2025 OM Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: OM'nin Piyasa Konumu ve Yatırım Potansiyeli

MANTRA (OM), güvenliği ön planda tutan bir RWA Layer 1 blokzinciri olarak, 2020'deki kuruluşundan bu yana dikkat çekici gelişmeler göstermektedir. 2025 yılı itibarıyla MANTRA’nın piyasa değeri 130.526.528 $’a ulaşmış, yaklaşık 1.091.358.933 dolaşımdaki token ile fiyatı 0,1196 $ seviyesinde seyretmektedir. “Regülasyon uyumlu blokzincir çözümü” olarak anılan bu varlık, kurumsal blokzincir uygulamaları alanında giderek daha önemli bir konuma gelmektedir.

Bu makalede, 2025-2030 döneminde MANTRA’nın fiyat trendlerine; geçmiş veriler, piyasa arz ve talebi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı bir analiz sunulacak, yatırımcılar için profesyonel fiyat tahminleri ve pratik yatırım stratejileri paylaşılacaktır.

I. OM Fiyat Geçmişi ve Piyasa Durumu

OM Fiyatının Tarihsel Gelişimi

- 2020: İlk çıkış, fiyatı 0,2 $ ile başladı

- 2023: Piyasa düşüşü, fiyatı 0,01726188 $ ile en düşük seviyeye indi

- 2025: Boğa piyasası, fiyatı 8,99 $ ile tüm zamanların en yüksek değerine ulaştı

OM Güncel Piyasa Görünümü

20 Ekim 2025 itibarıyla OM, 0,1196 $ seviyesinden işlem görüyor ve 24 saatlik işlem hacmi 346.121,85 $. Son 24 saatte token %0,08’lik hafif bir yükseliş yaşadı. OM’nin piyasa değeri 130.526.528 $ olup, kripto piyasasında 358. sırada yer alıyor.

Fiyat performansı zaman dilimlerine göre değişkenlik göstermiştir. Son bir haftada %7,58 yükseliş yaşanırken, son bir ayda ve yılda sırasıyla %43,56 ve %92,06 oranında sert düşüşler görülmüştür. Bu tablo, kısa vadede bir toparlanma olsa da uzun vadeli düşüş eğiliminin sürdüğünü göstermektedir.

OM’nin güncel fiyatı, 23 Şubat 2025’te görülen 8,99 $’lık zirvenin oldukça altında; bu da güçlü bir düzeltmeye işaret etmektedir. VIX endeksinin 29 seviyesinde olması, yatırımcıların hâlâ endişeli olduğunu göstermektedir.

Güncel OM piyasa fiyatını görmek için tıklayın

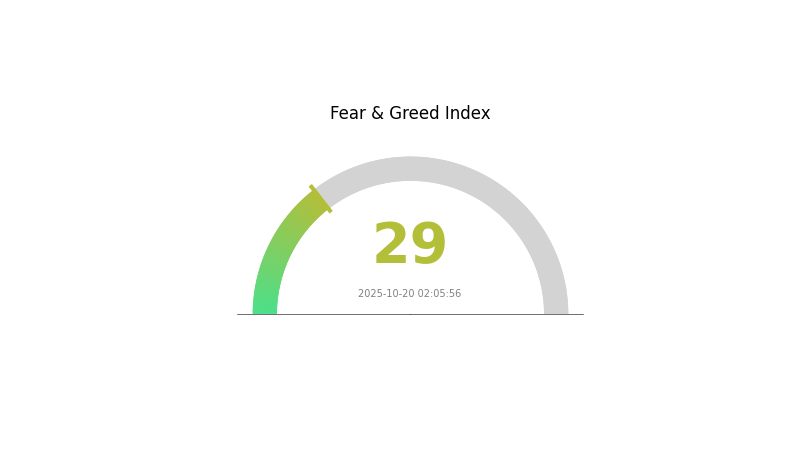

OM Piyasa Duyarlılığı Göstergesi

2025-10-20 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda korku hakim. Endeksin 29 olması, yatırımcıların temkinli davrandığını ve ters strateji uygulayanlar için potansiyel bir alım fırsatı doğduğunu gösteriyor. Ancak, piyasa koşulları hızla değişebilir. Yatırımcıların detaylı araştırma yapmaları ve kendi risk seviyelerine göre karar vermeleri gerekir. Çeşitlendirme ve uzun vadeli yaklaşım, dalgalı piyasalarda başarılı olmanın anahtarıdır.

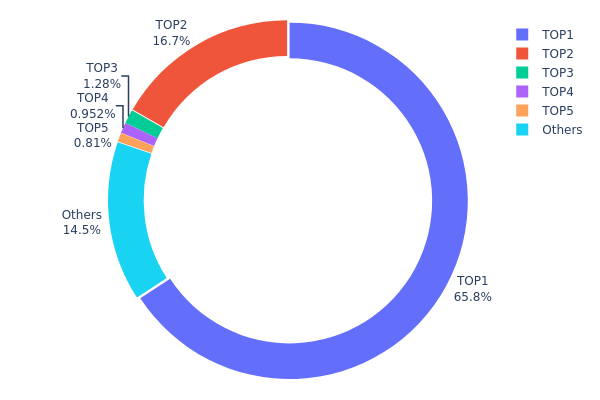

OM Varlık Dağılımı

Adres bazlı varlık dağılımı, OM tokenlerinin hangi adreslerde yoğunlaştığını gösteriyor. Analizler, dağılımın oldukça merkezileştiğini ortaya koyuyor. En büyük adres (muhtemelen bir yakım adresi: 0x0000...00dead) toplam arzın %65,80’ini tutarak bu tokenleri dolaşımdan çıkarıyor. İkinci en büyük adres ise %16,68’lik pay ile likidite üzerinde büyük bir hakimiyet kuruyor.

Bu yoğunlaşma, piyasa istikrarı ve olası fiyat manipülasyonları açısından risk oluşturuyor. Tokenlerin %82’sinden fazlası yalnızca iki adreste bulunuyor, bu da OM piyasasını büyük ölçekli hareketlere karşı kırılgan hale getiriyor ve fiyat dalgalanmasını tetikleyebiliyor. Diğer üst adreslerin payı ise düşük; örneğin üçüncü en büyük adresin oranı yalnızca %1,27. Bu dengesizlik, merkeziyetçi dağılıma işaret ederek projenin merkeziyetsizlik ve yönetim algısını etkileyebilir.

Mevcut dağılım, zincir üstü çeşitliliğin düşük ve istikrarın zayıf olduğunu gösteriyor. Yakım adresi dolaşımdaki arzı azaltırken, ikinci büyük adresteki yoğunlaşma piyasa dinamikleri açısından risk oluşturuyor ve yatırımcı güvenini zedeleyebilir.

Güncel OM varlık dağılımını incelemek için tıklayın

| Üst Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 584.923,94K | 65,80% |

| 2 | 0x073f...113ad7 | 148.307,31K | 16,68% |

| 3 | 0xa312...4ab647 | 11.376,08K | 1,27% |

| 4 | 0x91d4...c8debe | 8.458,56K | 0,95% |

| 5 | 0x9e15...feba93 | 7.204,21K | 0,81% |

| - | Diğerleri | 128.618,79K | 14,49% |

II. OM'nin Gelecek Fiyatına Yön Veren Temel Unsurlar

Arz Mekanizması

- Staking Ödülleri: OM sahipleri tokenlerini stake ederek ödül kazanabilir, bu da dolaşımdaki arzı azaltır.

- Mevcut Etki: Staking, kısa vadeli arz daralmaları yaratabilir ve fiyat istikrarını destekleyebilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: OM, kripto varlıklar gibi enflasyona karşı bir hedge aracı olarak algılanabilir.

Teknik Gelişim ve Ekosistem İnşası

- MANTRA DAO Platformu: MANTRA DAO’nun gelişimi ve benimsenmesi, OM’ye olan talebi artırabilir.

- Ekosistem Uygulamaları: MANTRA DAO’da sunulan DeFi hizmetleri (borç verme, borç alma, staking) OM’nin kullanım alanını ve talebini büyütebilir.

III. 2025-2030 OM Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,07841 $ - 0,1188 $

- Tarafsız tahmin: 0,1188 $ - 0,13781 $

- İyimser tahmin: 0,13781 $ - 0,15 $ (güçlü piyasa toparlanması ve artan benimsemeyle)

2027-2028 Görünümü

- Piyasa evresi: Konsolidasyon ve büyüme dönemi olasılığı

- Fiyat aralığı tahmini:

- 2027: 0,105 $ - 0,20046 $

- 2028: 0,16 $ - 0,21574 $

- Başlıca katalizörler: Teknolojik yenilikler, piyasa trendleri ve olası iş ortaklıkları

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,19776 $ - 0,24423 $ (istikrarlı piyasa büyümesi ve benimsemeyle)

- İyimser senaryo: 0,24423 $ - 0,30773 $ (hızlı benimseme ve olumlu piyasa şartlarıyla)

- Dönüştürücü senaryo: 0,30773 $ - 0,35 $ (çığır açan kullanım senaryoları ve ana akım entegrasyonla)

- 2030-12-31: OM 0,24423 $ (2030 için tahmini ortalama fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,13781 | 0,1188 | 0,07841 | 0 |

| 2026 | 0,18989 | 0,1283 | 0,09751 | 7 |

| 2027 | 0,20046 | 0,1591 | 0,105 | 33 |

| 2028 | 0,21574 | 0,17978 | 0,16 | 50 |

| 2029 | 0,2907 | 0,19776 | 0,17996 | 65 |

| 2030 | 0,30773 | 0,24423 | 0,14165 | 104 |

IV. OM İçin Yatırım Stratejileri ve Risk Yönetimi

OM Yatırım Stratejisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profiller: Yüksek risk toleranslı, MANTRA’nın uzun vadeli potansiyeline inanan yatırımcılar

- İşlem önerileri:

- Piyasa gerilemelerinde OM token biriktirin

- Kısmi kar realizasyonu için fiyat hedefleri belirleyin

- Tokenleri güvenli donanım cüzdanlarında veya güvenilir saklama hizmetlerinde muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını tespit etmek için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım veya aşırı satım seviyelerini belirlemeye yardımcı olur

- Dalgalı alım-satım için ipuçları:

- MANTRA’nın gelişim sürecini ve iş ortaklıklarını takip edin

- Zararları sınırlamak için zarar-durdur emirleri kullanın

OM Risk Yönetimi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Risk düzeyine göre kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Birden fazla kripto para ve geleneksel varlıkta yatırım yapın

- Zarar-durdur emirleri: Olası zararları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdanı

- Soğuk saklama: Uzun vadeli yatırımlar için donanım cüzdanları

- Güvenlik önlemleri: İki aşamalı kimlik doğrulama, güçlü şifre kullanımı ve oltalama saldırılarına karşı dikkatli olun

V. OM İçin Olası Riskler ve Zorluklar

OM Piyasa Riskleri

- Yüksek volatilite: OM fiyatı ciddi dalgalanmalara açık

- Rekabet: Diğer RWA ve Layer 1 projeleri MANTRA’nın payını azaltabilir

- Piyasa hissiyatı: Genel kripto piyasası OM’nin fiyatını proje temellerinden bağımsız etkileyebilir

OM Regülasyon Riskleri

- Değişen mevzuat: Yeni düzenlemeler MANTRA’nın faaliyetlerini ve tokenin işlevini etkileyebilir

- Uluslararası uyum: Birden fazla ülke mevzuatına uymak zorluk yaratabilir

- Kurumsal benimseme: Düzenleyici belirsizlik kurumsal katılımı yavaşlatabilir

OM Teknik Riskler

- Akıllı sözleşme zafiyetleri: Blokzincir kodunda hata veya açıklar olabilir

- Ölçeklenebilirlik sorunları: Benimseme arttıkça ağda tıkanıklık riski oluşabilir

- Uyumluluk problemleri: Diğer blokzincirler veya geleneksel sistemlerle entegrasyon zorlukları yaşanabilir

VI. Sonuç ve Eylem Önerileri

OM Yatırım Potansiyeli Değerlendirmesi

MANTRA (OM), güvenlik odaklı RWA Layer 1 blokzinciriyle benzersiz bir değer önerisi sunuyor. Kurumsal ve mevzuata uygun blokzincir alanında uzun vadeli büyüme potansiyeli taşırken, kısa vadede volatilite ve piyasa riskleri dikkatle izlenmeli.

OM Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarlarla başlayın, MANTRA’nın teknolojisi ve kullanım alanları hakkında bilgi edinin ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ile önemli piyasa olayları etrafında aktif işlemleri dengeleyin ✅ Kurumsal yatırımcılar: MANTRA’nın mevzuat uyumluluğunu ve mevcut sistemlerle entegrasyon potansiyelini analiz edin

OM Alım-Satım Yöntemleri

- Spot işlemler: Gate.com’da OM token alıp tutabilirsiniz

- Staking: Mevcutsa staking programlarına katılıp pasif gelir elde edebilirsiniz

- DeFi katılımı: MANTRA ekosisteminde merkeziyetsiz finans fırsatlarını değerlendirin

Kripto para yatırımları çok yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profillerine göre karar vermeli ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayınız.

Sıkça Sorulan Sorular

OM coin’in geleceği nedir?

OM coin’in geleceği olumlu ve büyüme potansiyeli taşıyor. Web3 benimsemesi arttıkça, OM’nin merkeziyetsiz finans alanındaki rolü büyüyecek ve 2025’e kadar talep ile değeri artabilir.

OM coin ne kadar yükselebilir?

OM coin, artan benimseme ve piyasa talebiyle 2026’da 10 $ seviyesine ulaşabilir. Fakat kripto para fiyatları oldukça değişken ve tahmin edilemezdir.

OM Mantra için 2030 fiyat tahmini nedir?

Piyasa trendleri ve potansiyel büyüme göz önüne alındığında, OM Mantra’nın fiyatı 2030’da 5 $ ile 7 $ arasında olabilir. Bu da mevcut seviyesine göre ciddi bir artışa işaret eder.

OM Mantra alınmalı mı satılmalı mı?

Mevcut piyasa koşullarına göre OM Mantra alınabilir. Yenilikçi blokzincir çözümleri ve artan benimseme, yakın vadede fiyatın yükselme potansiyeline işaret ediyor.

Gerçek dünya varlıklarının (RWA) tokenizasyonundaki yükseliş

2025 OMPrice Tahmini: Operasyonel Yönetim Yatırım Fırsatlarına Yönelik Piyasa Analizi ve Gelecek Trendler

2025 RWA Fiyat Tahmini: Dijital Ekonomide Gerçek Dünya Varlıkları İçin Piyasa Analizi ve Potansiyel Büyüme Yönleri

Propchain (PROPC) iyi bir yatırım mı? Gayrimenkul blockchain piyasasında potansiyel getiriler ve riskler nasıl değerlendirilmeli?

2025 SOIL Fiyat Tahmini: Yükselen Kripto Varlık için Büyüme Potansiyeli ve Piyasa Trendlerinin Analizi

2025 LANDSHARE Fiyat Tahmini: Gayrimenkul Token Pazarında Büyüme Potansiyelinin Analizi

Dijital Sanatı Keşfedin: Eşsiz NFT Marketplace Deneyimi

Cheems Meme Coin Rehberi Akıllı Yatırımcılar için Temel Bilgiler

Kripto para birimlerinde Proof of Reserves (Rezerv Kanıtı) kavramını anlamak

Sei Network'i Keşfetmek: Hızlı Blockchain Teknolojisinin Detaylı Bir Değerlendirmesi

SOMI Token'ın pratikliği ve fiyat görünümü, yatırımcılar için net bir analiz.