2025 SAAS Fiyat Tahmini: Bulut Tabanlı Yazılım Maliyetlerinin Değişen Dinamiklerinde Yol Almak

Giriş: SAAS'ın Piyasadaki Konumu ve Yatırım Potansiyeli

SaaSGo (SAAS), kodsuz eşler arası Dapp pazar yerlerinin kurulmasını mümkün kılan bir platform olarak DeFi sektöründe kuruluşundan bu yana dikkat çekiyor. 2025 itibarıyla SAAS'ın piyasa değeri 765.280,0 $; dolaşımdaki miktarı yaklaşık 800.000.000 token; fiyatı ise 0,0009566 $ civarında. "DeFi Dex Builder" olarak bilinen bu varlık, merkeziyetsiz finans pazarlarının oluşturulmasını demokratikleştirme sürecinde giderek daha önemli bir konuma yükseliyor.

Bu makalede, SAAS'ın 2025-2030 dönemindeki fiyat trendleri; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı şekilde analiz edilerek, yatırımcılara uzman fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. SAAS Fiyat Geçmişi ve Güncel Piyasa Durumu

SAAS'ın Tarihsel Fiyat Seyri

- 2024: İlk listeleme, fiyat tüm zamanların zirvesi olan 0,1182 $'a ulaştı

- 2025: Piyasada ciddi düşüş, fiyat en düşük seviye olan 0,000879 $'a geriledi

SAAS Güncel Piyasa Durumu

30 Ekim 2025 itibarıyla SAAS, 0,0009566 $ seviyesinden işlem görüyor ve son 24 saatte %6,44 değer kaybetti. Token, son dönemde ciddi değer kaybı yaşadı; 7 günlük düşüş %83,77, 30 günlük düşüş ise %95,98 seviyesinde. SAAS'ın mevcut fiyatı, 20 Aralık 2024'te kaydedilen tüm zamanların zirvesi olan 0,1182 $'ın oldukça altında. Token'in piyasa değeri 765.280 $; tam seyreltilmiş değerlemesi 956.600 $. Dolaşımdaki miktar 800.000.000 token olup, bu rakam toplam arzın %80'ine (toplam arz: 1.000.000.000) karşılık geliyor. 24 saatlik işlem hacmi 97.200,24 $ ile piyasa aktivitesinin orta düzeyde olduğunu gösteriyor. SAAS şu anda kripto piyasasında 3.074. sırada ve piyasa hakimiyeti %0,000024 düzeyinde.

Mevcut SAAS piyasa fiyatını görmek için tıklayın

SAAS Piyasa Duyarlılığı Göstergesi

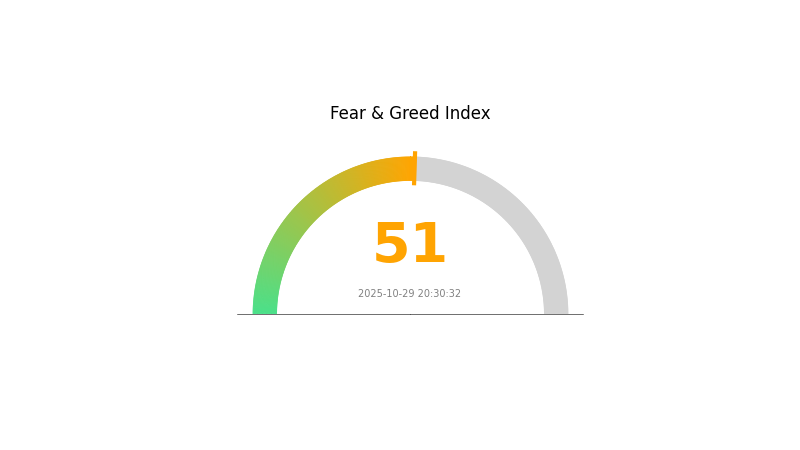

2025-10-29 Korku ve Açgözlülük Endeksi: 51 (Nötr)

Mevcut Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto para piyasasında duyarlılık, Ekim 2025 sonuna yaklaşırken nötr seviyede. Korku ve Açgözlülük Endeksi'nin 51 olarak okunması, yatırımcıların dengeli bir yaklaşım sergilediğini gösteriyor. Bu, piyasada temkinlilik ve iyimserlik arasında bir denge olduğunu işaret ediyor. Trader ve yatırımcılar tetikte olmalı; zira bu tür nötr ortamlar, önemli piyasa hareketleri öncesinde sıkça görülür. Piyasa duyarlılığını etkileyebilecek temel göstergeleri ve haberleri yakından izlemek önemlidir.

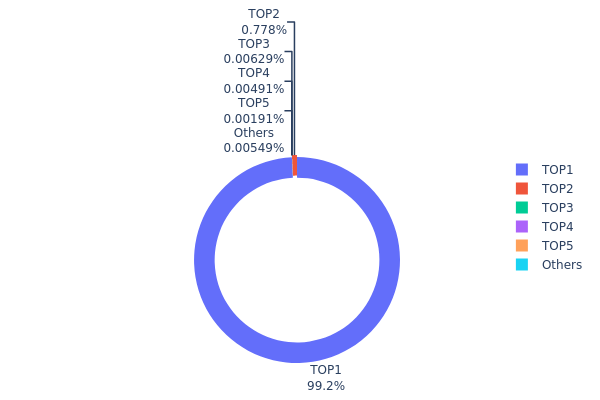

SAAS Token Dağılımı

SAAS'ta adres bazlı token dağılımı, sahipliğin son derece yoğunlaştığını gösteriyor. En üstteki adres, toplam arzın %99,20'sini elinde bulunduruyor ve 992.029,98K token tutuyor. Bu aşırı yoğunlaşma, token'in merkeziyetsizliği ve piyasa dinamikleri açısından önemli endişeler yaratıyor.

İkinci büyük sahip, arzın %0,77'sine sahipken, diğer adresler çok düşük miktarlarda token tutuyor. Bu denli dengesiz bir dağılım, SAAS'ın fiilen tek bir varlık tarafından yönetildiğini gösteriyor ve piyasa davranışında manipülasyona yüksek hassasiyet anlamına geliyor. Bu seviyede yoğunlaşma, fiyat oynaklığı ve hakim sahibin toplu satış riskini artırarak potansiyel yatırımcıları uzaklaştırabilir.

Piyasa yapısı açısından bu dağılım, düşük merkeziyetsizlik ve zincir üstü istikrarın tehlikeye girebileceğine işaret ediyor. Tek bir adreste aşırı yoğunlaşma, likiditenin azalmasına ve ani piyasa hareketlerine karşı hassasiyetin artmasına yol açabilir; bu da SAAS ekosisteminin uzun vadeli sürdürülebilirliği ve güvenilirliğini olumsuz etkileyebilir.

Mevcut SAAS Token Dağılımını görmek için tıklayın

| Üst | Adres | Miktar | Oran (%) |

|---|---|---|---|

| 1 | 0x6191...df589d | 992029,98K | 99,20% |

| 2 | 0x0d07...b492fe | 7783,98K | 0,77% |

| 3 | 0x1320...47fb46 | 62,93K | 0,00% |

| 4 | 0x0000...e08a90 | 49,12K | 0,00% |

| 5 | 0x157a...b191db | 19,09K | 0,00% |

| - | Diğerleri | 54,91K | 0,030000000000001% |

II. SAAS Fiyatlarını Gelecekte Etkileyecek Temel Faktörler

Arz Mekanizması

- Gelir Artışı: Geçmişte, özellikle erken ve hızlı büyüme dönemlerinde gelir artışı SaaS şirketlerinin değerlemesinde belirleyici oldu.

- Mevcut Etki: Son yıllarda odak, gelir artışından kârlılık göstergelerine (net kâr marjı gibi) kaydı.

Kurumsal ve Büyük Sahip Dinamikleri

- Kurumsal Benimseme: KOBİ'lerin dijitalleşmesindeki artış, SaaS kullanımını ve dolayısıyla fiyatları olumlu yönde etkileyebilir.

- Ulusal Politikalar: Özellikle KOBİ'ler için dijital dönüşümde devlet desteği, SaaS pazarının dinamiklerini ve fiyatlandırma stratejilerini şekillendirebilir.

Makroekonomik Ortam

- Enflasyon Karşıtı Özellikler: SaaS şirketleri, ekonomik koşullara ve enflasyona bağlı olarak fiyat stratejilerini yeniden düzenleyebilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Yapay Zeka Entegrasyonu: SaaS ürünlerine yapay zekanın dahil edilmesi, süreçleri ve veri analizlerini otomatikleştirerek fiyat yapısını etkileyebilir.

- Dikey SaaS Büyümesi: Sektöre özel SaaS ürünlerinde beklenen büyüme, ilgili alanlarda fiyatlandırmaya yön verebilir.

- Ekosistem Uygulamaları: SaaS sağlayıcılarının iş birliğiyle özel, zincir-üstü hizmetler sunması uzun vadede fiyat modellerini etkileyebilir.

III. 2025-2030 SAAS Fiyat Tahmini

2025 Beklentisi

- Temkinli tahmin: 0,00068 $ - 0,00095 $

- Nötr tahmin: 0,00095 $ - 0,00115 $

- İyimser tahmin: 0,00115 $ - 0,00136 $ (olumlu piyasa duyarlılığı ile)

2027 Orta Vadeli Beklenti

- Piyasa fazı tahmini: Olası büyüme dönemi

- Fiyat aralığı öngörüleri:

- 2026: 0,00092 $ - 0,00155 $

- 2027: 0,00109 $ - 0,00176 $

- Başlıca katalizörler: Artan benimseme, teknolojik ilerlemeler

2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,00185 $ - 0,00199 $ (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 0,00199 $ - 0,00219 $ (güçlü piyasa performansı ile)

- Dönüştürücü senaryo: 0,00219 $ üstü (çığır açan yenilikler ile)

- 2030-12-31: SAAS 0,00219 $ (potansiyel zirve fiyat)

| Yıl | Tahmini Maksimum Fiyat | Tahmini Ortalama Fiyat | Tahmini Minimum Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00136 | 0,00095 | 0,00068 | 0 |

| 2026 | 0,00155 | 0,00115 | 0,00092 | 20 |

| 2027 | 0,00176 | 0,00135 | 0,00109 | 41 |

| 2028 | 0,00219 | 0,00155 | 0,00151 | 62 |

| 2029 | 0,00211 | 0,00187 | 0,00103 | 95 |

| 2030 | 0,00219 | 0,00199 | 0,00185 | 108 |

IV. SAAS İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

SAAS Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Risk toleransı yüksek, uzun vadeli bakış açısına sahip yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde SAAS token biriktirin

- Kısmi kâr için fiyat hedefleri oluşturun

- Tokenleri güvenli donanım cüzdanlarında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası giriş/çıkış noktalarını tespit etmek için kullanılır

- Göreli Güç Endeksi (RSI): Aşırı alım/aşırı satım koşullarını izleyin

- Dalgalı alım-satımda önemli noktalar:

- SAAS tokeninin genel piyasa trendleriyle korelasyonunu izleyin

- Aşağı yönlü riski yönetmek için kesin stop-loss seviyeleri belirleyin

SAAS Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-2'si

- Agresif yatırımcılar: Kripto portföyünün %3-5'i

- Profesyonel yatırımcılar: Kripto portföyünün %5-10'u

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları birden fazla DeFi projesine dağıtın

- Stop-loss emirleri: Olası kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdan

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama etkinleştirin, güçlü şifreler kullanın

V. SAAS İçin Potansiyel Riskler ve Zorluklar

SAAS Piyasa Riskleri

- Yüksek oynaklık: SAAS token fiyatı büyük dalgalanmalara açık

- Rekabet: Yeni kodsuz DeFi platformları pazar payını etkileyebilir

- Likidite riski: Sınırlı işlem hacmi fiyat istikrarına zarar verebilir

SAAS Regülasyon Riskleri

- Belirsiz regülasyon ortamı: Daha sıkı DeFi düzenlemeleri gelebilir

- Uyum zorlukları: DeFi platformları için KYC/AML gereksinimleri sürekli değişiyor

- Sınır ötesi kısıtlamalar: Farklı ülkelerde değişen yasal statü

SAAS Teknik Riskler

- Akıllı sözleşme açıkları: Sömürü ya da hack riski

- Ölçeklenebilirlik sorunları: Altyapının sınırlamaları

- Birlikte çalışabilirlik zorlukları: Diğer DeFi protokolleriyle entegrasyon

VI. Sonuç ve Eylem Önerileri

SAAS Yatırım Değeri Değerlendirmesi

SAAS, kodsuz DeFi alanında yüksek riskli ve yüksek potansiyelli bir fırsat sunuyor. Uzun vadeli değer önerisi DeFi geliştirmeyi demokratikleştirme yeteneğine dayanırken, kısa vadeli riskler arasında piyasa oynaklığı ve regülasyon belirsizlikleri öne çıkıyor.

SAAS Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Kripto portföyünün %1-2'sini ayırın, öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: %3-5 oranında portföy ayırmayı değerlendirin, piyasa trendlerini yakından izleyin ✅ Kurumsal yatırımcılar: Stratejik ortaklıklar arayın, kapsamlı inceleme yapın

SAAS Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com'da SAAS token satın alın

- DeFi staking: SaaSGo'nun yerel staking programlarına katılın (varsa)

- Yield farming: SaaSGo platformunda likidite sağlama fırsatlarını değerlendirin

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre kararlarını dikkatle vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

SAAS 2025'te hâlâ önemli mi?

Evet, SAAS 2025'te hâlâ son derece önemini koruyor. Esneklik, maliyet avantajı ve ileri seviye yapay zeka entegrasyonu sunuyor. Yeni sağlayıcılar veri yönetimi sorunlarını çözerek, farklı sektörlerde uyum kabiliyetinin sürmesini sağlıyor.

SAAS'ın 3-3-2-2-2 kuralı nedir?

3-3-2-2-2 kuralı, SaaS şirketlerinin aylık %3 büyüme, 3 destek kanalı, her sürümde 2 yeni özellik, 2 geri bildirim döngüsü ve 2 pazarlama kanalı hedeflemesini öngörür.

SAAS'ın geleceği var mı?

Evet, SAAS'ın geleceği parlak. Yapay zeka ile gelişiyor, daha verimli hale geliyor ve iş süreçlerine daha fazla entegre oluyor.

SAAS'ta 40 kuralı nedir?

SAAS'ta 40 kuralı, bir şirketin gelir büyüme oranı ile kâr marjı toplamının en az %40 olması gerektiğini belirtir. Bu, SaaS sektöründe finansal sağlık ve performansın ölçütüdür.

Gate Square Spark Program 2025: Web3 Yenilikçi Yetiştirme Blockchain Girişimciliğini Desteklemek İçin

Momentum & BuildPad: Bilmeniz Gerekenler

Enso (ENSO) nedir?

Bir Kripto Projesinin Topluluğu ile Ekosistemindeki Aktiviteyi Nasıl Ölçebilirsiniz?

2025 UPrice Tahminleri: Dünya Genelinde Kentsel Gayrimenkul Piyasası Trendlerine Dair Kapsamlı Analiz ve Öngörü

2025 yılında temel analiz, bir kripto projenin değerini nasıl değerlendirir?

Polkadot Blockchain Ağları Arasında Birlikte Çalışabilirliğe Giriş

Sektörde tanınmış NFT yaratıcıları ve ikonik dijital sanat koleksiyonları

Vadeli İşlemler ile Forward Sözleşmeleri Arasındaki Farkların Kavranması

MetaMask’a Giriş: Kripto Cüzdanlara Yeni Başlayanlar İçin Rehber

Web3 Geliştiricisi Olmak: Blockchain Alanında Temel Beceriler ve Kariyer Yolunun Temel Unsurları