2025 REQ Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: REQ'nin Piyasa Konumu ve Yatırım Değeri

Request (REQ), Ethereum blokzinciri üzerinde kurulan merkeziyetsiz bir ağ olarak, 2017’den bu yana önemli mesafe kat etti. 2025 itibarıyla Request’in piyasa değeri 97.554.246 ABD Doları’na, dolaşımdaki arzı yaklaşık 744.291.192 tokene, fiyatı ise 0,13107 ABD Doları’na ulaşmıştır. Kripto paraların “PayPal’ı” olarak anılan bu varlık, güvenli ve şeffaf ödeme talepleri ile finansal işlemlerin kolaylaştırılmasında giderek daha önemli bir rol üstleniyor.

Bu makale, 2025-2030 döneminde Request’in fiyat hareketlerini; tarihsel trendler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler çerçevesinde kapsamlı biçimde analiz ederek profesyonel fiyat tahminleri ve yatırımcılara yönelik stratejik öneriler sunmaktadır.

I. REQ Fiyat Geçmişi ve Güncel Piyasa Durumu

REQ Tarihsel Fiyat Gelişimi

- 2018: Tüm zamanların zirvesi, fiyat 6 Ocak’ta 1,059 ABD Doları’na çıktı

- 2020: Piyasa düşüşü, fiyat 13 Mart’ta 0,00454707 ABD Doları’na gerileyerek en düşük seviyesini gördü

- 2025: Mevcut piyasa döngüsünde fiyat 0,13107 ABD Doları’na toparlandı

REQ Güncel Piyasa Görünümü

20 Ekim 2025’te REQ, 0,13107 ABD Doları’ndan işlem görüyor ve 24 saatlik işlem hacmi 76.476,83 ABD Doları seviyesinde. Token; son 24 saatte %4,01, son bir haftada %2,94, son 30 günde %1,66 ve yıllık bazda %33,019 artış gösterdi.

REQ’nin piyasa değeri 97.554.246,57 ABD Doları olup, kripto piyasasında 413. sıradadır. Dolaşımdaki arz 744.291.192,26 REQ olup toplam arzın %74,43’ünü oluştururken, tam seyreltilmiş piyasa değeri 131.070.000 ABD Doları’dır.

Fiyat, 6 Ocak 2018’deki 1,059 ABD Doları zirvesinin oldukça altında kalsa da; 13 Mart 2020’deki 0,00454707 ABD Doları dip seviyesinden belirgin biçimde toparlandı. Mevcut fiyat, bir yıl öncesine göre %33,019 yükselerek REQ’nin uzun vadeli olumlu trendini ortaya koyuyor.

Güncel REQ piyasa fiyatını görmek için tıklayın

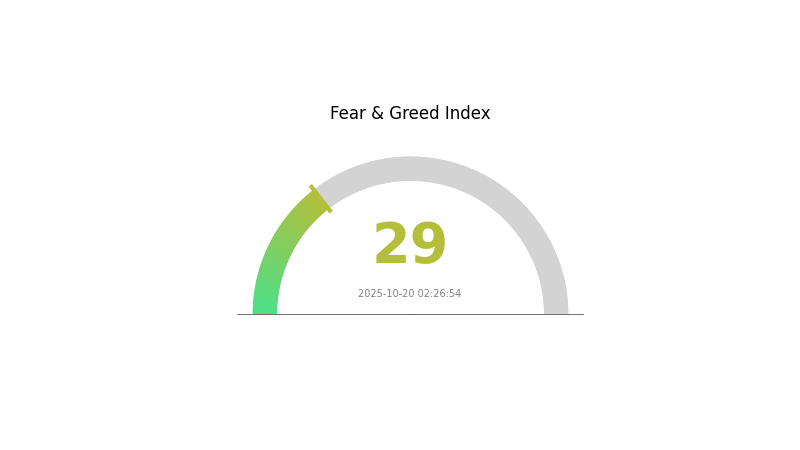

REQ Piyasa Duyarlılığı Endeksi

20 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku & Açgözlülük Endeksi’ni görmek için tıklayın

Kripto piyasasında duyarlılık halen temkinli; Korku ve Açgözlülük Endeksi 29 ile korku seviyesinde. Bu, yatırımcıların çekimser olduğunu ve fırsat arayışında olduklarını gösteriyor. Ancak piyasa duyarlılığının aniden değişebileceği unutulmamalı. Korku genellikle toparlanmanın habercisi olsa da, detaylı analiz yapmak ve riskleri yönetmek kritik önem taşıyor. Portföyünüzü çeşitlendirin ve piyasa gelişmelerini yakından takip ederek bilinçli hareket edin.

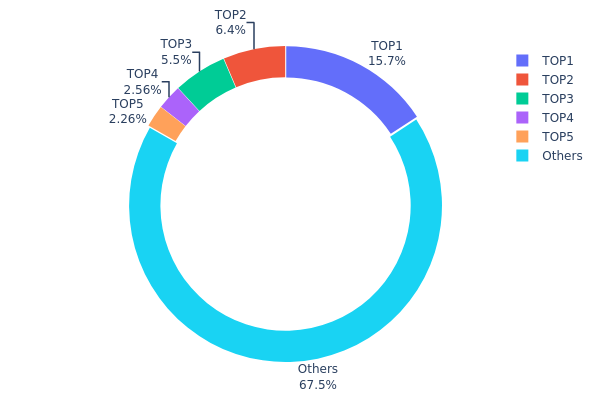

REQ Varlık Dağılımı

REQ tokenlerinin sahiplik dağılımı, en büyük adreslerde yüksek yoğunlaşma olduğunu gösteriyor. En büyük adres toplam arzın %15,74’ünü elinde tutarken, ilk 5 adresin toplam payı %32,45. Bu tablo, piyasada merkeziyetin yüksek olduğu anlamına geliyor ve fiyat hareketleri ile likidite üzerinde doğrudan etkili olabiliyor.

Böylesi bir dağılım büyük sahiplerin piyasada önemli hareketler yapabilme potansiyeli nedeniyle dalgalanma riskini artırıyor. Tokenlerin %67,55’i diğer adreslere dağılmış olsa da, üst sıralardaki bu yoğunluk, büyük transferlerde piyasa istikrarını olumsuz etkileyebilir.

Bu yoğunlaşma, REQ ekosisteminin merkeziyetsizlik düzeyiyle ilgili soru işaretlerine yol açıyor. Blokzincir teknolojisinin temel hedefi dağıtık kontrolken, mevcut sahiplik yapısı yatırımcılar için önemli bir değerlendirme kriteridir.

Güncel REQ Varlık Dağılımı’nı görmek için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x0632...30962e | 157.325,67K | 15,74% |

| 2 | 0xf977...41acec | 64.000,00K | 6,40% |

| 3 | 0xda5d...71ee25 | 55.000,00K | 5,50% |

| 4 | 0x4a60...aab931 | 25.542,88K | 2,55% |

| 5 | 0x3810...a53585 | 22.589,86K | 2,26% |

| - | Diğerleri | 674.959,19K | 67,55% |

II. REQ’nin Gelecek Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Token Yakımı: Request Network, dolaşımdaki REQ token miktarını azaltmak için token yakımı uygular.

- Tarihsel Etki: Geçmişteki token yakımları, arzın azalmasıyla REQ fiyatına genellikle olumlu yansıdı.

- Güncel Durum: Devam eden token yakımı, toplam arzı düşürerek REQ fiyatını desteklemeye devam edecektir.

Teknolojik Gelişim ve Ekosistem Büyümesi

- Layer 2 Entegrasyonu: Ölçeklenebilirlik ve düşük işlem maliyeti için Layer 2 çözümleriyle entegrasyon sağlandı.

- Çapraz Zincir Fonksiyonu: REQ, çoklu blokzincirlerde işlem yapabilecek çapraz zincir yeteneklerine kavuştu.

- Ekosistem Uygulamaları: Request Network, ticari işletmelere yönelik faturalandırma, ödeme talepleri ve finansal yönetim için çeşitli DApp’leri destekliyor.

III. 2025-2030 REQ Fiyat Tahmini

2025 Beklentisi

- Ihtiyatlı senaryo: 0,07079 - 0,13109 ABD Doları

- Nötr senaryo: 0,13109 - 0,15731 ABD Doları

- İyimser senaryo: 0,15731 - 0,18 ABD Doları (olumlu piyasa ve artan benimseme halinde)

2027-2028 Beklentisi

- Piyasa fazı: İstikrarlı büyüme ve muhtemel konsolidasyon

- Fiyat aralığı:

- 2027: 0,15156 - 0,17821 ABD Doları

- 2028: 0,15514 - 0,18962 ABD Doları

- Temel katalizörler: Ekosistem genişlemesi, teknolojik gelişmeler ve piyasa trendleri

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,181 - 0,18643 ABD Doları (piyasa büyümesi ve benimsemenin devamı varsayımıyla)

- İyimser senaryo: 0,19186 - 0,2349 ABD Doları (güçlü ekosistem ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,25 - 0,30 ABD Doları (çığır açan kullanım ve ana akım benimseme durumunda)

- 31 Aralık 2030: REQ 0,2349 ABD Doları (dönemin olası zirvesi)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,15731 | 0,13109 | 0,07079 | 0 |

| 2026 | 0,1889 | 0,1442 | 0,13411 | 10 |

| 2027 | 0,17821 | 0,16655 | 0,15156 | 27 |

| 2028 | 0,18962 | 0,17238 | 0,15514 | 31 |

| 2029 | 0,19186 | 0,181 | 0,11041 | 38 |

| 2030 | 0,2349 | 0,18643 | 0,13236 | 42 |

IV. REQ için Yatırım Stratejileri ve Risk Yönetimi

REQ Yatırım Yöntemleri

(1) Uzun Vadeli Tutma

- Uygun yatırımcı: Yüksek risk toleranslı uzun vadeli yatırımcılar

- Öneriler:

- Piyasa düşüşlerinde REQ biriktirin

- Kâr almak için fiyat hedefleri belirleyin

- Token’ları donanım cüzdanlarında veya güvenilir saklama servislerinde muhafaza edin

(2) Aktif Alım-Satım

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendi ve destek-direnci tespit etmek için kullanılır

- RSI: Aşırı alım ve satım seviyelerini belirler

- Dalgalı ticaret için:

- Piyasa duyarlılığı ve haberleri izleyin

- Zarar-kes emirleriyle riskinizi sınırlayın

REQ Risk Yönetimi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Agresif yatırımcı: Kripto portföyünün %5-8’i

- Profesyonel yatırımcı: Kripto portföyünün %10-15’i

(2) Riskten Korunma

- Diversifikasyon: Farklı kripto varlıklara yayılım

- Zarar-kes emirleri: Potansiyel kayıpları sınırlamak için kullanılır

(3) Güvenli Saklama

- Sıcak cüzdan: Gate Web3 Cüzdan

- Soğuk cüzdan: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik: İki adımlı doğrulama ve güçlü şifreler kullanın

V. REQ için Olası Riskler ve Zorluklar

REQ Piyasa Riskleri

- Volatilite: Kripto para piyasası son derece oynak

- Rekabet: Blokzincir tabanlı ödeme alanında yoğun rekabet

- Benimseme: Blokzincir teknolojisinin ana akımda yavaş yayılması

REQ Regülasyon Riskleri

- Küresel düzenlemeler: Kripto varlıklar için değişen regülasyon ortamı

- Uyumluluk: Artan regülasyonlara uyumda yaşanabilecek zorluklar

- Vergi etkisi: Farklı ülkelerde vergi uygulamaları net değil

REQ Teknik Riskler

- Akıllı sözleşme açıkları: Kodda güvenlik zafiyetleri riski

- Ölçeklenebilirlik: Yüksek işlem hacmini yönetmede zorluk

- Birlikte çalışabilirlik: Mevcut finansal sistemlerle entegrasyon güçlüğü

VI. Sonuç ve Eylem Önerileri

REQ Yatırım Değeri Analizi

REQ, blokzincir tabanlı ödeme ve faturalandırma alanında uzun vadeli potansiyel sunar. Ancak kısa vadede volatilite ve regülasyon belirsizliği önemli risklerdir.

REQ Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Az miktarla başlayın, teknoloji ve piyasayı öğrenin ✅ Deneyimli yatırımcılar: REQ’yi çeşitlendirilmiş portföyde değerlendirin, risk yönetimini uygulayın ✅ Kurumsal yatırımcılar: Detaylı analiz yapın, REQ’yi uzun vadeli blokzincir yatırımı olarak düşünün

REQ İşlemlerine Katılım Yolları

- Spot alım-satım: Güvenilir borsalarda REQ alıp tutun

- DeFi staking: Pasif gelir için staking fırsatlarını değerlendirin

- Ortalama maliyet: Piyasa oynaklığını azaltmak adına düzenli küçük alımlar yapın

Kripto para yatırımları çok yüksek risk taşır ve bu makalede yer alan bilgiler yatırım tavsiyesi değildir. Her yatırımcı kendi risk eşiğine göre dikkatli hareket etmeli ve profesyonel danışmanlık almalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

2030 için REQ fiyat tahmini nedir?

Piyasa trendleri ve büyüme potansiyeline göre, REQ fiyatı ekosistemin genişlemesi ve benimsenmenin artmasıyla 2030’da 5 ila 7 ABD Doları’na erişebilir.

Hangi kriptoda 1000 kat potansiyel var?

REQ (Request Network), yenilikçi ödeme altyapısı ve Web3 alanında artan kullanımı sayesinde 1000 kat büyüme potansiyeline sahip kriptolar arasında yer almaktadır.

Hamster Kombat Coin 1 ABD Doları’na ulaşır mı?

Hamster Kombat Coin’in 1 ABD Doları’na ulaşması düşük olasıdır. Mevcut fiyat ve piyasa değeri dikkate alındığında, bu seviyeye ulaşmak için olağanüstü büyüme ve benimseme gerekir ki, bu da kısa vadede gerçekçi görünmemektedir.

2025’te hangi kripto sıçrama yapacak?

Piyasa eğilimleri ve teknolojik ilerlemeler ışığında, Ethereum (ETH) yaygın kullanımı ve sürekli güncellemeleriyle 2025’te öne çıkabilir.

TRON ($TRX) AUD Fiyatı ve Potansiyeli

2025 AMP Fiyat Tahmini: Flexa'nın Token'ı Dijital Ödeme Ekosisteminde Yeni Zirvelere Ulaşacak mı?

2025 yılında XLM, önde gelen rakipleriyle nasıl bir performans sergiliyor?

Dash, performans ve pazar payı bakımından rakipleriyle nasıl kıyaslanıyor?

XLM Performans ve Pazar Payı Açısından Rakipleriyle Nasıl Karşılaştırılır?

2025 AMP Fiyat Tahmini: Bu kripto para yeni zirvelere ulaşacak mı yoksa piyasa düzeltmesiyle mi karşılaşacak?

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması