2025 PNG Fiyat Tahmini: Gelişen NFT Pazarında Dijital Varlık Değer Trendleri Üzerine Öngörüler

Giriş: PNG'nin Piyasa Konumu ve Yatırım Potansiyeli

Pangolin (PNG), Avalanche ağında faaliyet gösteren merkeziyetsiz borsa (DEX) olarak, kuruluşundan bu yana DeFi alanında önemli bir konuma ulaşmıştır. 2025 itibarıyla Pangolin’in piyasa değeri 27.315.287 ABD doları, dolaşımdaki token miktarı yaklaşık 224.373.971 ve fiyatı 0,12174 ABD doları seviyesinde işlem görmektedir. “Avalanche’ın Uniswap’ı” olarak nitelendirilen bu varlık, Avalanche ekosisteminde merkeziyetsiz alım-satım ve likidite sağlama süreçlerinde giderek daha stratejik bir rol üstlenmektedir.

Bu makalede, Pangolin’in 2025-2030 dönemindeki fiyat hareketleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler ışığında detaylı şekilde incelenerek; yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunuyoruz.

I. PNG Fiyat Geçmişi ve Güncel Piyasa Durumu

PNG Fiyat Tarihçesi

- 2021: PNG, 19 Şubat 2021’de 18,85 ABD dolarıyla tüm zamanların en yüksek seviyesine ulaşarak önemli bir dönüm noktası yaşadı.

- 2023: Token, 25 Ekim 2023’te 0,01180712 ABD dolarıyla en düşük seviyesini gördü ve belirgin bir piyasa düzeltmesi yaşadı.

- 2025: 04 Ekim 2025 itibarıyla PNG 0,12174 ABD doları fiyatından işlem görüyor; bu, en düşük seviyesinden toparlanma gösterse de zirvesinden oldukça uzakta.

PNG Güncel Piyasa Durumu

PNG, kripto para piyasasında şu anda 963. sırada ve fiyatı 0,12174 ABD doları. Son 24 saatte %0,15’lik hafif bir düşüş yaşanırken, işlem hacmi 87.412,4992567 ABD doları seviyesindedir. Mevcut piyasa değeri 27.315.287,22954 ABD doları olup, dolaşımdaki PNG miktarı 224.373.971 adettir. Toplam arz ise 538.000.000 PNG ile sınırlıdır.

PNG’nin son fiyat trendleri dönemsel olarak karmaşık bir tablo sergilemektedir. Son bir saatte %0,67, son 24 saatte %0,15 oranında gerileme yaşanırken; son bir haftada %0,08’lik hafif bir yükseliş kaydedilmiştir. Son 30 günde %11,86, son bir yılda ise %48,96 oranında belirgin değer kayıpları görülmüştür.

Mevcut fiyat, tüm zamanların en yüksek seviyesine göre ciddi bir gerilemeye işaret etmektedir; PNG şu anda zirve değerinin yaklaşık %0,65’i üzerinden işlem görmektedir. Yine de token, en düşük seviyesinin oldukça üzerinde kalmayı başarmıştır.

Güncel PNG piyasa fiyatını görüntülemek için tıklayın.

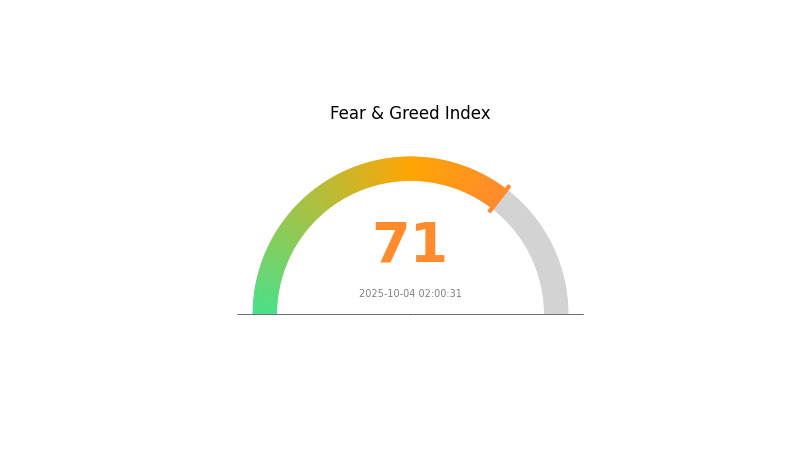

PNG Piyasa Duyarlılığı Göstergesi

04 Ekim 2025 Korku & Açgözlülük Endeksi: 71 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın.

Kripto piyasasında şu anda açgözlülük göstergeleri oldukça güçlü; Korku & Açgözlülük Endeksi 71 seviyesine ulaşmış durumda. Bu yüksek seviye, yatırımcıların iyimserliğinin arttığını ve fiyatların yükselebileceğini gösteriyor. Ancak aşırı açgözlülük genellikle piyasa düzeltmelerinden önce görüldüğü için temkinli olmak gerekir. Gate.com’daki profesyonel yatırımcılar bu göstergeleri yakından izleyerek, yükseliş fırsatlarını değerlendirmeye çalışırken olası geri dönüşlere karşı stratejilerini dengeliyor. Kripto piyasalarında çeşitlendirme ve risk yönetimi her zaman büyük önem taşır.

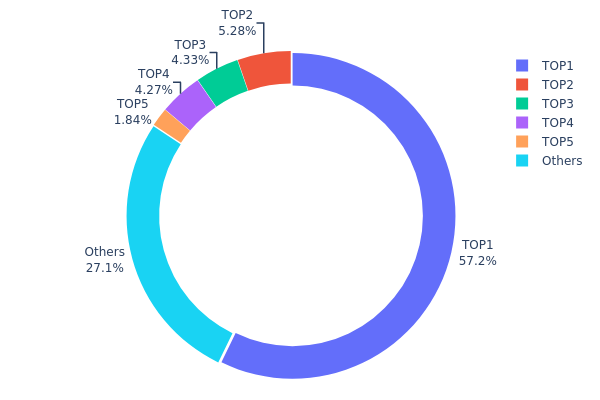

PNG Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, PNG’de son derece yoğunlaşmış bir sahiplik yapısını gösteriyor. En büyük adres toplam arzın %57,19’unu elinde bulunduruyor ve bu, yüksek merkezileşme görülüyor. Sonraki dört büyük adresin toplam payı %15,69’a ulaşıyor; böylece ilk beş adresin elindeki toplam miktar arzın %72,88’ine denk geliyor.

Bu yoğunlaşma düzeyi piyasa istikrarı ve olası fiyat manipülasyonu riskleri için önemli endişeler yaratır. Tek bir adresin arzın yarısından fazlasını kontrol etmesi, bu varlıkların satılması veya başka bir yere taşınması halinde piyasada ciddi dalgalanmalara yol açabilir. Yüksek yoğunlaşma, PNG’nin mevcut piyasa yapısının birkaç büyük oyuncunun hareketlerine bağlı olarak ani fiyat değişimlerine açık olduğunu gösteriyor.

Bu dağılım, PNG’de merkeziyetsizliğin düşük olduğunu gösteriyor. Kripto projeleri genellikle ağ güvenliği ve kullanıcı katılımı için yaygın dağılımı hedeflerken, PNG’nin mevcut yapısı daha merkezi bir sahiplik modelini yansıtıyor. Bu durum, projenin uzun vadeli stratejisinde ele alınmazsa yönetim kararları ve ekosistem gelişimi üzerinde etkili olabilir.

Güncel PNG Varlık Dağılımı için tıklayın.

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x6747...12acee | 307.726,03K | 57,19% |

| 2 | 0xfccd...1dfe91 | 28.394,09K | 5,27% |

| 3 | 0x88af...a0135b | 23.274,96K | 4,32% |

| 4 | 0xcff2...36a827 | 22.968,22K | 4,26% |

| 5 | 0x650f...a72358 | 9.900,00K | 1,84% |

| - | Diğerleri | 145.736,70K | 27,12% |

II. PNG’nin Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Merkez Bankası Altın Alımları: Merkez bankalarının altın alım eğilimi, altın piyasasında belirleyici olmaya devam ediyor. Dolarizasyonun azalması ve jeopolitik gerilimler, merkez bankalarının altın alımlarını sürdüreceğini gösteriyor.

- Tarihsel Model: Geçmişte merkez bankası alımlarındaki artış, arz-talep dinamiklerini değiştirerek altın fiyatlarını desteklemiştir.

- Güncel Etki: Merkez bankalarının süregelen altın biriktirme eğilimi, yakın vadede altın fiyatlarına yapısal destek sağlayacaktır.

Kurumsal ve Büyük Sahip Dinamikleri

- Kurumsal Varlıklar: Küresel altın yatırım talebi güçlü seyrini korurken, 2025’te Avrupa ve ABD’li yatırımcıların varlıklarında artış öngörülmektedir.

- Kurumsal Benimseme: Bu bağlamda özel bir bilgiye yer verilmemiştir.

- Ulusal Politikalar: Jeopolitik gerilimler ve dolarizasyonun azaltılması yönündeki politikalar, ülkelerin altın rezervlerini artırmasına yol açmaktadır.

Makroekonomik Ortam

- Para Politikası Etkisi: ABD Merkez Bankası’nın faiz kararları ve enflasyon yönetimi altın fiyatlarını önemli ölçüde etkiler. 2025 için olası faiz indirimleri beklentisi, altın fiyatlarını destekleyebilir.

- Enflasyon Riskine Karşı Koruma: Altın, enflasyona karşı koruma aracı olarak güçlü talep görmektedir. Özellikle ABD’de süren enflasyon endişeleri nedeniyle altına olan talebin yüksek kalacağı öngörülmektedir.

- Jeopolitik Unsurlar: Farklı bölgelerdeki jeopolitik gerilimler altını güvenli liman varlığı olarak cazip kılmaktadır.

Teknik Gelişmeler ve Ekosistem Oluşumu

- Yatırım Araçlarının Evrimi: Altına dayalı finansal ürünlerin, özellikle ETF’lerin yaygınlaşması piyasaya erişimi ve oynaklığı artırmıştır.

- Piyasa Yapısı Değişiklikleri: Altın piyasasında fiyatlama ve katılımcı yapılarındaki değişim, geleneksel analiz modellerinin fiyat hareketlerini tahmin etmede eskisi kadar etkili olmamasına neden olmuştur.

III. PNG 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,11321 - 0,12173 ABD doları

- Tarafsız tahmin: 0,12173 - 0,14486 ABD doları

- İyimser tahmin: 0,14486 - 0,16799 ABD doları (olumlu piyasa algısı gerektirir)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Olası büyüme dönemi

- Fiyat aralığı öngörüleri:

- 2027: 0,10828 - 0,2099 ABD doları

- 2028: 0,17318 - 0,22213 ABD doları

- Temel katalizörler: Benimsenme artışı, teknolojik ilerleme

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,19493 - 0,24315 ABD doları (istikrarlı piyasa büyümesi)

- İyimser senaryo: 0,24315 - 0,28110 ABD doları (güçlü piyasa performansı)

- Dönüştürücü senaryo: 0,28110 - 0,29907 ABD doları (çığır açıcı gelişmeler)

- 31 Aralık 2030: PNG 0,29907 ABD doları (potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,16799 | 0,12173 | 0,11321 | 0 |

| 2026 | 0,18832 | 0,14486 | 0,12023 | 18 |

| 2027 | 0,2099 | 0,16659 | 0,10828 | 36 |

| 2028 | 0,22213 | 0,18824 | 0,17318 | 54 |

| 2029 | 0,2811 | 0,20519 | 0,19493 | 68 |

| 2030 | 0,29907 | 0,24315 | 0,17993 | 99 |

IV. PNG Yatırımı İçin Profesyonel Stratejiler ve Risk Yönetimi

PNG Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Sabırlı ve yüksek risk toleransı olanlar

- Uygulama önerileri:

- Piyasa geri çekilmelerinde PNG biriktirmek

- Kısmi kar realizasyonu için fiyat hedefleri belirlemek

- PNG’yi güvenli, gözetimsiz bir cüzdanda saklamak

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli ortalamalar: Trend tespiti için

- RSI (Göreceli Güç Endeksi): Aşırı alım/ aşırı satım noktalarını belirlemek için

- Volatil piyasalar için dikkat edilmesi gereken noktalar:

- PNG’nin Avalanche ekosistemiyle korelasyonunu takip etmek

- DEX kullanım istatistiklerine ve likidite trendlerine dikkat etmek

PNG Risk Yönetimi Çerçevesi

(1) Portföy Dağılımı İlkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Aggresif yatırımcı: Kripto portföyünün %5-10’u

- Profesyonel yatırımcı: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: PNG’yi diğer DeFi ve DEX tokenları ile dengelemek

- Stop-loss emirleri: Potansiyel kayıpları sınırlandırmak için uygulamak

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate.com Web3 Cüzdanı

- Soğuk cüzdan: Uzun vadeli yatırımlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama, güçlü şifre kullanımı

V. PNG için Potansiyel Riskler ve Zorluklar

PNG Piyasa Riskleri

- Oynaklık: Küçük hacimli tokenlarda sık görülen yüksek fiyat dalgalanmaları

- Likidite: Sınırlı işlem hacmi, büyük işlemlerde zorluk yaratabilir

- Rekabet: Avalanche ekosisteminde gelişen yeni DEX’ler Pangolin’in pazar payını tehdit edebilir

PNG Düzenleyici Riskler

- DEX düzenlemeleri: Merkeziyetsiz borsalara yönelik olası düzenleyici incelemeler

- Token sınıflandırması: PNG’nin farklı ülkelerdeki hukuki statüsüne dair belirsizlikler

- Zincirler arası uyumluluk: Ethereum ve Avalanche ağlarında düzenlemelere uyum zorlukları

PNG Teknik Riskler

- Akıllı kontrat açıkları: Pangolin kodunda potansiyel hata veya istismar riski

- Ölçeklenebilirlik sorunları: Avalanche ağında olası tıkanıklıkların Pangolin performansına etkisi

- Uyumluluk zorlukları: Zincirler arası işlevsellikte oluşabilecek riskler

VI. Sonuç ve Eylem Önerileri

PNG Yatırım Değeri Değerlendirmesi

PNG, büyüyen Avalanche ekosistemi ve DEX pazarına erişim imkânı sunar. Ancak, ciddi rekabet ve düzenleyici belirsizliklerle karşı karşıyadır. Token’ın uzun vadeli değeri, Pangolin’in inovasyon ve pazar payı kazanma kapasitesine bağlı olacaktır.

PNG Yatırım Tavsiyeleri

✅ Yatırım yapmadan önce kapsamlı araştırma yapılmalı ve küçük, çeşitlendirilmiş pozisyonlar tercih edilmelidir ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle maliyet ortalaması stratejisi uygulanmalı ✅ Kurumsal yatırımcılar: PNG’yi geniş DeFi ve DEX token sepetinin bir parçası olarak değerlendirin

PNG Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com ve diğer destekli borsalarda işlem yapabilirsiniz

- Likidite sağlama: Pangolin’in likidite havuzlarına katılarak getiri elde edebilirsiniz

- Yönetim (Governance): PNG tokenları ile Pangolin DAO oylamalarında yer alabilirsiniz

Kripto para yatırımları son derece yüksek risk taşır. Bu makale yatırım tavsiyesi niteliği taşımaz. Yatırımcılar kendi risk toleranslarına göre karar vermeli. Profesyonel finansal danışmanlara danışmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayınız.

Sıkça Sorulan Sorular

PNG alınır mı?

Son dönemdeki performansına göre PNG cazip bir yatırım olmayabilir. Token %2,06 değer kaybetmiş ve hareketli ortalamalar satış sinyali vermektedir. 3,33 ABD doları fiyat seviyesinde düşük performans göstermekte ve kısa vadede bu eğilim sürebilir.

PNG tokenı için fiyat tahmini nedir?

PNG tokenı için 2026 fiyat tahmini 4,92 Kanada doları olup, beklentiler 4,00 ile 6,00 Kanada doları arasında değişmektedir.

Babygrok için 2025 fiyat tahmini nedir?

Babygrok’un fiyatının Kasım 2025’te 0,0126404 ABD dolarına ulaşması bekleniyor; yıl ortalaması ise 0,0126693 ABD dolarıdır. Tahmin eğilimi nötrdür.

PNG kripto ne kadar değerli?

04 Ekim 2025 itibarıyla PNG kripto token başına 0,122267 ABD doları değerindedir. Son 24 saatte fiyat %2,73 düştü ve piyasa değeri sıralamasında #380. sıradadır.

MYX Token Fiyatı ve 2025'te Gate.com'daki Piyasa Analizi

2025 VVS Fiyat Tahmini: Kripto Yatırımcılarına Yönelik Piyasa Analizi ve Geleceğe Bakış

2025 DODO Fiyat Tahmini: DeFi Tokeninin Gelecekteki Değerine Yönelik Büyüme Potansiyeli ve Piyasa Faktörlerinin Analizi

BMEX ve UNI: Kripto türev işlemleri ve merkeziyetsiz borsa alanında lider alım-satım platformlarının karşılaştırılması

SUPE ve SNX: Sentetik Varlık Alanında Performans ve Potansiyel Karşılaştırması

GRAIL ile BAT: Kanser Tespit Teknolojisinde Devrim Yarışı

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması