2025 MSOL Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: MSOL’un Piyasa Konumu ve Yatırım Potansiyeli

Marinade Staked SOL (MSOL), Solana için likit bir staking token’i olarak, ekosistemin başlangıcından beri temel bir rol üstlenmektedir. 2025 itibarıyla MSOL’un piyasa değeri 814.521.749,68 $’a ulaşmış, yaklaşık 3.133.258 adet dolaşımdaki token ile fiyatı 259,96 $ civarında seyretmektedir. “Likiditeye sahip staked SOL” olarak bilinen bu varlık, Solana staking ve DeFi ekosisteminde stratejik önemini her geçen gün artırmaktadır.

Bu makalede, 2025-2030 arasında MSOL’un fiyat eğilimleri geçmiş veriler, piyasa dinamikleri, ekosistem gelişimi ve makroekonomik etkenler ışığında kapsamlı şekilde analiz edilerek, yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir stratejiler sunulacaktır.

I. MSOL Fiyat Geçmişi ve Güncel Piyasa Durumu

MSOL Tarihsel Fiyat Gelişimi

- 2022: Piyasa gerilemesiyle fiyat, 30 Aralık’ta tüm zamanların en düşük seviyesi olan 8,93 $’a indi

- 2025: Boğa piyasasıyla fiyat, 19 Ocak’ta tüm zamanların en yüksek seviyesi olan 363,77 $’a ulaştı

- 2025: Piyasa düzeltmesiyle fiyat zirveden mevcut seviyelere geriledi

MSOL Güncel Piyasa Görünümü

16 Ekim 2025 itibarıyla MSOL, 259,96 $ seviyesinden işlem görüyor ve son 24 saatte %4,08’lik bir düşüş yaşadı. Token, kısa vadede %0,43 artış sergilerken, son hafta ve ayda sırasıyla %14,24 ve %16,31 geriledi. Ancak son bir yılda %38,11’lik güçlü bir büyüme kaydetti.

MSOL’un piyasa değeri 814.521.749,68 $ ve küresel kripto sıralamasında 109. sırada yer alıyor. Dolaşımdaki arzı 3.133.258 MSOL, maksimum arzı ise 4.480.536 MSOL. Mevcut dolaşımdaki arz, maksimum arzın %69,93’ünü oluşturuyor ve token dağıtımında ek potansiyel bulunduğunu gösteriyor.

24 saatlik işlem hacmi 23.497,94483 $ ve orta düzeyde piyasa aktivitesine işaret ediyor. Tokenin güncel fiyatı, tüm zamanların en yüksek seviyesine en düşük seviyesinden daha yakın; bu da genel olarak olumlu bir fiyat performansı anlamına geliyor.

Güncel MSOL piyasa fiyatını görüntülemek için tıklayın

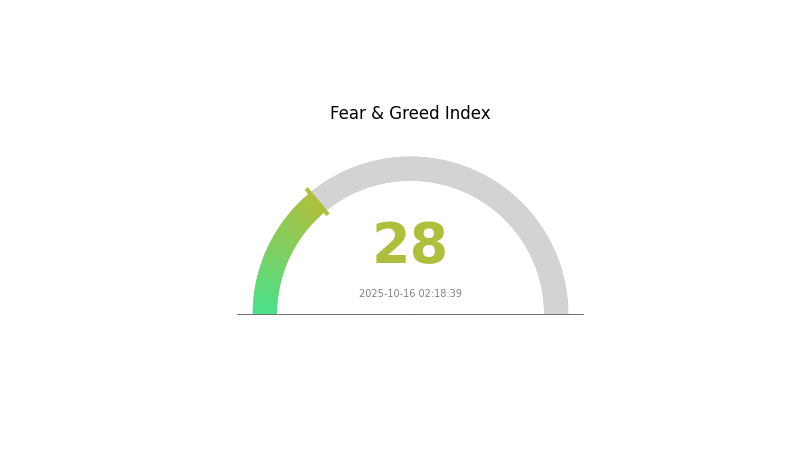

MSOL Piyasa Duyarlılık Endeksi

2025-10-16 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda Korku ve Açgözlülük Endeksi’nin 28 puanlık değeriyle korku hakim. Yatırımcılar temkinli ve belirsiz bir tutum sergiliyor. Bu gibi dönemlerde, yatırımcıların titiz araştırma yaparak temkinli hareket etmesi büyük önem taşıyor. Korku ortamı bazı yatırımcılara alım fırsatı sunabilir; ancak piyasa duyarlılığının hızla değişebileceğini akılda tutmak gerekir. Bilgiye dayalı kararlar verin ve dalgalı koşullarda riski azaltmak için portföyünüzü çeşitlendirin.

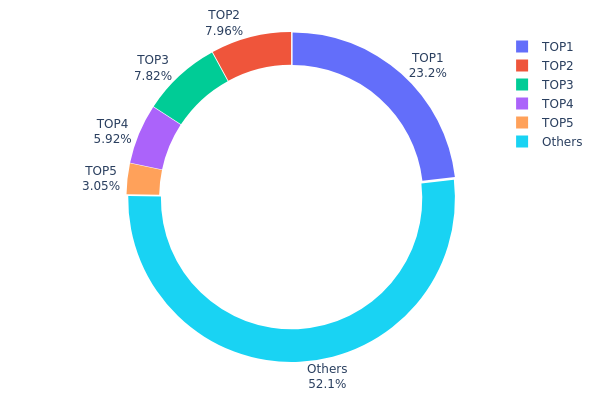

MSOL Varlık Dağılımı

Adres dağılımı verileri, MSOL’un sahiplik yapısının oldukça yoğunlaşmış olduğunu gösteriyor. En büyük adres, toplam arzın %23,16’sını elinde tutarken; ilk 5 adresin toplam kontrolü %47,89’a ulaşıyor. Bu yoğunluk, büyük sahiplerin piyasa üzerinde ani ve güçlü hareketler başlatma potansiyelini artırıyor.

Merkezileşme belirgin olsa da, ilk 5 adres dışında kalanlar tokenlerin %52,11’ini elinde bulunduruyor. Bu da küçük yatırımcılar arasında orta düzeyde bir yayılım olduğunu ve aşırı oynaklığa karşı bir tampon oluşturabileceğini gösteriyor. Yine de, en büyük adreslerin yüksek varlıkları, büyük miktarda transfer veya satış durumunda fiyat dalgalanması ve piyasa manipülasyonu riskini barındırıyor.

Mevcut dağılım, tamamen tek bir tarafın hakimiyetinde olmayan, kısmen merkezileşmiş bir piyasa yapısı anlamına geliyor. Bu denge, zincir üstü istikrarı makul seviyede tutsa da; büyük sahiplerin hareketleri MSOL piyasasını belirgin biçimde etkileyebilir ve yakından izlenmelidir.

Güncel MSOL Varlık Dağılımı için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 9DrvZv...yDWpmo | 725,89K | 23,16% |

| 2 | Gi2fcY...1eSQgt | 249,51K | 7,96% |

| 3 | DdZR6z...WPAuby | 245,11K | 7,82% |

| 4 | 8rWuQ5...4Fk4Tk | 185,40K | 5,91% |

| 5 | AkbDjk...yZgqxf | 95,51K | 3,04% |

| - | Others | 1.631,78K | 52,11% |

II. MSOL’un Gelecek Fiyatını Belirleyen Temel Unsurlar

Arz Mekanizması

- Likit Staking: Marinade Finance üzerinden SOL stake edildiğinde MSOL üretilir; böylece SOL arzı ile MSOL arzı doğrudan birbirine bağlıdır.

- Tarihsel Eğilimler: SOL staking oranlarındaki değişim, MSOL arz ve fiyatında geçmişte belirleyici olmuştur.

- Güncel Etki: Solana’da likit staking’in yaygınlaşması, MSOL arzının artmasına ve fiyatının şekillenmesine neden olabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Büyük kurumların SOL biriktirmesi, MSOL’a olan talebi ve fiyatı dolaylı olarak etkiler.

- Kurumsal Benimseme: Solana’yı tercih eden şirketler, likit staking için MSOL kullanımını artırabilir.

Makroekonomik Ortam

- Para Politikası Etkisi: Özellikle Fed’in politikaları, kripto piyasalarını ve MSOL fiyatını etkiler.

- Enflasyon Koruma Özellikleri: MSOL’un enflasyon karşıtı performansı, SOL’un enflasyonist ortamlardaki başarısına bağlıdır.

Teknik Gelişim ve Ekosistem Genişlemesi

- Solana Ağ Güncellemeleri: Solana ağında yapılan iyileştirmeler, MSOL’un kullanım alanı ve değerini doğrudan etkiler.

- Ekosistem Uygulamaları: Solana DeFi, NFT ve diğer uygulamaların yaygınlaşması, MSOL gibi likit staking çözümlerine talebi artırır.

III. 2025-2030 Dönemi MSOL Fiyat Öngörüleri

2025 Beklentisi

- Temkinli tahmin: 190,13 $ - 240 $

- Tarafsız tahmin: 240 $ - 280 $

- İyimser tahmin: 280 $ - 302,12 $ (olumlu piyasa duyarlılığı ve artan kullanım gerektirir)

2027-2028 Beklentisi

- Piyasa aşaması: Artan benimsemeyle büyüme dönemi olasılığı

- Fiyat aralığı öngörüsü:

- 2027: 209,61 $ - 401,76 $

- 2028: 329,12 $ - 488,49 $

- Ana katalizörler: Teknolojik ilerlemeler, Solana ekosisteminin yaygınlaşması ve genel kripto piyasa toparlanması

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 417,47 $ - 511,40 $ (istikrarlı büyüme ve benimseme varsayımı)

- İyimser senaryo: 511,40 $ - 605,33 $ (güçlü piyasa performansı ve kurumsal ilginin artması durumunda)

- Dönüştürücü senaryo: 605,33 $ - 690,39 $ (Solana teknolojisinde atılım ve yaygın benimseme ile)

- 2030-12-31: MSOL 690,39 $ (iyimser öngörüye göre olası zirve fiyat)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 302,12 | 260,45 | 190,13 | 0 |

| 2026 | 300,98 | 281,29 | 160,33 | 8 |

| 2027 | 401,76 | 291,13 | 209,61 | 11 |

| 2028 | 488,49 | 346,45 | 329,12 | 33 |

| 2029 | 605,33 | 417,47 | 242,13 | 60 |

| 2030 | 690,39 | 511,4 | 496,06 | 96 |

IV. MSOL Yatırımında Strateji ve Risk Yönetimi

MSOL Yatırım Yaklaşımları

(1) Uzun Vadeli Tutma Stratejisi

- Hedef yatırımcılar: Düşük riskle istikrarlı getiri arayanlar

- İşlem önerileri:

- Marinade.finance ile SOL stake ederek MSOL elde edin

- Stake gelirlerini yeniden yatırarak getiri artırın

- MSOL’u güvenli, saklama yetkisi olmayan cüzdanda muhafaza edin

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını saptamak için

- RSI: Aşırı alım/aşırı satım koşullarını izlemek için

- Dalgalı işlemde dikkat edilmesi gerekenler:

- Solana ekosistemindeki gelişmeleri takip edin

- Zarar-durdur emirleriyle riski yönetin

MSOL Risk Yönetimi Prensipleri

(1) Varlık Dağılımı İlkeleri

- Muhafazakar yatırımcılar: Kripto portföyünün %1-3’ü

- Orta düzey yatırımcılar: Kripto portföyünün %3-5’i

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: MSOL’u diğer kripto varlıklar ve klasik yatırım araçlarıyla dengeleyin

- Zarar-durdur emirleri: Olası kayıpları sınırlamak için otomatik satış emirleri kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 Wallet önerilir

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik: İki faktörlü doğrulama, güçlü şifre ve düzenli güncelleme

V. MSOL ile İlgili Potansiyel Riskler ve Zorluklar

MSOL Piyasa Riskleri

- Oynaklık: MSOL fiyatında yüksek dalgalanma riski

- Likitide riski: Sınırlı işlem çiftleri nedeniyle likitide sorunları

- Korelasyon riski: Solana performansına yüksek bağımlılık

MSOL Düzenleyici Riskleri

- Düzenleyici belirsizlik: Staking mevzuatındaki olası değişiklikler

- Uyum zorlukları: Gelişen KYC/AML gereksinimleri

- Vergi etkileri: Bazı ülkelerde staking ödüllerinin vergilendirilmesindeki belirsizlik

MSOL Teknik Riskler

- Akıllı sözleşme açıkları: Marinade.finance kodundaki olası hatalar

- Doğrulayıcı riski: Staking operasyonlarında üçüncü taraflara bağımlılık

- Ağ tıkanıklığı: Solana ağ sorunlarının MSOL işlemlerine etkisi

VI. Sonuç ve Uygulama Tavsiyeleri

MSOL Yatırım Potansiyeli Değerlendirmesi

MSOL, staking ödülleriyle pasif gelir avantajı sunar; fakat Solana ekosistemi ve kripto piyasasındaki volatiliteye bağlı riskler içerir. Uzun vadeli değer, Solana’nın yaygınlaşmasına ve başarısına bağlı; kısa vadede ise mevzuat ve teknik riskler öne çıkmaktadır.

MSOL Yatırım Önerileri

✅ Yeni başlayanlar: Küçük miktarla başlayın, staking işleyişini öğrenin ✅ Deneyimli yatırımcılar: MSOL’u dengeli bir portföyün parçası olarak düşünün ✅ Kurumsal yatırımcılar: Getiri odaklı değerlendirin, mevzuat değişimlerini yakından izleyin

MSOL'a Katılım Yolları

- Doğrudan alım: Gate.com üzerinden MSOL alın

- Staking: Marinade.finance ile SOL’u MSOL’a çevirin

- DeFi entegrasyonu: MSOL’u destekleyen protokollerde ek getiri fırsatları değerlendirin

Kripto para yatırımları çok yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profillerine göre hareket etmeli, profesyonel finans danışmanlarına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular (SSS)

2025’te 1 Solana’nın fiyatı ne olacak?

Mevcut öngörülere göre, 2025 yılında 1 Solana (SOL) yaklaşık 482 $ seviyesinde olacak. Bu fiyat, blokzincir kullanımının artması ve Solana’nın teknolojik ilerlemesiyle desteklenmektedir.

Kripto dünyasında mSOL nedir?

mSOL, Marinade Finance protokolünde stake edilen SOL ve ödüllerini temsil eden likit staking token’ıdır. Kullanıcılar bu sayede likiditeyi kaybetmeden staking ödülü kazanabilir.

En yüksek fiyat öngörüsüne sahip kripto hangisidir?

2025 için en yüksek fiyat beklentisi Bitcoin (BTC)’de olup, onu Ethereum (ETH) ve Solana (SOL) izlemektedir.

2040’ta Solana’nın fiyatı ne olacak?

2025’ten itibaren yıllık %5 büyüme öngörüsüyle, Solana’nın 2040’ta 409,11 $ seviyesine ulaşması beklenmektedir.

MSOL ve AAVE: DeFi Stake Etme Protokollerinde Getiri ve Risklerin Karşılaştırılması

Marinade Staked SOL (MSOL) yatırım için uygun mu?: Solana'nın likit staking token'ı MSOL'un riskleri ve olası getirileri üzerine analiz

MSOL ve KAVA: DeFi Ekosisteminde Önde Gelen İki Staking Protokolünün Karşılaştırılması

2025'te ETH Staking: Zincir Üstü Seçenekler ve En İyi Platformlar

ETH'nizi maksimize edin: Gate'in on-chain Staking'i 2025'te %5.82 yıllık getirisi sunuyor.

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak