2025 PAIN Fiyat Tahmini: Dijital varlık için piyasa trendleri ve potansiyel büyüme faktörlerinin analizi

Giriş: PAIN’in Piyasa Konumu ve Yatırım Değeri

PAIN (PAIN), OG meme efsanesi “Hide the Pain Harold”ın resmi memecoin’i olarak, blokzincir üzerinde acı ifadesiyle öne çıkmaktadır. 2025 yılı itibarıyla, PAIN’in piyasa değeri 3.805.899,40 $’a ulaşırken, dolaşımdaki arzı yaklaşık 3.499.999,45 token ve fiyatı 1,0874 $ civarında seyretmektedir. “Blokzincir acı ifadesi” olarak bilinen bu varlık, meme coin ve dijital varlık ekosisteminde giderek daha önemli bir rol üstlenmektedir.

Bu makalede, PAIN’in 2025-2030 dönemindeki fiyat eğilimleri; tarihsel desenler, piyasa arz ve talebi, ekosistem gelişimi ve makroekonomik ortam ile bütüncül olarak analiz edilerek, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. PAIN Fiyat Geçmişi ve Mevcut Piyasa Durumu

PAIN Tarihsel Fiyat Gelişimi

- 2025 (Şubat): PAIN, 22,5 $ ile tüm zamanların en yüksek seviyesine ulaşıp memecoin için önemli bir eşik oluşturdu.

- 2025 (Haziran): Token, sert bir düşüşle 0,8873 $’a gerileyerek tarihinin en düşük seviyesini gördü.

- 2025 (Ekim): PAIN, piyasa dalgalanmalarını yansıtan fiyat hareketleriyle toparlanma sinyalleri vermeye başladı.

PAIN Güncel Piyasa Durumu

12 Ekim 2025 itibarıyla PAIN, 1,0874 $ seviyesinden işlem görüyor ve 24 saatlik işlem hacmi 16.194,07 $. Token, son 24 saatte %9,23’lük bir değer kaybı yaşayarak kısa vadede ayı piyasasına işaret ediyor. Son bir haftada PAIN %23,71 oranında gerilerken, 30 günlük performans ise %27,70’lik negatif bir değişim gösteriyor.

PAIN’in mevcut piyasa değeri 3.805.899,40 $ olup, küresel kripto para piyasasında 1.888. sırada yer almaktadır. Dolaşımdaki 3.499.999,45 PAIN token, toplam arzın %35’ini oluşturmaktadır ve projenin tam seyreltilmiş değeri 10.874.000 $ olarak hesaplanmaktadır.

PAIN’in piyasa hakimiyeti %0,00028 seviyesindedir ve bu, genel kripto piyasasında küçük bir konuma işaret eder. 20 Şubat 2025’te ulaşılan 22,5 $’lık tarihi zirve, mevcut fiyatın çok üzerinde olup, piyasa koşulları iyileşirse büyüme potansiyelini göstermektedir.

Güncel PAIN piyasa fiyatını görüntülemek için tıklayın

PAIN Piyasa Duyarlılığı Göstergesi

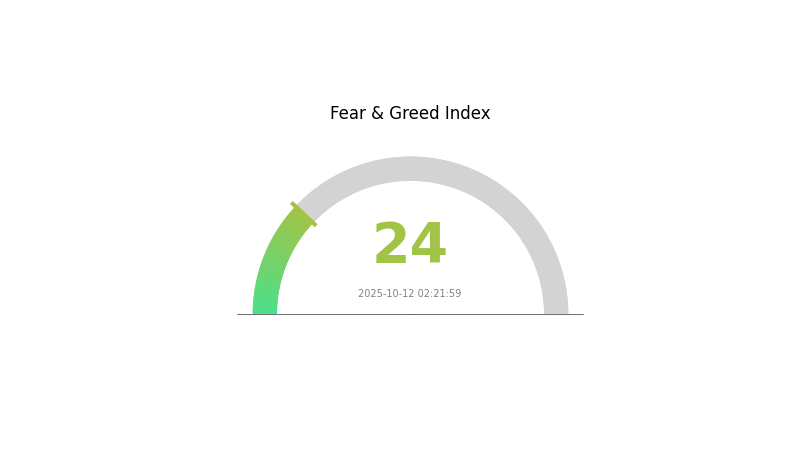

2025-10-12 Korku ve Açgözlülük Endeksi: 24 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında şu anda aşırı korku hakim ve Korku ve Açgözlülük Endeksi 24’e gerilemiş durumda. Bu, yatırımcılar arasında ciddi bir kötümserliğe işaret ederken, aksi pozisyonda olanlar için alım fırsatı yaratabilir. Ancak piyasa duyarlılığının hızla değişebileceği unutulmamalı; yatırımcıların portföylerini çeşitlendirmesi ve risk yönetimi uygulaması önerilir. Bu dalgalı ortamda yatırım kararı almadan önce piyasa trendlerini ve temel gelişmeleri yakından takip etmek büyük önem taşır.

PAIN Varlık Dağılımı

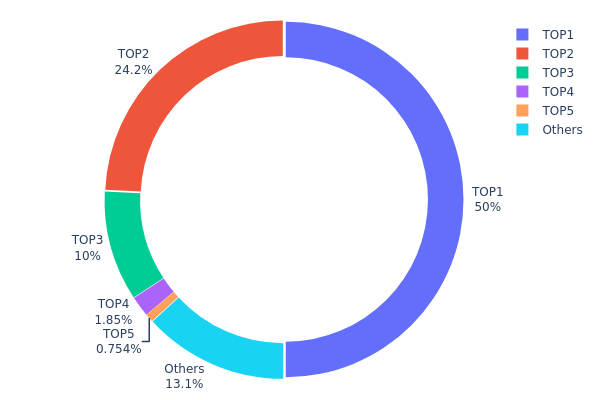

Adres bazlı dağılım verileri, PAIN token’larının farklı cüzdanlar arasında nasıl toplandığını gösterir. Analizler, yüksek yoğunluklu bir dağılımı ortaya koymaktadır. En büyük adres toplam arzın %50’sini, ikinci ve üçüncü büyük adresler ise sırasıyla %24,24 ve %10’unu elinde bulunduruyor. İlk üç adres, toplam tokenların %84,24’ünü kontrol etmektedir.

Bu yoğunlaşma, piyasa merkezileşmesi ve fiyat manipülasyonu riskini artırır. Tokenların büyük bir bölümü az sayıdaki adreste toplandığı için, bu büyük sahiplerin satış yapması halinde piyasada ciddi oynaklık yaşanabilir. Ayrıca bu yapı, tokenın likiditesi ve piyasa istikrarı üzerinde de etkili olabilir.

Mevcut dağılım, PAIN için düşük derecede merkeziyetsizlik göstermektedir. Bu durum kısa vadede bir miktar istikrar sağlayabilir; ancak uzun vadede büyüme ve benimseme önünde engel oluşturabilir. Yatırımcılar ve traderlar, PAIN’in piyasa dinamiklerini ve gelecek potansiyelini değerlendirirken bu yoğunlaşmayı dikkate almalıdır.

Güncel PAIN varlık dağılımını görüntülemek için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 5aSAxR...L3Q4dG | 5.000,00K | 50,00% |

| 2 | CopraA...br8zRZ | 2.424,41K | 24,24% |

| 3 | 6pREzW...GfECra | 1.000,00K | 10,00% |

| 4 | 5r2kwp...EAq1Bv | 185,18K | 1,85% |

| 5 | 7NzK7A...RfBciS | 75,44K | 0,75% |

| - | Diğerleri | 1.314,90K | 13,16% |

II. PAIN’in Gelecek Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Piyasa Duyarlılığı: PAIN’in fiyatı, özellikle meme coin ekosisteminde piyasa psikolojisinden yoğun şekilde etkilenir. Olumlu haber eksikliği ve azalan topluluk aktivitesi, fiyat üzerinde aşağı yönlü baskı oluşturabilir.

- Tarihsel Desen: Meme coin’ler, yüksek oynaklıkları ile bilinir ve piyasa duygusuna ve gündem olaylarına karşı hassastır.

- Mevcut Durum: Son dönemde kayda değer pozitif gelişmelerin olmaması ve topluluk etkileşiminin azalması, PAIN’in fiyatındaki düşüşte etkili olmuştur.

Kurumsal ve Whale Aktivitesi

- İşlem Hacmi: PAIN’in fiyat hareketlerini ve işlem hacmini izlemek kritik önemdedir. İstikrarlı fiyatlara eşlik eden kademeli işlem hacmi artışı, ileriye dönük pozitif işaret olarak görülebilir.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankalarının faiz oranları ve enflasyon hedeflerine yönelik adımları, kripto piyasasını ve PAIN’i dolaylı olarak etkileyebilir.

- Jeopolitik Faktörler: Özellikle petrol piyasalarını etkileyen uluslararası gelişmeler, genel piyasa psikolojisini ve kripto fiyatlarını etkileyebilir.

Teknik Gelişim ve Ekosistem Oluşturma

- Proje Ekibi İnovasyonu: PAIN’in geleceği, proje ekibinin sürekli inovasyon ve ekosistemi geliştirme yeteneğine bağlıdır.

- Topluluk Katılımı: PAIN topluluğundaki aktivite ve coşku, token’ın değeri ve benimsenmesinde belirleyicidir.

III. 2025-2030 PAIN Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,88 $ - 1,09 $

- Tarafsız tahmin: 1,09 $ - 1,30 $

- İyimser tahmin: 1,30 $ - 1,48 $ (güçlü piyasa ivmesi gerektirir)

2027 Orta Vadeli Görünüm

- Piyasa aşaması: Olası büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: 0,80 $ - 1,72 $

- 2027: 0,95 $ - 2,04 $

- Temel katalizörler: Benimsemede artış ve teknolojik gelişmeler

2030 Uzun Vadeli Görünüm

- Temel senaryo: 2,14 $ - 2,61 $ (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 2,61 $ - 3,21 $ (olumlu piyasa koşullarında)

- Dönüştürücü senaryo: 3,21 $+ (çok olumlu piyasa şartlarında)

- 2030-12-31: PAIN 3,21 $ (potansiyel zirve)

| 年份 | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 1,48009 | 1,0883 | 0,88152 | 0 |

| 2026 | 1,72082 | 1,28419 | 0,7962 | 18 |

| 2027 | 2,04341 | 1,50251 | 0,94658 | 38 |

| 2028 | 2,49987 | 1,77296 | 1,20561 | 63 |

| 2029 | 3,07644 | 2,13641 | 1,19639 | 96 |

| 2030 | 3,2059 | 2,60643 | 1,64205 | 139 |

IV. PAIN Yatırımı için Profesyonel Strateji ve Risk Yönetimi

PAIN Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profiller: Yüksek oynaklık toleransı olan riskli yatırımcılar

- Uygulama önerileri:

- PAIN’e uzun vadede düzenli alımlarla giriş yapın (dolar-maliyet ortalaması)

- Kısmi kar realizasyonu için fiyat hedefleri belirleyin

- Token’ları güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- RSI (Göreceli Güç Endeksi): Aşırı alım/satım noktalarını tespit edin

- Hareketli Ortalamalar: Trend belirleme ve giriş/çıkış noktaları için kullanın

- Swing trading için ana noktalar:

- Sosyal medya duyarlılığını izleyerek olası fiyat hareketlerini öngörün

- Riskleri sınırlamak için katı stop-loss emirleri belirleyin

PAIN Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-2’si

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları farklı meme coin’ler ve ana akım kripto varlıklar arasında dağıtın

- Opsiyon stratejileri: Düşüş riskine karşı put opsiyonu kullanmayı değerlendirin

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan: Gate web3 cüzdanı tercih edin

- Soğuk depolama: Uzun vadeli tutum için donanım cüzdanına transfer edin

- Güvenlik önlemleri: İki faktörlü doğrulama, benzersiz şifreler ve düzenli yazılım güncellemeleri uygulayın

V. PAIN İçin Olası Riskler ve Zorluklar

PAIN Piyasa Riskleri

- Yüksek oynaklık: Meme coin’lerde sıkça görülen aşırı fiyat dalgalanmaları

- Likidite riski: Büyük işlemlerde kayma riski ve likidite sorunları

- Piyasa duyarlılığı değişimleri: Yatırımcı psikolojisindeki hızlı değişimlerin ani fiyat hareketlerine yol açması

PAIN Düzenleyici Riskler

- Artan denetim: Meme coin’lere yönelik düzenleyici baskı riski

- İşlem kısıtlamaları: Bazı platformlarda meme coin işlemlerine getirilebilecek sınırlamalar

- Vergisel belirsizlik: Meme coin kazançlarının farklı ülkelerdeki vergilendirme şeklinin net olmaması

PAIN Teknik Riskler

- Akıllı kontrat açıkları: Token’ın altyapısında potansiyel güvenlik riskleri

- Ağ tıkanıklığı: Solana ağındaki sorunların işlem hızı ve maliyetine etkisi

- Cüzdan uyumluluğu: Farklı kripto cüzdanlarda kısıtlı destek

VI. Sonuç ve Eylem Önerileri

PAIN Yatırım Değeri Değerlendirmesi

PAIN, güçlü topluluk desteğiyle yüksek risk ve yüksek getiri potansiyeline sahip bir meme coin’dir. Uzun vadeli değeri belirsizliğini korurken, kısa vadeli fiyat oynaklığı hem fırsatlar hem de riskler sunmaktadır.

PAIN Yatırım Önerileri

✅ Yeni başlayanlar: Portföyünüzde küçük bir pay ayırın, önceliği eğitime verin ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle kısa vadeli işlemleri değerlendirin ✅ Kurumsal yatırımcılar: Dikkatli yaklaşın, yalnızca çeşitlendirilmiş bir kripto stratejisi içinde yer verin

PAIN İşlem Katılım Yöntemleri

- Spot işlem: Gate.com’da PAIN token alım-satımı

- Vadeli işlem: Desteklenen platformlarda dikkatle kaldıraçlı işlem

- Staking: Proje veya borsalar tarafından sunuluyorsa staking fırsatlarını değerlendirin

Kripto para yatırımları çok yüksek risk içerir. Bu makaledeki bilgiler yatırım tavsiyesi değildir. Yatırım kararınızı kendi risk toleransınıza göre verin ve profesyonel mali danışmanlara danışın. Kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

Pi Coin 100 $’a ulaşabilir mi?

Pi Coin’in 100 $ seviyesine ulaşması pek olası değildir. Büyük arzı ve mevcut piyasa koşulları göz önünde bulundurulduğunda, daha gerçekçi bir uzun vadeli fiyat hedefi cent veya düşük dolar seviyelerinde olacaktır.

2025’te 1 Pi ne kadar olacak?

Mevcut öngörülere göre 2025’te 1 Pi Coin’in maksimum fiyatı yaklaşık 0,26 $ seviyesinde beklenmektedir.

Hamster Kombat Coin 1 $’ı görebilir mi?

1 $ seviyesine ulaşması mümkün ancak kesin değildir. Analistler, güçlü topluluk desteği ve oyun ilgisiyle 2025’te 0,67 $ seviyesini görebileceğini tahmin ediyor.

Pi ileride değerli olacak mı?

Pi’nin potansiyel değeri var ancak belirsizliğini koruyor. Şu anki düşük fiyatı, daha geniş benimseme ve piyasa talebiyle yükselebilir. Gelecekteki değeri, projenin gelişimi ve genel kripto piyasası eğilimlerine bağlıdır.

kripto neden çöküyor ve toparlanacak mı?

2025 BRETT Fiyat Tahmini: Gelecek Piyasa Eğilimleri, Karşılaşılabilecek Zorluklar ve Büyüme Potansiyelinin Analizi

2025 DADDY Fiyat Tahmini: Bu Gelişen Token İçin Yükseliş Eğilimi ve Öne Çıkan Büyüme Faktörleri

2025 HOUSE Fiyat Tahmini: Pandemi Sonrası Dünyada Gayrimenkul Sektöründe Yol Haritası

2025 PATRIOT Fiyat Tahmini: Kripto Para Birimi İçin Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

MOG Token'ın likiditesi ve elde tutma yoğunluğu, fiyat oynaklığını nasıl etkiler?

Cysic: AI ve Dağıtık Hesaplama için Sıfır Bilgi Altyapı Platformu

ABD Bankacılık Düzenleyicisi OCC, ulusal bankaların kripto para ticareti yapmasını kolaylaştırıyor

ASTER Spot İşlem Rehberi: Anlık Fiyat Analizi ve İşlem Hacmi Bilgileri

Cantor Equity ile birleşmenin ardından Twenty One Capital Bitcoin hissesi yüzde 25 değer kaybetti

Dropee Günlük Kombinasyonu 10 Aralık 2025