2025 PAI Price Prediction: Analyzing Market Trends and Future Growth Potential in the Digital Asset Space

Introduction: PAI's Market Position and Investment Value

ParallelAI (PAI), as a pioneering force in AI development and GPU optimization, has been transforming the landscape of artificial intelligence since its inception. As of 2025, ParallelAI's market capitalization stands at $8,118,000, with a circulating supply of 100,000,000 tokens, and a price hovering around $0.08118. This asset, often referred to as the "AI-Blockchain Synergy Token," is playing an increasingly crucial role in democratizing AI innovation and optimizing GPU utilization globally.

This article will provide a comprehensive analysis of ParallelAI's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. PAI Price History Review and Current Market Status

PAI Historical Price Evolution Trajectory

- 2024: Project launch, price reached all-time high of $1.518 on December 12

- 2025: Market correction, price dropped to all-time low of $0.03475 on June 21

- 2025: Recent recovery, price currently at $0.08118 as of October 9

PAI Current Market Situation

PAI is currently trading at $0.08118, down 11.59% in the last 24 hours. The token has experienced significant volatility, with a 24-hour trading range between $0.08051 and $0.09553. Over the past week, PAI has declined by 24.97%, and it's down 36.54% over the last 30 days. The current market capitalization stands at $8,118,000, with a circulating supply of 100,000,000 PAI tokens. Despite recent downtrends, PAI has shown a 133.61% increase from its all-time low in June 2025, indicating some market recovery.

Click to view the current PAI market price

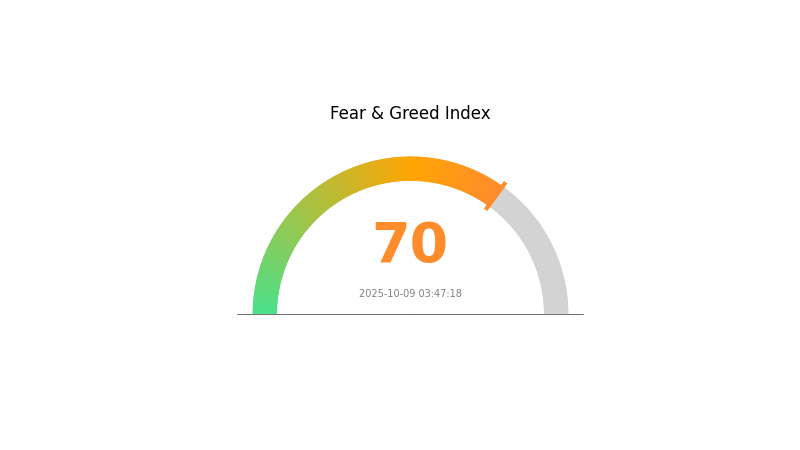

PAI Market Sentiment Indicator

2025-10-09 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a surge of optimism, with the Fear and Greed Index reaching 70, indicating a state of greed. This high level of enthusiasm suggests investors are becoming increasingly confident in the market's potential. However, it's crucial to remain cautious during such periods of heightened optimism. Historically, extreme greed has often preceded market corrections. Traders should consider diversifying their portfolios and setting stop-loss orders to protect their gains. As always, thorough research and risk management are essential in navigating the volatile crypto landscape.

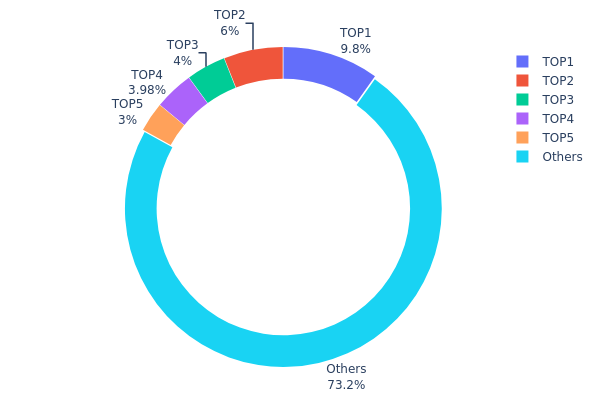

PAI Holdings Distribution

The address holdings distribution data provides insight into the concentration of PAI tokens among different wallet addresses. Analysis of this data reveals that the top 5 addresses collectively hold 26.78% of the total PAI supply, with the largest single address controlling 9.80%. This distribution pattern indicates a moderate level of concentration, as no single entity holds an overwhelmingly large portion of the tokens.

The current distribution structure suggests a relatively balanced market, with 73.22% of tokens spread among numerous smaller holders. This diversification helps mitigate the risk of market manipulation by any single large holder. However, the presence of several significant holders (each with 3-10% of the supply) could still potentially influence market dynamics, particularly if they were to coordinate their actions or make large transactions simultaneously.

Overall, the PAI token distribution reflects a reasonable degree of decentralization, which is generally positive for market stability and resistance to unilateral control. The presence of a substantial "Others" category indicates a healthy level of retail participation, contributing to liquidity and potentially more organic price discovery.

Click to view the current PAI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3cc9...aecf18 | 9803.18K | 9.80% |

| 2 | 0xe94e...11e717 | 6000.00K | 6.00% |

| 3 | 0x39f6...a86a47 | 4000.00K | 4.00% |

| 4 | 0x24b8...320817 | 3981.40K | 3.98% |

| 5 | 0x3440...b9e1d1 | 3000.00K | 3.00% |

| - | Others | 73215.42K | 73.22% |

II. Key Factors Influencing Future PAI Prices

Supply Mechanism

- Central Bank Purchases: Central banks' continuous gold purchases provide solid support for prices. Global central banks have been buying over 1,000 tonnes of gold annually since 2022, with an expected purchase of 900 tonnes this year.

- Historical Pattern: Central bank purchases have historically been a strong indicator of price trends.

- Current Impact: Ongoing central bank buying is expected to continue supporting PAI prices in the near term.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions are increasing their gold allocations due to economic uncertainties.

- Corporate Adoption: Some corporations are diversifying reserves into gold as a hedge against inflation and currency risks.

Macroeconomic Environment

- Monetary Policy Impact: Expectations of looser monetary policies from major economies could support PAI prices.

- Inflation Hedging Properties: PAI continues to be seen as an inflation hedge, attracting investors during periods of high inflation.

- Geopolitical Factors: Ongoing geopolitical tensions and conflicts are driving safe-haven demand for PAI.

Technical Development and Ecosystem Building

- Supply Chain Improvements: Advancements in gold supply chain tracking and transparency could increase confidence in PAI.

- Tokenization: The growing trend of tokenizing gold assets may increase accessibility and liquidity in the PAI market.

III. PAI Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.073 - $0.08

- Neutral forecast: $0.08 - $0.085

- Optimistic forecast: $0.085 - $0.09043 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.08474 - $0.12662

- 2028: $0.09845 - $0.15502

- Key catalysts: Increasing adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.13 - $0.15 (assuming steady market growth)

- Optimistic scenario: $0.15 - $0.17 (assuming strong market performance)

- Transformative scenario: $0.17 - $0.18 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: PAI $0.17233 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.09043 | 0.08296 | 0.073 | 2 |

| 2026 | 0.1127 | 0.08669 | 0.05115 | 6 |

| 2027 | 0.12662 | 0.0997 | 0.08474 | 22 |

| 2028 | 0.15502 | 0.11316 | 0.09845 | 39 |

| 2029 | 0.15554 | 0.13409 | 0.13007 | 65 |

| 2030 | 0.17233 | 0.14482 | 0.13034 | 78 |

IV. Professional PAI Investment Strategies and Risk Management

PAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and AI technology enthusiasts

- Operational advice:

- Accumulate PAI tokens during market dips

- Stay updated on Parallel AI's technological advancements

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor AI industry news for potential price catalysts

PAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple AI-related tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for PAI

PAI Market Risks

- High volatility: AI token market subject to rapid price swings

- Competition: Emergence of rival AI blockchain projects

- Adoption uncertainty: Pace of real-world integration of AI and blockchain tech

PAI Regulatory Risks

- Uncertain regulations: Evolving global stance on AI and crypto assets

- Compliance challenges: Potential issues with data privacy and AI governance

- Cross-border restrictions: Varying international regulations on AI technologies

PAI Technical Risks

- Scalability concerns: Potential limitations in handling increased network load

- Security vulnerabilities: Risks associated with smart contract flaws

- Technological obsolescence: Rapid advancements in AI may outpace development

VI. Conclusion and Action Recommendations

PAI Investment Value Assessment

PAI presents a unique value proposition in the intersection of AI and blockchain. Long-term potential is significant given the growing AI industry, but short-term volatility and adoption challenges pose risks.

PAI Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading ✅ Institutional investors: Explore strategic partnerships and larger positions based on thorough due diligence

PAI Trading Participation Methods

- Spot trading: Direct purchase and holding of PAI tokens

- DCA strategy: Regular small purchases to average out price volatility

- Staking: Participate in staking programs if offered by Parallel AI platform

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much will be 1 pi in 2025?

Based on market analysis, 1 PI is expected to trade between $500 and $520 in 2025.

Will pi hit 10 dollars?

It's possible but uncertain. Pi's price could rise significantly after mainnet launch, potentially reaching $10. Market trends and network development will be key factors in determining its future value.

How much will Pi coin cost in 2026?

Based on current trends and analyses, Pi coin is predicted to cost between $0.60 and $1.20 in 2026. However, exact future prices are uncertain.

How much is 1 pi worth in 2030?

In 2030, 1 pi is projected to be worth around $4.50 to $6.00, depending on continued adoption and ecosystem growth.

Share

Content