2025 SC Price Prediction: Analyzing Siacoin's Potential in the Decentralized Storage Market

Introduction: Market Position and Investment Value of SC

Siacoin (SC), as a decentralized cloud storage platform utilizing blockchain technology, has made significant strides since its inception in 2015. As of 2025, Siacoin's market capitalization has reached $114,572,426, with a circulating supply of approximately 56,025,636,522 coins, and a price hovering around $0.002045. This asset, often hailed as the "cloud storage coin," is playing an increasingly crucial role in the field of decentralized data storage and management.

This article will comprehensively analyze Siacoin's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. SC Price History Review and Current Market Status

SC Historical Price Evolution

- 2015: SC launched, price started at $0.00001262

- 2018: Reached all-time high of $0.092868 on January 6

- 2025: Price declined to $0.002045, down 61.33% year-over-year

SC Current Market Situation

SC is currently trading at $0.002045, with a 24-hour trading volume of $11,086.55. The price has increased by 1.13% in the past 24 hours but has seen significant declines over longer periods, including a 7.10% drop in the past week and a 30.03% decrease over the last month. SC's market capitalization stands at $114,572,426, ranking it 381st in the cryptocurrency market. The circulating supply is 56,025,636,522 SC, which represents 90.71% of the total supply. Despite recent short-term gains, SC is trading 97.80% below its all-time high, indicating a bearish long-term trend.

Click to view current SC market price

SC Market Sentiment Indicator

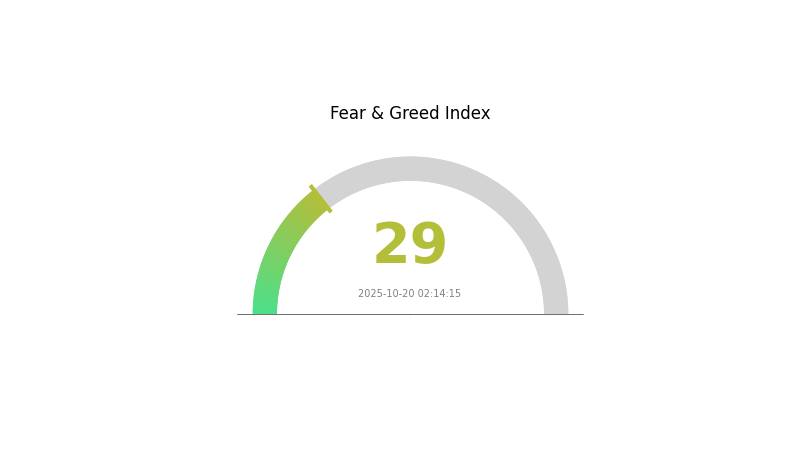

2025-10-20 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by fear, with the sentiment index at 29. This indicates a cautious mood among investors, potentially creating opportunities for contrarian traders. While fear can lead to overselling, it's crucial to remember that market sentiment can shift rapidly. Seasoned investors might view this as a chance to accumulate, but it's essential to conduct thorough research and manage risks carefully. Keep an eye on key technical indicators and fundamental developments that could influence market direction in the coming days.

SC Holdings Distribution

The address holdings distribution data for SC reveals a relatively decentralized ownership structure. With no single address holding a significant percentage of the total supply, the risk of market manipulation by large individual holders appears to be minimal. This distribution pattern suggests a healthier market structure, where the influence of any single entity on price movements is limited.

The absence of highly concentrated holdings also indicates a potentially more stable on-chain structure for SC. This distribution pattern may contribute to reduced volatility in the market, as large-scale sell-offs from individual whales are less likely to occur. Furthermore, the decentralized nature of the holdings aligns well with the principles of blockchain technology, potentially enhancing the overall credibility and robustness of the SC ecosystem.

Click to view the current SC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting SC's Future Price

Technical Development and Ecosystem Building

- Skynet: An upgrade to enhance decentralized storage and hosting capabilities, potentially increasing SC's utility and demand.

- Ecosystem Applications: DApps and projects built on Sia network, such as decentralized file storage and content delivery solutions, which could drive adoption and value.

III. SC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00108 - $0.00204

- Neutral prediction: $0.00204 - $0.00253

- Optimistic prediction: $0.00253 - $0.00326 (requires strong market momentum and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00266 - $0.00347

- 2028: $0.00237 - $0.00409

- Key catalysts: Technological advancements, wider industry partnerships, and improved market sentiment

2029-2030 Long-term Outlook

- Base scenario: $0.00259 - $0.00369 (assuming steady market growth and adoption)

- Optimistic scenario: $0.00369 - $0.00403 (with accelerated adoption and favorable regulatory environment)

- Transformative scenario: $0.00403+ (with breakthrough use cases and mainstream integration)

- 2030-12-31: SC $0.00369 (potential for significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00253 | 0.00204 | 0.00108 | 0 |

| 2026 | 0.00326 | 0.00228 | 0.00194 | 11 |

| 2027 | 0.00347 | 0.00277 | 0.00266 | 35 |

| 2028 | 0.00409 | 0.00312 | 0.00237 | 52 |

| 2029 | 0.00378 | 0.0036 | 0.00259 | 76 |

| 2030 | 0.00403 | 0.00369 | 0.00288 | 80 |

IV. SC Professional Investment Strategy and Risk Management

SC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term value investors

- Operational suggestions:

- Accumulate SC during market downturns

- Monitor Sia network growth and adoption metrics

- Use Gate.com's secure storage solutions

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trend directions and potential reversals

- RSI (Relative Strength Index): Spot overbought or oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

SC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. SC Potential Risks and Challenges

SC Market Risks

- High volatility: SC price can experience significant fluctuations

- Competition: Other decentralized storage projects may gain market share

- Adoption challenges: Slow uptake of decentralized storage solutions

SC Regulatory Risks

- Uncertain regulatory landscape: Potential for unfavorable regulations

- Cross-border compliance: Varying regulations across different jurisdictions

- Tax implications: Evolving tax treatment of cryptocurrency transactions

SC Technical Risks

- Network security: Potential vulnerabilities in the Sia network

- Scalability challenges: Ability to handle increased network demand

- Smart contract risks: Potential bugs or exploits in smart contracts

VI. Conclusion and Action Recommendations

SC Investment Value Assessment

SC offers long-term potential in the decentralized storage market but faces short-term volatility and adoption challenges. Investors should carefully consider their risk tolerance and investment horizon.

SC Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the technology ✅ Experienced investors: Consider dollar-cost averaging and set clear profit targets ✅ Institutional investors: Conduct thorough due diligence and consider OTC trading

SC Trading Participation Methods

- Spot trading: Buy and sell SC on Gate.com's spot market

- Staking: Participate in SC staking programs if available

- DeFi: Explore decentralized finance options involving SC tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for SC in 2030?

Based on market trends and potential technological advancements, SC could reach $0.50 to $1 by 2030, reflecting significant growth in the Web3 ecosystem.

Does Siacoin have a bright future?

Yes, Siacoin has a promising future. Its decentralized storage solution addresses a growing need in the digital economy. With increasing adoption and technological advancements, Siacoin is poised for significant growth in the coming years.

What is the share price prediction for Syntara in 2025?

Based on market trends and expert analysis, Syntara's share price is predicted to reach $12.50 by the end of 2025, showing a potential 150% increase from its current value.

Is Siacoin a good investment?

Yes, Siacoin shows potential as a long-term investment. Its decentralized storage solution and growing adoption in the Web3 space make it promising for future growth and value appreciation.

Share

Content