2025 PENG Price Prediction: Bullish Outlook as DeFi Adoption Accelerates

Introduction: PENG's Market Position and Investment Value

PENG (PENG), as a meme token inspired by penguins, has made a notable impact in the cryptocurrency market since its inception. As of 2025, PENG's market capitalization stands at $971,900, with a circulating supply of 100,000,000 tokens and a price hovering around $0.009719. This asset, often referred to as the "Penguin-themed meme coin," is primarily gaining traction in the social token and community engagement sectors.

This article will provide a comprehensive analysis of PENG's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. PENG Price History Review and Current Market Status

PENG Historical Price Evolution

- 2024: Project launch, price reached all-time high of $1.2 on March 18

- 2025: Market correction, price dropped to all-time low of $0.00532 on October 10

PENG Current Market Situation

As of October 29, 2025, PENG is trading at $0.009719. The token has experienced significant volatility over the past year, with a 94.17% decrease in price. However, it has shown some recovery in the short term, with a 21.27% increase over the past week. The 24-hour trading volume stands at $28,088.52, indicating moderate market activity. PENG's market capitalization is currently $971,900, ranking it at 2,888 in the global cryptocurrency market. The circulating supply matches the total supply of 100,000,000 PENG tokens, suggesting no additional tokens will be released in the future.

Click to view the current PENG market price

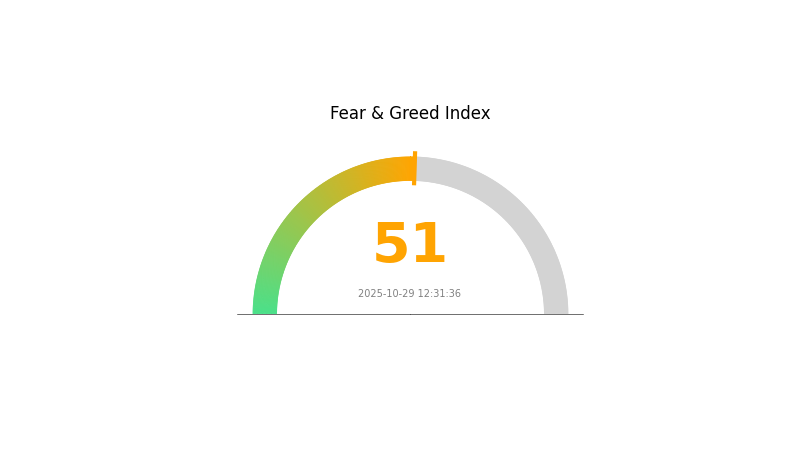

PENG Market Sentiment Indicator

2025-10-29 Fear and Greed Index: 51 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index at 51, indicating a neutral outlook. This equilibrium suggests investors are neither overly pessimistic nor excessively optimistic. Such a neutral stance often presents opportunities for careful analysis and strategic decision-making. Traders on Gate.com may find this an ideal time to reassess their portfolios and consider both potential risks and rewards in the current market climate.

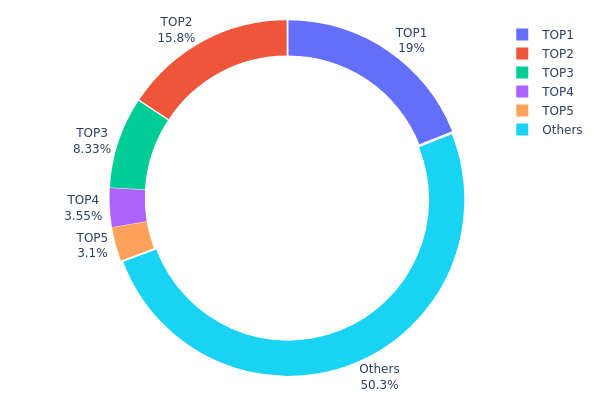

PENG Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of PENG tokens among different addresses. Analysis of this data reveals a relatively high concentration of tokens in the top addresses. The top 5 addresses collectively hold 49.67% of the total PENG supply, with the largest holder possessing 18.95% of the tokens.

This level of concentration raises concerns about potential market manipulation and price volatility. The top two addresses alone control over one-third of the supply, which could significantly impact market dynamics if large quantities are moved or sold. However, it's worth noting that 50.33% of the tokens are distributed among numerous other addresses, indicating a degree of decentralization among smaller holders.

The current distribution structure suggests a market that is susceptible to whale influence but maintains a substantial base of smaller investors. This balance between large holders and a diverse group of smaller participants could contribute to market stability, provided the major holders maintain their positions. Monitoring changes in these top addresses will be crucial for assessing the ongoing health and decentralization of the PENG ecosystem.

Click to view the current PENG Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 18947.03K | 18.95% |

| 2 | ASTyfS...g7iaJZ | 15758.23K | 15.76% |

| 3 | u6PJ8D...ynXq2w | 8326.78K | 8.32% |

| 4 | D5jx4w...e1nw8p | 3544.39K | 3.54% |

| 5 | A77HEr...oZ4RiR | 3103.94K | 3.10% |

| - | Others | 50290.60K | 50.33% |

II. Key Factors Influencing PENG's Future Price

Macroeconomic Environment

- Impact of Monetary Policy: Major central banks' policies, especially the Federal Reserve's interest rate decisions, are expected to significantly influence PENG prices.

- Inflation Hedging Properties: PENG has shown resilience in inflationary environments, potentially serving as a hedge against inflation.

- Geopolitical Factors: International tensions and trade disputes, such as the 2025 U.S. tariff impacts, can drive capital flows into PENG as a safe-haven asset.

Technical Developments and Ecosystem Building

- ETF Approval: The approval of PENG ETFs in early 2024 has reduced its correlation with tech stocks and increased its similarity to gold as an inflation hedge.

- Ecosystem Applications: PENG is increasingly being adopted in DeFi and other blockchain-based applications, expanding its utility beyond just a store of value.

III. PENG Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00787 - $0.00971

- Neutral forecast: $0.00971 - $0.01049

- Optimistic forecast: $0.01049 - $0.01127 (requires favorable market conditions)

2026-2027 Outlook

- Market phase expectation: Gradual growth phase

- Price range prediction:

- 2026: $0.00766 - $0.0108

- 2027: $0.00745 - $0.01288

- Key catalysts: Increased adoption and potential technological improvements

2028-2030 Long-term Outlook

- Base scenario: $0.01118 - $0.01516 (assuming steady market growth)

- Optimistic scenario: $0.01516 - $0.01690 (assuming strong market performance)

- Transformative scenario: $0.01690 - $0.02122 (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: PENG $0.02122 (potential peak price under highly favorable conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01127 | 0.00971 | 0.00787 | 0 |

| 2026 | 0.0108 | 0.01049 | 0.00766 | 7 |

| 2027 | 0.01288 | 0.01065 | 0.00745 | 9 |

| 2028 | 0.01506 | 0.01177 | 0.01118 | 21 |

| 2029 | 0.0169 | 0.01341 | 0.00791 | 38 |

| 2030 | 0.02122 | 0.01516 | 0.00864 | 55 |

IV. PENG Professional Investment Strategy and Risk Management

PENG Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a high appetite for volatility

- Operation suggestions:

- Accumulate PENG tokens during price dips

- Set a long-term price target based on project developments

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversal points

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key points for swing trading:

- Monitor social media sentiment and community engagement

- Set strict stop-loss orders to manage downside risk

PENG Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple meme coins and established cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for PENG

PENG Market Risks

- High volatility: Meme coins are subject to extreme price swings

- Limited utility: Lack of real-world use cases may impact long-term value

- Market saturation: Competition from other meme coins could dilute investor interest

PENG Regulatory Risks

- Increased scrutiny: Regulators may target meme coins for investor protection

- Trading restrictions: Some jurisdictions may limit or ban trading of meme coins

- Tax implications: Unclear tax treatment in many countries

PENG Technical Risks

- Smart contract vulnerabilities: Potential for exploitation if security flaws are present

- Network congestion: High transaction volumes could lead to delays on the Solana network

- Wallet compatibility: Limited support from some wallets due to SPL-20 token standard

VI. Conclusion and Action Recommendations

PENG Investment Value Assessment

PENG offers high-risk, high-reward potential typical of meme coins. While it has shown significant price movements, its long-term value proposition remains speculative. Short-term risks include extreme volatility and regulatory uncertainty.

PENG Investment Recommendations

✅ Newcomers: Consider small, experimental positions only if comfortable with high risk ✅ Experienced investors: Implement strict risk management and consider as part of a diversified crypto portfolio ✅ Institutional investors: Approach with caution, conduct thorough due diligence before any allocation

PENG Trading Participation Methods

- Spot trading: Available on Gate.com and other supported exchanges

- Limit orders: Use to enter positions at desired price levels

- Dollar-cost averaging: Regular small purchases to mitigate volatility risk

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is PENG a good investment?

PENG shows strong potential with an A grade for growth and B for momentum. Its solid performance metrics suggest it could be a promising investment in the current market.

Is PENG a buy, sell, or hold?

Based on current analyst recommendations, PENG is primarily considered a buy. Most experts view it as a strong buy, with some suggesting to buy or hold.

What is the future price target for PENG?

The future price target for PENG is projected to be $26.57, with estimates ranging from $23.00 to $30.00 based on analyst predictions.

What is the price prediction for Pengu in 2050?

Based on long-term analysis, Pengu's price is predicted to reach $0.0075 by 2050, with a potential range between $0.0071 and $0.0084.

Share

Content