2025 POLYX Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: POLYX's Market Position and Investment Value

Polymesh (POLYX), as an institutional-grade public-permissioned blockchain for regulated assets, has been making significant strides since its inception. As of 2025, Polymesh's market capitalization has reached $103,145,263, with a circulating supply of approximately 1,210,625,158 POLYX tokens, and a price hovering around $0.0852. This asset, often referred to as a "regulatory-compliant blockchain solution," is playing an increasingly crucial role in the realm of regulated financial instruments and securities.

This article will provide a comprehensive analysis of Polymesh's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. POLYX Price History Review and Current Market Status

POLYX Historical Price Evolution

- 2021: POLYX launched in October, initial price fluctuations as the project gained traction

- 2023: Reached all-time high of $0.95 on February 15, marking a significant milestone

- 2025: Market cycle shift, price declined from its peak to the current level

POLYX Current Market Situation

POLYX is currently trading at $0.0852, experiencing a slight 24-hour decline of 0.09%. The token has seen significant downward pressure over various timeframes, with a 1-hour drop of 0.77%, a 7-day decrease of 8.35%, and a substantial 30-day decline of 37%. The long-term trend is also bearish, with a 67% decrease over the past year. POLYX's market capitalization stands at $103,145,263, ranking it 402nd in the cryptocurrency market. The circulating supply is 1,210,625,158 POLYX, with no maximum supply limit. The token's all-time high of $0.95 was achieved on February 15, 2023, while its all-time low of $0.0439 was recorded on October 10, 2025. The current price represents a significant drop from its peak, indicating a challenging market environment for POLYX.

Click to view the current POLYX market price

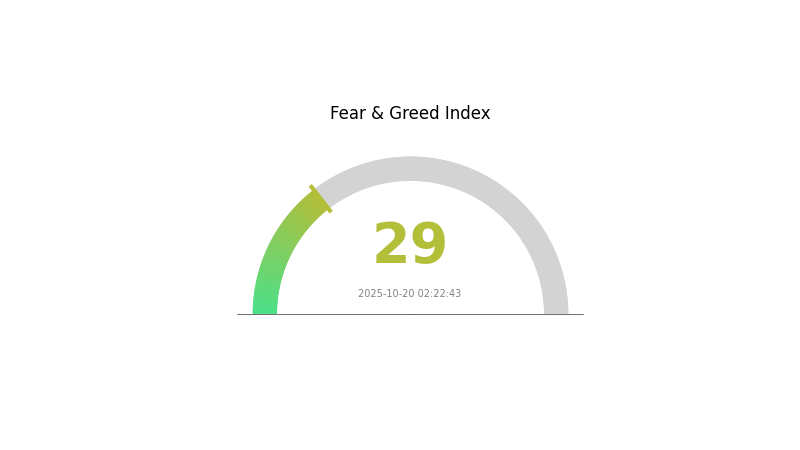

POLYX Market Sentiment Indicator

2025-10-20 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment for POLYX remains cautious as the Fear and Greed Index sits at 29, indicating a state of fear. This suggests investors are hesitant and potentially looking for buying opportunities. However, it's crucial to remember that market sentiment can shift rapidly. Traders should stay informed, manage risks wisely, and consider diversifying their portfolios. As always, thorough research and prudent decision-making are essential in navigating the volatile crypto landscape.

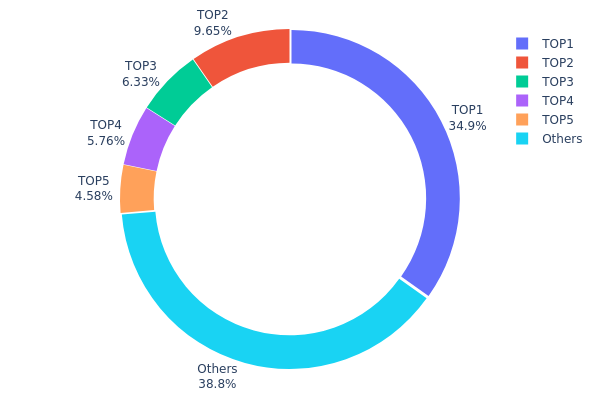

POLYX Holdings Distribution

The address holdings distribution data for POLYX reveals a highly concentrated ownership structure. The top address holds a substantial 34.85% of the total supply, equivalent to 421,980.79K POLYX tokens. The top five addresses collectively control 61.16% of the circulating supply, indicating a significant concentration of wealth and potential influence over the POLYX ecosystem.

This level of concentration raises concerns about market stability and centralization. With such a large portion of tokens held by a small number of addresses, there's an increased risk of price volatility and potential market manipulation. The top holder, in particular, has the capacity to significantly impact the market should they decide to liquidate their position. Furthermore, this concentration may undermine the project's decentralization ethos, as a small group of holders could exert disproportionate influence over governance decisions and network operations.

Overall, the current POLYX holdings distribution suggests a nascent market structure with limited distribution among retail investors. This concentration could pose challenges for long-term stability and may deter broader adoption due to concerns over centralized control. As the project evolves, monitoring changes in this distribution will be crucial for assessing the maturation and decentralization of the POLYX ecosystem.

Click to view the current POLYX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 2DzB6L...QLFUkb | 421980.79K | 34.85% |

| 2 | 2Fd1UG...wfuU83 | 116847.11K | 9.65% |

| 3 | 2H2F5a...N42L3i | 76682.60K | 6.33% |

| 4 | 2DbjUi...JePw6Y | 69740.85K | 5.76% |

| 5 | 2HexZQ...BX7HMq | 55414.90K | 4.57% |

| - | Others | 469958.91K | 38.84% |

II. Key Factors Affecting POLYX's Future Price

Technical Development and Ecosystem Building

- Polymesh Upgrade: Polymesh is planning a major upgrade to enhance security and scalability, which could positively impact POLYX's value.

- Ecosystem Applications: Several DApps focused on tokenized securities and regulatory compliance are being developed on the Polymesh network, potentially increasing demand for POLYX.

III. POLYX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.05107 - $0.07000

- Neutral prediction: $0.07000 - $0.09000

- Optimistic prediction: $0.09000 - $0.10979 (requires strong market recovery)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.08926 - $0.13596

- 2028: $0.09830 - $0.17262

- Key catalysts: Increased adoption of Polymesh blockchain, regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $0.14624 - $0.17257 (assuming steady market growth)

- Optimistic scenario: $0.17947 - $0.19889 (assuming accelerated adoption)

- Transformative scenario: $0.20000 - $0.25000 (assuming major breakthroughs in tokenized securities)

- 2030-12-31: POLYX $0.17257 (102% growth from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.10979 | 0.08511 | 0.05107 | 0 |

| 2026 | 0.11012 | 0.09745 | 0.08088 | 14 |

| 2027 | 0.13596 | 0.10379 | 0.08926 | 21 |

| 2028 | 0.17262 | 0.11987 | 0.0983 | 40 |

| 2029 | 0.19889 | 0.14624 | 0.12284 | 71 |

| 2030 | 0.17947 | 0.17257 | 0.08974 | 102 |

IV. POLYX Professional Investment Strategies and Risk Management

POLYX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Institutional investors and long-term crypto believers

- Operation suggestions:

- Accumulate POLYX during market dips

- Set a 3-5 year investment horizon

- Store in secure cold wallets for long-term holding

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Watch for breakouts above key resistance levels

- Set stop-loss orders to manage risk

POLYX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for POLYX

POLYX Market Risks

- High volatility: Significant price swings common in crypto markets

- Limited liquidity: Potential difficulty in executing large trades

- Market sentiment: Susceptible to rapid shifts in investor sentiment

POLYX Regulatory Risks

- Regulatory uncertainty: Changing global regulations may impact adoption

- Security token classification: Potential for increased scrutiny from regulators

- Cross-border compliance: Challenges in meeting diverse international requirements

POLYX Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability issues: May face challenges as network usage grows

- Interoperability concerns: Integration with other blockchain networks

VI. Conclusion and Action Recommendations

POLYX Investment Value Assessment

POLYX offers long-term potential in the security token space but faces short-term volatility and regulatory uncertainties. Its success depends on widespread adoption and regulatory clarity.

POLYX Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Explore strategic partnerships and larger positions with hedging strategies

POLYX Trading Participation Methods

- Spot trading: Available on Gate.com and other exchanges

- Staking: Participate in network validation for potential rewards

- Security token offerings: Monitor for POLYX-based investment opportunities

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will polygon hit $10?

Yes, Polygon (MATIC) could potentially reach $10 by 2025, driven by increased adoption, network upgrades, and overall crypto market growth.

Does polka dot crypto have a future?

Yes, Polkadot has a promising future. Its innovative interoperability solutions and growing ecosystem position it well for long-term success in the blockchain space.

What is the future of Pepe coin in 2025?

By 2025, Pepe coin may see increased adoption in meme-based NFTs and social tokens, potentially reaching $0.0001 with improved utility and community growth.

Does polygon crypto have a future?

Yes, Polygon (MATIC) has a promising future. Its scalability solutions and growing ecosystem position it well for continued adoption and value growth in the Web3 space.

Share

Content