2025 PROPrice Prediction: Analyzing Market Trends and Factors Driving Future Valuations

Introduction: PRO's Market Position and Investment Value

Propy (PRO), as a pioneering platform in the real estate industry, has made significant strides since its inception in 2017. By 2025, Propy's market capitalization has reached $43,914,564, with a circulating supply of approximately 57,896,591 tokens and a price hovering around $0.7585. This asset, often referred to as the "blockchain real estate innovator," is playing an increasingly crucial role in revolutionizing property transactions and ownership.

This article will comprehensively analyze Propy's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. PRO Price History Review and Current Market Status

PRO Historical Price Evolution

- 2017: Initial launch, price started at $0.4178

- 2024: Reached all-time high of $3.958 on April 12

- 2025: Hit all-time low of $0.4556 on April 9, followed by recovery

PRO Current Market Situation

As of October 1, 2025, PRO is trading at $0.7585, with a market cap of $43,914,564. The token has experienced a 24-hour decline of 2.84%, but shows a 30-day gain of 4.12%. PRO's current price represents a 80.85% decrease from its all-time high and a 66.48% increase from its all-time low. With a circulating supply of 57,896,591 PRO tokens out of a total supply of 100,000,000, the token has a market dominance of 0.0018%.

Click to view the current PRO market price

PRO Market Sentiment Indicator

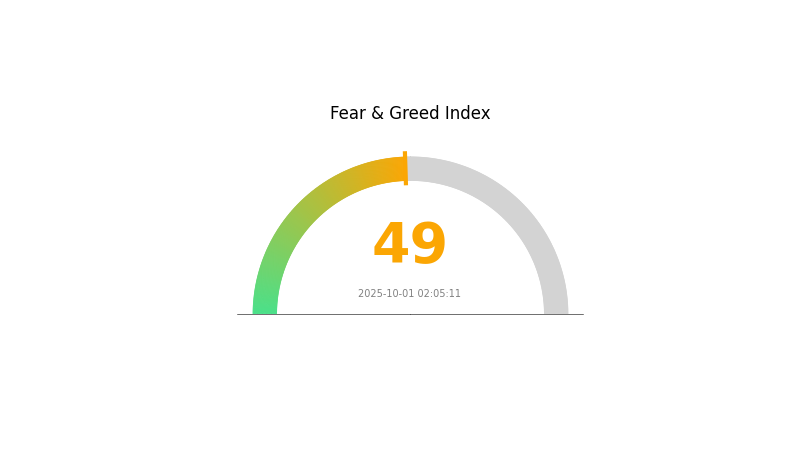

2025-10-01 Fear and Greed Index: 49 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced as we enter October 2025, with the Fear and Greed Index hovering at a neutral 49. This equilibrium suggests investors are neither overly pessimistic nor excessively optimistic about the market's direction. While uncertainty persists, the neutral sentiment could indicate a potential turning point or consolidation phase in the crypto landscape. Traders and investors should remain vigilant, as market conditions can shift rapidly in either direction from this neutral stance.

PRO Holdings Distribution

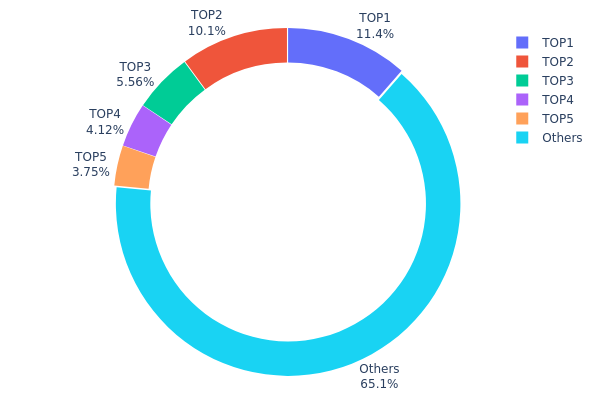

The address holdings distribution data provides crucial insights into the concentration of PRO tokens among different addresses. Based on the provided data, we observe a moderate level of concentration among the top holders. The top 5 addresses collectively hold approximately 34.91% of the total PRO supply, with the largest holder possessing 11.44%.

This distribution pattern suggests a relatively balanced ownership structure, as no single address holds an overwhelming majority of tokens. However, it's worth noting that the top two addresses together control over 21% of the supply, which could potentially influence market dynamics. The remaining 65.09% distributed among other addresses indicates a substantial level of decentralization, potentially contributing to market stability and reducing the risk of price manipulation by any single entity.

While the current distribution doesn't show extreme centralization, it's important to monitor these top holders' activities, as significant movements from these addresses could impact PRO's market price and liquidity. Overall, this distribution reflects a moderately decentralized ecosystem for PRO, balancing between larger stakeholders and a diverse base of smaller holders.

Click to view the current PRO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9708...de40ef | 11440.92K | 11.44% |

| 2 | 0x5da5...d77479 | 10069.67K | 10.06% |

| 3 | 0x860b...04e52f | 5563.53K | 5.56% |

| 4 | 0x0017...f310e9 | 4115.15K | 4.11% |

| 5 | 0x6cc8...07fd21 | 3749.73K | 3.74% |

| - | Others | 65061.00K | 65.09% |

II. Key Factors Influencing PRO's Future Price

Supply Mechanism

- Scarcity: Bitcoin's total supply is limited to 21 million coins, creating a unique scarcity as circulating supply gradually decreases.

- Historical Pattern: Past supply reductions have typically led to price increases.

- Current Impact: The ongoing supply limitation is expected to create favorable conditions for price appreciation as market demand continues to grow.

Institutional and Whale Dynamics

- Institutional Holdings: Bitcoin's institutional adoption rate is rising, partly due to the introduction of Bitcoin ETFs and continued investments from companies like MicroStrategy.

- Corporate Adoption: The launch of ETFs has lowered investment barriers, allowing more traditional investors to access Bitcoin.

- Government Policies: Increasing institutional participation is not only bringing significant capital inflows but also elevating Bitcoin's status as a mainstream financial asset.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and their effects on inflation and currency values will likely influence Bitcoin's perceived value as a hedge.

- Inflation Hedging Properties: Bitcoin is increasingly viewed as a store of value during economic uncertainties, enhancing its appeal in inflationary environments.

- Geopolitical Factors: International tensions and economic instability may drive investors towards Bitcoin as a safe-haven asset.

Technological Development and Ecosystem Building

- ETF Introduction: The launch of Bitcoin ETFs has significantly lowered entry barriers for retail and institutional investors, driving demand growth.

- Mainstream Integration: Bitcoin is gradually being recognized as a mainstream financial asset, strengthening its role as a store of value during economic uncertainties.

- Ecosystem Applications: The growing Bitcoin ecosystem, including Layer 2 solutions and DeFi applications, is expanding its utility and attracting more users.

III. PRO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.43 - $0.60

- Neutral prediction: $0.60 - $0.80

- Optimistic prediction: $0.80 - $0.95 (requires strong market recovery and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential bull market phase

- Price range forecast:

- 2027: $0.76 - $1.19

- 2028: $0.72 - $1.26

- Key catalysts: Broader crypto market recovery, increased institutional adoption, and PRO ecosystem expansion

2029-2030 Long-term Outlook

- Base scenario: $1.05 - $1.30 (assuming steady growth and adoption)

- Optimistic scenario: $1.30 - $1.42 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $1.42+ (extreme positive market conditions and breakthrough use cases)

- 2030-12-31: PRO $1.27 (potential stabilization point after long-term growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.95313 | 0.7625 | 0.43463 | 0 |

| 2026 | 1.098 | 0.85781 | 0.45464 | 13 |

| 2027 | 1.19305 | 0.97791 | 0.76277 | 28 |

| 2028 | 1.25915 | 1.08548 | 0.71641 | 43 |

| 2029 | 1.37161 | 1.17231 | 0.71511 | 54 |

| 2030 | 1.4246 | 1.27196 | 1.05573 | 67 |

IV. PRO Professional Investment Strategies and Risk Management

PRO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors interested in real estate technology

- Operation suggestions:

- Accumulate PRO tokens during market dips

- Stay updated on Propy's development and real estate industry trends

- Store tokens securely in a hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought or oversold conditions

- Key points for swing trading:

- Track real estate market news that may impact PRO's price

- Set stop-loss orders to manage downside risk

PRO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-8% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various real estate-related tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet solution: Use reputable multi-signature wallets

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for PRO

PRO Market Risks

- Volatility: Real estate token market may experience significant price fluctuations

- Liquidity: Lower trading volume compared to major cryptocurrencies

- Competition: Emerging real estate blockchain projects may impact PRO's market share

PRO Regulatory Risks

- Uncertain regulations: Potential changes in cryptocurrency and real estate laws

- Cross-border transactions: Varying legal frameworks in different countries

- Securities classification: Risk of PRO being classified as a security

PRO Technical Risks

- Smart contract vulnerabilities: Potential bugs in the token's underlying code

- Blockchain scalability: Ethereum network congestion may affect transaction speeds

- Integration challenges: Difficulties in implementing blockchain technology in traditional real estate processes

VI. Conclusion and Action Recommendations

PRO Investment Value Assessment

PRO offers long-term potential in revolutionizing the real estate industry through blockchain technology. However, short-term risks include market volatility and regulatory uncertainties.

PRO Investment Recommendations

✅ Beginners: Start with small investments and focus on learning about the real estate tokenization market

✅ Experienced investors: Consider allocating a portion of the portfolio to PRO as part of a diversified crypto strategy

✅ Institutional investors: Conduct thorough due diligence on Propy's technology and market position before significant investments

PRO Trading Participation Methods

- Spot trading: Buy and sell PRO tokens on Gate.com

- Dollar-cost averaging: Regularly purchase small amounts of PRO to mitigate market volatility

- Staking: Participate in staking programs if available to earn passive income

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the prediction for prosper?

Prosper's value is predicted to reach $0.0726 by October 1, 2025, showing a 4.48% increase based on recent technical indicators.

Is prosper crypto a good investment?

Prosper crypto shows promising potential. Forecasts suggest a bullish trend, with positive growth expected in the coming years. It could be a good investment opportunity.

What is Pepe's price prediction for 2025?

Pepe is predicted to trade between $0.0000256 and $0.0000564 in 2025, based on current market trends and analysis.

What crypto has the highest price prediction?

As of 2025, Bitcoin is predicted to have the highest price, followed by Ethereum. These two cryptocurrencies are expected to maintain their leading positions in terms of value and market dominance.

Share

Content