2025 NPC Fiyat Tahmini: Piyasa Trendleri ile Sanal Varlık Değerlerine Etki Eden Olası Faktörlerin Analizi

Giriş: NPC'nin Piyasa Konumu ve Yatırım Potansiyeli

Non-Playable Coin (NPC), memecoin-NFT hibrit kategorisinde 2023’te piyasaya sürülmesinden bu yana dikkat çekici bir ilerleme kaydetmiştir. 2025 yılı itibarıyla NPC'nin piyasa değeri 104.482.592 ABD Doları’na ulaşmış, yaklaşık 8.050.126.520 adet dolaşımdaki token ile fiyatı 0,012979 ABD Doları civarında seyretmektedir. “İlk meme-menkul token” (MFT) unvanı ile öne çıkan bu varlık, meme kültürü, kripto para ve NFT dünyaları arasında stratejik bir köprü oluşturmaktadır.

Bu makalede, NPC’nin 2025-2030 fiyat trendleri detaylı biçimde incelenecek; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik dinamikler analiz edilerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. NPC Fiyat Geçmişi ve Güncel Piyasa Durumu

NPC Tarihsel Fiyat Gelişimi

- 2024: Proje lansmanı, 4 Eylül’de fiyat 0,07226 ABD Doları’yla zirve yaptı

- 2025: Piyasa düşüşü, 11 Mart’ta fiyat tüm zamanların en düşük seviyesi olan 0,005666 ABD Doları’na geriledi

- 2025: Kademeli toparlanma, mevcut fiyat 0,012979 ABD Doları civarında dengelendi

NPC Güncel Piyasa Durumu

20 Ekim 2025 tarihi itibarıyla NPC; 0,012979 ABD Doları fiyatından işlem görürken, 24 saatlik işlem hacmi 186.154,34 ABD Doları’dır. Token son 24 saatte %3,96 artış kaydederek kısa vadeli olumlu bir momentum yakalamıştır. Ancak uzun vadeli eğilimler hâlâ aşağı yönlüdür; son bir haftada %25,74, son 30 günde ise %36,57 düşüş yaşanmıştır. Mevcut piyasa değeri 104.482.592,10 ABD Doları olup, NPC küresel kripto sıralamasında 398. sıradadır. Dolaşımda olan 8.050.126.520 NPC, toplam ve maksimum arzı temsil etmekte; böylece token tamamen dolaşımdadır. Güncel fiyat, zirve seviyesinden %82,05 oranında aşağıda olduğundan, piyasa koşulları iyileşirse kayda değer bir toparlanma potansiyeli mevcuttur.

Güncel NPC piyasa fiyatını görüntülemek için tıklayın

NPC Piyasa Duyarlılık Göstergesi

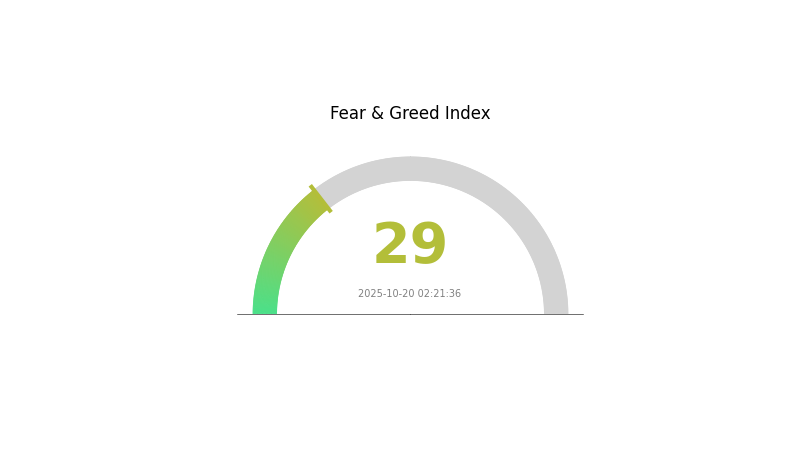

20 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku ve Açgözlülük Endeksi’ni görüntülemek için tıklayın

Kripto piyasasında şu anda korku hâkim; endeks değeri 29. Bu görünüm, yatırımcıların temkinli olduğunu ve tersine hareket edenler için alım fırsatları doğabileceğini gösteriyor. Ancak piyasa duyarlılığı hızla değişebilir. Yatırımcılar, işlem öncesinde kapsamlı analiz yapmalı ve risk toleranslarını göz önünde bulundurmalıdır. Gate.com, bu belirsiz piyasa koşullarına karşı çeşitli araçlar ve kaynaklar sunmaktadır.

NPC Varlık Dağılımı

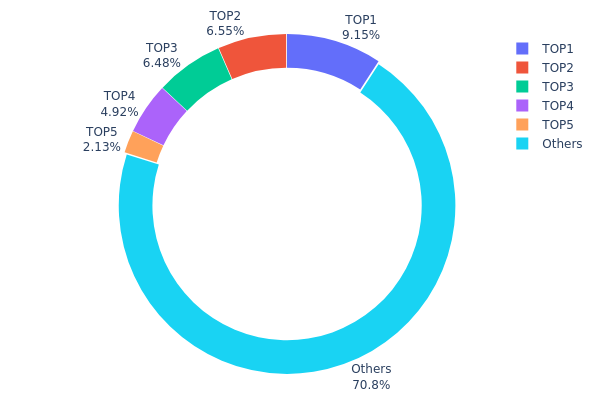

Adres bazlı dağılım verileri, NPC tokenlerinin farklı cüzdanlarda ne oranda toplandığını gösterir. Analiz, ilk 5 adresin toplam arzın yaklaşık %29,21’ini kontrol ettiğini ve orta düzeyde bir yoğunlaşma olduğunu ortaya koyuyor. En büyük adres %9,15 oranında NPC tutarken, sonraki dört adresin her biri %2,12 ile %6,55 arasında token bulunduruyor.

Bu dağılım, piyasa merkezileşmesini önleyip dengeli bir ekosistem yaratıyor. Büyük sahipler kayda değer paylara sahip olsa da, tokenlerin çoğu (%70,79) diğer adreslere yayılmıştır ve bu, daha sağlıklı bir merkeziyetsiz yapı sunar. Bu dağılım, tek bir aktörün fiyatları manipüle etme riskini azaltarak piyasa istikrarını destekler.

Bununla birlikte, birkaç büyük adresin varlığı piyasa dinamiklerini etkileyebilir. Bu adreslerin işlemleri kısa süreli fiyat dalgalanmaları yaratabilir, ancak geniş dağılım kalıcı dengesizlikleri önler. Sonuç olarak, mevcut NPC token dağılımı, büyük yatırımcılar ile küçük sahipler arasında dengeli ve makul ölçüde merkeziyetsiz bir ekosistemi yansıtır.

Güncel NPC Varlık Dağılımı verilerini görüntülemek için tıklayın

| En Büyük | Adres | Tutulan Miktar | Oran (%) |

|---|---|---|---|

| 1 | 0xb0a3...7e4411 | 736.897,96K | 9,15% |

| 2 | 0x8ed9...5408f6 | 527.381,01K | 6,55% |

| 3 | 0x3cc9...aecf18 | 521.912,75K | 6,48% |

| 4 | 0x3ee1...8fa585 | 395.900,07K | 4,91% |

| 5 | 0x69c7...a673ca | 171.266,62K | 2,12% |

| - | Diğerleri | 5.696.768,11K | 70,79% |

II. NPC’nin Gelecek Fiyatına Yön Veren Temel Faktörler

Arz Mekanizması

- Halving: NPC ağı periyodik blok ödülü yarılanmaları ile arzı azaltır.

- Tarihsel Eğilim: Geçmiş halving’ler, azalan arz enflasyonu nedeniyle genellikle fiyat artışı getirmiştir.

- Mevcut Etki: Yaklaşan halving ile yeni arz azalacağı için NPC fiyatlarının yükselmesi bekleniyor.

Makroekonomik Ortam

- Para Politikası Etkisi: Büyük merkez bankalarının temkinli politikaları, NPC gibi alternatif varlıkların avantajına olabilir.

- Enflasyona Karşı Koruma: NPC, yüksek enflasyon dönemlerinde yatırımcı ilgisini çekerek enflasyona karşı koruma potansiyeli göstermiştir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Katman 2 Çözümleri: İşlem hızı ve maliyetlerini optimize eden Layer 2 ölçeklenebilirlik çözümleri uygulanıyor.

- Akıllı Sözleşme Yükseltmeleri: Daha gelişmiş DApp’leri destekleyecek şekilde akıllı sözleşme fonksiyonları geliştiriliyor.

- Ekosistem Uygulamaları: NPC ağı üzerinde DeFi platformları ve NFT pazarlarının sayısı giderek artıyor.

III. 2025-2030 NPC Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,01038 - 0,01297 ABD Doları

- Tarafsız tahmin: 0,01297 - 0,01582 ABD Doları

- İyimser tahmin: 0,01582 - 0,01771 ABD Doları (olumlu piyasa ve artan benimsenme ile)

2027-2028 Görünümü

- Piyasa dönemi beklentisi: Artan volatiliteyle büyüme aşaması

- Fiyat aralığı tahmini:

- 2027: 0,01027 - 0,01926 ABD Doları

- 2028: 0,01307 - 0,02331 ABD Doları

- Ana tetikleyiciler: Teknolojik yenilikler, ekosistem entegrasyonu ve piyasa duyarlılığının iyileşmesi

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,01086 - 0,02171 ABD Doları (istikrarlı büyüme ve benimsenme ile)

- İyimser senaryo: 0,02048 - 0,02869 ABD Doları (hızlı benimsenme ve olumlu piyasa)

- Dönüştürücü senaryo: 0,02869 - 0,03500 ABD Doları (çığır açan kullanım alanları ve genel entegrasyon)

- 31 Aralık 2030: NPC 0,0211 ABD Doları (ortalama fiyat öngörüsü, güçlü büyüme potansiyelini gösteriyor)

| Yıl | En Yüksek Tahmin | Ortalama Tahmin | En Düşük Tahmin | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,01582 | 0,01297 | 0,01038 | 0 |

| 2026 | 0,01771 | 0,0144 | 0,01238 | 10 |

| 2027 | 0,01926 | 0,01605 | 0,01027 | 23 |

| 2028 | 0,02331 | 0,01766 | 0,01307 | 36 |

| 2029 | 0,02171 | 0,02048 | 0,01086 | 57 |

| 2030 | 0,02869 | 0,0211 | 0,01751 | 62 |

IV. NPC İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

NPC Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Uzun vadeli bakış açısına ve yüksek risk toleransına sahip yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde NPC token biriktirin

- En az 1-2 yıl boyunca tutarak piyasa dalgalanmalarını aşın

- Varlıklarınızı Gate Web3 cüzdanında güvenli şekilde saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: 50 ve 200 günlük ortalamalarla trend takibi

- RSI: Aşırı alım/aşırı satım seviyeleriyle uygun giriş/çıkış noktaları belirleyin

- Dalgalı al-sat için kritik noktalar:

- Net stop-loss ve kar alma seviyeleri belirleyin

- NPC ile ilgili haber ve sosyal medya duyarlılığını izleyin

NPC Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Portföyün %1-3’ü

- Agresif yatırımcılar: Portföyün %5-10’u

- Profesyonel yatırımcılar: Portföyün %15’ine kadar

(2) Riskten Koruma Yöntemleri

- Diversifikasyon: NPC’yi diğer kripto varlıklar ve geleneksel yatırımlarla dengeleyin

- Stop-loss emirleri: Olası kayıpları sınırlayın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan: Gate Web3 cüzdan

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: 2FA etkinleştirin, güçlü ve benzersiz şifreler kullanın, yazılımı güncel tutun

V. NPC İçin Olası Riskler ve Zorluklar

NPC Piyasa Riskleri

- Yüksek volatilite: NPC fiyatı ciddi dalgalanmalara açık

- Likidite riski: Kısıtlı işlem hacmi alım/satımda sıkıntı yaratabilir

- Piyasa duyarlılığı: Meme coin popülaritesi hızla değişebilir

NPC Düzenleyici Riskler

- Belirsiz regülasyon ortamı: Meme coin’lere yönelik incelemenin artma ihtimali

- Platform riski: Borsalardan çıkarılma likiditeyi olumsuz etkileyebilir

- Vergi yükümlülükleri: Değişen vergi mevzuatı NPC yatırımlarını etkileyebilir

NPC Teknik Riskler

- Akıllı sözleşme açıkları: Sömürü veya hata ihtimali

- Ağ tıkanıklığı: Yoğun dönemlerde Ethereum’da yüksek gas ücretleri

- Teknolojik geride kalma: Daha yeni meme coin’lerin rekabeti

VI. Sonuç ve Eylem Önerileri

NPC Yatırım Potansiyeli Değerlendirmesi

NPC yüksek getiri fırsatı sunarken dikkate değer riskler barındırır. Uzun vadeli değer potansiyeli belirsizdir; kısa vadeli oynaklık ise yatırımcılar için hem fırsat hem de risk teşkil eder.

NPC Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Portföyde küçük bir pay ile sınırlandırın, bilgi ve eğitim önceliğiniz olsun ✅ Deneyimli yatırımcılar: NPC’yi sıkı risk yönetimiyle kısa vadeli al-sat için değerlendirin ✅ Kurumsal yatırımcılar: Dikkatli yaklaşın, çeşitlendirilmiş kripto stratejinizin bir parçası olarak ele alın

NPC İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com spot piyasasında NPC alıp satabilirsiniz

- Limit emirleri: Giriş ve çıkış fiyatlarınızı belirleyerek riskleri yönetin

- DCA stratejisi: Düzenli küçük alımlar ile fiyat dalgalanmasını dengeleyin

Kripto para yatırımları aşırı derecede yüksek risk içerir ve bu içerik yatırım tavsiyesi niteliği taşımaz. Yatırımcılar kararlarını kendi risk toleranslarına göre vermeli, profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayınız.

SSS

NPC iyi bir yatırım mı?

Evet, NPC güçlü bir potansiyele sahip. Yenilikçi teknolojisi ve Web3 alanında artan kullanımı, 2025 ve sonrası için cazip bir yatırım alternatifi sunar.

Hangi coin 1000x kazandırır?

Net bir garanti olmasa da, NPC yenilikçi yapay zekâ tabanlı fiyat tahmin modeli ve Web3’teki artan benimsenme ile yüksek büyüme potansiyeline sahiptir.

NPC coin’lerinin değeri var mı?

Evet, NPC coin’leri değer taşır. 2025’te aktif şekilde kripto piyasasında işlem görüp, Web3 uygulamaları ve oyun ekosistemlerinde yaygınlaşmaktadır.

2025’te hangi coin 1 ABD Doları’na ulaşacak?

Mevcut piyasa trendleri ve analist öngörülerine göre, NPC (NPC Fiyat Tahmini) yenilikçi teknolojisi ve Web3’teki artan kullanımıyla 2025’te 1 ABD Doları’na ulaşabilir.

2025 ASM Fiyat Tahmini: Gelecek Eğilim Analizi ve Piyasa Değerini Belirleyen Ana Unsurlar

2025 AIL Fiyat Tahmini: Hızla Gelişen Piyasada Yapay Zekâ Tokenlerinin Geleceğini Şekillendirmek

Gate Meme Go: Gate.com'da Yapay Zeka Destekli Web3 Meme Ticaretinde Devrim

2025’te Meme Coin Alım-Satımı Hakkında Kapsamlı Rehber: Meme Go’da Meme Coin Alım-Satımının Püf Noktaları

En iyi meme token alım-satım platformu hangisi? Gate Meme Go’yu keşfedin

2025 NPC Fiyat Tahmini: Dijital Koleksiyon Ürünleri Alanında Piyasa Trendleri ve Gelecek Değerlemelerinin Analizi

Solana AUD Fiyat Beklentisi ve Ana Piyasa Sürücüleri Analizi

Kripto dünyasında İşlem Kimliğinin Anlamı

Kripto Sektöründe SPWN Ne İfade Eder?

Sei ve Xiaomi, 2026’da piyasaya sürülecek yeni akıllı telefonlara kripto cüzdanlarını önceden yüklemek üzere ortaklık kurdu

Gemini, CFTC’den onay aldı; bu gelişme kripto tahmin piyasaları açısından ne ifade ediyor