2025 MV Fiyat Tahmini: Elektrikli Araç Sektöründe Piyasa Trendleri ve Teknolojik Gelişmelerin Analizi

Giriş: MV'nin Piyasa Konumu ve Yatırım Değeri

GensoKishi Metaverse (MV), Japonya pazarında öne çıkan bir GameFi projesi olarak kuruluşundan bu yana kayda değer bir gelişim gösterdi. 2025 yılı itibarıyla MV'nin piyasa değeri 2.443.196 dolar, dolaşımdaki arzı yaklaşık 399.737.601 token ve fiyatı ise 0,006112 dolar civarındadır. Sıklıkla “Elemental Knight'ın Halefi” olarak anılan bu varlık, oyun ve blokzincir teknolojisinin kesişiminde kritik bir rol üstleniyor.

Bu makalede, 2025-2030 yılları arasında MV'nin fiyat hareketleri, tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler dikkate alınarak profesyonel fiyat tahminleri ile yatırımcılara yönelik stratejik öneriler sunulacaktır.

I. MV Fiyat Geçmişi ve Güncel Piyasa Durumu

MV Fiyatının Tarihsel Gelişimi

- 2022: İlk çıkış, 9 Şubat'ta tüm zamanların en yüksek seviyesi olan 1,66 dolara ulaşıldı

- 2023: Piyasa düşüşü, fiyat ciddi şekilde geriledi

- 2024: Düşüş eğilimi sürdü, fiyat tarihsel dip seviyelere indi

- 2025: Hafif toparlanma var, ancak seviye hâlâ zirvenin oldukça altında

MV Güncel Piyasa Durumu

15 Ekim 2025 itibarıyla MV, 0,006112 dolardan işlem görmekte, 24 saatlik işlem hacmi ise 183.900,98 dolar. Token, son 24 saatte %1,01 yükselerek kısa vadede olumlu bir hareket sergiledi. Ancak, uzun vadeli trendler hâlâ aşağı yönlü; son bir haftada %22,48, son 30 günde ise %33,42 değer kaybetti.

MV'nin piyasa değeri şu anda 2.443.196 dolar ve toplam kripto piyasasında 2231. sırada bulunuyor. Dolaşımdaki MV miktarı 399.737.601,72 adetle toplam arzın %19,99'una karşılık geliyor (toplam arz: 2.000.000.000 MV).

Token, 9 Şubat 2022'deki 1,66 dolarlık tüm zamanların en yüksek seviyesinin çok altında. Şu anki fiyat zirveden %99,63 daha düşük. Buna karşın, MV şu anda 9 Mayıs 2025'te görülen tüm zamanların en düşük seviyesi olan 0,00428504 dolardan %42,64 yukarıda.

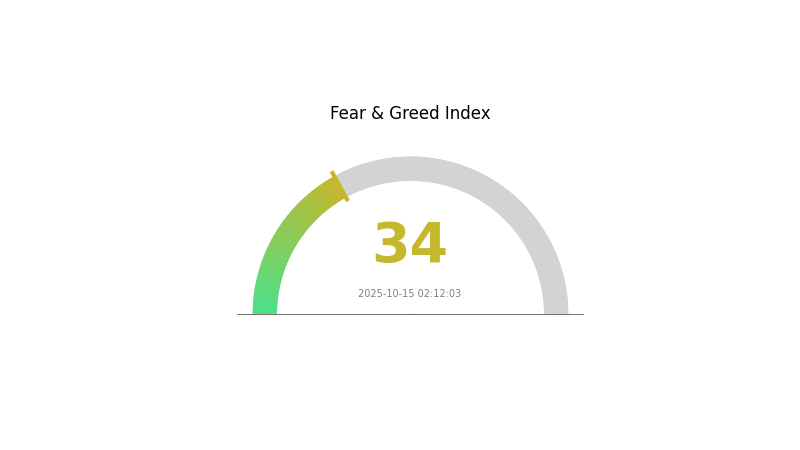

Piyasa duyarlılığı MV için temkinli; genel kripto piyasasında korku ve açgözlülük endeksi 34 ile “Korku” seviyesinde bulunuyor.

Mevcut MV piyasa fiyatını görmek için tıklayın

MV Piyasa Duyarlılığı Göstergesi

15 Ekim 2025 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksi'ni görmek için tıklayın

Kripto piyasasında duyarlılık temkinli; Korku ve Açgözlülük Endeksi 34 ile korku seviyesinde. Bu, yatırımcıların riskten kaçındığını ve muhtemelen daha güvenli varlıklara yöneldiğini gösteriyor. Yine de, karşıt yatırımcılar için bu tür korku dönemleri alım fırsatı olabilir. Yatırım kararı öncesinde kapsamlı araştırma yapın ve risk iştahınızı göz önünde bulundurun. Kripto piyasasında duyarlılık hızla değişebilir.

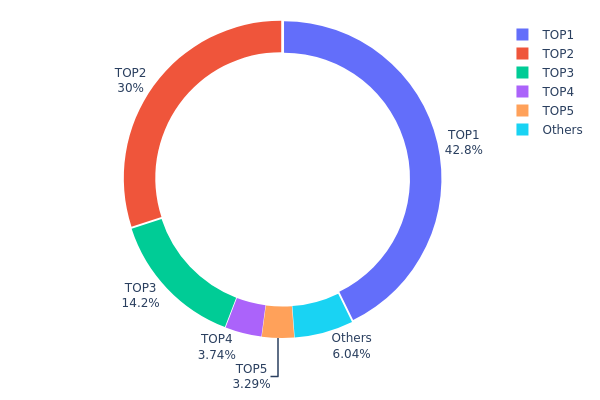

MV Varlık Dağılımı

MV'nin cüzdan bazında varlık dağılımı, son derece yoğunlaşmış bir sahiplik yapısına işaret ediyor. En büyük cüzdan toplam arzın %42,76'sını, ilk 5 cüzdan ise tüm MV tokenlerinin %93,94'ünü kontrol ediyor. Bu yoğunlaşma, potansiyel olarak merkezileşmiş bir piyasa yapısına işaret ediyor.

Böyle bir dağılım, piyasa istikrarı ve fiyat manipülasyonu açısından risk yaratıyor. Arzın neredeyse yarısı tek bir elde olduğu için, büyük satış baskısı veya hızlı piyasa hareketleri token fiyatını ciddi şekilde etkileyebilir. Ayrıca, yüksek yoğunlaşma perakende yatırımcılar arasında dolaşımın az olduğunu ve bunun likidite ile fiyat oluşumunu etkilediğini gösteriyor.

Daha geniş açıdan bakıldığında, bu dağılım MV ekosistemindeki merkeziyetsizliğin düşük olduğunu gösteriyor. Blokzincir projeleri genellikle daha geniş dağılım hedeflerken, MV'nin mevcut durumu daha kontrollü bir yapı sunuyor. Bu, yönetişim ve proje yönetiminde merkeziyetsizlik ilkeleriyle çelişebilir.

Güncel MV Varlık Dağılımı için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1127...8cac91 | 855.366,56K | 42,76% |

| 2 | 0xb2ef...cff23a | 600.000,10K | 30,00% |

| 3 | 0x40ec...5bbbdf | 283.190,00K | 14,15% |

| 4 | 0xe505...18a473 | 74.812,33K | 3,74% |

| 5 | 0x28cc...d8841f | 65.859,63K | 3,29% |

| - | Others | 120.771,38K | 6,06% |

II. MV'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Merkez Bankası Alımları: Küresel merkez bankaları 2022’den bu yana yılda 1.000 tonun üzerinde altın alıyor. Bu eğilim devam ettikçe altın fiyatları için güçlü destek oluşuyor.

- Tarihsel Eğilim: Önceki döngülerde, ABD faiz indirimi başlarken altın fiyatlarında yükseliş eğilimi gözlemlendi.

- Güncel Etki: Dolarizasyonun azaltılması ve merkez bankalarının altın rezervlerini yeniden yapılandırması, altın fiyatlarında yukarı yönlü baskıyı sürdürüyor.

Kurumsal ve Büyük Sahip Dinamikleri

- Kurumsal Varlıklar: Eylül ayında altın ETF varlıkları 3,6 milyon ons artarak yıl başından bu yana %17 yükseldi ve Eylül 2022 sonrası en yüksek seviyeye, 97,2 milyon onsa ulaştı.

- Kurumların Benimsemesi: Goldman Sachs gibi büyük finans kurumları, 2026 Aralık'a kadar ons başına 4.900 dolar beklentisiyle altın fiyat tahminlerini yükseltti.

- Ulusal Politikalar: Gelişmekte olan piyasa merkez bankaları ABD dolarına bağımlılığı azaltmak için altın rezervlerini artırıyor, bu eğilim giderek yaygınlaşıyor.

Makroekonomik Ortam

- Para Politikası Etkisi: ABD Merkez Bankası'nın Eylül toplantısı, yıl içinde faiz indirimlerinin süreceğine işaret ediyor. Düşük reel faiz ve gevşek likidite, altın tutmanın alternatif maliyetini ciddi şekilde azaltıyor.

- Enflasyondan Korunma Özellikleri: Yüksek enflasyon, yüksek harcama ve borç ortamında, portföydeki diğer varlıklar değer kaybederken altın öne çıkıyor.

- Jeopolitik Faktörler: Süregelen ticaret ve bölgesel gerilimler, altının güvenli liman olarak cazibesini artırıyor.

Teknik Gelişmeler ve Ekosistem Oluşumu

- Fiyatlama Mantığı Değişimi: Altının temel değeri sıradan bir emtiadan “para sistemi dengeleyici” ve “döngüsel riskten korunma aracı”na evrildi; devlet rezerv tahsisi ve portföy çeşitlendirmesi fiyatlamada belirleyici rol üstleniyor.

- Piyasa Duyarlılığı: Ons başına 4.000 doları aşan altın fiyatı; küresel varlık fiyatlamasında paradigmanın değiştiğini, piyasanın ABD doları riskine karşı altına bakışını yeniden değerlendirdiğini gösteriyor.

III. 2025-2030 Dönemi MV Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,00449 - 0,00500 dolar

- Tarafsız tahmin: 0,00500 - 0,00607 dolar

- İyimser tahmin: 0,00607 - 0,00625 dolar (olumlu piyasa koşullarında)

2027-2028 Görünümü

- Piyasa beklentisi: İstikrarlı büyüme dönemi

- Fiyat tahmini:

- 2027: 0,00411 - 0,00749 dolar

- 2028: 0,00569 - 0,00783 dolar

- Temel katalizörler: Artan benimseme ve teknolojik ilerleme

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00747 - 0,00863 dolar (piyasa büyümesi sürerse)

- İyimser senaryo: 0,00863 - 0,01000 dolar (güçlü piyasa performansı halinde)

- Dönüştürücü senaryo: 0,01000 - 0,01286 dolar (çığır açan yenilikler ve kitlesel benimseme ile)

- 31 Aralık 2030: MV 0,01286 dolar (potansiyel zirve fiyat)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,00625 | 0,00607 | 0,00449 | 0 |

| 2026 | 0,00733 | 0,00616 | 0,0037 | 0 |

| 2027 | 0,00749 | 0,00675 | 0,00411 | 10 |

| 2028 | 0,00783 | 0,00712 | 0,00569 | 16 |

| 2029 | 0,00979 | 0,00747 | 0,00381 | 22 |

| 2030 | 0,01286 | 0,00863 | 0,00457 | 41 |

IV. MV Profesyonel Yatırım Stratejileri ve Risk Yönetimi

MV Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Uzun vadeli yatırımcılar ve GameFi meraklıları

- İşlem önerileri:

- Piyasa düşüşlerinde MV token biriktirin

- Gensokishi Metaverse ekosistemine katılın

- Tokenleri güvenli, saklama hizmeti olmayan cüzdanda saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli eğilimleri takip edin

- RSI: Aşırı alım ve satım koşullarını belirleyin

- Dalgalı işlemde odak noktaları:

- Oyun güncellemelerini ve kullanıcı benimsemesini takip edin

- GameFi piyasa duyarlılığını izleyin

MV Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları farklı GameFi projelerine yaymak

- Zarar durdur emri: Potansiyel kayıpları sınırlayacak seviyeler belirleyin

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Gate Web3 Cüzdan

- Yazılım cüzdanı: Resmi Gensokishi Metaverse cüzdanı (varsa)

- Güvenlik: İki faktörlü kimlik doğrulama açın, güçlü şifreler kullanın

V. MV için Olası Riskler ve Zorluklar

MV Piyasa Riskleri

- Yüksek oynaklık: GameFi tokenlarında sert fiyat dalgalanmaları olabilir

- Rekabet: GameFi projelerinin artması pazar payını etkileyebilir

- Kullanıcı benimsemesi: Aktif kullanıcı sayısının yavaş artması token değerini olumsuz etkileyebilir

MV Regülasyon Riskleri

- Belirsiz düzenlemeler: GameFi ve NFT regülasyonları hâlâ şekilleniyor

- Sınır ötesi uyum: Farklı ülkelerde farklı yaklaşımlar

- Vergi etkileri: Sanal varlıklar ve oyun içi kazançlarda vergileme değişiklikleri olabilir

MV Teknik Riskler

- Akıllı sözleşme açıkları: Sömürü veya saldırı riski

- Ölçeklenebilirlik sorunları: Yüksek kullanımda ağ tıkanıklığı

- Birlikte çalışabilirlik: Diğer blokzincir veya oyunlarla entegrasyon sorunları

VI. Sonuç ve Eylem Önerileri

MV Yatırım Değeri Değerlendirmesi

MV, köklü bir oyun markasının desteğiyle GameFi sektöründe özgün bir fırsat sunuyor. Ancak, yatırımcılar alandaki yüksek oynaklık ve regülasyon belirsizliklerine dikkat etmelidir.

MV Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, Gensokishi Metaverse ekosistemini öğrenin ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ile stratejik al-sat kombinasyonunu değerlendirin ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın, MV’yi çeşitlendirilmiş bir GameFi portföyünde değerlendirin

MV İşlem Katılım Yöntemleri

- Spot işlemler: Gate.com’da MV token alım-satımı

- Staking: Gensokishi Metaverse tarafından sunuluyorsa staking programlarına katılım

- Oyun içi alımlar: MV tokenleri Gensokishi Metaverse oyununda kullanma

Kripto para yatırımları son derece yüksek risk içerir, bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profilini dikkate alarak karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

2025 için metaverse tahmini nedir?

2025 yılında metaverse, gerçek dünyayı kopyalamaktan çok eğitim ve senaryo planlama gibi endüstriyel uygulamalara odaklanıyor. Gerçek dünyada mümkün olmayan alanlarda beceri geliştirme ve güvenlik testlerinde kullanılıyor.

2030 için MOVE coin tahmini nedir?

Güncel eğilimlere göre MOVE coin, artan benimseme ve piyasa büyümesiyle 2030'da 0,50-1,00 dolar aralığına ulaşabilir; ancak bu öngörüler spekülatiftir.

MV kripto nedir?

MV, GensoKishi Metaverse’in kripto parasıdır ve web3 tabanlı 3D MMORPG oyununda kullanılır. Toplam arzı 2 milyar token olup oyun ekosistemine entegredir.

2025 için Chainlink tahmini nedir?

Chainlink’in 2025’te yaklaşık 215 dolara ulaşacağı ve güçlü büyüme potansiyeli olduğu tahmin ediliyor. Güncel fiyatı 19,62 dolar olup, LINK için önümüzdeki yıllarda yükseliş bekleniyor.

SLN ve SAND: Metaverse Alanında İki Popüler Kripto Paranın Karşılaştırılması

2025 KT Fiyat Tahmini: Piyasa Eğilimleri ve Olası Büyüme Faktörlerinin Değerlendirilmesi

2025 FYN Fiyat Tahmini: Yükselen Eğilimler ve Bu Yeni Kripto Paranın Geleceğini Belirleyen Piyasa Dinamikleri

NightVerse.Game (NVG) iyi bir yatırım mı?: Yükselen bu metaverse tokeninin potansiyelini ve risklerini değerlendiriyoruz

PUMP ve MANA: 2023 yılında hangi kripto para birimi daha yüksek büyüme potansiyeline sahip?

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması