2025 ROOM Price Prediction: Analyzing Market Trends and Potential Growth in the Digital Real Estate Sector

Introduction: ROOM's Market Position and Investment Value

OptionRoom Token (ROOM), as a governable Oracle and prediction protocol based on Polkadot, has been making waves in the crypto space since its inception in 2021. As of 2025, ROOM's market capitalization has reached $648,031, with a circulating supply of approximately 12,493,373 tokens, and a price hovering around $0.05187. This asset, often referred to as a "multi-use case protocol," is playing an increasingly crucial role in Oracle services and event predictions.

This article will provide a comprehensive analysis of ROOM's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price forecasts and practical investment strategies for investors.

I. ROOM Price History Review and Current Market Status

ROOM Historical Price Evolution

- 2021: Launch and all-time high, price reached $4.66 on February 5th

- 2025: Significant price drop, hitting an all-time low of $0.00006881 on May 1st

- 2025: Market recovery, price rebounded to $0.05187 as of October 30th

ROOM Current Market Situation

As of October 30, 2025, ROOM is trading at $0.05187. The token has shown positive momentum in the short term, with a 1.82% increase in the last 24 hours and a 0.19% gain in the past hour. However, it's experiencing a downtrend in the medium term, with declines of 3.78% over the past week and 6.81% in the last 30 days. Despite these recent setbacks, ROOM has demonstrated strong performance over the past year, boasting a significant 31.87% increase.

The current market capitalization of ROOM stands at $648,031, ranking it 3226th among all cryptocurrencies. With a circulating supply of 12,493,373 ROOM tokens, representing 12.49% of the total supply of 100 million tokens, the project maintains a relatively low circulation ratio. The fully diluted valuation of the project is $5,187,000.

Trading volume in the past 24 hours reached $28,321, indicating moderate market activity. The token is currently trading at about 1.11% of its all-time high of $4.66, achieved on February 5, 2021, but significantly above its all-time low of $0.00006881, recorded on May 1, 2025.

Click to view the current ROOM market price

ROOM Market Sentiment Indicator

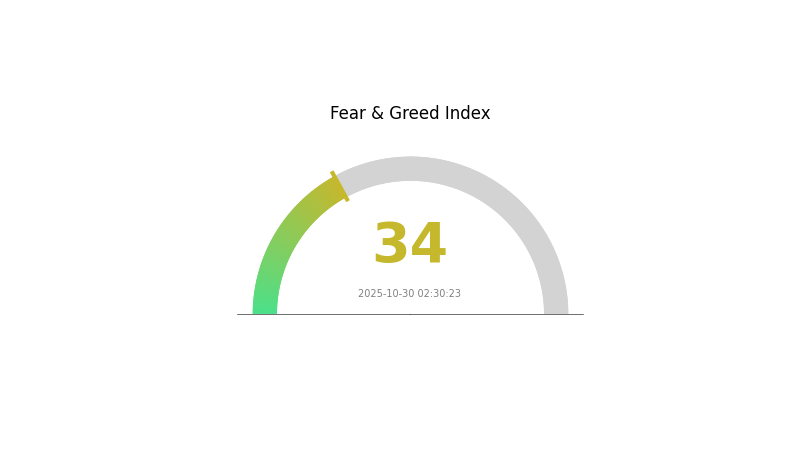

2025-10-30 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by fear, with the Fear and Greed Index standing at 34. This suggests a cautious sentiment among investors, potentially indicating undervalued market conditions. During such periods, seasoned traders often view it as a potential buying opportunity, adhering to the adage "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and exercise prudence before making any investment decisions in this volatile market.

ROOM Holdings Distribution

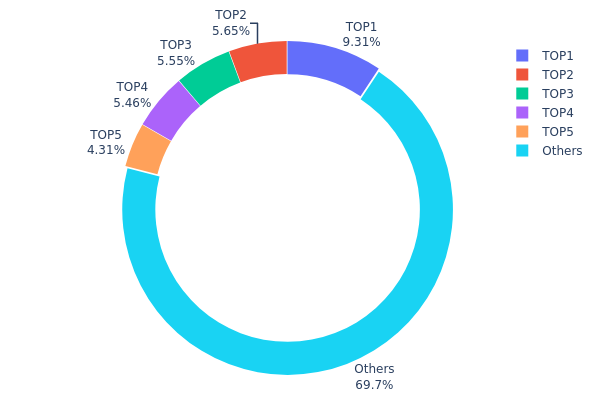

The address holdings distribution data provides crucial insights into the concentration of ROOM tokens among different wallet addresses. Based on the provided data, we observe a moderate level of concentration at the top. The largest holder possesses 9.30% of the total supply, while the top five addresses collectively control 30.26% of ROOM tokens.

This distribution suggests a relatively balanced ownership structure, with no single address holding an overwhelming majority. The fact that 69.74% of tokens are distributed among other addresses indicates a decent level of decentralization. However, the presence of several large holders could potentially influence market dynamics. These major stakeholders might have the capacity to impact price movements if they decide to make significant trades.

From a market structure perspective, this distribution reflects a healthy balance between institutional or early investor involvement and wider community participation. It suggests that ROOM has achieved a reasonable level of adoption and distribution beyond its initial backers. While the top holders could exert some influence, the overall structure appears sufficiently decentralized to mitigate extreme manipulation risks.

Click to view the current ROOM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x84d1...a15cb3 | 9308.36K | 9.30% |

| 2 | 0x9838...d2f679 | 5652.89K | 5.65% |

| 3 | 0xda75...c2edc2 | 5552.38K | 5.55% |

| 4 | 0xca9d...4ab200 | 5456.71K | 5.45% |

| 5 | 0x0d07...b492fe | 4314.01K | 4.31% |

| - | Others | 69715.64K | 69.74% |

II. Key Factors Affecting Future ROOM Prices

Supply Mechanism

- Population Dynamics: The total population and negative growth trends have an unfavorable impact on housing prices. Population size directly affects housing demand.

Institutional and Major Investor Dynamics

- Government Policies: Real estate-related systems and policies involve various government departments' responsibilities, significantly impacting housing prices.

Macroeconomic Environment

-

Monetary Policy Impact: Current concerns about rising housing prices in many economies, accompanied by surging household debt, are intensifying worries about financial instability.

-

Geopolitical Factors: International situations and policies of new administrations can influence future economic and trade policies, potentially affecting housing markets.

Technological Development and Ecosystem Building

- Carbon Market Development: As carbon emission caps tighten and reduction targets increase, global carbon markets need to adopt innovative strategies to address hard-to-reduce key industries and ensure fair transition. Carbon markets guide investment directions by providing long-term price signals and market frameworks.

III. ROOM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.04738 - $0.05207

- Neutral prediction: $0.05207 - $0.06066

- Optimistic prediction: $0.06066 - $0.06925 (requires sustained market growth)

2027-2028 Outlook

- Market phase expectation: Potential consolidation followed by growth

- Price range forecast:

- 2027: $0.04868 - $0.07659

- 2028: $0.04316 - $0.10542

- Key catalysts: Increased adoption, technological advancements, market sentiment improvement

2029-2030 Long-term Outlook

- Base scenario: $0.07047 - $0.10262 (assuming steady market growth)

- Optimistic scenario: $0.10262 - $0.11715 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.11715 - $0.12211 (with breakthrough use cases and widespread integration)

- 2030-12-31: ROOM $0.12211 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06925 | 0.05207 | 0.04738 | 0 |

| 2026 | 0.06915 | 0.06066 | 0.0552 | 16 |

| 2027 | 0.07659 | 0.06491 | 0.04868 | 25 |

| 2028 | 0.10542 | 0.07075 | 0.04316 | 36 |

| 2029 | 0.11715 | 0.08808 | 0.07047 | 69 |

| 2030 | 0.12211 | 0.10262 | 0.05233 | 97 |

IV. ROOM Professional Investment Strategies and Risk Management

ROOM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate ROOM tokens during market dips

- Set price alerts for significant market movements

- Store tokens in a secure wallet, preferably hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Polkadot ecosystem developments

- Track OptionRoom's platform usage and adoption metrics

ROOM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance ROOM with other crypto assets and traditional investments

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for ROOM

ROOM Market Risks

- High volatility: Cryptocurrency markets are known for rapid price fluctuations

- Competition: Other oracle and prediction platforms may impact ROOM's market share

- Liquidity risk: Limited trading volume may affect entry and exit positions

ROOM Regulatory Risks

- Uncertain regulatory environment: Changing regulations may impact ROOM's operations

- Cross-border compliance: Varying international regulations may limit global adoption

- Potential classification as a security: Could lead to additional regulatory scrutiny

ROOM Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Scalability challenges: Future growth may test the platform's technical capabilities

- Oracle reliability: Accuracy and timeliness of data feeds are crucial for the platform's success

VI. Conclusion and Action Recommendations

ROOM Investment Value Assessment

ROOM presents a unique value proposition within the Polkadot ecosystem, offering oracle and prediction market services. However, it faces significant competition and regulatory uncertainties. The project's long-term success depends on widespread adoption and technological robustness.

ROOM Investment Recommendations

✅ Beginners: Consider small, exploratory positions after thorough research ✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct comprehensive due diligence and consider ROOM as part of a diversified crypto portfolio

ROOM Trading Participation Methods

- Spot trading: Available on Gate.com for direct ROOM/USDT trading

- Staking: Participate in OptionRoom's staking programs for potential passive income

- Governance: Engage in protocol governance to influence the project's direction

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is a price forecast?

A price forecast is a prediction of future market prices based on data analysis and trends. It helps estimate potential revenues and manage price risks, serving as a crucial tool for planning and decision-making in various markets.

Does Dash Coin have a future?

Yes, Dash Coin has potential for growth. Its focus on privacy and role in crypto banking could drive value increases if market conditions improve and privacy coins gain more traction.

What is hotel price prediction machine learning?

Hotel price prediction uses AI to forecast room rates based on historical data, market trends, and demand patterns. It helps optimize pricing strategies and maximize revenue for hotels.

Which type of machine learning algorithm is best suited for predicting house prices based on features such as size, location, and number of rooms?

Linear regression is best suited for predicting house prices based on features like size, location, and number of rooms. It offers a simple yet effective prediction model.

Share

Content