2025 OLPrice Tahmini: Dijital Moda ve Sanal Varlık Değerlemelerinde Geleceğe Yön Vermek

Giriş: OL'nin Piyasa Konumu ve Yatırımdaki Yeri

Open Loot (OL), Web3 tabanlı bir oyun dağıtım platformu ve pazar yeri olarak kurulduğu günden itibaren oyun geliştiricileri ve yayıncıları desteklemektedir. 2025 yılı itibarıyla Open Loot’un piyasa değeri 6.999.741 dolar seviyesine yükseldi; dolaşımdaki yaklaşık 201.373.461 token mevcut ve fiyatı 0,03476 dolar civarında dalgalanmaktadır. Oyun sektöründeki etkisiyle tanınan bu varlık, Web3 oyun ekosisteminde giderek daha kritik bir rol üstlenmektedir.

Bu makalede, Open Loot’un 2025-2030 dönemindeki fiyat hareketleri kapsamlı biçimde incelenecek; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik ortam bir arada değerlendirilerek yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. OL Fiyat Geçmişi ve Mevcut Piyasa Durumu

OL Tarihsel Fiyat Gelişimi

- 2024: İlk çıkışında fiyat 0,01 dolar oldu

- 2024: 5 Aralık’ta tüm zamanların en yüksek noktası olan 0,69 dolara ulaştı

- 2025: Piyasa dalgalanmasıyla 19 Kasım’da fiyat 0,02 dolar seviyesine geriledi

OL Güncel Piyasa Durumu

10 Ekim 2025 itibarıyla OL, 0,03476 dolardan işlem görüyor. Son 24 saatte %2,87’lik bir düşüş yaşandı; işlem hacmi ise 122.577,77 dolar. OL’nin piyasa değeri şu anda 6.999.741,50 dolar ve kripto para piyasasında 1.600’üncü sırada yer alıyor. Dolaşımdaki arz 201.373.461 OL; bu, toplam 5.000.000.000 tokenin %4,03’üne denk geliyor. Son dönemdeki düşüşe rağmen OL, son bir yılda %248,60’lık bir fiyat artışı ile kayda değer büyüme gösterdi.

Güncel OL piyasa fiyatını görüntüleyin

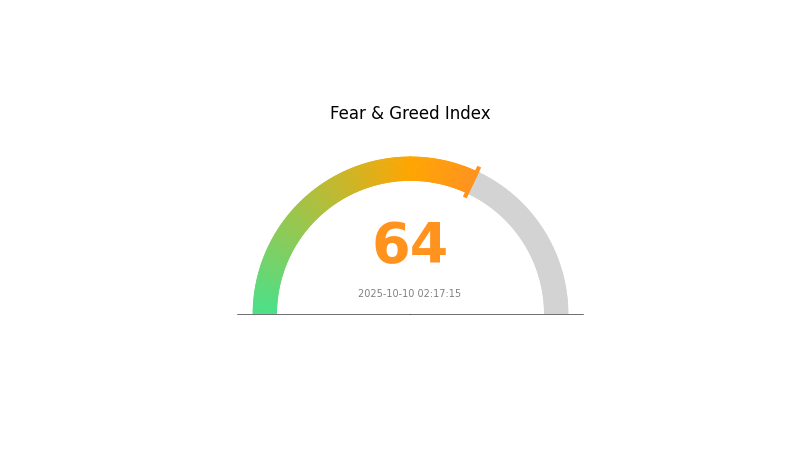

OL Piyasa Duyarlılığı Göstergesi

10 Ekim 2025 Korku ve Açgözlülük Endeksi: 64 (Açgözlülük)

Kripto piyasasında canlılık gözleniyor; Korku ve Açgözlülük Endeksi 64 seviyesinde ve bu, “Açgözlülük” eğilimini gösteriyor. Yatırımcılar giderek daha iyimser davranıyor ve bu, fiyatların yükselmesini tetikleyebilir. Ancak deneyimli yatırımcılar, bu tür dönemlerde temkinli olmayı tercih eder. Piyasa ivmesi pozitif görünse de, dengeli bir yaklaşım benimsemek ve FOMO’nun kararları etkilemesine izin vermemek önemlidir. Unutmayın, piyasalar döngüseldir ve yükselen her varlık bir noktada düşüş gösterebilir.

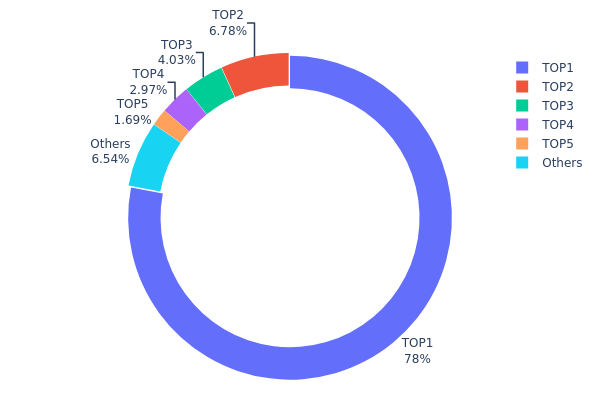

OL Varlık Dağılımı

OL’deki adres varlık dağılımı, son derece yoğunlaşmış bir sahiplik yapısı sergiliyor. En büyük adres, toplam arzın %77,99’unu elinde bulunduruyor; bu, 3.899.999,97K tokene karşılık geliyor. İkinci en büyük adresin payı %6,78’e gerilerken, ilk beş adres OL tokenlerinin %93,44’ünü kontrol ediyor; kalan %6,56 ise diğer sahipler arasında dağılmış durumda.

Böylesi yoğunlaşma, piyasa manipülasyonu ve oynaklık risklerini artırıyor. Hakim adres, OL’nin fiyat hareketleri ve likiditesi üzerinde önemli etkiler yaratabilir. Merkezi bir dağılım yapısı, piyasa istikrarsızlığına ve yatırımcı güveninde azalmaya yol açabilir. Ayrıca, merkeziyetsizlik düzeyinin düşük olması, birçok kripto projesinin temel ilkeleriyle çelişmektedir.

Mevcut varlık dağılımı, başlıca sahiplerin başlatabileceği büyük satış ya da alım işlemlerine karşı piyasayı savunmasız kılmaktadır. Bu yoğunlaşma, OL’nin zincir üzerindeki yönetişim ve karar süreçlerinin (uygulanıyorsa) az sayıda sahip tarafından belirlenebileceğini ve projenin merkeziyetsiz yapısı ile uzun vadeli istikrarının tehlikeye girebileceğini gösteriyor.

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xfc5a...20d8c1 | 3.899.999,97K | 77,99% |

| 2 | 0x4695...fd7d37 | 339.026,19K | 6,78% |

| 3 | 0x611f...dfb09d | 201.311,88K | 4,02% |

| 4 | 0x3154...0f2c35 | 148.552,16K | 2,97% |

| 5 | 0x0297...a337d5 | 84.298,45K | 1,68% |

| - | Diğerleri | 326.811,36K | 6,56% |

II. OL’nin Gelecek Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Halving: OL ağı, her dört yılda bir halving gerçekleştirip blok ödülünü %50 azaltır.

- Tarihsel Eğilim: Önceki halving’lerin ardından aylarda fiyatlarda kayda değer artışlar gözlemlenmiştir.

- Güncel Etki: Sonraki halving’in 2026’da gerçekleşmesi bekleniyor; bu, olumlu piyasa beklentisi ve fiyat yükselişi yaratabilir.

Makroekonomik Ortam

- Parasal Politika Etkisi: Merkez bankalarının faiz ve niceliksel gevşeme kararları, OL’nin alternatif yatırım olarak fiyatını etkileyebilir.

- Enflasyona Karşı Koruma: OL, yüksek enflasyon dönemlerinde yatırımcıların ilgisini çekerek enflasyona karşı koruma potansiyeli göstermektedir.

Teknik Gelişim ve Ekosistem İnşası

- Layer 2 Ölçeklenebilirlik: İşlem hızını artırmak ve ücretleri düşürmek için Layer 2 çözümlerinin uygulanması.

- Akıllı Sözleşme Yetkinliği: OL ağında akıllı sözleşme fonksiyonlarının geliştirilmesi için sürekli çalışmalar.

- Ekosistem Uygulamaları: OL blokzinciri üzerinde büyüyen DeFi protokolleri ve NFT platformları.

III. 2025-2030 OL Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,02374 - 0,03491 dolar

- Tarafsız tahmin: 0,03491 - 0,03875 dolar

- İyimser tahmin: 0,03875 - 0,04000 dolar (olumlu piyasa koşullarıyla)

2027-2028 Görünümü

- Piyasa beklentisi: Olası büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,02572 - 0,05145 dolar

- 2028: 0,03745 - 0,05477 dolar

- Başlıca tetikleyiciler: Piyasa adaptasyonu ve teknolojik ilerleme

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,05079 - 0,06069 dolar (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 0,06069 - 0,08011 dolar (güçlü piyasa performansıyla)

- Dönüştürücü senaryo: 0,08011 - 0,09000 dolar (olağanüstü piyasa koşulları ve yaygın benimsenmeyle)

- 31 Aralık 2030: OL 0,08011 dolar (olası zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 0,03875 | 0,03491 | 0,02374 | 0 |

| 2026 | 0,04751 | 0,03683 | 0,02099 | 5 |

| 2027 | 0,05145 | 0,04217 | 0,02572 | 21 |

| 2028 | 0,05477 | 0,04681 | 0,03745 | 34 |

| 2029 | 0,0706 | 0,05079 | 0,03961 | 46 |

| 2030 | 0,08011 | 0,06069 | 0,03156 | 74 |

IV. OL için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

OL Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli bakış açısına sahip, risk toleransı yüksek olanlar

- Operasyonel öneriler:

- Piyasa geri çekilmelerinde OL token biriktirin

- Hedef fiyatlar belirleyip portföyünüzü düzenli olarak gözden geçirin

- Tokenleri saklama hizmeti sunmayan bir cüzdanda muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüşleri tespit etmek için kullanılır

- Göreli Güç Endeksi (RSI): Aşırı alım/aşırı satım koşullarını belirler

- Dalgalı alım-satımda dikkat edilmesi gerekenler:

- Fiyat hareketlerinin doğrulanması için işlem hacmini izleyin

- Riskinizi yönetmek için kesin stop-loss emirleri belirleyin

OL Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- İhtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı birden fazla kripto varlığına yayın

- Stop-loss emirleri: Potansiyel kayıpları sınırlandırmak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama kullanın ve özel anahtarlarınızı güvenli şekilde yedekleyin

V. OL için Olası Riskler ve Zorluklar

OL Piyasa Riskleri

- Oynaklık: Kripto para piyasalarında yüksek dalgalanma

- Likidite: Düşük likidite işlem verimliliğini etkileyebilir

- Rekabet: Web3 oyun alanında artan rekabet

OL Düzenleyici Riskleri

- Belirsiz düzenlemeler: Kripto paralar için değişen mevzuat ortamı

- Uyum zorlukları: Küresel mevzuata uyumda potansiyel problemler

- Vergisel sonuçlar: Farklı ülkelerde net olmayan vergi uygulamaları

OL Teknik Riskler

- Akıllı sözleşme açıkları: Token sözleşmesindeki olası güvenlik zafiyetleri

- Ölçeklenebilirlik sorunları: Ağ yükü arttığında oluşabilecek sınırlamalar

- Blokzincirler arası uyumluluk: Zincirler arası entegrasyonda yaşanabilecek problemler

VI. Sonuç ve Eylem Tavsiyeleri

OL Yatırım Değeri Değerlendirmesi

OL, büyüyen Web3 oyun sektöründe yüksek riskli ve yüksek potansiyelli bir yatırım fırsatı sunuyor. Uzun vadeli değer önerisi, Open Loot platformunun başarısına bağlı; kısa vadede ise piyasa oynaklığı ve düzenleyici belirsizlikler en önemli riskler arasında.

OL Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın ve bilgi edinmeye odaklanın ✅ Deneyimli yatırımcılar: Portföyünüzü düzenli olarak dengeleyip dengeli bir strateji izleyin ✅ Kurumsal yatırımcılar: Detaylı inceleme yapın ve güçlü risk yönetimi uygulayın

OL Alım-Satım Katılım Yöntemleri

- Spot alım-satım: OL tokenlerini Gate.com üzerinden alıp satabilirsiniz

- Staking: Uygun programlar mevcutsa staking’e katılabilirsiniz

- DeFi entegrasyonu: OL tokenler için merkeziyetsiz finans olanaklarını değerlendirin

Kripto para yatırımları son derece yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre hareket etmeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alamayacağınız bir tutardan fazlasını yatırmayın.

Sıkça Sorulan Sorular

2025 için IOT fiyat tahmini nedir?

Piyasa eğilimleri ve uzman analizlerine göre, IOT’nin fiyatının 2025 sonunda 0,75 – 1,00 dolar aralığına ulaşması bekleniyor ve IoT sektöründe önemli büyüme potansiyeli öne çıkıyor.

Petrol fiyatları için öngörü nedir?

Küresel talebin artması ve arz büyümesinin sınırlı kalması nedeniyle petrol fiyatlarının 2025’te varil başına 90 – 100 dolar seviyesine çıkması bekleniyor.

OL coin nedir?

OL coin, Web3 ekosisteminde merkeziyetsiz uygulamalar ve akıllı sözleşmeler için geliştirilmiş bir kripto para birimidir. Ağda hızlı ve güvenli işlemleri sağlamak amacıyla tasarlanmıştır.

OpenLedger için fiyat tahmini nedir?

OpenLedger’ın fiyatının 2025 sonunda 0,15 dolara ulaşması bekleniyor; 2026’da ise artan kullanım ve piyasa talebiyle 0,20 dolara kadar çıkma potansiyeli bulunuyor.

2025 FURY Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 NVIR Fiyat Tahmini: Sanal Gerçeklik Yatırımlarının Geleceğinde Yön Bulmak

2025’te Rakip Analizi Kripto Pazar Payı Üzerinde Nasıl Etki Yaratır?

2025 SHARDS Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 CREO Fiyat Tahmini: Yeni Gelişen Kripto Para Birimi İçin Büyüme Potansiyeli ve Piyasa Trendlerinin Analizi

2025 LOE Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi

DeFi'de Flash Loan'ları Anlamak: Başlangıç Seviyesi Bir Rehber

GameFi'ye Giriş: Blockchain Oyunları için Yeni Başlayanlar Kılavuzu