2025 RION Fiyat Tahmini: Gelişmekte Olan Kripto Para Birimi İçin Potansiyel Büyüme ve Piyasa Trendleri Analizi

Giriş: RION’un Piyasa Konumu ve Yatırım Potansiyeli

Hyperion (RION), Aptos ekosisteminde öncü merkeziyetsiz borsa (DEX) olarak, kuruluşundan bu yana işlem hacmiyle küresel ölçekte ilk 12 DEX arasında yerini sağlamlaştırmıştır. 2025 yılı itibarıyla Hyperion’un piyasa değeri 7.187.600 $’a ulaşırken, yaklaşık 17.000.000 adet dolaşımdaki token bulunmaktadır ve fiyatı 0,4228 $ seviyesinde seyretmektedir. “Aptos’un birleşik likidite ve işlem katmanı” olarak tanınan bu varlık, merkeziyetsiz finans ve token takaslarında giderek daha önemli bir rol üstlenmektedir.

Bu makalede, Hyperion’un 2025-2030 dönemindeki fiyat hareketleri; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı biçimde incelenerek, yatırımcılara profesyonel fiyat tahminleri ve uygulamaya yönelik stratejiler sunulacaktır.

I. RION Fiyat Geçmişi ve Mevcut Piyasa Durumu

RION Fiyatının Tarihsel Seyri

- 2025: RION, 17 Temmuz’da 1,1064 $ ile tüm zamanların en yüksek seviyesine ulaşarak önemli bir dönüm noktası kaydetti.

- 2025: Token, 4 Eylül’de 0,2704 $ ile en düşük seviyesini görerek piyasadaki yüksek oynaklığı gösterdi.

RION Güncel Piyasa Durumu

10 Ekim 2025 itibarıyla RION, 0,4228 $’dan işlem görüyor ve son 24 saatte %1,85 düşüş yaşadı. Token, farklı zaman aralıklarında karma bir performans sergiliyor; son bir saatte %0,71 artış, haftalık bazda %3,42 düşüş gözleniyor. Son bir ayda ise %17,53’lük güçlü bir büyüme yakaladı. Yıllık performansı ise %31,99’luk azalma ile negatif durumda.

RION’un piyasa değeri 7.187.600 $ seviyesindedir ve dolaşımdaki arzı 17.000.000 adettir. Bu, toplam 100.000.000 RION tokenın %17’sine karşılık gelmektedir. Tam seyreltilmiş piyasa değeri ise 42.280.000 $’dır.

Son 24 saatteki işlem hacmi 22.746,09 $ olup, bu seviye orta düzeyde piyasa aktivitesini işaret etmektedir. RION’un piyasa hakimiyeti şu anda %0,00096’dır ve bu oran, kripto para piyasasında küçük bir oyuncu olduğunu gösterir.

Fiyat dalgalanmalarına rağmen RION, Aptos ekosisteminde kritik bir rol üstlenmeye devam ederek küresel işlem hacmine göre ilk 12 DEX arasında yerini koruyor. Bu durum, Hyperion platformuna olan ilginin sürdüğüne işaret ediyor.

Güncel RION piyasa fiyatını görmek için tıklayın

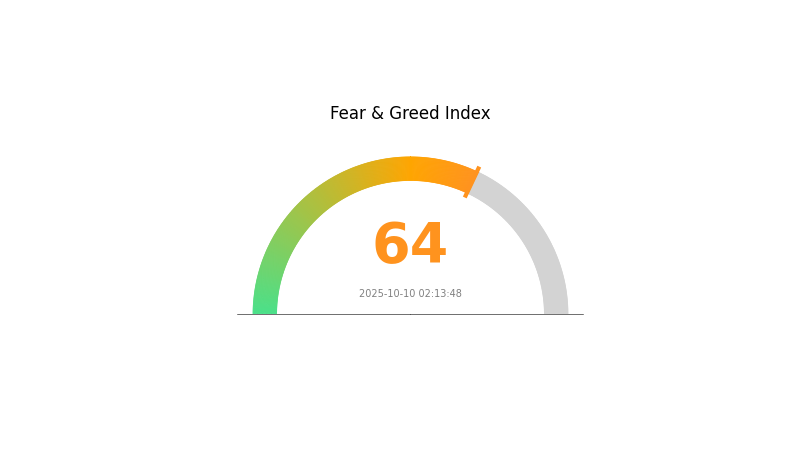

RION Piyasa Duyarlılığı Göstergesi

2025-10-10 Korku ve Açgözlülük Endeksi: 64 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasası şu anda açgözlülük modunda ve Korku ve Açgözlülük Endeksi 64 seviyesine ulaşmış durumda. Yatırımcıların artan iyimserliği fiyatların yükselmesini tetikleyebilir; ancak aşırı açgözlülük düzeltmelere yol açabilir, bu nedenle dikkatli hareket edilmelidir. Yatırımcılar portföylerini çeşitlendirmeli ve kârları korumak için zarar durdur emirleri kullanmalıdır. Piyasa duyarlılığı hızla değişebileceğinden, güncel kalıp stratejinizi güncellemek önemlidir. Gate.com bu piyasa koşullarında etkin yön bulmanız için çeşitli araçlar ve kaynaklar sunar.

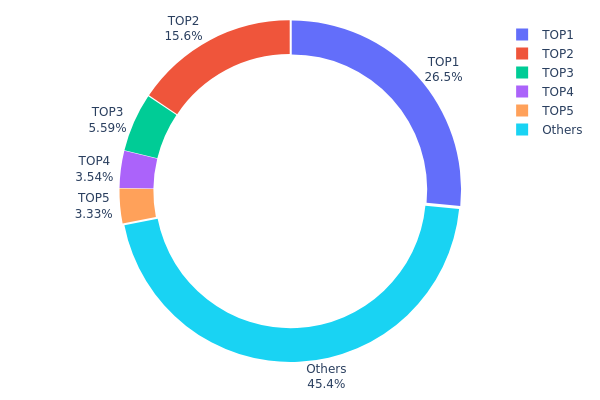

RION Varlık Dağılımı

RION adres dağılımı, sahipliğin oldukça yoğunlaştığını gösteriyor. En üstteki adres toplam arzın %26,52’sini elinde bulundururken, ilk 5 adres birlikte RION tokenlarının %54,57’sini kontrol ediyor. Bu yoğunlaşma, büyük sahiplerin hareketlerine karşı duyarlılık yaratıyor.

Böyle bir dağılım, fiyat oynaklığını artırabilir ve piyasa manipülasyonuna zemin hazırlayabilir. Özellikle toplam arzın dörtte birinden fazlasını elinde tutan en büyük adresin işlemleri, RION’un piyasa dinamiklerini ciddi biçimde etkileyebilir. Bununla birlikte, tokenların %45,43’ü diğer adreslere dağılmış durumda ve bu, belirli bir merkeziyetsizlik sağlıyor.

Mevcut dağılım, RION’un zincir üstü yapısında orta düzeyde bir merkezileşme olduğunu gösteriyor. Bu durum, büyük paydaşların istikrarı açısından avantaj sunarken, piyasa dayanıklılığı ve gerçek merkeziyetsizlik açısından riskler barındırıyor. Dağılımdaki değişiklikleri takip etmek, RION’un pazar yapısındaki olası dönüşümleri anlamak açısından önem taşıyor.

Güncel RION Varlık Dağılımı için tıklayın

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x14ac...5f5c3d | 3.000,00K | 26,52% |

| 2 | 0x6d09...9100dd | 1.765,37K | 15,61% |

| 3 | 0x73d8...4946db | 631,84K | 5,58% |

| 4 | 0x7e6a...802f89 | 400,46K | 3,54% |

| 5 | 0x662e...12e7c1 | 376,28K | 3,32% |

| - | Diğerleri | 5.134,13K | 45,43% |

II. RION’un Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Sabit Arz: RION’un maksimum arzı sabittir ve bu kıtlık unsuru, uzun vadeli fiyat artışını destekleyebilir.

- Tarihsel Örüntü: Sınırlı arz, benzer kripto varlıklarda fiyat istikrarı ve kademeli büyümeye katkı sağlamıştır.

- Mevcut Etki: Sabit arz, talep artarsa RION’un fiyatına destek olmaya devam edecektir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: RION, kripto para özelliğiyle dijital varlıklar gibi enflasyona karşı bir koruma aracı olarak değerlendirilebilir.

- Jeopolitik Etkenler: Küresel ekonomik belirsizlik ve jeopolitik riskler, RION gibi alternatif yatırımlara ilgiyi artırabilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: RION, merkeziyetsiz uygulamalar (DApp) ve ekosistem projeleri geliştirerek kullanım ve benimsenmeyi artırma yolunda ilerlemektedir.

III. RION 2025-2030 Fiyat Öngörüleri

2025 Beklentisi

- Tedbirli tahmin: 0,22831 $ - 0,4228 $

- Nötr tahmin: 0,4228 $ - 0,52427 $

- İyimser tahmin: 0,52427 $ - 0,62574 $ (güçlü piyasa ivmesiyle)

2027 Orta Vadeli Beklenti

- Piyasa evresi: Artan oynaklık döneminde potansiyel büyüme

- Fiyat aralığı:

- 2026: 0,34078 $ - 0,60291 $

- 2027: 0,29307 $ - 0,81721 $

- Temel tetikleyiciler: Teknolojik gelişmeler, yaygın benimseme, uygun düzenlemeler

2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,49095 $ - 0,77929 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,77929 $ - 1,08321 $ (güçlü piyasa ve benimsenmeyle)

- Dönüştürücü senaryo: 1,08321 $ üzeri (büyük ortaklıklar ve teknolojik atılımlar durumunda)

- 2030-12-31: RION 1,08321 $ (olası yıl zirvesi)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,62574 | 0,4228 | 0,22831 | 0 |

| 2026 | 0,60291 | 0,52427 | 0,34078 | 24 |

| 2027 | 0,81721 | 0,56359 | 0,29307 | 33 |

| 2028 | 0,75944 | 0,6904 | 0,58684 | 63 |

| 2029 | 0,83366 | 0,72492 | 0,4132 | 71 |

| 2030 | 1,08321 | 0,77929 | 0,49095 | 84 |

IV. RION İçin Profesyonel Yatırım Stratejisi ve Risk Yönetimi

RION Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun olanlar: Uzun vadeli yatırımcılar, Aptos ekosistemine inananlar

- Uygulama önerileri:

- Piyasa düşüşlerinde RION biriktirin

- Hyperion likidite havuzlarında yer alarak ek getiri sağlayın

- Tokenları güvenli, saklamacı olmayan cüzdanlarda tutun

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli ortalamalar: Trend ve dönüş noktalarını saptamak için kullanın

- RSI: Aşırı alım/satım durumlarını izleyin

- Dalgalı işlemde dikkat edilmesi gerekenler:

- Zarar durdur emirleriyle kayıpları sınırlayın

- Belirlenen direnç seviyelerinde kâr alın

RION Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Tedbirli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Aptos üzerindeki birden fazla DeFi projesine yatırım yaparak riskleri dağıtın

- Opsiyon stratejileri: Satım opsiyonlarıyla aşağı yönlü riskleri sınırlandırın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 cüzdan

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü şifre kullanımı

V. RION İçin Olası Riskler ve Zorluklar

RION Piyasa Riskleri

- Oynaklık: RION fiyatında keskin dalgalanmalar yaşanabilir

- Likidite: Kısıtlı işlem çiftleri fiyat istikrarını etkileyebilir

- Rekabet: Aptos’taki diğer DEX’ler pazar payı elde edebilir

RION Düzenleyici Riskleri

- Belirsiz düzenlemeler: DeFi mevzuatında potansiyel değişiklikler

- Sınır ötesi uyumluluk: Farklı ülkelerde değişen yasal statü

- Vergi etkileri: DEX tokenları için net olmayan vergilendirme

RION Teknik Riskleri

- Akıllı sözleşme açıkları: Sömürü ya da saldırı riski

- Ölçeklenebilirlik sorunları: Aptos ağında yoğunluk, Hyperion performansını etkileyebilir

- Yükseltme riskleri: Protokol güncellemeleri beklenmeyen sorunlara neden olabilir

VI. Sonuç ve Eylem Önerileri

RION Yatırım Potansiyeli Değerlendirmesi

RION, Aptos üzerinde lider bir DEX tokenı olarak potansiyel taşıyor; ancak ciddi rekabet ve yasal belirsizlikler mevcut. Uzun vadeli değer, Hyperion’un pazar payını koruyup yenilikçi çözümler geliştirme başarısına bağlıdır.

RION Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, Aptos ekosistemini tanıyın

✅ Deneyimli yatırımcılar: Çeşitlendirilmiş DeFi portföyünde RION’a yer verin

✅ Kurumsal yatırımcılar: Büyük yatırım öncesi Hyperion’un teknolojisini ve pazar konumunu detaylı inceleyin

RION İşlem Katılım Yöntemleri

- Spot işlem: Gate.com ve diğer desteklenen borsalarda mevcut

- Likidite sağlama: Hyperion havuzlarına katılarak ek getiri elde edin

- Stake etme: RION sahipleri için varsa stake etme imkanlarını değerlendirin

Kripto para yatırımları çok yüksek risk taşır. Bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarına göre dikkatli karar vermelidir. Profesyonel finans danışmanına başvurulması önerilir. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Kripto 2025'te Yeniden Yükselir mi?

2025 1INCH Fiyat Tahmini: Bu DeFi protokol token’ı, merkeziyetsiz borsa pazarında yeni zirvelere ulaşabilir mi?

2025 CETUS Fiyat Tahmini: Değişen DeFi Ekosisteminde Büyüme Potansiyeli ve Piyasa Dinamiklerinin Analizi

2025 HFT Fiyat Tahmini: Olgunlaşan DeFi Ekosisteminde Hashflow Token için Piyasa Analizi ve Büyüme Potansiyeli

2025 UPC Fiyat Tahmini: Küresel Perakende Ekosisteminde Universal Product Codes İçin Piyasa Analizi ve Trend Tahminleri

2025 LOGX Fiyat Tahmini: Merkeziyetsiz Lojistik Tokenlerinin Geleceğine Yön Vermek

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi