2025 NC Fiyat Tahmini: Piyasa Trendleri ve Gelecekteki Büyüme Potansiyelinin Analizi

Giriş: NC'nin Piyasadaki Konumu ve Yatırım Değeri

Nodecoin (NC), merkeziyetsiz bir yapay zeka altyapı platformu olarak kuruluşundan bu yana dikkat çekici ilerlemeler kaydetmiştir. 2025 yılı itibarıyla Nodecoin’in piyasa değeri 12.507.810 ABD Doları’na ulaşırken, yaklaşık 208.000.000 adet dolaşımdaki coin bulunmakta ve fiyatı 0,012508 ABD Doları civarında seyretmektedir. “Yapay zeka bant genişliği gelir token’ı” olarak bilinen bu varlık, yapay zeka geliştirme ve merkeziyetsiz bilişim alanlarında giderek daha önemli bir rol üstlenmektedir.

Bu makalede, Nodecoin’in 2025-2030 yılları arasındaki fiyat eğilimleri; geçmiş hareketler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı biçimde analiz edilecektir. Hedef, profesyonel fiyat tahminleri ve yatırımcılara yönelik uygulanabilir yatırım stratejileri sunmaktır.

I. NC Fiyat Geçmişi ve Güncel Piyasa Durumu

NC Tarihsel Fiyat Gelişimi

- 2025: NC ilk olarak 0,1 ABD Doları ile piyasaya sürüldü ve 17 Ocak’ta tüm zamanların en yüksek değeri olan 0,335 ABD Doları’na ulaştı

- 2025: Piyasa düzeltmesinde fiyat 10 Ekim’de 0,009261 ABD Doları’na kadar geriledi

- 2025: Kademeli toparlanma sürecinin ardından, 15 Ekim itibarıyla fiyat 0,012508 ABD Doları civarında istikrar kazandı

NC Güncel Piyasa Durumu

NC, şu anda 0,012508 ABD Doları seviyesinden işlem görüyor ve son 24 saatte %7,79 oranında değer kaybetti. Token, geçtiğimiz yıl yüksek volatilite yaşadı ve tüm zamanların en yüksek seviyesinden %97,053 oranında geriledi. Şu anki piyasa değeri 2.601.664 ABD Doları olup, genel kripto para sıralamasında 2.180. sırada. Son 24 saatteki işlem hacmi 582.659,72 ABD Doları ile orta düzeyde piyasa hareketliliği gösteriyor. Dolaşımdaki arz 208.000.000 NC ve bu, toplam arzın (999.984.825,75 NC) %20,8’ine denk geliyor. Son fiyat düşüşlerine rağmen NC, 16 borsada işlem görmeye devam ediyor ve bu da piyasada ilginin sürdüğünü gösteriyor.

Güncel NC piyasa fiyatını görmek için tıklayın

NC Piyasa Duyarlılık Göstergesi

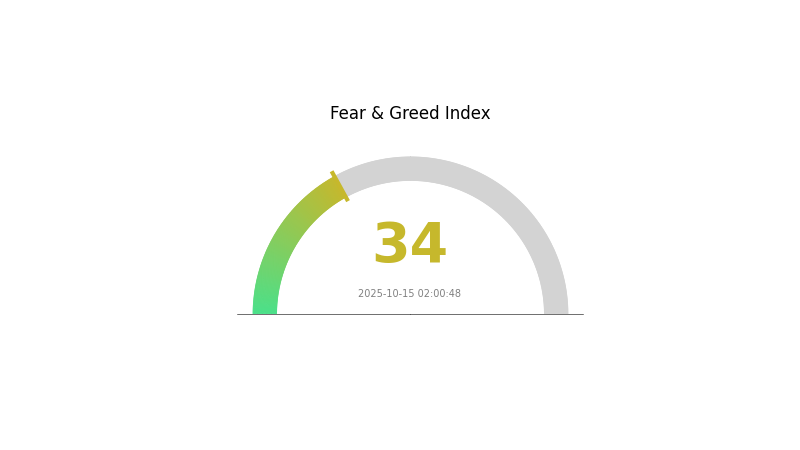

2025-10-15 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksi’ni görmek için tıklayın

Kripto piyasasında duyarlılık temkinli seyrediyor; Korku ve Açgözlülük Endeksi 34 ile korku ortamına işaret ediyor. Bu, yatırımcıların piyasa belirsizlikleri veya son fiyat dalgalanmalarından dolayı temkinli davrandığını gösteriyor. Böyle bir dönemde, deneyimli yatırımcılar genellikle “diğerleri korkarken alım fırsatlarını değerlendir” yaklaşımını benimser. Yine de, yatırım kararı almadan önce detaylı araştırma yapmak ve risk toleransınızı gözetmek önemlidir.

NC Varlık Dağılımı

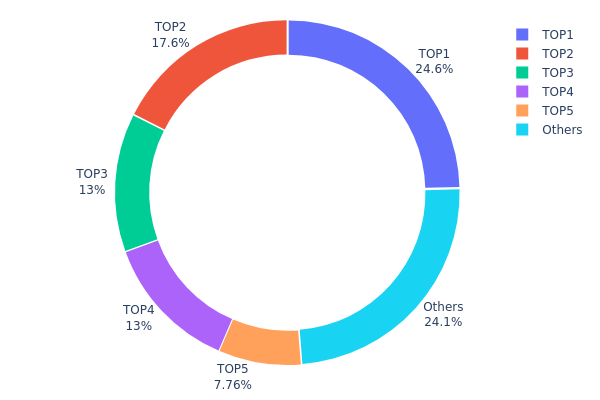

NC adres varlık dağılımı verileri, tokenların büyük kısmının az sayıda üst adreste toplandığını gösteriyor. En büyük adres, toplam arzın %24,59’unu elinde bulundururken, ilk beş adres toplamda %75,86’lık bir paya sahip. Bu yüksek yoğunlaşma, token’ın merkeziyetsizliği ve potansiyel piyasa manipülasyonu açısından endişe yaratıyor.

Böylesine konsantre bir dağıtım yapısı, fiyat oynaklığını ve büyük satış veya birikim hareketlerine karşı hassasiyeti artırabilir. Ana sahiplerin ağırlığı, olası zincir üstü oylama mekanizmalarında yönetişim kararlarını da etkileyebilir. Yine de, tokenların %24,14’ü diğer adreslere dağılmış durumda ve bu, üst sahipler dışında da bir yayılım olduğunu gösteriyor.

Bu yoğunlaşma modeli, NC’nin piyasa yapısının şu an ideal merkeziyetsiz bir varlıktan daha merkeziyetçi olduğunu gösteriyor. Bu durum, dağıtımın erken aşamasında olunduğuna veya bilinçli bir tahsis stratejisi izlendiğine işaret edebilir. Yatırımcılar ve piyasa katılımcıları, fiyat ve genel piyasa dinamiklerini etkileyebilecek önemli hareketler için bu üst adresleri izlemelidir.

Güncel NC Varlık Dağılımı’nı görmek için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | F5o3ML...yEnSiU | 245996,12K | 24,59% |

| 2 | 9cM2M6...DtKnUg | 175617,80K | 17,56% |

| 3 | 7QaLNh...YubMfZ | 130000,00K | 13,00% |

| 4 | 9i33D8...5TLQzW | 129500,00K | 12,95% |

| 5 | C68a6R...XFdqyo | 77617,37K | 7,76% |

| - | Diğerleri | 241253,53K | 24,14% |

II. NC’nin Gelecek Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Token Kullanım Alanı: NC’nin değeri, Nodepay platformunun pratik kullanım alanları ve kullanıcı büyümesiyle yakından bağlantılıdır.

- Mevcut Etki: Kullanıcılar ağ kaynaklarını yapay zeka eğitimini desteklemek için sağladıkça, piyasa tarafından yaygın şekilde benimsenirse talep artabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: Yapay zeka ve merkeziyetsiz bilişim sektöründe önde gelen şirketlerin NC’yi benimsemesi, fiyat üzerinde önemli bir etki yaratabilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: Dijital bir varlık olarak NC, diğer kripto paralar gibi enflasyona karşı bir koruma aracı olarak değerlendirilebilir.

- Jeopolitik Faktörler: Uluslararası gelişmeler ve önemli ekonomilerdeki düzenleyici değişiklikler, genel kripto para piyasası ve NC üzerinde etkili olabilir.

Teknolojik Gelişim ve Ekosistem Oluşturma

- Platform Güncellemeleri: Nodepay’in 2025 yol haritası, yapay zeka entegrasyonunda kayda değer gelişmeleri öngörmekte; bu, NC’nin kullanım alanı ve değerini artırabilir.

- Ekosistem Uygulamaları: Nodepay üzerinde geliştirilecek merkeziyetsiz uygulamalar (DApp) ve ekosistem projeleri, NC’ye olan talebi artırabilir.

III. 2025-2030 NC Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,00703 - 0,01255 ABD Doları

- Nötr tahmin: 0,01255 - 0,01355 ABD Doları

- İyimser tahmin: 0,01355 - 0,01455 ABD Doları (olumlu piyasa duyarlılığı halinde)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Büyüme aşaması

- Fiyat aralığı tahmini:

- 2027: 0,01198 - 0,01663 ABD Doları

- 2028: 0,01152 - 0,02027 ABD Doları

- Temel etkenler: Artan benimseme ve teknolojik gelişmeler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,01782 - 0,02004 ABD Doları (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 0,02004 - 0,02265 ABD Doları (güçlü piyasa performansında)

- Dönüştürücü senaryo: 0,02265 ABD Doları üzeri (son derece olumlu piyasa koşullarında)

- 2030-12-31: NC 0,02265 ABD Doları (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,01455 | 0,01255 | 0,00703 | 0 |

| 2026 | 0,01463 | 0,01355 | 0,00881 | 8 |

| 2027 | 0,01663 | 0,01409 | 0,01198 | 12 |

| 2028 | 0,02027 | 0,01536 | 0,01152 | 22 |

| 2029 | 0,02227 | 0,01782 | 0,01301 | 42 |

| 2030 | 0,02265 | 0,02004 | 0,01844 | 60 |

IV. Profesyonel NC Yatırım Stratejileri ve Risk Yönetimi

NC Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Hedef yatırımcılar: Değer odaklı ve yapay zeka altyapısına inananlar

- İşlem önerileri:

- Piyasa düşüşlerinde NC token biriktirin

- Kâr realizasyonu için fiyat hedefleri belirleyin

- Token’ları güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve dönüş noktalarını tespit etmek için kullanılır

- Göreli Güç Endeksi (RSI): Aşırı alım/aşırı satım durumları için takip edilir

- Dalgalı al-sat için ana noktalar:

- Yapay zeka sektörüyle ilgili haberleri ve benimseme oranlarını izleyin

- Zarar durdur emirleriyle risk yönetimini sağlayın

NC Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Orta seviye yatırımcılar: Kripto portföyünün %3-5’i

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımlarınızı farklı yapay zeka ve blokzincir projelerine dağıtın

- Düzenli Alım (Dolar-Maliyet Ortalaması): Piyasa oynaklığını azaltmak için sabit tutarda düzenli yatırım yapın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama, güçlü şifre kullanımı ve özel anahtarların çevrimdışı tutulması

V. NC İçin Potansiyel Riskler ve Zorluklar

NC Piyasa Riskleri

- Yüksek volatilite: NC fiyatı ciddi dalgalanmalara açık

- Rekabet: Diğer yapay zeka altyapı projeleri NC’nin pazar payını etkileyebilir

- Benimseme riski: Nodepay platformunun yavaş benimsenmesi token değerini olumsuz etkileyebilir

NC Düzenleyici Riskleri

- Belirsiz düzenleyici ortam: Değişen yasal düzenlemeler NC’nin faaliyetlerini etkileyebilir

- Veri gizliliği endişeleri: Veri toplama uygulamaları düzenleyici denetime tabi olabilir

- Sınır ötesi kısıtlamalar: Uluslararası düzenlemeler küresel genişlemeyi sınırlayabilir

NC Teknik Riskler

- Ağ güvenliği: Nodepay platformunda potansiyel güvenlik açıkları

- Ölçeklenebilirlik sorunları: Artan ağ talebini karşılama kapasitesi

- Teknolojik eskime: Yapay zekadaki hızlı gelişmeler Nodepay’in gelişimini geride bırakabilir

VI. Sonuç ve Eylem Önerileri

NC Yatırım Değeri Değerlendirmesi

NC, yapay zeka altyapı alanında uzun vadeli büyüme potansiyeliyle öne çıkan özgün bir değer sunar. Ancak kısa vadeli dalgalanmalar ve benimseme riskleri göz önünde bulundurulmalıdır.

NC Yatırım Önerileri

✅ Yeni başlayanlar: Projeyi ve piyasa dinamiklerini anlamak için küçük ve düzenli yatırımlarla başlayın ✅ Deneyimli yatırımcılar: Risk toleransınıza ve piyasa koşullarına göre dengeli bir yaklaşım benimseyin ✅ Kurumsal yatırımcılar: Kapsamlı analiz yaparak NC’yi çeşitlendirilmiş bir yapay zeka ve blokzincir portföyüne eklemeyi değerlendirin

NC Katılım Yöntemleri

- Gate.com üzerinden NC token satın alın

- Nodepay ağına bant genişliği sağlayarak NC token kazanın

- Nodepay platformunun sağladığı yapay zeka hizmetleriyle ekosisteme katılın

Kripto para yatırımları çok yüksek risk taşır ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, risk toleranslarını dikkate alarak kendi kararlarını vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze aldığınızdan fazlasını yatırmayın.

Sıkça Sorulan Sorular

2025’te hangi coin 1 ABD Doları’na ulaşır?

Güncel eğilimlere göre, Ethereum (ETH) yaygın kullanımı ve blokzincir teknolojisindeki ilerlemeler sayesinde 2025’te 1 ABD Doları’nı aşacak önde gelen adaydır.

2025’te hangi kripto para sıçrama yapacak?

Solana, yeni yüksek performanslı doğrulayıcı istemcisi Firedancer ile 2025’te büyük bir sıçrama bekliyor. Ethereum 2.0 ve yeni blokzincir projeleri de ciddi büyüme potansiyeli taşıyor.

Hamster Kombat coin 1 ABD Doları’na ulaşır mı?

Mevcut projeksiyonlara göre Hamster Kombat coin’in 2025’e kadar 1 ABD Doları’na ulaşması beklenmiyor. 2024’te ortalama fiyatın 0,02 ABD Doları (₹1,68) civarında olacağı, ileriki yıllarda ise büyüme potansiyeli taşıdığı öngörülüyor.

Hangi kripto para 10.000 ABD Doları’na ulaşabilir?

Bitcoin ve Ethereum, piyasa hakimiyeti ve geçmiş performanslarıyla 10.000 ABD Doları’na ulaşma potansiyeli en yüksek kripto paralardır. Yükselen altcoinler de güçlü büyüme ile bu seviyeye ulaşabilir.

2025 FET Fiyat Tahmini: Fetch.ai’nin Yerel Token’ı FET İçin Piyasa Eğilimleri ve Gelecek Potansiyeli Analizi

2025 TRACAI Fiyat Tahmini: Yükselen Blockchain Teknolojisi için Gelecek Değerleme Analizi ve Piyasa Potansiyeli

2025 CAMP Fiyat Tahmini: Blockchain oyun varlıklarının piyasa trendleri ve büyüme potansiyeli üzerine analiz

2025 AITECH Fiyat Tahmini: Piyasa Trendleri, Ekonomik Gelişmeler ve Yapay Zeka Sektöründe Yatırım Olanakları

2025 REX Fiyat Tahmini: Benimsenme ve kullanımın büyümeyi tetiklemesiyle yükseliş yönlü görünüm

2025 MIRA Fiyat Tahmini: Gelecek Trendler ve Potansiyel Büyüme Faktörlerinin Analizi

MPC Çok Taraflı Hesaplama Blok Zinciri Uygulaması

Bitcoin Musluklarıyla Kripto Para Kazanabileceğiniz En İyi Uygulamalar

EVM Uyumluluğunu Anlamak: Blockchain Ağlarını Keşfetmek

Griffin AI GAIN Token Güvenlik Açığı Kriz Analizi

Niza Global NIZA Token Göç Ekonomi Yükseltmesi