2025 SAUCEPrice Prediction: Analyzing Market Trends and Growth Potential for Crypto Enthusiasts

Introduction: SAUCE's Market Position and Investment Value

SaucerSwap (SAUCE), as a decentralized exchange built on the Hedera network, has established itself as a unique player in the DeFi space since its inception. As of 2025, SAUCE has a market capitalization of $46,663,113, with a circulating supply of approximately 856,203,925 tokens, and a price hovering around $0.0545. This asset, dubbed the "Hedera-powered DEX," is playing an increasingly crucial role in providing fair and efficient decentralized trading services.

This article will comprehensively analyze SAUCE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. SAUCE Price History Review and Current Market Status

SAUCE Historical Price Evolution Trajectory

- 2023: SAUCE launched at $0.024, marking the beginning of its market journey

- 2024: Reached all-time high of $0.188 on December 3, signaling strong market interest

- 2025: Experienced a market correction, dropping to all-time low of $0.02582 on June 22

SAUCE Current Market Situation

As of September 30, 2025, SAUCE is trading at $0.0545, showing a -0.58% change in the last 24 hours. The token has demonstrated positive momentum over longer timeframes, with a 1.93% increase over the past week and a significant 13.8% gain in the last 30 days. SAUCE's current price represents a recovery from its all-time low but remains well below its peak, suggesting a stabilizing market. With a market cap of $46,663,113 and a fully diluted valuation of $54,500,000, SAUCE holds the 713th position in the cryptocurrency market rankings.

Click to view the current SAUCE market price

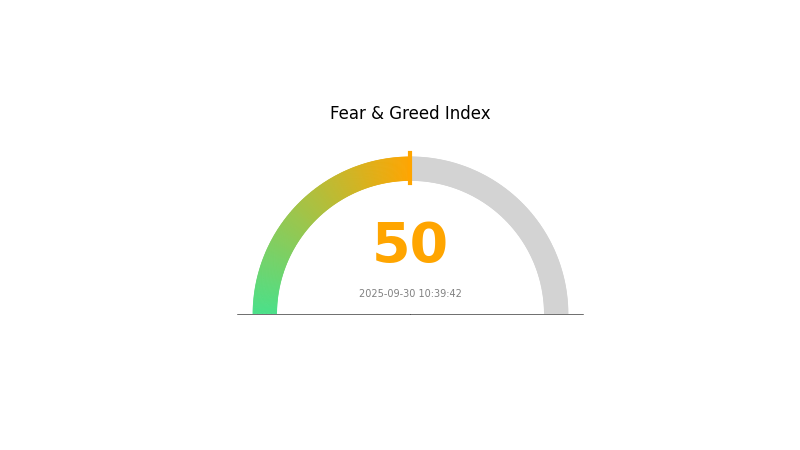

SAUCE Market Sentiment Indicator

2025-09-30 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment is currently balanced, with the Fear and Greed Index sitting at a neutral 50. This indicates that investors are neither overly fearful nor excessively greedy. Such equilibrium often presents a stable environment for trading, as extreme emotions are less likely to drive market movements. However, traders should remain vigilant, as neutral periods can sometimes precede significant shifts in market direction. It's an ideal time to reassess strategies and maintain a diversified portfolio. As always, conducting thorough research and using tools like Gate.com's market data can help inform investment decisions in this ever-evolving space.

SAUCE Holdings Distribution

The address holdings distribution data for SAUCE reveals a unique pattern in its token distribution. This metric provides insights into the concentration of tokens among different addresses, offering a snapshot of the project's decentralization and potential market dynamics.

Based on the available data, it appears that SAUCE has a relatively even distribution among its holders. The absence of significantly large holdings by individual addresses suggests a healthy level of decentralization. This distribution pattern can be indicative of a more stable and resilient market structure, as it reduces the risk of price manipulation by large token holders, often referred to as "whales."

The current distribution structure of SAUCE may contribute to reduced volatility in its market price. With tokens spread across a broader base of holders, the impact of individual trading decisions is likely to be less pronounced, potentially leading to more gradual and organic price movements. This distribution also aligns well with the principles of decentralization, which is often valued in the cryptocurrency space.

Click to view the current SAUCE holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting SAUCE's Future Price

Supply Mechanism

- Weather Conditions: Unpredictable changes in agricultural yields due to adverse weather conditions can lead to increased costs for manufacturers, affecting profit margins and pricing strategies.

- Historical Pattern: Climate factors such as sunlight, temperature, and humidity have significantly influenced the fermentation process, impacting product quality and market competitiveness.

- Current Impact: The natural fermentation mode of certain sauce products makes them highly susceptible to weather and manual operation influences, leading to production fluctuations and potential quality instability.

Macroeconomic Environment

- Trade Regulations: Changes in trade regulations can impact the pricing and availability of sauce products in the global market.

- Supply Chain Disruptions: Geopolitical tensions and supply chain interruptions can affect the production and distribution of sauce products, influencing prices.

- Inflation Hedging Properties: The sauce industry has shown some resilience in inflationary environments, with the seasoning sector experiencing a growth of nearly 13% in recent years.

Technological Development and Ecosystem Building

- Health-Oriented Innovations: There's a growing trend towards healthier sauce products, with consumers expecting future seasonings to be both flavorful and health-conscious.

- Product Optimization: Data analysis methods, such as decision tree models and Latent Dirichlet Allocation (LDA) models, are being used to analyze consumer preferences and improve product offerings.

- Ecosystem Applications: E-commerce platforms are becoming increasingly important for sauce product distribution and marketing, with a focus on addressing issues like traffic concentration on these platforms.

III. SAUCE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.03598 - $0.05452

- Neutral prediction: $0.05452 - $0.06624

- Optimistic prediction: $0.06624 - $0.07796 (requires strong market recovery and increased adoption)

2027 Mid-term Outlook

- Market stage expectation: Potential consolidation phase with gradual upward trend

- Price range forecast:

- 2026: $0.05829 - $0.08081

- 2027: $0.06691 - $0.07573

- Key catalysts: Expanding use cases, improved market sentiment, and potential technological advancements

2030 Long-term Outlook

- Base scenario: $0.07992 - $0.09867 (assuming steady growth and adoption)

- Optimistic scenario: $0.09867 - $0.1036 (with significant ecosystem expansion and market penetration)

- Transformative scenario: $0.1036 - $0.11301 (extreme favorable conditions, such as major partnerships or technological breakthroughs)

- 2030-12-31: SAUCE $0.1036 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07796 | 0.05452 | 0.03598 | 0 |

| 2026 | 0.08081 | 0.06624 | 0.05829 | 21 |

| 2027 | 0.07573 | 0.07353 | 0.06691 | 34 |

| 2028 | 0.09404 | 0.07463 | 0.04329 | 36 |

| 2029 | 0.11301 | 0.08433 | 0.05313 | 54 |

| 2030 | 0.1036 | 0.09867 | 0.07992 | 81 |

IV. SAUCE Professional Investment Strategies and Risk Management

SAUCE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Hedera ecosystem

- Operational suggestions:

- Accumulate SAUCE tokens during market dips

- Participate in SaucerSwap's liquidity provision and staking programs

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Hedera ecosystem developments and SaucerSwap updates

- Keep an eye on overall crypto market sentiment

SAUCE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Hedera ecosystem projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official SaucerSwap wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for SAUCE

SAUCE Market Risks

- Volatility: Cryptocurrency market fluctuations can impact SAUCE price

- Competition: Emergence of new DEXs on Hedera or other networks

- Liquidity: Potential for low liquidity in certain trading pairs

SAUCE Regulatory Risks

- Regulatory uncertainty: Changing global regulations on DeFi and DEXs

- Compliance challenges: Potential need for KYC/AML implementation

- Legal status: Unclear classification of SAUCE tokens in various jurisdictions

SAUCE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: Hedera network issues could impact SaucerSwap operations

- Integration risks: Challenges in integrating with new protocols or assets

VI. Conclusion and Action Recommendations

SAUCE Investment Value Assessment

SAUCE presents a unique opportunity within the Hedera ecosystem, offering potential long-term growth as the platform expands. However, investors should be aware of short-term volatility and regulatory uncertainties in the DeFi space.

SAUCE Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about DeFi and Hedera ✅ Experienced investors: Consider a balanced approach, combining holding and active trading ✅ Institutional investors: Explore liquidity provision and strategic partnerships with SaucerSwap

SAUCE Participation Methods

- Direct purchase: Buy SAUCE tokens on Gate.com

- Liquidity provision: Participate in SaucerSwap's liquidity pools

- Yield farming: Engage in SaucerSwap's farming programs, if available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is sauce crypto worth?

As of 2025-09-30, SAUCE crypto has a market capitalization of $44.79 million, reflecting its current value in the cryptocurrency market.

What is the XRP price prediction in 2025?

Based on technical analysis, XRP is predicted to decrease by 0.92% by October 1, 2025. Current market trends support this forecast.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction for 2025, followed closely by Ethereum. These predictions are based on current market trends and expert analysis.

What price will Shiba Inu reach in 2030?

Based on current trends, Shiba Inu is predicted to reach between $0.00001839 and $0.00002609 by 2030.

Share

Content