2025 PNUT Fiyat Tahmini: Kripto Para Biriminin Piyasa Trendleri ve Olası Büyüme Potansiyelinin Analizi

Giriş: PNUT'un Piyasa Konumu ve Yatırım Potansiyeli

Sosyal medya ilhamlı özgün bir kripto para olan Peanut the Squirrel (PNUT), ortaya çıktığı günden bu yana milyonlarca kişinin ilgisini topladı. 2025 yılı itibarıyla PNUT'un piyasa değeri 138.480.459 $’a ulaşmış, dolaşımdaki arzı yaklaşık 999.858.912 token olarak kaydedilmiş ve fiyatı 0,1385 $ civarında seyretmektedir. “Ölümsüz Sincap” olarak adlandırılan bu varlık, devlet müdahalelerine dikkat çekme ve reform taleplerini gündeme taşıma konusunda giderek daha etkin bir rol üstlenmektedir.

Bu makalede, PNUT'un 2025-2030 yılları arasındaki fiyat hareketleri; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler ışığında detaylı şekilde analiz edilecek, yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunulacaktır.

I. PNUT Fiyat Geçmişi ve Güncel Piyasa Durumu

PNUT Tarihsel Fiyat Seyri

- 2024: Proje başlangıcı, 5 Kasım’da fiyat en düşük seviye olan 0,048 $’a indi

- 2024: Hızlı yükseliş, 14 Kasım’da en yüksek seviye olan 2,50119 $’a ulaştı

- 2025: Piyasa düzeltmesiyle fiyat mevcut 0,1385 $ seviyesine geriledi

PNUT Güncel Piyasa Durumu

20 Ekim 2025 itibarıyla PNUT, 0,1385 $ seviyesinden işlem görüyor. Token, son 24 saatte %1,98 artış kaydederken işlem hacmi 390.892,92 $ oldu. PNUT’un piyasa değeri 138.480.459 $ ve genel kripto para sıralamasında 347. sıradadır.

Dolaşımdaki PNUT miktarı 999.858.912,07 token olup, bu toplam arzın %99,99’una karşılık gelmektedir (1.000.000.000 token). Projenin tam seyreltilmiş değeri ise 138.500.000 $’dır.

Son dönemde PNUT fiyatı farklı zaman dilimlerinde aşağıdaki gibi hareket etti:

- 1 saat: +%0,51

- 24 saat: +%1,98

- 7 gün: -%6,85

- 30 gün: -%42,67

- 1 yıl: +%221.556,70

Yıllık artış, kısa vadeli dalgalanmalara rağmen PNUT'un güçlü uzun vadeli büyüme potansiyeline işaret ediyor.

Güncel PNUT piyasa fiyatını görüntüleyin

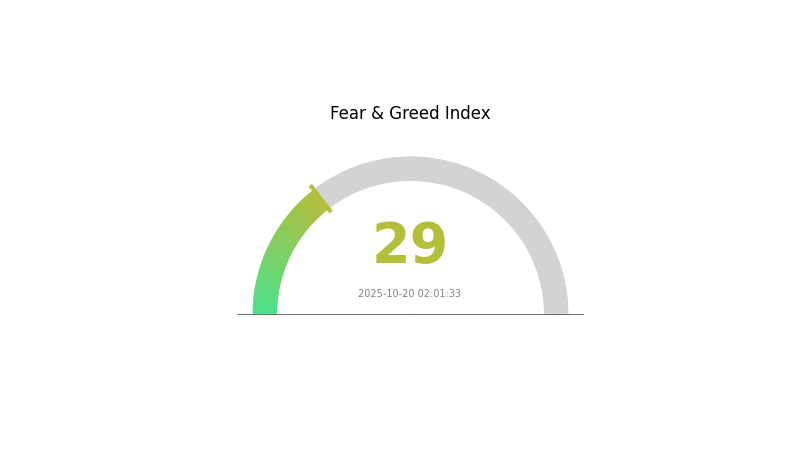

PNUT Piyasa Duyarlılık Endeksi

20 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 29 seviyesinde. Bu durum yatırımcılar arasında temkinli bir atmosfer oluşturuyor ve çoğunluğun çekindiği dönemlerde alım yapanlara fırsat doğurabilir. Ancak piyasa duyarlılığının hızla değişebileceğini akılda tutmak önemli. Yatırımcılar, işlem kararlarını bu göstergenin yanı sıra teknik ve temel analizlere dayanarak vermelidir. Her zaman olduğu gibi, volatil piyasalarda riski yönetmek ve duygusal işlemlerden kaçınmak akıllıcadır.

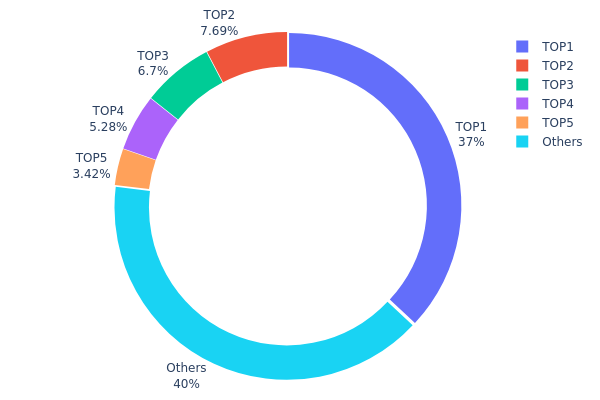

PNUT Token Dağılımı

PNUT adres varlık dağılımı incelendiğinde, tokenlerin büyük kısmının az sayıdaki üst adreste yoğunlaştığı görülüyor. En büyük adres toplam arzın %36,95’ine sahipken, ilk 5 adres PNUT tokenlerinin %60,01’ini kontrol ediyor. Bu yüksek yoğunluk, piyasada merkezi bir sahiplik yapısının varlığını gösteriyor ve fiyat dinamiklerini etkileyebilir.

Yoğunlaşmış dağılım, piyasa manipülasyonu ve fiyat oynaklığı ile ilgili riskleri artırır. En büyük sahip, arzın üçte birinden fazlasını elinde bulundurarak fiyat üzerinde önemli bir etkiye sahip. Büyük sahiplerin alım ya da satım hareketleri fiyat dalgalanmasını yükseltebilir.

Dağılımın mevcut hali, PNUT için düşük merkeziyetsizlik düzeyine işaret ediyor. Tokenlerin %39,99’u küçük adreslerde olsa da, birkaç büyük sahibin hakimiyeti zincir üstü yapısal istikrarı sınırlıyor. Bu tablo, tokenin uzun vadeli sürdürülebilirliği için risk teşkil edebilir ve PNUT'un piyasa dinamiklerini değerlendiren yatırımcılar için önemli bir unsurdur.

Güncel PNUT Varlık Dağılımı için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 9WzDXw...YtAWWM | 369.518,98K | 36,95% |

| 2 | CBEADk...sebkVG | 76.872,99K | 7,68% |

| 3 | 4xLpwx...k99Qdg | 66.943,27K | 6,69% |

| 4 | 3B7XAQ...hhei9z | 52.819,90K | 5,28% |

| 5 | 8Tp9fF...DdeBzG | 34.159,35K | 3,41% |

| - | Diğerleri | 399.537,16K | 39,99% |

II. PNUT’un Gelecek Fiyatını Belirleyen Temel Faktörler

Arz Mekanizması

- Deflasyonist Model: PNUT, toplam arzı kademeli olarak azaltan token yakma mekanizmasını uygulamaktadır.

- Geçmiş Eğilim: Önceki token yakımları, dolaşımdaki arzın azalması nedeniyle genellikle kısa vadeli fiyat artışıyla sonuçlanmıştır.

- Mevcut Etki: Devam eden deflasyonist mekanizma, talebin sabit veya artması halinde PNUT fiyatında yukarı yönlü baskı oluşturabilir.

Kurumsal ve Balina Hareketleri

- Kurumsal Varlıklar: Birçok kripto yatırım şirketinin son dönemde portföyüne PNUT eklemesi, kurumsal ilginin arttığını göstermektedir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: PNUT, geleneksel enflasyon koruma araçlarıyla belirli bir korelasyon sergileyerek yüksek enflasyon dönemlerinde yatırımcıların ilgisini çekebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: PNUT ekosistemi; merkeziyetsiz finans (DeFi) uygulamaları, NFT pazaryerleri ve yönetişim platformlarıyla kullanım alanı ve potansiyel değerini artırmaktadır.

III. 2025-2030 Dönemi PNUT Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,08864 $ - 0,13850 $

- Nötr tahmin: 0,13850 $ - 0,15000 $

- İyimser tahmin: 0,15000 $ - 0,16759 $ (olumlu piyasa koşulları ve artan benimsenme ile)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Artan benimsenmeyle büyüme dönemine geçiş

- Fiyat aralığı öngörüsü:

- 2027: 0,10030 $ - 0,23865 $

- 2028: 0,13171 $ - 0,29223 $

- Temel katalizörler: Teknolojik ilerlemeler, daha geniş piyasa benimsenmesi ve olası iş ortaklıkları

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,24901 $ - 0,28637 $ (istikrarlı piyasa büyümesi ve benimsenme varsayımıyla)

- İyimser senaryo: 0,28637 $ - 0,32372 $ (hızlı benimsenme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,32372 $ - 0,35509 $ (çığır açan kullanım alanları ve yaygın entegrasyon ile)

- 2030-12-31: PNUT 0,35509 $ (çok elverişli koşullarda potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,16759 | 0,1385 | 0,08864 | 0 |

| 2026 | 0,19283 | 0,15304 | 0,14845 | 10 |

| 2027 | 0,23865 | 0,17294 | 0,1003 | 24 |

| 2028 | 0,29223 | 0,2058 | 0,13171 | 48 |

| 2029 | 0,32372 | 0,24901 | 0,18676 | 79 |

| 2030 | 0,35509 | 0,28637 | 0,16323 | 106 |

IV. PNUT Profesyonel Yatırım Stratejileri ve Risk Yönetimi

PNUT Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Sabırlı ve yüksek risk iştahı olanlar

- İşlem önerileri:

- Piyasa geri çekilmelerinde PNUT biriktirin

- Fiyat hedefleri belirleyin ve bunlara sadık kalın

- Güvenli bir Gate Web3 cüzdanında saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve destek/direnç seviyelerini belirlemek için kullanın

- RSI: Aşırı alım/aşırı satım koşullarını izlemek için kullanın

- Dalgalı işlemde dikkat edilmesi gerekenler:

- Kaybı sınırlamak için zarar durdur emirleri kullanın

- Belirlenen seviyelerde kâr alımı gerçekleştirin

PNUT Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli: %1-2

- Agresif: %5-10

- Profesyonel: %10-15

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Farklı kripto paralara yatırım yaparak riski dağıtın

- Zarar durdur emirleri: Potansiyel kayıpları sınırlandırmak için otomatik satış emirleri oluşturun

(3) Güvenli Saklama Seçenekleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdanı

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama aktive edin, güçlü parolalar kullanın

V. PNUT ile İlgili Potansiyel Riskler ve Zorluklar

PNUT Piyasa Riskleri

- Yüksek volatilite: Fiyatlar kısa sürede ciddi şekilde dalgalanabilir

- Likidite riski: Düşük işlem hacmi, çıkışlarda sorun yaratabilir

- Piyasa duyarlılığı: Yatırımcı algısı hızla değişebilir

PNUT Düzenleyici Riskler

- Belirsiz düzenleyici ortam: Sıkı düzenleme ihtimali

- Hukuki statü: Menkul kıymet olarak sınıflandırılma riski

- Vergi etkileri: Değişen vergi mevzuatı yatırım getirilerini etkileyebilir

PNUT Teknik Riskler

- Akıllı kontrat açıkları: Sömürü veya hata riski mevcut

- Ağ tıkanıklığı: Yoğun kullanımda yüksek işlem ücretleri

- Ölçeklenme sorunları: Solana ağında sınırlı işlem kapasitesi

VI. Sonuç ve Eylem Önerileri

PNUT Yatırım Potansiyeli Değerlendirmesi

PNUT, yüksek risk-yüksek getiri fırsatı sunuyor. Meme coin kimliği ve sosyal medya etkisi hızlı büyüme potansiyeli sağlarken, aynı zamanda yatırımcıları ciddi volatilite ve düzenleyici belirsizliklere maruz bırakıyor.

PNUT Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Portföyünüzün yalnızca küçük bir kısmını ayırın ya da hiç yatırım yapmayın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle spekülatif yatırım olarak değerlendirin ✅ Kurumsal yatırımcılar: Dikkatli olun, kapsamlı durum tespiti yapın

PNUT İşlem Yöntemleri

- Spot al-sat: Gate.com’da PNUT alım-satımı yapın

- Staking: Uygun programlarda staking’e katılın

- DeFi: Solana ağında merkeziyetsiz finans seçeneklerini inceleyin

Kripto para yatırımları çok yüksek risk taşır, bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli kararlar almalı ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

PNUT coin iyi bir yatırım mı?

PNUT coin, Web3 ekosisteminde büyüme potansiyeli sunuyor. Yenilikçi özellikleri ve artan benimsenmesi, kripto piyasasında umut vadeden bir yatırım fırsatı oluşturabilir.

PNUT 5 $’a ulaşır mı?

Evet, PNUT, Web3 sektöründe artan benimsenme ve piyasa büyümesiyle 2025 yılına kadar 5 $ seviyelerine ulaşabilir.

Bir PNUT coin en fazla ne kadar yükselebilir?

Piyasa trendleri ve potansiyel büyüme göz önüne alındığında PNUT, 2026 yılında 0,50 $ - 1 $ aralığına ulaşabilir; iyimser senaryolarda uzun vadede 2-3 $ seviyeleri öngörülebilir.

PNUT kripto değeri artar mı?

Evet, PNUT kripto para biriminin değeri artma eğilimindedir. Web3 ekosistemi büyüdükçe ve merkeziyetsiz finans çözümlerine talep arttıkça, PNUT’un kullanım alanı ve benimsenmesi önümüzdeki yıllarda fiyatını yukarı taşıyabilir.

Kripto 2025'te Yeniden Yükselir mi?

2025 SHIB Fiyat Tahmini: Yükseliş Hareketi mi Yoksa Düzeltici Bir Geri Çekilme mi Geliyor?

FLOKI'nin Token Ekonomik Modeli Nedir ve Nasıl Değişim Gösterir?

FLOKI'nin teknik dokümanının asıl mantığı nedir ve bu durum, projenin temel dinamiklerine nasıl yansır?

Gate'deki xStocks: TSLAx ve NVDAx Satın Alma Kılavuzu 2025

Ethereum Gaz Ücretleri Açıklanmıştır

Dijital Sanat Oluşturma: NFT Üretiminde Öne Çıkan Yapay Zekâ Araçları

Kripto Parada Proof of Reserve'ın Anlaşılması

Ethereum Katman 2 Çözümlerini Keşfetmek: Optimism'e Odaklanma

Ethereum İşlem Maliyetlerini Azaltmaya Yönelik Etkin Stratejiler

NFT Nadirliğinde Uzmanlaşma: Puanlama ve Değerleme İçin Kapsamlı Rehber