2025 SMILE Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: SMILE's Market Position and Investment Value

bitSmiley (SMILE), as the first platform on the Bitcoin blockchain to offer native lending and stablecoin fusion, has made significant strides since its inception. As of 2025, SMILE's market capitalization stands at $51,402.4, with a circulating supply of approximately 26,800,000 tokens, and a price hovering around $0.001918. This asset, dubbed the "DeFi innovator on Bitcoin," is playing an increasingly crucial role in revolutionizing decentralized finance.

This article will provide a comprehensive analysis of SMILE's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. SMILE Price History Review and Current Market Status

SMILE Historical Price Evolution

- 2024: Initial launch, price peaked at $0.8 on November 6th

- 2025: Significant market downturn, price dropped to an all-time low of $0.001272 on October 30th

SMILE Current Market Situation

As of November 3, 2025, SMILE is trading at $0.001918, showing a 21.79% increase in the last 24 hours. The token has experienced substantial volatility, with a 24-hour trading volume of $10,936.43. Despite the recent uptick, SMILE has seen a significant decline over the past year, with a -99.57% change. The current market capitalization stands at $51,402.4, ranking 5808th in the cryptocurrency market. The circulating supply is 26,800,000 SMILE, representing 12.76% of the total supply of 210,000,000 tokens.

Click to view the current SMILE market price

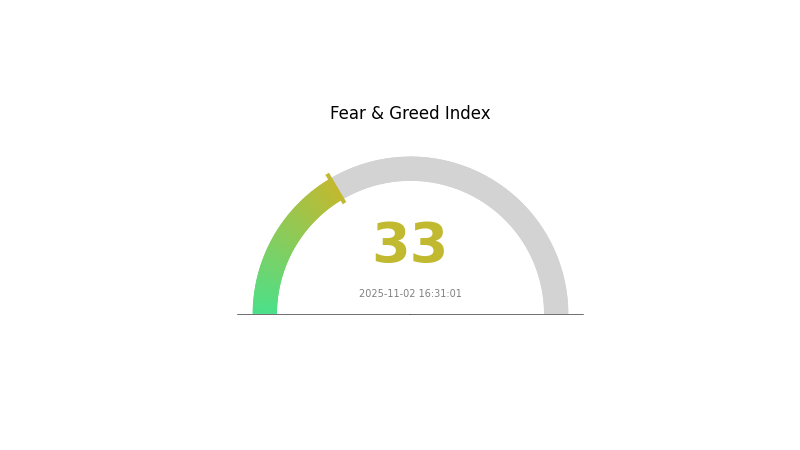

SMILE Market Sentiment Indicator

2025-11-02 Fear and Greed Index: 33 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone, with the Fear and Greed Index at 33. This indicates a cautious atmosphere among investors, potentially signaling undervalued market conditions. Historically, extreme fear has presented buying opportunities for long-term investors. However, it's crucial to conduct thorough research and consider your risk tolerance before making investment decisions. Keep an eye on market trends and key indicators to navigate these uncertain times effectively.

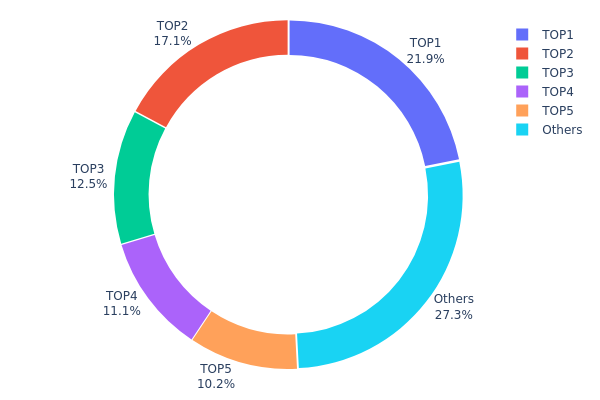

SMILE Holdings Distribution

The address holdings distribution data provides insight into the concentration of SMILE tokens among different wallet addresses. Analysis of this data reveals a relatively high concentration of SMILE tokens among the top holders. The top five addresses collectively control 72.67% of the total supply, with the largest holder possessing 21.86% of all tokens.

This concentration level raises concerns about potential market manipulation and price volatility. With such a significant portion of tokens held by a small number of addresses, large-scale selling or buying activities from these major holders could have substantial impacts on SMILE's market price and liquidity. Furthermore, this distribution pattern suggests a lower degree of decentralization, which may be at odds with the principles of many blockchain projects.

The current holdings distribution reflects a market structure that is susceptible to whale movements and potentially less resistant to coordinated actions by large token holders. While this concentration doesn't necessarily indicate malicious intent, it does highlight the importance of monitoring these major addresses for any significant token movements that could signal upcoming market shifts or project developments.

Click to view the current SMILE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc6e1...1850fd | 45916.49K | 21.86% |

| 2 | 0x4782...0c835a | 35942.07K | 17.11% |

| 3 | 0x4de1...d48269 | 26250.00K | 12.50% |

| 4 | 0x8bd2...62883b | 23213.48K | 11.05% |

| 5 | 0xf89d...5eaa40 | 21331.61K | 10.15% |

| - | Others | 57346.35K | 27.33% |

II. Key Factors Affecting Future SMILE Prices

Supply Mechanism

- Volatility Smile: The implied volatility varies for different strike prices, creating a "smile" shape when plotted.

- Historical Pattern: Higher volatility typically leads to larger price fluctuations and lower risk premiums.

- Current Impact: Increased volatility may result in more significant price movements for SMILE.

Macroeconomic Environment

- Inflation Hedging Properties: As a derivative of options market volatility, SMILE may serve as a potential hedge against economic uncertainties.

- Geopolitical Factors: International tensions and global economic shifts can impact market volatility, indirectly affecting SMILE prices.

Technical Development and Ecosystem Building

- Market Risk Assessment: SMILE reflects the market's perception of future asset price volatility, serving as an indicator of overall market risk.

- Liquidity Considerations: The liquidity of the underlying options market can influence SMILE's pricing and trading dynamics.

III. SMILE Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00183 - $0.00191

- Neutral forecast: $0.00191 - $0.00225

- Optimistic forecast: $0.00225 - $0.00258 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00257 - $0.00393

- 2028: $0.00198 - $0.00366

- Key catalysts: Increased adoption, technological advancements

2030 Long-term Outlook

- Base scenario: $0.00373 - $0.00417 (assuming steady market growth)

- Optimistic scenario: $0.00417 - $0.00450 (assuming strong market performance)

- Transformative scenario: $0.00450 - $0.00500 (assuming breakthrough innovations)

- 2030-12-31: SMILE $0.00417 (potential peak for the year)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00258 | 0.00191 | 0.00183 | 0 |

| 2026 | 0.0031 | 0.00225 | 0.00162 | 17 |

| 2027 | 0.00393 | 0.00267 | 0.00257 | 39 |

| 2028 | 0.00366 | 0.0033 | 0.00198 | 72 |

| 2029 | 0.00397 | 0.00348 | 0.00247 | 81 |

| 2030 | 0.00417 | 0.00373 | 0.0019 | 94 |

IV. Professional Investment Strategies and Risk Management for SMILE

SMILE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate SMILE tokens during market dips

- Set price targets and stick to the investment plan

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to limit potential losses

SMILE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet solution: Use reputable mobile or desktop wallets with strong security features

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for SMILE

SMILE Market Risks

- High volatility: SMILE's price may experience significant fluctuations

- Limited liquidity: Trading volume may be low, affecting price stability

- Market sentiment: Overall crypto market trends can impact SMILE's performance

SMILE Regulatory Risks

- Uncertain regulatory environment: Changes in cryptocurrency regulations may affect SMILE

- Compliance challenges: Potential difficulties in adhering to evolving legal requirements

- Cross-border restrictions: International regulations may limit SMILE's adoption

SMILE Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the underlying code

- Scalability issues: Challenges in handling increased transaction volume

- Blockchain congestion: Network slowdowns during peak usage periods

VI. Conclusion and Action Recommendations

SMILE Investment Value Assessment

SMILE presents a high-risk, high-potential investment opportunity in the decentralized finance space. While its innovative approach to lending and stablecoins on the Bitcoin blockchain offers long-term value, short-term volatility and regulatory uncertainties pose significant risks.

SMILE Investment Recommendations

✅ Beginners: Start with small investments and focus on learning about the project

✅ Experienced investors: Consider allocating a portion of portfolio based on risk tolerance

✅ Institutional investors: Conduct thorough due diligence and monitor regulatory developments closely

SMILE Trading Participation Methods

- Spot trading: Buy and sell SMILE tokens on Gate.com

- Dollar-cost averaging: Regularly invest small amounts to mitigate price volatility

- Staking: Participate in staking programs if available to earn passive income

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of Smile Coin?

Smile Coin is projected to reach $0.0000226 by 2025. While growth may be limited, it shows potential in the evolving crypto market.

What will XLM be worth in 2025?

XLM is projected to reach between $1.50 and $3.00 in 2025, based on strong market demand and interest.

Can Sol reach $1000?

While ambitious, SOL reaching $1000 is possible in the long term. It depends on Solana's continued technological advancements and wider crypto market growth.

What will XLM be worth in 2030?

XLM could reach a high of $1.062 and a low of $0.738 by 2030, influenced by market demand, technological advancements, and regulatory changes.

Share

Content