2025 NEXO Price Prediction: Analyzing Growth Potential and Market Trends for the Cryptocurrency Lending Platform

Introduction: NEXO's Market Position and Investment Value

NEXO (NEXO), as a leading provider of advanced crypto-backed loans, has achieved significant milestones since its inception in 2018. As of 2025, NEXO's market capitalization has reached $1.2 billion, with a circulating supply of 1 billion tokens and a price hovering around $1.20. This asset, often referred to as the "crypto credit pioneer," is playing an increasingly crucial role in the decentralized finance (DeFi) lending sector.

This article will comprehensively analyze NEXO's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. NEXO Price History Review and Current Market Status

NEXO Historical Price Evolution

- 2018: Initial launch, price reached an all-time low of $0.04515276 on September 13

- 2021: Bull market peak, price hit an all-time high of $4.07 on May 12

- 2022-2023: Crypto winter, price declined from highs and stabilized

NEXO Current Market Situation

As of October 16, 2025, NEXO is trading at $1.2017, ranking 89th by market capitalization. The token has experienced a 1.94% decrease in the past 24 hours, with a trading volume of $21,826.17. NEXO's market cap stands at $1,201,700,000, representing 0.030% of the total cryptocurrency market.

In recent price trends, NEXO has shown negative performance across multiple timeframes:

- 1 hour: -0.80%

- 24 hours: -1.94%

- 7 days: -5.97%

- 30 days: -6.67%

However, it's worth noting that NEXO has seen a positive performance of 19.040% over the past year, indicating long-term growth despite short-term fluctuations.

The current price of $1.2017 is significantly higher than its all-time low but remains well below its all-time high, suggesting potential for both upside and downside movement.

Click to view the current NEXO market price

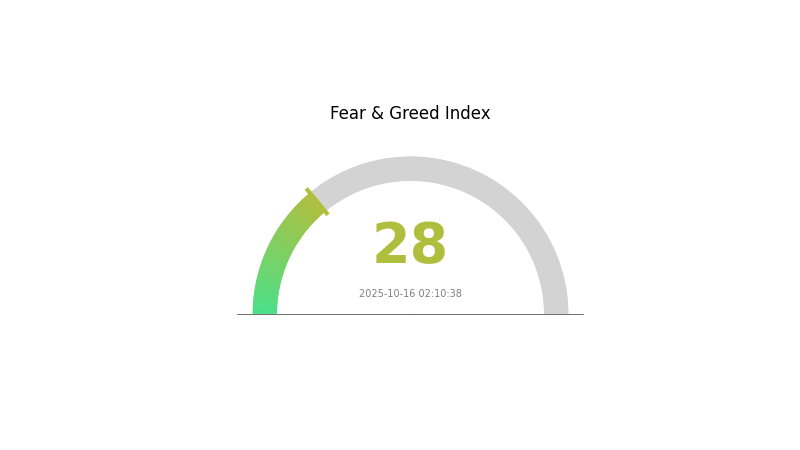

NEXO Market Sentiment Indicator

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing a fearful sentiment today, with the Fear and Greed Index at 28. This indicates a cautious approach among investors, potentially presenting buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift quickly. Always conduct thorough research and consider your risk tolerance before making investment decisions. Stay informed and use Gate.com's tools to navigate these uncertain market conditions.

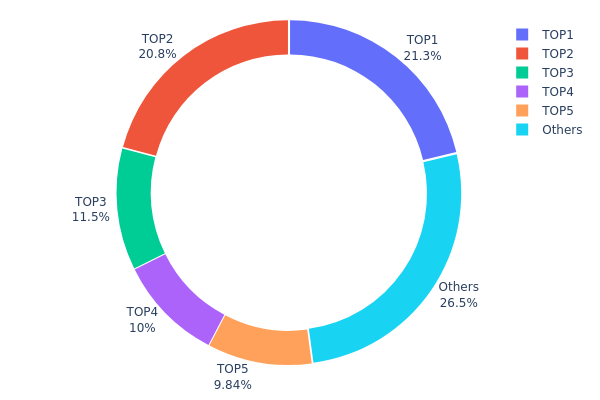

NEXO Holdings Distribution

The address holdings distribution data for NEXO reveals a highly concentrated ownership structure. The top five addresses collectively control 73.47% of the total NEXO supply, with the remaining 26.53% distributed among other addresses. This concentration is particularly pronounced in the top two addresses, which hold 21.32% and 20.83% respectively, accounting for over 42% of the total supply.

Such a concentrated distribution raises concerns about market stability and potential price manipulation. With a small number of addresses controlling a significant portion of the supply, there's an increased risk of large-scale sell-offs or buying pressure that could dramatically impact NEXO's price. This concentration also suggests a lower level of decentralization, which may be at odds with the principles of distributed ledger technology.

The current address distribution indicates a market structure that is susceptible to volatility and potentially vulnerable to the actions of a few large holders. While this concentration might provide some stability in terms of reduced circulation, it also presents risks to the overall health and fairness of the NEXO market ecosystem.

Click to view the current NEXO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9bdb...e14447 | 213231.99K | 21.32% |

| 2 | 0x1111...111111 | 208333.33K | 20.83% |

| 3 | 0x1c43...76b497 | 114800.95K | 11.48% |

| 4 | 0x9099...cccd07 | 100000.00K | 10.00% |

| 5 | 0x2222...222222 | 98437.50K | 9.84% |

| - | Others | 265196.23K | 26.53% |

II. Key Factors Influencing NEXO's Future Price

Supply Mechanism

- Current Trend: NEXO has been on an upward trend since October 7, 2025, with a total price change of 0.79% during this period.

- Current Impact: Technical indicators point towards a medium-term Buy outlook, with 3 buy signals and 2 sell signals currently displayed.

Institutional and Whale Dynamics

- Corporate Adoption: Nexo is balancing product innovation with security upgrades as the crypto lending market regains activity.

Macroeconomic Environment

- Geopolitical Factors: The raid by the Bulgarian government on Nexo appears to be a coordinated attack, potentially aimed at increasing popularity and voter confidence. This could impact Nexo's trustworthiness in the market.

Technical Development and Ecosystem Building

- Product Updates: Nexo announced a quarterly product update series called "Spotlight" on October 4, 2025, hinting at potential innovations in their offerings.

III. NEXO Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.98 - $1.20

- Neutral forecast: $1.20 - $1.40

- Optimistic forecast: $1.40 - $1.56 (requires favorable market conditions)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range predictions:

- 2026: $1.07 - $1.86

- 2027: $0.85 - $1.76

- Key catalysts: Broader crypto market trends, NEXO platform developments

2030 Long-term Outlook

- Base scenario: $1.97 - $2.44 (assuming steady market growth)

- Optimistic scenario: $2.44 - $2.92 (with accelerated adoption of NEXO services)

- Transformative scenario: $2.92+ (under extremely favorable market conditions)

- 2030-12-31: NEXO $2.92 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.56052 | 1.2004 | 0.98433 | 0 |

| 2026 | 1.86362 | 1.38046 | 1.07676 | 15 |

| 2027 | 1.76802 | 1.62204 | 0.85968 | 35 |

| 2028 | 2.40695 | 1.69503 | 0.91532 | 41 |

| 2029 | 2.83036 | 2.05099 | 1.14855 | 70 |

| 2030 | 2.92881 | 2.44068 | 1.97695 | 103 |

IV. Professional Investment Strategies and Risk Management for NEXO

NEXO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors seeking stable growth

- Operation suggestions:

- Accumulate NEXO tokens during market dips

- Participate in Nexo's lending and borrowing services

- Store tokens securely in non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought and oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Monitor Nexo platform updates and market news for potential price catalysts

NEXO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different cryptocurrencies and traditional assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Nexo wallet for platform integration

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for NEXO

NEXO Market Risks

- Volatility: Cryptocurrency market fluctuations can impact NEXO token value

- Competition: Increasing number of crypto lending platforms may affect Nexo's market share

- Correlation: NEXO token price may be influenced by overall crypto market trends

NEXO Regulatory Risks

- Regulatory uncertainty: Changing regulations in different jurisdictions may impact Nexo's operations

- Compliance costs: Adapting to new regulatory requirements could increase operational expenses

- Licensing issues: Potential challenges in obtaining or maintaining necessary licenses in certain regions

NEXO Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the token's underlying smart contract

- Platform security: Risks associated with hacking attempts or technical failures on the Nexo platform

- Scalability challenges: Potential issues in handling increased user demand and transaction volume

VI. Conclusion and Action Recommendations

NEXO Investment Value Assessment

NEXO presents a unique value proposition in the crypto lending space, with potential for long-term growth. However, investors should be aware of short-term volatility and regulatory uncertainties in the evolving crypto landscape.

NEXO Investment Recommendations

✅ Beginners: Start with small allocations and focus on understanding the Nexo platform's services ✅ Experienced investors: Consider a balanced approach, combining NEXO holdings with platform usage ✅ Institutional investors: Evaluate NEXO as part of a diversified crypto portfolio, focusing on long-term potential

NEXO Participation Methods

- Direct purchase: Buy NEXO tokens on Gate.com

- Platform usage: Engage with Nexo's lending and borrowing services to earn interest or receive benefits

- Staking: Participate in Nexo's loyalty program to earn additional rewards and benefits

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for NEXO in 2025?

Based on current analysis, NEXO's price is predicted to reach a minimum of $1.27 and an average of $1.29 by 2025.

What is the future of NEXO crypto?

NEXO's future looks promising with AI-powered tools launching in 2025, driving growth and user interest. The outlook is bullish, supported by product enhancements and positive market trends.

Is NEXO crypto good?

NEXO offers high leverage trading, but fees are high and risks are significant due to market volatility. Use caution.

What will XRP be in 2030 price prediction?

XRP's price could reach $5 to $10 by 2030, driven by increased adoption and potential regulatory clarity. However, market volatility may impact this prediction.

Share

Content