2025 STOS Fiyat Tahmini: Dijital Varlık İçin Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: STOS'un Piyasa Konumu ve Yatırım Potansiyeli

Stratos (STOS), blokzincir endüstrisi ve Web 3.0 için yeni nesil merkeziyetsiz veri altyapısı olarak 2021’de piyasaya sürülmesinden bu yana önemli ilerlemeler kaydetti. 2025 yılı itibarıyla Stratos’un piyasa değeri 2.494.989,952 USD’ye ulaştı; yaklaşık 69.036.800 adet dolaşımdaki tokeni bulunuyor ve fiyatı yaklaşık 0,03614 USD seviyesinde. “Web 3.0 Veri Çözümü” olarak tanımlanan bu varlık, merkeziyetsiz depolama ve içerik hızlandırma alanında giderek daha büyük önem kazanıyor.

Bu makalede, Stratos’un 2025-2030 yılları arasındaki fiyat hareketleri, geçmiş trendler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler bir arada değerlendirilerek yatırımcılara profesyonel fiyat tahminleri ve uygulamaya dönük stratejiler sunulacaktır.

I. STOS Fiyat Geçmişi ve Güncel Piyasa Durumu

STOS Fiyatının Tarihsel Gelişimi

- 2021: İlk çıkış, 26 Kasım'da tüm zamanların en yüksek seviyesi olan 5,18 USD’ye ulaştı

- 2022-2024: Ayı piyasası sürecinde kademeli değer kaybı

- 2025: 20 Eylül’de 0,03594088 USD ile tüm zamanların en düşük seviyesine geriledi

STOS Güncel Piyasa Görünümü

15 Ekim 2025 tarihi itibarıyla STOS, 0,03614 USD’den işlem görüyor ve son 24 saatte %24,02’lik bir düşüş yaşadı. Token farklı zaman aralıklarında büyük kayıplar yaşadı; son bir haftada %12,73, son bir ayda %25,99 ve son bir yılda ise %90,7 değer kaybetti. Güncel fiyat, tüm zamanların en yüksek seviyesinden %99,3 düşerek uzun süredir devam eden ayı trendini gösteriyor. Piyasa değeri 2.494.989 USD, tam seyreltilmiş değeri ise 3.614.000 USD ve STOS şu anda kripto para piyasasında 2.213’üncü sırada yer alıyor. Dolaşımdaki arz 69.036.800 STOS ve bu miktar toplam arzın %69,04’üne karşılık geliyor (toplam arz: 100.000.000 token).

Güncel STOS piyasa fiyatını görmek için tıklayın

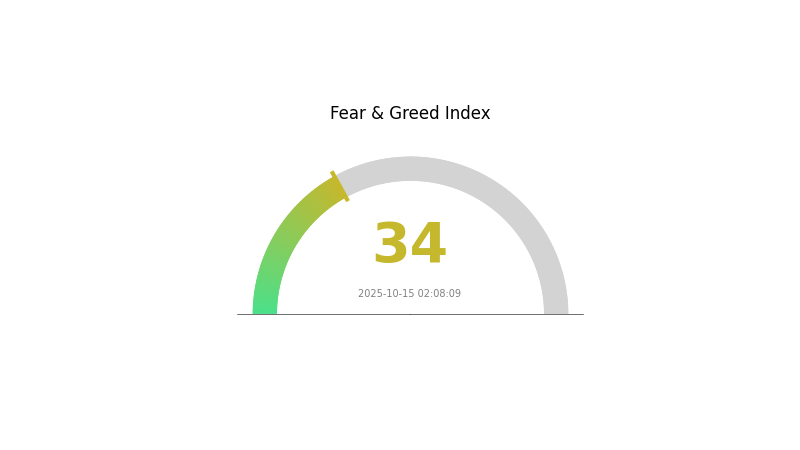

STOS Piyasa Duyarlılık Endeksi

2025-10-15 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto para piyasasında, Korku ve Açgözlülük Endeksi’nin 34 değeriyle yatırımcılar belirgin bir korku dönemi yaşıyor. Bu, piyasanın yönü konusunda temkinli ve belirsiz bir tutum olduğunu gösteriyor. Böyle dönemlerde yatırım kararı almadan önce dikkatli olmak ve detaylı araştırma yapmak gerekir. Piyasa duyarlılığı hızla değişebilir; bugün korkunun hâkim olduğu bir ortam, bilgi sahibi ve hazırlıklı olanlar için fırsat yaratabilir.

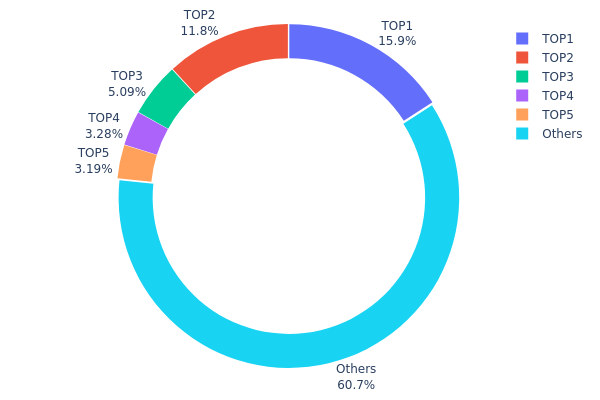

STOS Varlık Dağılımı

STOS adres varlık dağılım grafiği, piyasada orta düzeyde yoğunlaşma olduğunu gösteriyor. En büyük 5 adres, toplam arzın %39,23’ünü elinde bulundururken, en büyük sahip %15,88 paya sahip. Bu yapı, büyük yatırımcıların önemli bir etkiye sahip olduğunu fakat aşırı bir merkezileşme olmadığını gösteriyor.

Dağılım yapısı, büyük sahiplerle birlikte geniş ve çeşitli bir küçük yatırımcı tabanına işaret ediyor. En üstteki adresler yüksek miktara sahip olsa da “Diğerleri” kategorisindeki %60,77’lik oran, katılımın yaygın olduğunu gösteriyor. Bu yapı, tek bir varlığın piyasada aşırı kontrolünü önleyerek istikrarı artırabilir; ancak büyük sahiplerin hareketleri fiyatı yine kısa vadede etkileyebilir.

Genel olarak STOS token dağılımı, orta seviyede merkeziyetsiz bir yapıyı yansıtıyor. Birden fazla büyük sahip ve geniş bir küçük yatırımcı tabanı, zincir üstü sağlıklı bir dağılıma işaret ediyor. Yine de, yatırımcılar en büyük sahiplerin işlemlerinin fiyatı kısa vadede etkileyebileceğinin farkında olmalı.

Güncel STOS Varlık Dağılımını görmek için tıklayın

| En Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x0000...e08a90 | 4.583,43B | 15,88% |

| 2 | 0x7088...fcef8a | 3.410,36B | 11,81% |

| 3 | 0x9642...2f5d4e | 1.470,02B | 5,09% |

| 4 | 0x858d...c334c5 | 945,29B | 3,27% |

| 5 | 0x96f9...c9eff5 | 920,00B | 3,18% |

| - | Diğerleri | 17.530,74B | 60,77% |

II. Gelecekteki STOS Fiyatlarını Belirleyen Temel Faktörler

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Devlet Politikaları: Düzenleyici değişiklikler ve piyasa kabulleri STOS fiyatlarında kritik rol oynar. Kripto paraların merkeziyetsiz ve anonim yapısı nedeniyle dolandırıcılık ve fiyat oynaklığı gibi problemlere karşı ülkeler düzenlemeleri sıkılaştırıyor.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: Kripto varlıklardaki yüksek fiyat dalgalanmalarında, stabilcoin’ler değer saklama alternatifi sunar. Kripto varlıkların değerinin ciddi şekilde düşmesi beklendiğinde, stabilcoin’e dönüşümle değer korunabilir ve piyasa toparlanmasından fayda sağlanabilir.

Teknik Gelişim ve Ekosistem Oluşumu

-

Mainnet Lansmanı: Stratos (STOS) ana ağını 28 Eylül’de başlattı; bu gelişme fiyat ve benimsenme üzerinde etkili olabilir.

-

Ekosistem Uygulamaları: Stratos ekosisteminin ve DApp’lerin gelişimi, STOS fiyatını etkiler. Ekosistemin büyümesi ve ağ kullanımının artması, token değerinde pozitif hareketler yaratabilir.

III. 2025-2030 STOS Fiyat Tahmini

2025 Beklentisi

- Temkinli öngörü: 0,02275 - 0,03000 USD

- Tarafsız öngörü: 0,03000 - 0,03611 USD

- İyimser öngörü: 0,03611 - 0,03828 USD (pozitif piyasa ve proje gelişmeleriyle)

2027-2028 Beklentisi

- Piyasa fazı: Benimsenmenin arttığı büyüme dönemi olasılığı

- Fiyat aralığı tahmini:

- 2027: 0,03593 - 0,05133 USD

- 2028: 0,03435 - 0,06163 USD

- Başlıca tetikleyiciler: Teknolojik yenilikler, kullanım alanı genişlemesi ve genel kripto piyasa toparlanması

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,05434 - 0,06684 USD (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 0,06684 - 0,07934 USD (hızlı benimseme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,07934 - 0,10000 USD (çığır açan yenilik ve genel benimsenmeyle)

- 2030-12-31: STOS 0,07419 USD (muhtemel yıl sonu değeri)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 0,03828 | 0,03611 | 0,02275 | 0 |

| 2026 | 0,04835 | 0,03719 | 0,03459 | 2 |

| 2027 | 0,05133 | 0,04277 | 0,03593 | 18 |

| 2028 | 0,06163 | 0,04705 | 0,03435 | 30 |

| 2029 | 0,07934 | 0,05434 | 0,04076 | 50 |

| 2030 | 0,07419 | 0,06684 | 0,04746 | 85 |

IV. STOS Profesyonel Yatırım Stratejileri ve Risk Yönetimi

STOS Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Değer yatırımcıları, blokzincir teknolojisi meraklıları

- Uygulama önerileri:

- Piyasa düşüşlerinde STOS biriktirin

- Kısmi kâr alımı için fiyat hedefleri belirleyin

- Tokenleri güvenli donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüş noktalarını belirlemek için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım koşullarını tespit etmeye yardımcı olur

- Dalgalı işlem için temel noktalar:

- Trend teyidi için işlem hacmini izleyin

- Zararı durdur emirleriyle aşağı yönlü riski yönetin

STOS Risk Yönetimi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Orta riskli yatırımcılar: Kripto portföyünün %3-5’i

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

(2) Riskten Koruma Yöntemleri

- Çeşitlendirme: Yatırımı birden fazla kripto varlığına yaymak

- Maliyet Ortalaması: Fiyat oynaklığını azaltmak için düzenli küçük alımlar yapmak

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 Wallet

- Yazılım cüzdanı seçeneği: Resmi Stratos cüzdanı (mevcutsa)

- Güvenlik önlemleri: İki faktörlü doğrulama, güçlü parolalar ve özel anahtarların çevrimdışı saklanması

V. STOS’a Yönelik Potansiyel Riskler ve Zorluklar

STOS Piyasa Riskleri

- Yüksek oynaklık: Kripto piyasalarında yaygın olan sert fiyat dalgalanmaları

- Sınırlı likidite: Büyük hacimli işlemlerde likidite sıkıntısı yaşanabilir

- Piyasa duyarlılığı: Kripto piyasasının genel eğilimlerine hassas

STOS Düzenleyici Riskler

- Belirsiz mevzuat: Olumsuz düzenleyici değişiklik olasılığı

- Ülke bazlı kısıtlamalar: Farklı ülkelerde farklı yasal statü

- Uyumluluk gereklilikleri: Artan KYC/AML düzenlemeleri ihtimali

STOS Teknik Riskler

- Akıllı kontrat zafiyetleri: Sömürü veya hata riski

- Ağ ölçeklenebilirliği: Artan işlem hacmine cevap vermede zorluklar

- Rekabet: Yeni teknolojiler Stratos'u geride bırakabilir

VI. Sonuç ve Eylem Tavsiyeleri

STOS Yatırım Potansiyeli Değerlendirmesi

Stratos, merkeziyetsiz veri altyapısında uzun vadeli potansiyel sunarken; kısa vadede fiyat oynaklığı ve piyasa riskleri önemli birer endişe kaynağıdır.

STOS Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasayı öğrenmek için düşük tutarlı ve düzenli yatırımlar yapın

✅ Deneyimli yatırımcılar: Net giriş ve çıkış stratejileriyle dengeli yaklaşım benimseyin

✅ Kurumsal yatırımcılar: Kapsamlı analiz yapın, büyük pozisyonlar için OTC seçeneklerini değerlendirin

STOS İşlem Katılım Yöntemleri

- Spot alım-satım: STOS’u Gate.com spot piyasasında alıp satabilirsiniz

- Staking: Stratos tarafından sunuluyorsa staking programlarına katılın

- DeFi entegrasyonu: Uygun seçenekler piyasaya çıktıkça merkeziyetsiz finans uygulamalarını değerlendirin

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine göre dikkatli karar almalı ve profesyonel finansal danışmanlara danışmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Stratos iyi bir yatırım mı?

Mevcut piyasa analizlerine göre Stratos kısa vadede iyi bir yatırım olarak değerlendirilmiyor. Tahminler zayıf performans öngörüyor. Ancak yatırım kararınızdan önce mutlaka kendi araştırmanızı yapın.

Stacks kripto para biriminin geleceği var mı?

Evet, Stacks (STX) gelecekte potansiyel taşıyor. Analistlere göre fiyatı 2033’te 0,1254 USD’ye kadar çıkabilir ve genel görünüm olumlu. Fiyat dalgalanmalarına rağmen projenin yenilikçi yaklaşımı büyüme beklentisini destekliyor.

Solana 2030’da ne kadar değer kazanabilir?

Mevcut eğilimler dikkate alındığında, Solana 2030’a kadar 500 USD ve üzerinde bir değere ulaşabilir. Düşük işlem ücretleri ve hızlı ağ yapısı, önümüzdeki yıllarda benimsenmeyi ve değer artışını destekleyebilir.

Cosmos 100 USD’ye ulaşabilir mi?

Bunun mümkün olması kısa vadede pek olası değil. Mevcut piyasa döngüsünde Cosmos için daha gerçekçi hedef 20-30 USD aralığı olarak öngörülüyor.

2025 RLC Fiyat Tahmini: RLC Bir Sonraki Boğa Piyasasında 10 Dolar Seviyesine Ulaşacak mı?

2025 PPrice Tahmini: Piyasa Trendlerinin Analizi ve Yatırımcılar İçin Gelecekteki Değerleme Potansiyelleri

2025 SQR Fiyat Tahmini: Piyasa Eğilimleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 LIY Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Etkenlerini Değerlendirmek

2025 CHAPZ Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 TOWN Fiyat Tahmini: Dijital Gayrimenkul Tokeni'nin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması