2025 OKB Fiyat Tahmini: Bu Borsa Token’ı Kripto Piyasasında Yeni Zirvelere Ulaşabilir mi?

Giriş: OKB'nin Piyasa Konumu ve Yatırım Değeri

OKB (OKB), kripto para ekosisteminde küresel çapta kullanılan bir utility token olarak 2019 yılındaki çıkışından bu yana dikkate değer başarılar elde etti. 2025 yılı itibarıyla OKB'nin piyasa değeri 3,76 milyar dolara ulaşırken, dolaşımdaki arzı yaklaşık 21.000.000 token ve fiyatı 179,22 dolar seviyesinde bulunuyor. Genellikle "büyük bir kripto ekosisteminin belkemiği" olarak anılan bu varlık, merkeziyetsiz finans ve platform yönetiminde giderek daha önemli bir rol üstleniyor.

Bu makalede, 2025-2030 yılları arasında OKB'nin fiyat eğilimleri; tarihsel desenler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler temelinde kapsamlı şekilde analiz edilerek yatırımcılara profesyonel fiyat öngörüleri ve uygulamaya yönelik yatırım stratejileri sunulacaktır.

I. OKB Fiyat Geçmişi ve Güncel Piyasa Durumu

OKB'nin Tarihsel Fiyat Gelişimi

- 2019: İlk çıkış, 14 Ocak'ta fiyat 0,580608 dolara geriledi

- 2022: Boğa piyasası döngüsü, fiyat kayda değer biçimde yükseldi

- 2025: 22 Ağustos'ta 255,5 dolar ile yeni zirve kaydedildi

OKB'nin Güncel Piyasa Durumu

15 Ekim 2025 itibarıyla OKB, 179,22 dolardan işlem görüyor ve bu, zirvesine göre yüzde 29,85'lik bir gerilemeye işaret ediyor. Token, son 24 saatte yüzde 2,02 ve son bir haftada yüzde 18,82 düşüş yaşadı. Son dönemdeki kısa vadeli olumsuz eğilime rağmen, OKB geçen yıl boyunca yüzde 325,22 oranında dikkat çekici bir büyüme gösterdi. Güncel piyasa değeri 3.763.620.000 dolar ve bu, OKB'yi piyasa değeri açısından en büyük 39. kripto para konumuna getiriyor. Dolaşımdaki arz 21.000.000 OKB ile sabit ve maksimum arzı da temsil ediyor; bu nedenle token'ın kıtlık unsuru değişmiyor. 24 saatlik işlem hacmi 9.795.176,64 dolar ile orta seviyede piyasa faaliyetine işaret ediyor. Genel piyasa duyarlılığı ise piyasa duygu endeksindeki "Korku" seviyesiyle birlikte temkinli.

Güncel OKB piyasa fiyatına bakmak için tıklayın

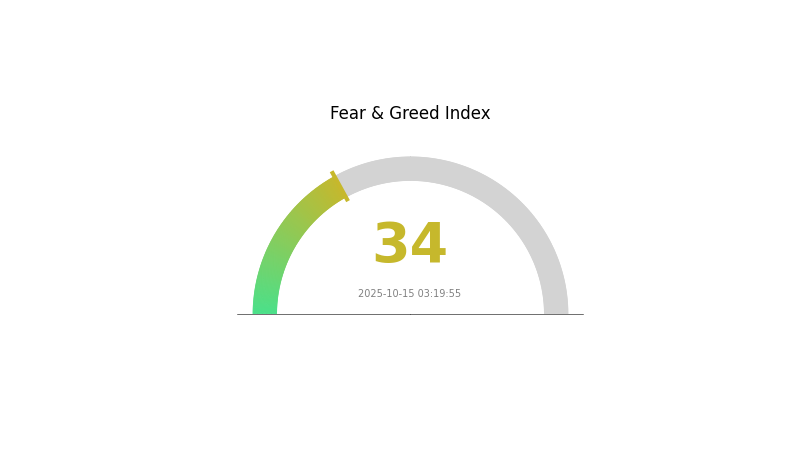

OKB Piyasa Duyarlılık Göstergesi

2025-10-15 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto para piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 34 seviyesinde bulunuyor. Bu durum, yatırımcılar arasında temkinli bir tutuma işaret ediyor ve "başkaları korkarken cesur davran" yaklaşımını benimseyenler için fırsatlar sunabilir. Ancak, yatırım kararı almadan önce kapsamlı araştırma yapmak ve kendi risk toleransınızı değerlendirmek gerekir. Piyasa trendlerini izlemeye ve kripto alanındaki gelişmeleri takip etmeye devam edin.

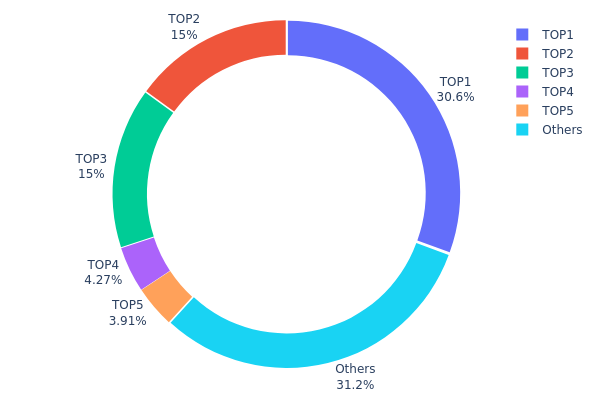

OKB Varlık Dağılımı

Adres varlık dağılımı verileri, OKB tokenlarının hangi adreslerde yoğunlaştığına dair önemli bilgiler sunar. Analiz, OKB'nin oldukça merkezi bir dağıtım yapısına sahip olduğunu gösteriyor. İlk üç adres toplam arzın yüzde 60,59'unu kontrol ediyor, en büyük cüzdan ise yüzde 30,58'lik paya sahip. Bu yoğunlaşma, potansiyel piyasa manipülasyonu ve fiyat oynaklığı riskini beraberinde getiriyor.

Böyle bir merkezi yapı, büyük sahiplerin varlıklarını satması ya da taşıması halinde piyasada ciddi dalgalanmalara yol açabilir. Ayrıca, OKB ekosisteminin düşük merkeziyetsizliğe sahip olduğunu ve az sayıda aktörün ciddi etki sahibi olduğunu ortaya koyuyor. Bu durum, istikrarsızlık ya da yüklü satış riski algısıyla bazı yatırımcılar için caydırıcı olabilir.

Ancak, OKB tokenlarının yüzde 31,23'ü ilk 5 adresin dışında tutuluyor; bu da küçük yatırımcılar arasında bir miktar dağılım olduğu ve piyasa yapısına sınırlı da olsa istikrar katabileceği anlamına gelir. Genel olarak, mevcut OKB varlık dağılımı, zincir üstünde merkezi bir yapı ortaya koyuyor ve piyasa dinamikleri ile uzun vadeli istikrar açısından önemli sonuçlar doğurabilir.

Güncel OKB Varlık Dağılımını görmek için tıklayın

| En Büyükler | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x91d4...c8debe | 203,88K | 30,58% |

| 2 | 0x9e76...680fd2 | 100,10K | 15,01% |

| 3 | 0xe5f3...1cc293 | 100,00K | 15,00% |

| 4 | 0xc0bf...c49c9e | 28,49K | 4,27% |

| 5 | 0x80c4...7bdb97 | 26,07K | 3,91% |

| - | Diğerleri | 208,06K | 31,23% |

II. OKB'nin Gelecekteki Fiyatını Belirleyecek Temel Faktörler

Arz Mekanizması

- Token Yakımı: OKB, Ağustos 2025'te gerçekleştirdiği büyük token yakımıyla toplam arzı kalıcı olarak 21 milyon tokena sabitledi; bu model, Bitcoin'in kıtlık yaklaşımına benziyor.

- Tarihsel Desen: Geçmişteki büyük token yakımları, fiyatlar üzerinde olumlu etki yaratmış; diğer platform tokenlarında da yakım sonrası ciddi fiyat artışları yaşanmıştır.

- Güncel Etki: Son yakım, dolaşımdaki arzı yaklaşık yüzde 52 oranında azalttı ve fiyat üzerinde hızlı şekilde yukarı yönlü baskı oluşturdu.

Kurumsal ve Büyük Yatırımcı (Whale) Dinamikleri

- Kurumsal Varlıklar: Detaylar açıklanmasa da, platform tokenlarına yönelik kurumsal ilgi giderek artıyor.

- Kurumsal Benimseme: DeFi ve ödemeye odaklanan X Layer'ın benimsenmesi, OKB'nin kurumsal faydasını artırabilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma Özelliği: OKB, diğer dijital varlıklar gibi enflasyona karşı bir koruma aracı olarak değerlendirilebilir.

Teknik Gelişim ve Ekosistem Oluşumu

- X Layer Benimsenmesi: X Layer üzerinden DeFi ve ödeme çözümlerine odaklanılması, OKB'nin kullanım alanını ve talebini artırabilir.

- Ekosistem Uygulamaları: X Layer ekosisteminin ve potansiyel DApp/DeFi projelerinin büyümesi, OKB'nin uzun vadeli değerinde belirleyici olacaktır.

III. OKB 2025-2030 Fiyat Tahmini

2025 Öngörüsü

- Ihtiyatlı tahmin: 163,09 - 179,22 dolar

- Tarafsız tahmin: 179,22 - 192,66 dolar

- İyimser tahmin: 192,66 - 206,1 dolar (olumlu piyasa koşulları ve artan benimseme gerektirir)

2027-2028 Öngörüsü

- Piyasa aşaması beklentisi: Konsolidasyonun ardından kademeli büyüme

- Fiyat aralığı tahmini:

- 2027: 163,38 - 226,69 dolar

- 2028: 135,74 - 221,92 dolar

- Başlıca katalizörler: Küresel kripto piyasasının toparlanması, platform güncellemeleri ve OKB'nin artan kullanımı

2029-2030 Uzun Vadeli Öngörü

- Temel senaryo: 218,69 - 268,98 dolar (istikrarlı piyasa büyümesi ve ekosistem genişlemesi varsayımıyla)

- İyimser senaryo: 268,98 - 319,28 dolar (güçlü piyasa performansı ve yaygın benimseme varsayımıyla)

- Dönüştürücü senaryo: 319,28 - 336,23 dolar (OKB ekosistemi ve kripto piyasasında köklü yenilikler olması halinde)

- 2030-12-31: OKB 336,23 dolar (iyimser projeksiyona göre olası zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 206,1 | 179,22 | 163,09 | 0 |

| 2026 | 215,78 | 192,66 | 131,01 | 7 |

| 2027 | 226,69 | 204,22 | 163,38 | 13 |

| 2028 | 221,92 | 215,45 | 135,74 | 20 |

| 2029 | 319,28 | 218,69 | 190,26 | 22 |

| 2030 | 336,23 | 268,98 | 188,29 | 50 |

IV. OKB İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

OKB Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Hedef kitle: Uzun vadeli bakış açısına sahip, risk toleransı yüksek yatırımcılar

- İşlem önerileri:

- Piyasa gerilemelerinde OKB biriktirmek

- Kısmi kâr almak için fiyat hedefleri belirlemek

- Varlıkları güvenli bir donanım cüzdanında saklamak

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını tespit etmek

- RSI: Aşırı alım/aşırı satım durumlarını belirlemek

- Swing trade için kritik noktalar:

- OKB'nin genel kripto piyasasıyla korelasyonunu izlemek

- OKB'ye özgü haber ve gelişmeleri takip etmek

OKB Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Orta düzeyde riskli yatırımcılar: Kripto portföyünün %3-7'si

- Aggresif yatırımcılar: Kripto portföyünün %7-15'i

(2) Riskten Korunma Çözümleri

- Diversifikasyon: OKB'yi diğer kripto ve geleneksel varlıklarla dengelemek

- Zarar durdur emirleri: Olası kayıpları sınırlamak için çıkış noktası belirlemek

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 Cüzdan

- Yazılım cüzdanı alternatifi: Resmi OKB cüzdanı (varsa)

- Güvenlik önlemleri: İki aşamalı doğrulama, güçlü şifreler ve özel anahtarların çevrimdışı korunması

V. OKB İçin Potansiyel Riskler ve Zorluklar

OKB Piyasa Riskleri

- Volatilite: Kripto piyasasındaki dalgalanmalar büyük fiyat değişimlerine neden olabilir

- Rekabet: Yeni borsa tokenları OKB'nin piyasa konumunu zorlayabilir

- Likitide: Aşırı piyasa koşullarında likidite sorunları yaşanabilir

OKB Düzenleyici Riskler

- Değişen regülasyonlar: Yeni kripto düzenlemeleri OKB'nin kullanım alanını ve değerini etkileyebilir

- Küresel uyum: Uluslararası düzenlemelerdeki farklılıklar OKB'nin benimsenme hızını etkileyebilir

- Token sınıflandırması: Borsa tokenlarının SEC tarafından incelenmesi riski

OKB Teknik Riskleri

- Akıllı sözleşme açıkları: Token kodunda güvenlik zafiyetleri oluşabilir

- Blockchain göçü: Gelecekte OKChain'e geçiş sırasında riskler yaşanabilir

- Merkeziyet endişeleri: İhraç eden vakfa ve borsaya aşırı bağımlılık

VI. Sonuç ve Eylem Önerileri

OKB Yatırım Değeri Değerlendirmesi

OKB, bağlı olduğu ekosistemin başarısına endeksli yüksek riskli, yüksek potansiyelli bir yatırım sunar. Uzun vadeli değeri, borsanın büyümesi ve token'ın kullanım alanının genişlemesine, kısa vadeli değeri ise yüksek volatiliteye bağlıdır.

OKB Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, bilgi ve risk yönetimine öncelik verin

✅ Deneyimli yatırımcılar: OKB'yi çeşitlendirilmiş bir kripto portföyüne dahil etmeyi değerlendirin

✅ Kurumsal yatırımcılar: Kapsamlı analiz ve güçlü risk kontrolleri uygulayın

OKB İşlemlerine Katılım Yöntemleri

- Spot alım-satım: OKB'yi Gate.com gibi güvenilir borsalarda alıp satmak

- DeFi platformları: (varsa) getiri çiftçiliği veya likidite sağlama olanaklarını değerlendirmek

- OTC piyasaları: Büyük hacimli işlemler için slippage riskini azaltmak amacıyla kullanmak

Kripto para yatırımları yüksek risk taşır. Bu makale yatırım tavsiyesi değildir. Yatırım kararlarınızı kendi risk toleransınıza göre dikkatlice verin ve profesyonel finansal danışmanlardan destek alın. Kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

OKB coin'in geleceği nasıl?

OKB, 2025 yılına kadar yüzde 65'e varan bir artış potansiyeli ile önemli ölçüde büyüyebilir. Geleceği piyasa trendleri ve kriptonun benimsenmesine bağlıdır; tahminler kesin değildir.

OKB fiyatı neden yüksek?

OKB fiyatı; işlem hacmindeki artış, yatırımcı ilgisi ve piyasa spekülasyonları nedeniyle yüksektir. Son dönemde olumlu haberler fiyatı ciddi oranda yükseltti.

OKB'ye yatırım yapmanın riskleri nelerdir?

OKB'ye yatırım yapmak; piyasa dalgalanması, düzenleyici belirsizlikler ve sermaye kaybı riski içerir. Kripto para değeri hızla değişebilir ve getirileri etkileyebilir.

OKB token'ın güncel değeri nedir?

2025-10-15 tarihi itibarıyla OKB token birim başına 108,58 dolar değerinde. Piyasa değeri 6,43 milyar dolar, günlük işlem hacmi ise 1,13 milyar dolar.

Finansta CY'nin açıklaması: Neyi temsil ediyor?

Zincir Üstü Veri Analizi, Kripto Piyasa Trendlerini Nasıl Ortaya Koyar?

Zincir üstü veri analizi, 2025 yılında kripto para alım satımını nasıl dönüştürüyor?

2025’te Zincir Üstü Veri Analizi Kripto Yatırımlarında Nasıl Bir Devrim Yaratıyor?

2025 H Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Etkilerin Hidrojen Yakıt Maliyetlerine Etkilerinin Analizi

En Büyük Kripto Güvenlik Riskleri Nelerdir ve Bunlardan Nasıl Kaçınılır?

Web3 Dünyasında Gerçek Varlıkların Tokenleştirilmesi Fırsatlarını Keşfedin

Lüks tutkunlarına özel, yat konseptli NFT koleksiyonlarını keşfedin

Verimli Kripto Musluk Yönetimi İçin En İyi Araçlar

Devrim niteliğindeki milyon dolarlık Layer 2 Ethereum ölçeklendirme çözümünü keşfedin

Maksimum getiri sağlamak isteyenler için en avantajlı kripto tasarruf hesapları