2025 SDN Price Prediction: Navigating the Future of Software-Defined Networking

Introduction: SDN's Market Position and Investment Value

ShidenNetwork (SDN), as a multi-chain decentralized application layer on the Kusama network, has been bridging various blockchains since its inception in 2021. As of 2025, SDN's market capitalization stands at $2,599,269, with a circulating supply of approximately 68,115,041 tokens, and a price hovering around $0.03816. This asset, known as the "Smart Contract Layer for Kusama," is playing an increasingly crucial role in supporting DeFi, NFTs, and other blockchain applications.

This article will comprehensively analyze SDN's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. SDN Price History Review and Current Market Status

SDN Historical Price Evolution

- 2021: SDN launched, reaching an all-time high of $8.36 on September 12

- 2022-2024: Gradual decline in price amid broader crypto market downturn

- 2025: Price hit an all-time low of $0.02703627 on October 1

SDN Current Market Situation

As of October 15, 2025, SDN is trading at $0.03816, representing a 99.54% decrease from its all-time high. The token has experienced significant volatility in recent periods:

- 1-hour change: -2.09%

- 24-hour change: -5.61%

- 7-day change: -43.58%

- 30-day change: -6.41%

- 1-year change: -72.6%

SDN's market capitalization currently stands at $2,599,269, ranking it 2182nd among all cryptocurrencies. The 24-hour trading volume is $18,234.69, indicating moderate market activity. The circulating supply of SDN is 68,115,041.53, which is 78.22% of the total supply of 87,079,176.74 tokens.

Click to view the current SDN market price

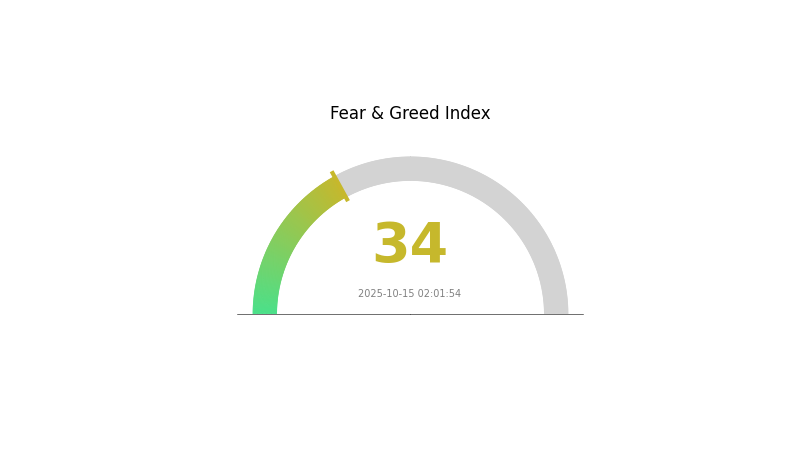

SDN Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a state of fear, with the Fear and Greed Index standing at 34. This suggests that investors are cautious and uncertain about market conditions. During such periods, some traders view it as a potential buying opportunity, adhering to the contrarian philosophy of "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and exercise caution before making any investment decisions in this volatile market.

SDN Holdings Distribution

The address holdings distribution data for SDN reveals a notable absence of significant concentrations among top holders. This suggests a relatively dispersed ownership structure, which is generally considered a positive indicator for market health and decentralization.

The lack of dominant addresses holding large percentages of the total supply indicates a reduced risk of market manipulation by individual actors. This distribution pattern may contribute to enhanced price stability and more organic market movements, as no single entity appears to have outsized influence over the circulating supply.

Overall, the current SDN address distribution reflects a fairly decentralized ecosystem. This structure potentially supports a more resilient and equitable market, reducing systemic risks associated with high ownership concentration. However, continued monitoring of ownership patterns remains crucial for assessing long-term market dynamics and potential shifts in token distribution.

Click to view the current SDN holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting Future SDN Prices

Supply Mechanism

- Market Growth: The SDN market is expected to grow significantly in the coming years. Data shows that China's SDN market size was 2.59 billion yuan in 2020, with a year-on-year growth rate of 37.6%. It is projected to reach 12 billion yuan by 2025.

- Historical Patterns: The SDN controller software market is expected to enter a mature development phase in the next five years.

- Current Impact: The expanding market size and maturing technology are likely to drive price changes in the SDN sector.

Macroeconomic Environment

- Monetary Policy Impact: As income growth stagnates and future network growth faces uncertainties, telecom companies are finding it increasingly difficult to meet substantial investment demands.

- Geopolitical Factors: The adoption of new network technologies by customers may drive future growth to some extent.

Technological Development and Ecosystem Building

- COTS Hardware: The commercialization of off-the-shelf (COTS) hardware is changing the landscape of data centers.

- Virtualization Technology: This is creating significant differences between cloud data centers and traditional data centers.

- Distributed Storage: Along with SDN, distributed storage is a key feature distinguishing modern data centers from traditional ones.

- Ecosystem Applications: SD-WAN (Software-Defined Wide Area Network) is emerging as a significant application of SDN technology, providing end-to-end manageable enterprise connectivity services.

III. SDN Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.02231 - $0.03847

- Neutral forecast: $0.03847 - $0.04001

- Optimistic forecast: $0.04001 - $0.05337 (requires significant market adoption)

2027-2028 Outlook

- Market phase expectation: Growth phase with increasing adoption

- Price range prediction:

- 2027: $0.03797 - $0.06853

- 2028: $0.04191 - $0.06258

- Key catalysts: Technological advancements and expanding use cases

2029-2030 Long-term Outlook

- Base scenario: $0.06000 - $0.0744 (assuming steady market growth)

- Optimistic scenario: $0.0744 - $0.09523 (assuming accelerated adoption)

- Transformative scenario: $0.09523 - $0.10000 (assuming breakthrough applications)

- 2030-12-31: SDN $0.09523 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04001 | 0.03847 | 0.02231 | 0 |

| 2026 | 0.05337 | 0.03924 | 0.03414 | 2 |

| 2027 | 0.06853 | 0.0463 | 0.03797 | 21 |

| 2028 | 0.06258 | 0.05742 | 0.04191 | 50 |

| 2029 | 0.0888 | 0.06 | 0.0432 | 57 |

| 2030 | 0.09523 | 0.0744 | 0.04464 | 94 |

IV. SDN Professional Investment Strategy and Risk Management

SDN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate SDN during market dips

- Hold for at least 2-3 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Swing trading tips:

- Set stop-loss orders to limit downside risk

- Take profits at predetermined price targets

SDN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Options trading: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for SDN

SDN Market Risks

- High volatility: SDN price can experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades

- Competition: Other smart contract platforms may outperform Shiden Network

SDN Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter crypto regulations

- Compliance challenges: Changing legal requirements for DeFi platforms

- Cross-border restrictions: Varying regulations across different jurisdictions

SDN Technical Risks

- Smart contract vulnerabilities: Potential for coding errors or exploits

- Scalability issues: May face challenges in handling high transaction volumes

- Interoperability concerns: Compatibility issues with other blockchain networks

VI. Conclusion and Action Recommendations

SDN Investment Value Assessment

SDN offers potential long-term value as a multi-chain dApp platform on Kusama, but faces short-term risks due to market volatility and competition in the smart contract space.

SDN Investment Recommendations

✅ Beginners: Start with small positions and focus on education ✅ Experienced investors: Consider allocating 5-10% of crypto portfolio to SDN ✅ Institutional investors: Explore SDN as part of a diversified crypto strategy

SDN Trading Participation Methods

- Spot trading: Buy and hold SDN tokens on Gate.com

- Staking: Participate in staking programs for passive income

- DeFi integration: Explore yield farming opportunities on Shiden Network

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is SDN crypto?

As of 2025-10-15, SDN crypto is priced at $0.05852, down 12.35% in the past 24 hours and 31.62% from its 7-day high.

How much is SDN to USD?

As of 2025-10-15, 1 SDN (Shiden Network) is worth $0.04045 USD. This price represents a 1.20% increase over the past month.

What is the share price prediction for synergia energy in 2025?

Based on current projections, Synergia Energy's share price is expected to reach approximately $0.46 by 2025, with a potential range between $0.28 and $0.46.

Will hamster token prices increase?

Yes, hamster token prices are expected to increase. Forecasts suggest a 30%-50% rise by July 2025, potentially reaching $0.0015-$0.0019, based on current market trends.

Share

Content