the past week and a 29.56% decline in the last month. The current price represents a 74.88% drop from a year ago, reflecting the challenging market conditions in the crypto space. Despite these downward trends, STX has shown a slight uptick of 0.45% in the last hour, indicating some short-term buying activity.

Click to view the current STX market price

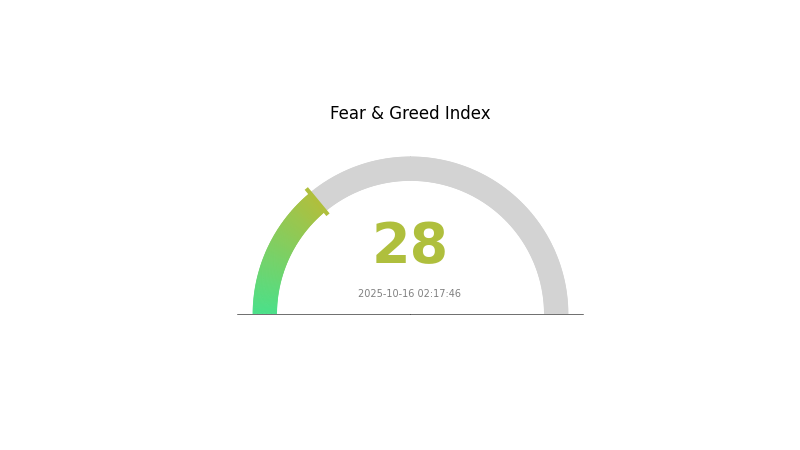

STX Market Sentiment Indicator

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by fear, with the sentiment index at a low 28. This indicates a cautious atmosphere among investors, potentially creating buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. Traders should stay vigilant, conduct thorough research, and consider using risk management tools available on platforms like Gate.com to navigate these uncertain waters.

STX Holdings Distribution

The address holdings distribution data for STX reveals a relatively decentralized ownership structure. Without any specific large holders dominating the distribution, it suggests a more evenly spread allocation of STX tokens across various addresses. This pattern indicates a lower concentration of ownership, which is generally considered positive for the overall health and stability of the token's ecosystem.

The absence of highly concentrated holdings reduces the risk of market manipulation by individual large holders. It also implies that the STX market may be less susceptible to sudden price swings caused by the actions of a few major players. This distributed ownership structure potentially contributes to a more robust and resilient market, as it reduces the impact of any single entity's trading decisions on the token's price and liquidity.

Overall, the current STX address distribution reflects a relatively high degree of decentralization and a balanced on-chain structure. This characteristic aligns well with the principles of distributed ledger technology and may contribute to a more stable and equitable ecosystem for STX token holders.

Click to view the current STX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing STX's Future Price

Supply Mechanism

- Token Deflationary Mechanism: The deflationary nature of STX tokens contributes to potential price appreciation.

- Current Impact: The token's deflationary mechanism is one of the multiple favorable factors driving the recent price increase.

Institutional and Whale Dynamics

- Institutional Holdings: Large-scale inflow of institutional funds has been a significant driver of STX's recent price surge.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, STX may be viewed as a potential hedge against inflation, which could influence its price in the current economic climate.

Technological Development and Ecosystem Building

- On-chain Activity: The significant increase in on-chain activity on the BNB Chain has positively impacted STX's price.

- Ecosystem Applications: The technological innovation and token flywheel effect allow STX to maintain high prices over extended periods.

Note: While the market generally holds a positive long-term outlook for STX, analysts caution investors to remain vigilant. Predictions suggest that if market trends remain favorable, STX could reach a maximum price of $7 by the end of 2025. However, more moderate growth estimates place the price between $2.06 and $2.63.

III. STX Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.33 - $0.40

- Neutral forecast: $0.40 - $0.50

- Optimistic forecast: $0.50 - $0.65 (requires favorable market conditions and strong adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range prediction:

- 2027: $0.38 - $0.64

- 2028: $0.58 - $0.81

- Key catalysts: Technological advancements, ecosystem expansion, and broader crypto market trends

2030 Long-term Outlook

- Base scenario: $0.60 - $0.80 (assuming steady growth and adoption)

- Optimistic scenario: $0.80 - $1.00 (assuming strong ecosystem development and market penetration)

- Transformative scenario: $1.00 - $1.09 (assuming breakthrough applications and mainstream adoption)

- 2030-12-31: STX $1.09 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.65592 | 0.4555 | 0.33252 | 0 |

| 2026 | 0.62795 | 0.55571 | 0.39455 | 21 |

| 2027 | 0.63918 | 0.59183 | 0.38469 | 29 |

| 2028 | 0.81247 | 0.6155 | 0.57857 | 34 |

| 2029 | 0.79252 | 0.71399 | 0.62831 | 55 |

| 2030 | 1.09222 | 0.75325 | 0.39922 | 64 |

IV. STX Professional Investment Strategies and Risk Management

STX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and blockchain technology enthusiasts

- Operational suggestions:

- Accumulate STX during market dips

- Set price targets for partial profit-taking

- Store in secure hardware wallets or reputable custody solutions

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Bitcoin price movements as they often influence STX

- Pay attention to Stacks ecosystem developments and partnerships

STX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-7% of crypto portfolio

- Aggressive investors: 7-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. STX Potential Risks and Challenges

STX Market Risks

- High volatility: STX price can experience significant fluctuations

- Correlation with Bitcoin: STX performance may be influenced by Bitcoin market trends

- Limited liquidity: Potential difficulty in executing large trades without impacting price

STX Regulatory Risks

- Uncertain regulatory environment: Potential for stricter cryptocurrency regulations

- Securities classification: Risk of STX being classified as a security in some jurisdictions

- Tax implications: Evolving tax laws may impact STX investments

STX Technical Risks

- Smart contract vulnerabilities: Potential for exploits in Stacks-based applications

- Scalability challenges: Possible network congestion during high demand periods

- Competition: Emerging blockchain platforms may challenge Stacks' market position

VI. Conclusion and Action Recommendations

STX Investment Value Assessment

STX presents a unique value proposition as a Bitcoin-connected smart contract platform. While it offers long-term potential in decentralized applications and Web3 development, investors should be aware of short-term volatility and regulatory uncertainties.

STX Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a balanced approach with both long-term holdings and active trading ✅ Institutional investors: Conduct thorough due diligence and consider STX as part of a diversified crypto portfolio

STX Trading Participation Methods

- Spot trading: Buy and sell STX on Gate.com

- Staking: Participate in Stacks staking to earn rewards

- DeFi participation: Explore Stacks-based decentralized finance applications

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is STX coin a good investment?

STX shows potential for growth in the Web3 ecosystem. Its unique features and increasing adoption make it an attractive option for investors seeking exposure to blockchain technology.

What is the future of STX coin?

STX coin has a promising future, with its layer-2 solutions for Bitcoin driving adoption. By 2030, it's expected to reach $7, showing significant growth potential.

How high can Stacks go?

Stacks (STX) could potentially reach $4.28, with projections suggesting it may hover in the upper $3 range until Bitcoin surpasses $130k.

Is STX a good buy?

Yes, STX looks like a good buy. With strong growth potential and positive market sentiment, it's expected to see significant price appreciation in the coming years.

Share

Content