2025 PACE Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

Introduction: PACE's Market Position and Investment Value

3Space Art (PACE), as a virtual platform for digital art accessibility, has been making strides in the NFT and digital collectibles space since its inception. As of 2025, PACE has a market capitalization of $455,964.79, with a circulating supply of approximately 66,024,441.66 tokens, and a price hovering around $0.006906. This asset, often referred to as a "digital art enabler," is playing an increasingly crucial role in enhancing the exposure and management of digital art and collectibles.

This article will provide a comprehensive analysis of PACE's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. PACE Price History Review and Current Market Status

PACE Historical Price Evolution

- 2024: Project launched, price reached ATH of $0.30074 on July 30

- 2025: Market downturn, price dropped to ATL of $0.003294 on August 3

- 2025: Recent recovery, price increased by 41.46% in the past 30 days

PACE Current Market Situation

As of October 30, 2025, PACE is trading at $0.006906. The token has experienced a slight decline of 1.31% in the past 24 hours and a more significant drop of 7.48% over the past week. However, it has shown strong performance over the past month with a 41.46% increase. The current price represents a substantial 80.15% decrease from its value one year ago.

PACE has a circulating supply of 66,024,441.66 tokens, which is 66.02% of its total supply of 100,000,000 tokens. The current market capitalization stands at $455,964.79, with a fully diluted valuation of $690,600.00. The token's 24-hour trading volume is $19,994.42, indicating moderate market activity.

The token's all-time high of $0.30074 was achieved on July 30, 2024, while its all-time low of $0.003294 was recorded on August 3, 2025. This price history suggests significant volatility in PACE's market performance over the past year.

Click to view the current PACE market price

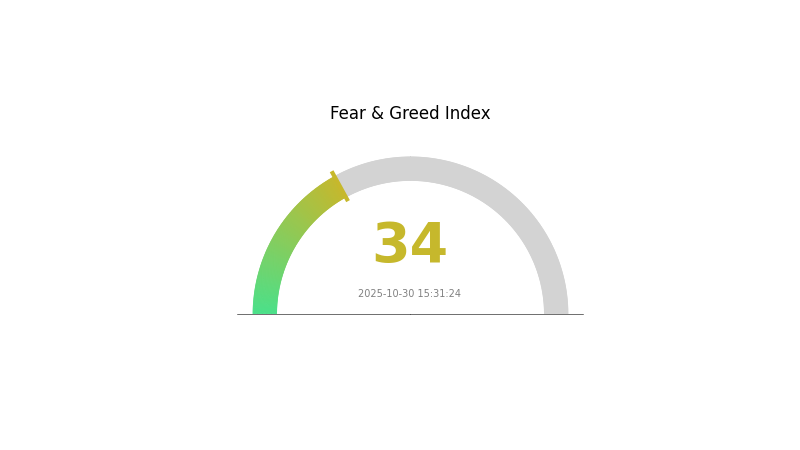

PACE Market Sentiment Indicator

2025-10-30 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by fear, as indicated by the PACE sentiment index. With a reading of 34, investors are showing significant caution. This fearful sentiment often presents potential buying opportunities for long-term investors, as assets may be undervalued. However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Keep an eye on market trends and remember that sentiment can shift rapidly in the volatile crypto space.

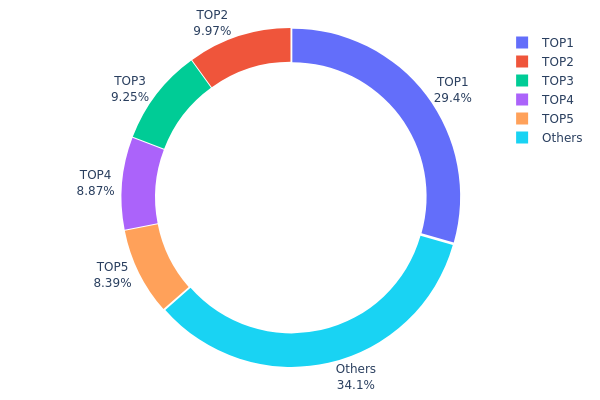

PACE Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of PACE tokens among different wallet addresses. Analysis of this data reveals a significant concentration of PACE tokens in a small number of addresses. The top address holds 29.40% of the total supply, while the top five addresses collectively control 65.85% of all PACE tokens.

This high concentration level raises concerns about potential market manipulation and price volatility. With such a large portion of tokens held by a few addresses, any significant movement or liquidation from these wallets could have a substantial impact on PACE's market price and trading volume. Furthermore, this concentration may indicate a lower level of decentralization within the PACE ecosystem, potentially affecting its governance structure and overall market stability.

However, it's worth noting that 34.15% of PACE tokens are distributed among other addresses, suggesting some level of wider distribution. This broader holding base could provide a degree of market resilience and help mitigate some of the risks associated with high concentration. Nonetheless, the current distribution pattern warrants close monitoring by investors and market participants to assess potential future impacts on PACE's market dynamics and overall ecosystem health.

Click to view the current PACE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 29408.89K | 29.40% |

| 2 | 0x1fb6...357ea9 | 9968.49K | 9.96% |

| 3 | 0x43c8...148cca | 9252.73K | 9.25% |

| 4 | 0x2a3d...ca2ede | 8869.71K | 8.86% |

| 5 | 0x5708...1685a1 | 8387.14K | 8.38% |

| - | Others | 34113.03K | 34.15% |

II. Key Factors Affecting PACE's Future Price

Macroeconomic Environment

-

Impact of Monetary Policy: Major central banks, especially the Federal Reserve, are expected to continue their tight monetary policy. The aggressive interest rate hikes have led to a continuous tightening of global liquidity, which could impact PACE's price.

-

Inflation Hedging Properties: Core PCE inflation remains above the 2% target, with the past 12 months showing a 4.7% core PCE inflation rate. This persistent high inflation environment could influence PACE's performance as a potential hedge.

-

Geopolitical Factors: The Russia-Ukraine conflict has led to significant increases in commodity prices, affecting global economic stability. This geopolitical tension could impact PACE's value as investors seek safe-haven assets.

Technical Development and Ecosystem Building

-

Automotive Industry Trends: The PACE framework for the automotive industry in 2040 reveals four major trends: Polarization (growth in China/Global South markets), Automation (40% L4 penetration rate), Connectivity (75% V2X coverage rate), and Electrification (68% BEV share). These long-term trends could influence PACE's adoption and value.

-

Battery Technology: Advancements in battery technology are crucial for the widespread adoption of electric vehicles. This factor could significantly impact PACE's price, especially if it's related to the automotive or energy storage sectors.

-

Supply Chain Improvements: The easing of supply chain bottlenecks could affect demand and potentially influence PACE's price. This is particularly relevant if PACE is connected to industries reliant on global supply chains.

III. PACE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00388 - $0.00600

- Neutral prediction: $0.00600 - $0.00700

- Optimistic prediction: $0.00700 - $0.00755 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00771 - $0.01171

- 2028: $0.00977 - $0.01203

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.01100 - $0.01300 (assuming steady market growth)

- Optimistic scenario: $0.01300 - $0.01524 (assuming strong market performance)

- Transformative scenario: $0.01524+ (extreme favorable conditions)

- 2030-12-31: PACE $0.01200 (potential stabilization point)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00755 | 0.00693 | 0.00388 | 0 |

| 2026 | 0.0105 | 0.00724 | 0.00644 | 4 |

| 2027 | 0.01171 | 0.00887 | 0.00771 | 28 |

| 2028 | 0.01203 | 0.01029 | 0.00977 | 48 |

| 2029 | 0.01283 | 0.01116 | 0.00658 | 61 |

| 2030 | 0.01524 | 0.012 | 0.0096 | 73 |

IV. PACE Professional Investment Strategies and Risk Management

PACE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operational advice:

- Accumulate PACE tokens during market dips

- Set clear long-term price targets

- Store tokens securely in a hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor NFT market trends closely

- Set strict stop-loss and take-profit levels

PACE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple digital art projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage option: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, avoid sharing private keys

V. Potential Risks and Challenges for PACE

PACE Market Risks

- High volatility: Digital art market subject to rapid price swings

- Limited liquidity: Potential difficulty in executing large trades

- Market sentiment: Susceptible to changes in NFT popularity

PACE Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting NFTs

- Tax implications: Evolving tax laws may impact NFT transactions

- Copyright issues: Potential legal challenges related to digital art ownership

PACE Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying technology

- Scalability concerns: Ethereum network congestion may affect transactions

- Interoperability challenges: Potential difficulties in cross-platform NFT transfers

VI. Conclusion and Recommended Actions

PACE Investment Value Assessment

PACE presents a high-risk, high-reward opportunity in the digital art and NFT space. Long-term value lies in the potential growth of the NFT market, while short-term risks include high volatility and regulatory uncertainties.

PACE Investment Recommendations

✅ Beginners: Consider small, exploratory investments to understand the NFT market ✅ Experienced investors: Implement a balanced approach with defined risk management ✅ Institutional investors: Conduct thorough due diligence and consider strategic partnerships

PACE Participation Methods

- Direct purchase: Buy PACE tokens on Gate.com

- NFT acquisition: Participate in 3Space Art NFT auctions or secondary markets

- Staking: Explore potential staking options if available on the platform

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is Pepe's price prediction for 2025?

Based on current market trends, Pepe's price is predicted to reach $0.057132 by October 2025, showing no significant changes from its current value.

Will SLP coin reach $1?

It's unlikely SLP will reach $1 without major changes to the game's economics. Current market trends suggest this price target is improbable.

Can ICP reach $1000?

Yes, ICP can potentially reach $1000 if market conditions are favorable and its adoption grows significantly. This would require a substantial increase from its current price.

Which AI is best for stock price prediction?

DDG-DA + TFT combo is highly regarded, offering reliable long-term stock price forecasts.

Share

Content