2025 NBLU Fiyat Tahmini: Piyasa Trendlerinin ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: NBLU’nun Piyasa Konumu ve Yatırım Değeri

Sosyal bağlantılar üzerine odaklanan bir metaverse platformu olan NuriTopia (NBLU), kuruluşundan bu yana sürekli ilerleme kaydetmiştir. 2025 yılı itibarıyla NBLU’nun piyasa değeri 3.012.992 $ seviyesine ulaşmış, dolaşımdaki arzı yaklaşık 2.165.283.665 tokene yükselmiş ve fiyatı 0,0013915 $ civarında seyretmektedir. “Sosyal metaverse tokenı” olarak bilinen bu varlık, hem sanal hem de gerçek dünyadaki sosyal etkileşimlerde giderek daha önemli bir rol üstlenmektedir.

Bu makalede, NBLU’nun 2025-2030 yıllarına yönelik fiyat hareketleri; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında profesyonel fiyat tahminleri ve yatırımcılar için uygulanabilir stratejilerle kapsamlı biçimde analiz edilecektir.

I. NBLU Fiyat Geçmişi ve Güncel Piyasa Durumu

NBLU Tarihsel Fiyat Gelişimi

- 2023: İlk çıkışı, 24 Mart’ta 0,039995 $ ile tüm zamanların en yüksek seviyesine ulaştı.

- 2024: Piyasa dalgalanmaları, fiyatta yoğun volatilite yaşandı.

- 2025: Ayı trendi, 12 Ekim’de 0,0013495 $ ile tüm zamanların en düşük seviyesi görüldü.

NBLU Güncel Piyasa Durumu

14 Ekim 2025 itibarıyla NBLU, 0,0013915 $ seviyesinden işlem görmektedir ve son 24 saatte %2,44 düşüş yaşamıştır. Token, geçtiğimiz yıl %69,25 değer kaybederek ciddi bir düşüş süreci geçirmiştir. Kısa vadede, son 7 günde %10,24 ve son 30 günde %5,11 oranında düşüş göstermiştir. Mevcut fiyat, tüm zamanların en yüksek seviyesinin oldukça altında ve uzun süreli ayı trendinin sürdüğünü göstermektedir. 3.012.992 $ piyasa değeriyle NBLU, kripto para piyasasında 2.094. sırada yer almaktadır. Son 24 saatteki işlem hacmi 38.844 $ ile orta düzeyde aktiviteye işaret etmektedir.

Güncel NBLU piyasa fiyatını görmek için tıklayın

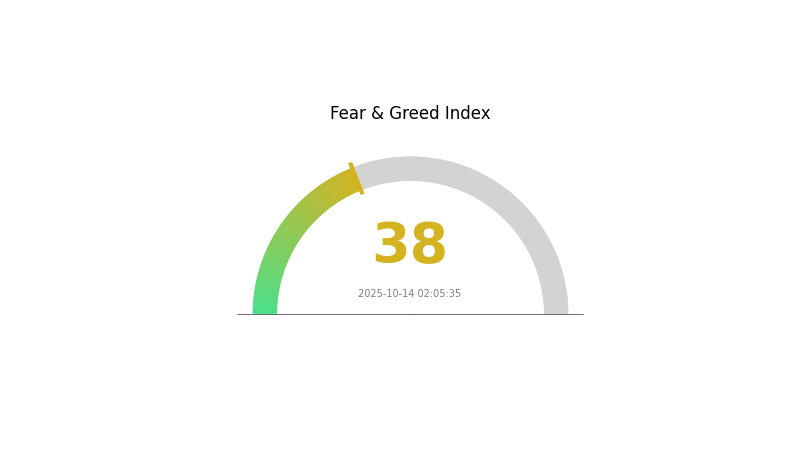

NBLU Piyasa Duyarlılık Göstergesi

14 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto para piyasası şu anda belirsizlik döneminden geçiyor ve Korku & Açgözlülük Endeksi 38 seviyesinde. Bu, yatırımcılar arasında belirgin bir korku eğilimi olduğunu gösteriyor. Böylesi piyasa koşulları, genellikle “korkuda al, açgözlülükte sat” stratejisini benimseyen tecrübeli yatırımcılar için fırsatlar yaratır. Ancak, yatırım kararları öncesinde mutlaka dikkatli olunmalı ve kapsamlı araştırma yapılmalıdır. Piyasa eğilimlerini takip etmek ve sektördeki son gelişmelerden haberdar olmak önemlidir.

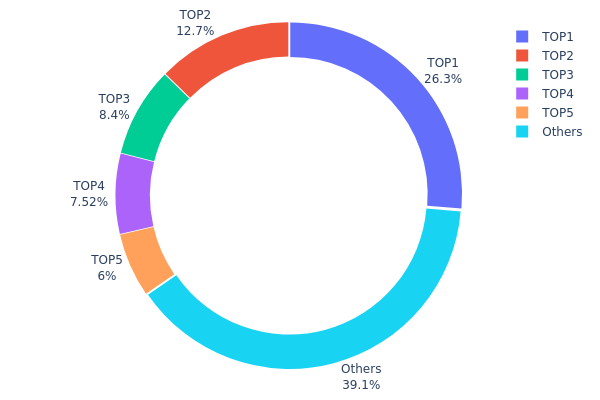

NBLU Varlık Dağılımı

NBLU’nun adres bazlı varlık dağılımı, tokenların büyük bir bölümünün az sayıda adreste toplandığını gösteriyor. En büyük sahip, toplam arzın %26,31’ine sahipken; ilk 5 adres toplam NBLU tokenlarının %60,91’ini kontrol ediyor. Bu yoğunlaşmış yapı, piyasa dinamikleri üzerinde etkili olabilecek görece merkezileşmiş bir sahiplik profilini yansıtıyor.

Böylesi bir dağılım, fiyat oynaklığının artmasına ve büyük ölçekli piyasa hareketlerine karşı hassasiyetin yükselmesine neden olabilir. Bu büyük sahiplerin hamleleri, NBLU’nun piyasa başarısını önemli düzeyde etkileyebilir. Aynı zamanda, bu yoğunluk merkeziyetsizlik ve olası piyasa manipülasyonu açısından soru işaretleri doğuruyor.

Ancak, tokenların %39,09’u diğer adresler arasında dağılmış durumda ve bu, daha geniş bir dağılımı işaret ediyor. Büyük sahipler ile küçük yatırımcılar arasındaki bu denge, NBLU’nun uzun vadeli piyasa istikrarı ve merkezileşmeye karşı direnci için kritik öneme sahiptir.

Güncel NBLU Varlık Dağılımını görmek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xc3af...d7fa87 | 1.315.966,33K | 26,31% |

| 2 | 0xb774...caf406 | 634.033,67K | 12,68% |

| 3 | 0xe0d7...74ba85 | 420.000,00K | 8,40% |

| 4 | 0x4456...5612e5 | 376.250,00K | 7,52% |

| 5 | 0x5336...c52a7b | 300.000,00K | 6,00% |

| - | Diğerleri | 1.953.750,00K | 39,09% |

II. NBLU’nun Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Halving: NBLU, düzenli aralıklarla halving süreçleri geçirerek yeni coin üretimini azaltır.

- Tarihsel Eğilim: Önceki halving dönemleri, genellikle orta ve uzun vadede fiyat artışlarına zemin hazırlamıştır.

- Güncel Etki: Yaklaşan halving, arz enflasyonunun azalmasıyla NBLU fiyatı üzerinde yukarı yönlü baskı yaratması beklenmektedir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Büyük finans kuruluşları, son dönemde NBLU pozisyonlarını artırıyor.

- Küresel Benimseme: Birçok Fortune 500 şirketi, NBLU’yu bilançolarına eklemeye yönelik planlar açıkladı.

Makroekonomik Ortam

- Parasal Politika Etkisi: Merkez bankalarının sıkılaştırıcı politikaları, NBLU gibi riskli varlıklara olan likiditeyi azaltabilir.

- Enflasyona Karşı Koruma: NBLU, enflasyonla kısmi korelasyon göstererek koruma arayan yatırımcıların ilgisini çekebiliyor.

- Jeopolitik Etkiler: Küresel ekonomik belirsizlikler, NBLU’nun potansiyel “güvenli liman” özelliğine olan ilgiyi artırmaktadır.

Teknolojik Gelişim ve Ekosistem İnşası

- Layer 2 Ölçeklenebilirlik: Layer 2 çözümlerinin devreye alınmasıyla NBLU’nun işlem hızı artacak ve işlem ücretleri düşecek.

- Akıllı Sözleşme Yeteneği: Yakında hayata geçecek yükseltmeler ile akıllı sözleşme desteği gelecek ve NBLU’nun kullanım alanları genişleyecek.

- Ekosistem Uygulamaları: NBLU ağı üzerinde geliştirilen çeşitli DeFi ve NFT projeleri, token talebini artırabilir.

III. 2025-2030 Dönemi için NBLU Fiyat Tahmini

2025 Beklentisi

- İhtiyatlı tahmin: 0,00082 $ - 0,00139 $

- Tarafsız tahmin: 0,00139 $ - 0,00172 $

- İyimser tahmin: 0,00172 $ - 0,00205 $ (olumlu piyasa havası ve artan benimseme ile)

2027-2028 Beklentisi

- Piyasa aşaması: Artan benimsemeyle potansiyel büyüme evresi

- Fiyat aralığı tahmini:

- 2027: 0,00130 $ - 0,00288 $

- 2028: 0,00218 $ - 0,00321 $

- Kilit katalizörler: Teknolojik gelişmeler, genişleyen kullanım alanları ve piyasa toparlanması

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,00286 $ - 0,00336 $ (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 0,00336 $ - 0,00385 $ (hızlı benimseme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,00385 $ - 0,00429 $ (çığır açan inovasyonlar ve yaygın kabul ile)

- 31 Aralık 2030: NBLU 0,00429 $ (iyimser projeksiyona göre olası zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00205 | 0,00139 | 0,00082 | 0 |

| 2026 | 0,00254 | 0,00172 | 0,00098 | 23 |

| 2027 | 0,00288 | 0,00213 | 0,0013 | 53 |

| 2028 | 0,00321 | 0,0025 | 0,00218 | 80 |

| 2029 | 0,00385 | 0,00286 | 0,00163 | 105 |

| 2030 | 0,00429 | 0,00336 | 0,00201 | 141 |

IV. NBLU Profesyonel Yatırım Stratejileri ve Risk Yönetimi

NBLU Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Uzun vadeli yatırımcılar ve metaverse vizyonuna inananlar

- Uygulama önerileri:

- Piyasa düşüşlerinde NBLU token biriktirin

- NURITOPIA platformunun gelişimini izleyin

- Tokenları güvenli, kişisel cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını belirlemek için kullanın

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım bölgelerini tespit edin

- Kısa vadeli al-sat için önemli noktalar:

- Zarar durdur emirleriyle kayıpları sınırlayın

- Kârı, önceden belirlenen direnç seviyelerinde alın

NBLU Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Aggresif yatırımcılar: %5-10

- Profesyoneller: %15’e kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları birden fazla metaverse projesine dağıtın

- Zarar durdur: Muhtemel kayıpları sınırlandırmak için kullanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik: İki aşamalı doğrulama kullanın, güçlü şifreler belirleyin

V. NBLU için Potansiyel Riskler ve Zorluklar

NBLU Piyasa Riskleri

- Yüksek oynaklık: Küçük hacimli tokenlarda belirgin fiyat dalgalanmaları

- Kısıtlı likidite: Büyük işlemlerde likidite riski

- Rekabet: Metaverse projelerinin hızla artması

NBLU Regülasyon Riskleri

- Belirsiz regülasyon ortamı: Metaverse tokenları için sıkılaştırıcı mevzuat riski

- Sınır ötesi uyum: Farklı ülkelerde yasal uyum sorunları

- Vergisel etkiler: Sanal varlıklar ve metaverse işlemleri için değişen vergi rejimi

NBLU Teknik Riskler

- Akıllı sözleşme açıkları: Sözleşme istismarı veya hata riski

- Ölçeklenebilirlik zorlukları: Artan kullanıcı yükünü karşılamada sınırlar

- Uyumluluk problemleri: Diğer platform veya blokzincirlerle entegrasyon sıkıntıları

VI. Sonuç ve Eylem Önerileri

NBLU Yatırım Değeri Değerlendirmesi

NBLU, yükselen metaverse sektöründe yüksek riskli ve yüksek potansiyelli bir yatırım imkânı sunar. Sanal dünyaya açılan büyüme fırsatına erişim sağlasa da, erken aşamadaki yapısı ve piyasa volatilitesi nedeniyle yatırımcılar temkinli yaklaşmalıdır.

NBLU Yatırım Önerileri

✅ Yeni başlayanlar: Sıkı risk yönetimiyle küçük ve deneysel pozisyonlar alın

✅ Deneyimli yatırımcılar: Belirli kâr hedefleriyle ortalama maliyetleme uygulayın

✅ Kurumsal yatırımcılar: Kapsamlı inceleme sonrası çeşitlendirilmiş metaverse portföyünde değerlendirin

NBLU İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden NBLU token satın alın

- Staking: Pasif gelir için mevcutsa staking programlarına katılın

- NFT entegrasyonu: NURITOPIA ekosisteminde potansiyel NFT fırsatlarını inceleyin

Kripto para yatırımları son derece yüksek risk içerir ve bu makale yatırım tavsiyesi niteliği taşımaz. Yatırımcılar, kendi risk toleranslarına göre karar vermeli ve profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

Bomb Crypto için 2025 fiyat tahmini nedir?

Piyasa trendleri ve uzman görüşlerine göre, Bomb Crypto’nun 2025’te token başına 0,15 $ – 0,20 $ aralığına ulaşması ve Web3 oyun sektöründe büyüme potansiyeli göstermesi bekleniyor.

Kripto için 2025 fiyat tahmini nedir?

Güncel piyasa eğilimleri ve uzman analizlerine göre, kripto piyasasının 2025’e dek ciddi büyüme göstermesi bekleniyor. Birçok analist Bitcoin’in 100.000 – 150.000 $’a, Ethereum’un ise 10.000 – 15.000 $’a erişebileceğini öngörüyor.

En yüksek fiyat tahminine sahip kripto hangisidir?

Bitcoin (BTC), sıklıkla en yüksek fiyat öngörüsü yapılan kripto paradır; bazı analistler 2030 yılına kadar 500.000 $ ve üzerine ulaşabileceğini ifade etmektedir.

Kripto için 2030 fiyat tahmini nedir?

Mevcut eğilimler ve piyasa analizlerine göre, kripto fiyatlarının 2030’a kadar ciddi artış göstermesi bekleniyor. Birçok uzman, Bitcoin’in 500.000 $’a ulaşabileceğini; büyük kripto paralarda ise mevcut seviyelere göre 10 ile 100 kat arasında değer artışı yaşanabileceğini öngörüyor.

2025 WILD Fiyat Tahmini: WILD Token Ekosistemi’nin Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 SOMI Fiyat Tahmini: Piyasa Eğilimleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 MPT Fiyat Tahmini: Metaverse Property Token için Piyasa Trendleri ve Gelecek Öngörülerinin Analizi

VEMP (VEMP) iyi bir yatırım mı?: Bu yükselen kripto paranın potansiyeli ve taşıdığı riskler üzerine analiz

2025 WILD Fiyat Tahmini: Yükseliş Trendleri ve Token'ın Gelecekteki Değerini Belirleyen Ana Etkenler

2025 WILD Fiyat Tahmini: Kripto Ormanında Yolculuk - WILD Kükreyecek mi Yoksa Sessiz mi Olacak?

OpenEden Gerçek Dünya Varlık Tokenizasyon Platformu ve EDEN Token Ekonomisi

Anoma Ağı Niyet Odaklı Dağıtık İşletim Sistemi Çoklu Zincir Birlikte Çalışabilirlik

Aster Merkeziyetsiz Sürekli Sözleşme ve Çok Zincirli Türevler Ticaret Platformu

Web3 dünyasında NFT dijital sanatına yönelik önde gelen platformları keşfetmek

Kriptoda Farcaster Protokolü’nü Anlamak